6 Best Stock Brokers: Investing in Fractional Shares

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

As stock broker competition has heated up, internet players have hastened to provide additional options to their customers, such as the ability to invest in fractions of a share. Rather than having enough funds to buy a complete share, this feature allows investors to buy a stock or exchange-traded fund (ETF) with nearly any amount of money. It’s ideal for stocks like Alphabet and Amazon, which are high-priced bellwethers.

The possibility of purchasing fractional shares is quite appealing, especially for new investors. You can invest considerably less money, and some stocks sell for thousands of dollars per share, so you can buy as much as you can afford. It’s considerably easier to employ dollar-cost averaging with this function, especially now that major online brokers have eliminated transaction costs.

While some brokers have only recently begun to allow investors to purchase fractional shares, others have done so for many years through dividend reinvestment plans. This situation would exist even if the brokers did not provide fractional share trading. This difference persists today, with some brokers providing fractional shares only through dividend reinvestment.

Dividend reinvestment schemes allow you to buy only the stock that paid out the dividend and nothing else. Of course, now that all major online brokerages have eliminated trading costs, you can reinvest the money at no additional expense.

This article has highlighted six (6) best stock brokers that allow you to invest in a fractional share.

6 Best Stock Brokers that allow you to Invest in Fractional Shares

#1. Robinhood

Robinhood is an online brokerage and one of the first to offer commission-free trading. Robinhood now offers fractional shares. With Robinhood, you can trade stock and ETFs in pieces of shares and whole share increments.

Robinhood offers fractional shares that are as small as 1/1000000 of a share. Trading is also real-time and commission-free, though certain types of transactions incur fees. There is no required account minimum to make you eligible to open an account with Robinhood. You can place fractional share orders in dollar amounts or share amounts; every purchase you make is rounded to the nearest penny.

You can only join the Robinhood waitlist at the moment, but there is no cost to join. In addition, it is not compulsory for you to participate in its fractional share trading once it is rolled out. With your account, you can enjoy features such as high-yield cash management and access to alternative investments such as cryptocurrencies and precious metals. A newly approved Robinhood brokerage account will get you free stock worth $2.50 to $150 per share.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Robinhood website |

#2. M1 Finance

M1 Finance is a free investing account platform devoted to making it easy and affordable for the general public to invest in fractional shares. The company also works to lower the barriers to entry for buying into some of the highest-priced stock shares on the market. The M1 Finance app offers a free checking account and low-cost borrowing solution. For its base plan holders, it offers a free automated investing platform.

All stocks listed on the M1 Finance platform as available for trading can be bought as fractional shares. You do not incur any charges for placing fractional shares trades. M1 Finance does not require any minimum deposit for you to invest on the platform.

The M1 Finance app provides investors with two investment options. The first is a traditional investing method, where you build your portfolio with your preferred stocks and ETFs tailored to your investment objectives. The second option is the platform’s pre-made “Expert Portfolio Pies,” which contains different stocks and ETFs for you to invest in.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through M1 Finance website |

#3. Fidelity

Fidelity is a full-service online stock broker that offers investors over 7,000 US Stocks and ETFs for fractional share trading. With Fidelity, you can get commission-free stock and ETF trades with fractional share investing capabilities. The Fidelity Stocks by The Slice feature makes dollar-based investing easy for everyone. Fidelity aims to give investors the luxury of choice, ease, and flexibility.

If you are a self-directed investor looking to skip out on fund fees, Fidelity offers a vast library of no-fee Fidelity ETFs. This can help you build a fee-free portfolio. Fidelity offers flexible pricing plans for their different accounts. They offer the Fidelity Go Robo-advisor and the Fidelity Personalized Planning & Advice hybrid platform for hands-off investors.

Fidelity accounts eligible for fractional share trading include brokerage, IRAs, Fidelity Youth Account, HSAs, and BrokerageLink. Fidelity offers real-time trading, and you do not need an account minimum to open a Fidelity self-directed account or a Fidelity Go Robo-advisor account.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Fidelity website |

#4. SoFi

SoFi Invest is a low-cost investing app developed to help people reach financial independence and realize their ambitions. They are devoted to helping members get their money right. SoFi offers financial planning services, VIP member events, and career services.

So-Fi invest is a SIPC-insured investing platform. Unlike many traditional brokerages, SoFi Invest offers investors cryptocurrency investing. The platform’s fractional shares, known as Stock Bits, are offered in denominations as low as $1. SoFi Invest’s portfolio management solution offers dynamic rebalancing and dividend reinvestment, which are made possible with fractional shares.

With SoFi, investors get self-directed and managed portfolio options, both of which utilize fractional shares and do not charge commissions or management fees. However, an account minimum of $1 is required to open an Active Invest and automated investing accounts. You can earn up to $1,000 worth of stock for free when you download the SoFi Invest app and open a new Active Invest Account.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Sofi website |

#5. Webull

Webull is an online brokerage that allows investors to buy and sell fractional shares of individual stock and ETF trades. Like many other online brokerages, Webull does not come with stock trading or management fees.

