How To Invest: Are Your Investment Right Your Age

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

The #1 Forex Trading Course is Asia Forex Mentor

If you do not want to work until the day you live, it is extremely important for you to invest your money in the right way. A lot of people hold liquid cash whereas a lot of people opt for saving deposits with banks as a way to keep their money secure. However, the global inflation rate is higher than the interest rate offered by most banks. This is one of the reasons why you should always try to invest your money, rather than just storing it.

However, making investments is easier said than done primarily because there is a lot of confusion, and risks involved with investments. If you are in your early 20s, and 30s, it is the best time for you to start investing your money primarily because, in the early stages of your career, you can take more risks. Additionally, investments deal with compound interest, and more the time, the more profits you can make.

Now, there are several methods to invest your money, and each method comes with its own pros and cons. They include real estate, stocks, gold, cryptocurrency, and more. Moreover, the same investment strategy might or might not work for two individuals.

It is so because different individuals invest for different reasons, and their investment categories are also different. Investing involves risk as well which is one of the major reasons why you need to be really careful with your investments. You need to be really clear about your financial goals, and make the investments on the basis of the same. So how do you invest your money at every age? What should be your investment goals as per your age?

What is the best method for you to invest money in your 20s? How should you invest your money if you start later than others? You will find the answers to all these questions in this article. So let’s jump straight into the article. This article is going to be only personal finance, and investment fund guide you will ever need.

How To Invest: What is Investment

Before we can start discussing how to invest, it is important for us to know: What do you mean by Investment or Why do you need to Invest Money? In simple words, investing is a way in which you grow the money you earn. Let’s understand the most simple method of investing: depositing your own money in banks. For a lot of people, placing your money in a bank’s savings account is the best method of investment.

It is one of the safest methods to invest money, and your money grows annually at a rate of about 2 to 3%. For example, if you decide to keep your 1000 dollars in a savings bank account, and you get an interest rate of 3%, then by the end of the year, you should have 1030 dollars. This means that you made a profit of 30 dollars on your investment.

This is how most of the investment options work. You decide to invest your money in one particular option, and you expect a profit or return of x% on the same. It is worth pointing out that I have mentioned the term, expect, and not get. It is so because most investment options always come with some risk.

Now, there are different investment options that you can look out for. They include real estate, stocks, betting, gold, art, cryptocurrency, and more. None of the investment options mentioned above is the best. Each of these investment options has a portfolio of people who have earned ridiculous amounts of money by investing in them. For example, Warren Buffet, one of the wealthiest people in the world has made a majority of his fortunes by investing in the market.

Now, if you are planning to invest your money in stocks, or cryptocurrencies, or bonds, you will have to take the help of a third party that offers you to use a brokerage account. There are plenty of advisory or brokerage services as well, that help you in making the investments, and also advise you about the same.

There are plenty of individual investment advisors, as well as investment retirement accounts, that you can take help of if the need arises of the same. Regardless of which financial institutions you choose, they need to be trustworthy, and they should ideally have a successful investment portfolio to show to you.

Best Investment for your 30s

The 30s are one of the best times for investing because, by this point in time in life, you are usually done with a lot of expenses. Your house mortgage, car loans, and education loans are paid off, and you have enough savings in your bank account.

In your 30s, your risk tolerance as an investor increases, and you can look out for more options when it comes to making an investment. If you can handle the fall of stock markets, you can make aggressive investments in the market, and expect your money to grow at a rapid rate. So what are the investment advice or investment options for someone who is in their 30s?

#1. Workplace 401(k) or 403(b)

A lot of employees can not only grow their money by investing in Workplace 401(k) or 403(b) accounts, but you can also earn a lot of free money as well. A lot of employers pay their employees the equal sum of money their invest in Workplace 401(k) or 403(b) accounts, and this is free money, and you should definitely not miss out on this opportunity. You can easily invest 10 to 15% of your monthly salary into this investment option.

