5 Stages of a Stock Market Bubble 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

The stock exchange is a financial marketplace where the ownership equities of companies and other financial assets are traded between buyers and sellers. The global stock market is made up of exchanges, investors, and speculators as well as the assets traded on the various stock exchanges. The stock market is often a measure of the health of an economy because the ownership shares of the biggest companies are listed and traded there.

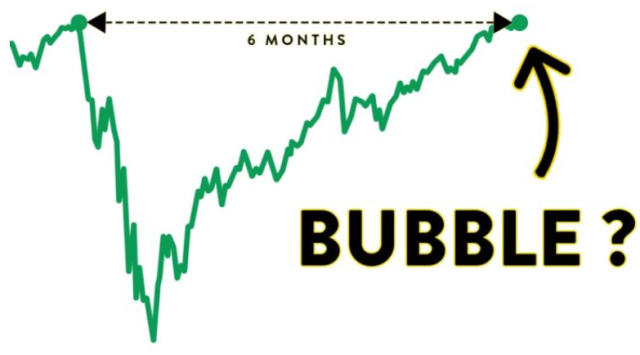

From time to time, stock market bubbles, stock market crashes, etc occur while at other times, it is a bull market and the market flourishes. In the article, we will discuss the meaning of a stock market bubble and the five stages that characterize it. We will also explain what happens when the eventually bubble bursts and how you can invest during market bubbles. Finally, we will introduce the best forex trading course.

What is a Stock Market Bubble?

A stock market bubble occurs when stock market investors or speculators are overconfident about a company’s stock and so drive its prices above its estimated fundamental value.

It is often difficult to calculate the fundamental value of a stock, but there are established methods widely used by investors to estimate a stock’s intrinsic value. The most common method used is the price-earnings ratio (P/E) which is obtained by dividing the company’s stock price by its trailing earnings over the last 12 months. Other methods used are: asset-based valuation and discounted cash flow analysis.

Originally, a bubble means a sphere of liquid enclosing air or gas. Sadly, all bubbles eventually burst and disappear. Market bubbles are no exception as they also burst when the stock prices eventually nosedive causing many traders to suffer losses.

Over the years, there have been several stock market bubbles that have adversely affected investors and entrepreneurs.

Bubbles are not peculiar to the stock markets, there have been other bubbles such as:

- Credit bubbles: upsurge in businesses offering debt instruments such as credit cards, loans, mortgages, etc

- Asset bubbles: This happens when the value of assets such as stocks, real estate, bonds, etc experiences a rapid rise in prices

- Commodity bubbles: when there is a spike in the prices of traded hard commodities like Gold, silver, or soft commodities like sugar, cotton, coffee, etc

- Economic bubble: This is an occurrence where the price of an asset or asset sector is exceedingly high when compared to its intrinsic value. Economic or asset bubbles usually end in a crisis in the economy of the nation or the globe at least. It is also called speculative bubbles, financial bubbles, or speculative mania

5 Stages of a Stock Market Bubble

#1. Displacements

This is the first stage of the stock bubble and it is characterized by a major innovation, discovery, technology, or change. It may also be triggered by low interest rates. Consequently, investor enthusiasm is engendered and financial market analyses will focus primarily on its potential and rewards.

For example, at the beginning of the dot com bubble, the advent of internet technology created excitement as its potentials were enormous. Investors did not want to lose out in the future when the new startups must have grown into blue chip companies. So, most tech stocks were regarded as growth stocks, and massive investments were made into them.

#2. Boom

As excitement and investments increase, demand outweighs supply which causes the stock prices to rise. More investors borrow money to invest or trade from highly leveraged brokerage accounts. As the stock prices rise, the asset involves attracts more attention from the media. Analysts, bloggers, and commentators give the speculative bubble some form of hype so that the public believes that the hyped products are growth or defensive stocks.

At this juncture, anyone who has not bought the stocks might believe that he may be missing a lifetime opportunity to invest wisely. So, they rush to buy at inflated prices.