The minimum amount required to make a fractional share investment with Webull is $5, although the platform currently requires no minimum balance requirement. Also, you can get two free stocks worth a total value of $2,300 when you open your account and complete some qualifying activities by the stated offer end date.

| Broker | Best For | More Details |

|---|---|---|

| Active Traders

| securely through Webull website |

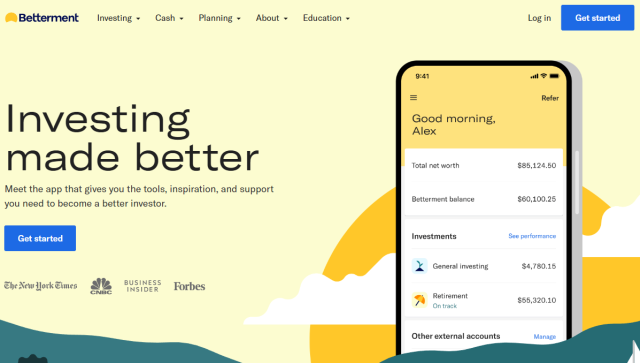

#6. Betterment

Betterment is one of the first online investment platforms to offer fractional share investing to the general public. It specializes in tax-optimized, custom-allocated portfolios for passive investors. Betterment offers ETF investing through automated investment accounts. Also, the platform does not use options, mutual funds, bonds, or other investments.

Betterment is a Robo-advisor platform, making it ideal for people saving for retirement. It offers traditional and Roth IRAs and SEP IRAs for self-employed people. A betterment investment account can be opened with a joint owner. You may also decide to set up a trust account with Betterment and contribute to it.

Betterment Checking is a checking account with a great cash back rewards program, even though it has no account fees and ATM reimbursement. Along with Betterment Checking, Betterment offers a cash reserve account that earns interest.

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Stock and Forex Training Course

The best forex course which is most effective is provided by Asia Forex Mentor. Through this amazing course, traders do not just make some profit, on the contrary, the pro-traders make massive profits making 6 figures per trade, with the help of financial experts, every time through their amazing strategy of mathematical probability.

This may sound unrealistic and impossible. However, there is no miracle or bragging here but the magic of mathematical probability through, the proprietary system of the one core program provided by the Asia Forex Mentor. The one core program is the recipe for ingenious trading results to humungous profits. All of this is possible due to the expert traders and trainers of the one core program who have designed strategies and know-how to edge out the market every time from basic to advanced level.

The developers of the Proprietary One Core Program are not just ordinary traders but are financial experts equipped with research-based trading strategies. These trainers have years of experience behind banks and successful trading institutions. As a result, these experts have come up with a comprehensive trading course ranging from beginner to advanced level.

Moreover, the One Core Program is not just a set of strategies to learn from but a complete trading solution with expert advice and tweaks and customized expert solutions for every individual client whether a beginner or an experienced trader. Hence, the AFM Proprietary One Core Program is the ultimate solution to all your trading needs

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Stock Brokers that allow you to Invest in Fractional shares

Fractional shares are important because they provide opportunities for people who may not ordinarily be able to participate in the stock market. They can sample some stocks as well as ETFs without having to commit to buying a full share. It also gives investors the flexibility to invest as much as possible in companies or ETFs they believe in.

Fractional shares are ideal if you are an investor with a low risk-tolerance level. They can help you manage risk more conveniently. They can also help you diversify your portfolio with smaller amounts of money since you don’t have to buy an entire share.

Another advantage of fractional shares is that it allows you to choose exactly how much money to pull from the market if you have a financial obligation. It also gives you more control over your portfolio than buying whole shares. For example, you may not wish to liquidate all your holdings of a company’s stock. Fractional shares allow you to choose what fraction of the shares to liquidate.

Finally, fractional shares allow you to buy into companies with high-priced stocks without paying huge sums of money upfront. Fractional shares are an interesting and exciting avenue for the new investor.

Stock Brokers that allow you to Invest in Fractional shares FAQs

Does Robinhood allow fractional shares?

Fractional shares are fractions of a company’s or ETF’s complete shares. Thanks to Robinhood Financial’s Fractional Shares, you may trade stocks and ETFs in fractional and full share increments.

Robinhood introduced fractional share trading in 2019. Fractional share trading allows you to buy 0.000001 shares of any stock, rounded up to the nearest cent, or simply $1 of any stock with no fees. Fractional shares offered by Robinhood can be as small as 1/1000000 of a share, and fractional share trading is real-time and commission-free.

For the time being, Robinhood only allows market orders for fractional shares and does not allow limit orders. Users of Robinhood can sign up on their website for access to fractional share trading.

Do brokers allow fractional shares?

Brokerage firms that offer fractional shares may impose restrictions on the securities that can be purchased and sold with fractional shares. Some may only accept fractional share stock investments, while others may provide both stocks and ETFs. Some brokerage services may impose restrictions on the stocks and ETFs that can be purchased in fractional shares.

Many brokers are beginning to provide fractional shares to attract younger customers, although some still do not. This could be due to brokers not being prepared to handle the recordkeeping and bookkeeping that comes with fractional shares, as well as issues with clearing firms and the broker’s financial commitment to hold the remaining fractional shares.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.