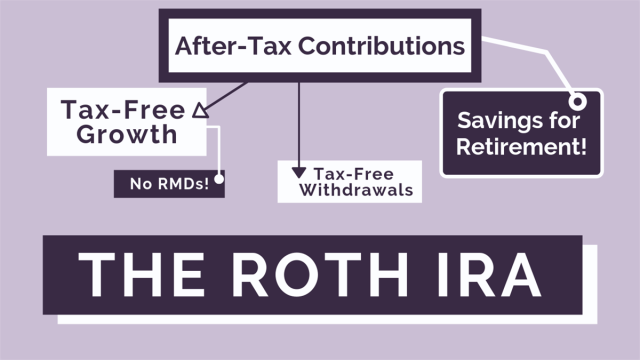

#2. Roth IRA

If you don’t have access to a 401(k) account, you can decide to put your money in the tax-advantaged Roth IRA scheme. If you satisfy certain income-related guidelines, you can invest up to 500 dollars a month in the Roth IRA scheme, or up to 7,000 dollars a year if you’re 50 or older.

#3. Investing in the Stock Markets

For a lot of people, for a lot of risk-takers, investing in the stock market is the best method of investment primarily because of the amount of money involved in stock trading. If you are a risk-taker, you can continue investing in the market even after incurring losses, and you learn from your mistakes, then investing in the stock market might just be the best choice for you.

If we have a look at the S&P 500 stocks from a period starting from 1928 to 2020, you will see that they have provided an annual return of roughly 10% on average. This is higher than most other forms of investment during the same time period. Every day when the stock market opens, there are hundreds of people who make thousands of dollars in just a few minutes, while there are thousands who lose the same amounts of money. This is just how the stock market works.

If you decide to invest your money in the market, make sure that you conduct proper research before placing your bets. Do not blindly follow any advice you read on the internet or something someone recommended. Always carry out your own research on the stocks you invest in because this is the only way you will grow as a stock trader.

#4. Real Estate

Real Estate is a type of market that you either love investing in or absolutely hate. There are hundreds of real estate tycoons all over the world who have made a fortune by investing in the real estate business.

However, there have been times when the real estate market has witnessed a huge lump that lasted for several years at a stretch. Regardless of the risks involved, the real estate business is bound to grow because of the ever-increasing population, and the limited amount of land available.

Investing in the real estate market should be an ideal choice for you if you have a large sum of money to invest, or if you are a bulk investor. You can purchase a home, and rent it out until you are getting a great deal on the house. You can also invest in plots, and either rent them on a lease or set up your own business there.

#5. Forex Market

The Forex Market is the largest financial institution in the world, and currencies worth trillions of dollars are traded on the Forex market every day. The Forex Market is quite similar to the Stock market in some ways, with one major difference: in the stock market, you trade on the stocks of different companies, whereas in the forex market you trade in different currencies being used in different countries across the globe.

#6. Cryptocurrencies

If you are a youngster, you must have seen some of your friends investing a huge chunk of their salaries in cryptocurrencies, and for the right reasons. Cryptocurrencies, especially Bitcoin, and Ethereum have given huge returns in the near past, and they are one of the hottest means of investment right now.

The risk to reward ratio involved in crypto trading is extremely high, and cryptocurrency is still not recognized by a lot of governments across the world. However, they are as legal as they get, and you can easily trade in cryptocurrencies.

#7. Mutual Funds and Index Funds

Mutual funds and index funds have gained immense popularity in the past few years, as they offer a decent return on your overall investment, with a less risk to reward ratio involved with them. You can always invest a small portion of your income into mutual funds, and index funds if you are looking to make a long-term investment.

There are several stock funds, and bond funds as well that you can look out for. There are also plenty of exchange-traded funds that you can take advantage of. In order to invest in a fund, you will have to take help from an online broker, and it usually comes with some small trading costs.

Best Investment for your 40s

If you haven’t started planning for your retirement by now, it is high time you start thinking of the same. Investing in your 40s is highly different from investing in your 30s because certain factors regarding our investments change as we grow older. So what are the investment options best suited for an investor in their 40s?

#1. Workplace 401(k) or 403(b)

What if I say that you can start investing in Workplace 401(k) even in your 40s, and you can make a million dollars by the time you retire? You can invest a maximum of 20,500 dollars every year in the Workplace. Let’s say you are getting an interest rate of about 6%. You will still retire with a million dollars in your hands.

A lot of employers pay their employees the equal sum of money they invest in Workplace 401(k) or 403(b) accounts, and this is free money, and you should definitely not miss out on this opportunity. You can easily invest 10 to 15% of your monthly salary into this investment option.