#3. Euphoria

The bullish trend is sustained for some time until investors become reckless. They devise metrics and analyses to justify the unusual price increases, even though it is clear that the prices are beyond the fundamental value. The company’s valuation skyrockets and the greater fool theory takes over the speculative frenzy.

“Greater fool theory” is an occurrence that plays out during stock market bubbles. Investors generally believe that they will definitely find someone who will buy the overvalued stocks from them. So, during market bubbles, they go ahead to buy at exorbitant prices hoping to find a greater fool who will be willing to pay higher prices.

#4. Profit-Taking

As the prices rise to the maximum, the smart money investors initiate their profit-taking strategies and sell assets in the bubble market while hedging their positions. This is done systematically because it is almost impossible to predict exactly when stock market bubbles or even economic bubbles will burst.

So, to avoid losing money when the bubble bursts, smart investors reduce their stakes and become watchful so as to cash out if any major signs show up.

#5. Panic

At this stage of the bubble, the price increases cease, instead it reverses rapidly and investors start losing money. In a bid to cut their losses, there is panic selling as everyone is ready to sell at any price to mitigate losses. This drives the prices even lower and lower until it hits the floor where it becomes almost impossible to find a willing buyer.

Pros and Cons of a Stock Market Bubble Bursts

Pros

- Prices begin to stabilize after a bubble until it returns to normal.

- Smart investors who made money from the irrational exuberance of investors during the bubble are left with huge investment capital.

- The government may intervene to bailout some companies that lost money courtesy of the financial markets bubble.

Cons

- Prices decline steeply as sellers are much more than buyers resulting in losses.

- Stock market bubbles may affect the overall stock market or even the entire economy depends on the assets or sectors involved in the bubble.

How to Invest during a Stock Market Bubble

A stock market bubble inflates prices artificially; these rising prices reach a threshold where they can no longer be sustained leading to a crash. But, even in the midst of a market bubble, you can still make profits. One effective way of achieving this is to find assets that you can quickly buy, hold for a short term and then sell before the bubble will burst. This is a risky strategy but if applied correctly, it can be highly rewarding.

You can also search for blue chip companies with good fundamentals and performance history and invest in them. These big companies are most likely to withstand financial turbulence and economic stress. Even if the bubble bursts, they are likely to survive.

Sometimes, it is a good practice to ignore the market bubble and wait for it to burst. When it finally bursts, it signals a good time to buy the stocks of the big companies at low prices.

Best Stock and Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You’ll be able to trade forex profitably with a skilled trader’s help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew’s teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It’s not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines’ second-largest state-owned corporation.

Due to his strategy’s effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Stock Market Bubble

A stock market bubble refers to a period when the stock prices of a company rise exponentially above its intrinsic value. Most market bubbles are only identified after the bubble has burst and the subsequent crash in asset prices.

The damage done by bubble bursting depends on the asset classes or stocks involved and the size of market participants. It could cause a stock market crash or an unstable economy. For example, in 1992 when the Japanese asset price bubble burst, the Japanese economy was affected. Real estate and stock market asset prices crashed. The country experienced stagnant economic growth for a long time.

The five stages of that characterize a stock market bubble are; displacement, boom, euphoria, profit taking, and panic selling.

Stock Market Bubble FAQs

Why should I care about stock market bubbles?

It is important to watch out for stock market bubbles because of the following reasons:

- To avoid losing money: Many investors lose money when the market bubble bursts. But, speculators who are on guard and recognize it take advantage and make money during the asset bubble.

- Wealth management: It is a good practice to always assess your portfolio in manage it wisely. Anytime, you see a bubble forming, you can identify the investments at risk and move them to lower-risk alternatives.

- Protect your investments: When some market bubble eventually bursts, it may affect the overall stock market or economy. You may lose a lot of money, so, it pays to properly manage your finances to withstand an impending crisis.

When was the last stock market bubble?

The last bubble started in early March 2020 when the Dow Jones industrial average (Dow) dropped by about 7.7.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.