#2. Stocks and Bonds

Investing in stocks and bonds is one of the most favorable investment options for everyone regardless of their age. The only difference is that the ratio of investing in stocks and bonds will change. It is recommended that in your 40s, you should invest in stocks and bonds in a ratio of 60:40.

Investing in this ratio allows you to place your bets in the stock market, and still makes way for you to grow your money in a much more dependable way. The other options we discussed in the earlier section are also applicable here. The only difference is that they are not the best-suited investment option for you provided that you are going to start investing so late in your life.

#3. Cryptocurrencies

If you are in your late 40s, and you can take risks if you want to reap bigger rewards, then investing in cryptocurrencies might be a good option. It is primarily because cryptocurrencies have shown exceptional return rates in the past few years, and the demand for cryptocurrencies is on a constant rise. You can invest a decent portion of your investment money in cryptocurrency.

Best Investment for your 50s

Investing in your 50s, and later comes with its own set of cons. Because you have less time in your hands, the power of compound interest would not be fully applicable in this case. In order to get high returns on your investment, you will have to risk higher. Even if your risks pay off, you might not be able to grow your money significantly in this time period. You need to be really careful with the investment option you decide to go with.

The better investment option for you would be investing in the stock market. You still have about 10 -12 years before you retire. This gives you enough time to save a decent sum of money if you play your cards right. However, you will have to be really smart about the investments you make.

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Training Course

If you want to start trading in the Forex market, and you want to make it big, then taking a professional course that tells you everything you need to know about the Forex market might seem like a great choice. Now, there are plenty of courses on the internet that claim to educate you about the Forex market, but none of them come close to the Asia Forex Mentor course by Ezekiel Chew.

If you are a beginner who knows nothing about the Forex market, or whether you are a seasoned veteran who has spent years trading in the market, this course is meant for everyone. Beginners can learn the basics of the market, and how to start their journey in the Forex market.

Ezekiel Chew is one of the biggest names in the Forex trading world, and he is known for his immense knowledge of the market. He has developed the course over several years, and he keeps making new additions to the course every year to keep up with the modern practices of the Forex markets.

For example, one of the lessons in the course teaches you how to use mathematical probability techniques to predict the behavior of the market. This would certainly help you place your bets much more sensibly in the market. This course can be used by both beginner and advanced forex traders alike. It is a one-stop solution for all your Forex-related requirements.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: How To Invest

No matter when you start, by the time you stop, you will always wish that you had started investing earlier in your life, and rightly so. Investing your money the right way is extremely important because it not only helps you plan your retirement life better but also equips you with the power to deal with emergencies.

If something can be said with assurity about investment strategies, it is that one strategy might work for someone, and it might not be suitable for someone else. This is the reason why you do not follow anyone blindly who gives you investment strategies because what worked for them might not work for you.

The best way to invest your money is by researching the investment option you are looking to choose. If you are planning to invest in the stock market, you should analyze the stock market, and try to learn the basics of the market. If you are planning to invest in real estate, you should try to know how the real estate business has performed in the past few years.

Yes, it would have been better if you had started a few years ago, but it is never too late to invest your money. You can start in your 20s, and you can start in your 60s. All you need to do is take the first step in the world of investing your money.

If you are considering the option of investing your money in the Forex market, and you want to make the most of it, then taking a professional course might be a good choice. The Asia Forex Mentor course by Ezekiel Chew is one of the best courses on the internet, that would help you make better bets in the Forex Market.

How To Invest FAQs

Why is diversification important for investment strategies?

It is never a good idea to put all your eggs in one basket, and the same cannot be any more true when it comes to making investments. For example, if you have to invest 100 dollars, you should not invest the entire 100 dollars in any one asset like stocks or bonds. Instead, you should split the money, and invest it in different investing options.

Whether you like it or not, it is impossible to deny that you cannot make an accurate prediction regarding any investment option, because most of them are highly volatile in nature provided the return rates they provide. To protect yourself from this volatility, it is of utmost importance that you should always diversify your investment options.

Let's say that the stock markets around the world witness a crash tomorrow, and you have all your money invested in the same market? What would happen in such a case? You will lose all your money that is invested in the market, and you will be left with almost nothing.

On the other hand, if you had diversified your portfolio, it would be possible that you will still be having some of your investments still intact, and profitable. For an investor, a diversified portfolio is a must have. Just make sure that whatever investment decisions you make, is after a lot of research. Just do not follow anything financial advisors say to you.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.