3 Stock Order Types – Explained By An Expert 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

In the financial market, traders and investors are always looking for ways to make profitable returns. However, there are many steps an investor has to go through to achieve this success. From analyzing the market through technical analysis and using multiple indicators to gauge the market conditions to the final order executions there are numerous actions involved. However, the last and final step is the application of the appropriate stock order types.

To understand stock order types better, we've got Ezekiel Chew who has made his mark in the forex market through his exceptional trading skills. Moreover, he is also well-known for his forex training platform where traders across the world learn from his trading techniques.

According to Ezekiel, stock orders are instructions that are given by the traders to the brokers or automated trading systems for the execution of the trade. These instructions could be given in multiple ways, known as stock order. There are multiple types of stock orders, and each of them has a specific function in the trading process. For this reason, each stock order type is relevant for the traders.

In light of the above knowledge, this review aims in providing a deeper understanding of stock orders and their types. Moreover, the benefits and limitations of each order type will also be discussed in detail. Finally, a corresponding concept of price gaps is also explained to the readers to have a comprehensive understanding of the financial concepts.

What is a Stock Order?

Success in the financial market is based on many integral components. Among these components are the stock order and its types. Investors and traders who are either affiliated with a broker or brokerage firm or trade on their own have to give an order of instructions.

Without the stock order, any trading process would not be able to start as it contains the trading instructions. For this reason, stock order is an important component in financial markets. This stock order is further executed by the broker or the automated system and the final buying selling or entry and exit in the market takes place accordingly.

There are three different types of stock orders and each performs a varying task for the traders. For instance, one order would help traders to reduce risks while the other would make sure that the trading transactions are made immediately. Hence, each type of order is important as each serves a unique purpose.

Traders and investors may choose the stock order type according to their trading styles as there are many different types of orders. The trader's view of the market and the price action of the underlying asset determines the type of order. Therefore, a stock order has a great impact on the trading results.

3 Order Types

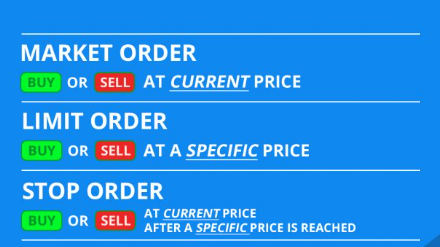

There are 3 main and most commonly used stock order types; market order, limit order and stop order. Traders and investors may choose any stock order type according to their trading styles as there are many different types of orders. The trader's view of the market and the specified price of the underlying asset determines the type of order.

All three types of stock orders are used to buy and sell not only stocks but any underlying asset in the financial market including commodities, securities, bonds, currencies, or any other asset. The main aim of these orders is to assist investors in trading stocks effectively.

The difference between the three types of stock orders lies in the stock price limit and time duration of the buying and selling process. Each type defines the specified price of assets that they want to buy or sell and also when they want to buy or sell. Moreover, there is also a type that provides instructions to brokers regarding stopping the trading process.

Each of the stock order types is designed to perform a specific task. For instance, one helps in reducing risks while the other provides immediate trading transactions. For this reason, investors and traders who are looking for obtaining the desired trading results need to be familiar with each type of stock order.

#1. Market Order

Market orders are the most popular and widely used order type by investors and brokerage firms. Market orders are frequently used when investors want to buy or sell assets immediately. Whenever investor realizes that the market condition is suitable for trading, they may use the market order to execute the trading process.

The best part about market orders is that the investor can buy and sell any asset at the current market price. When a market order is executed whatever bid or ask price is in the market, the order is filled at that price. This allows the investors to analyze the market prices and execute an order whenever the best price is being offered.

Even when the price limit is already determined by the investor while placing a market order, the exact price cannot be assured. In a volatile market where the prices are fluctuating rapidly, price movement is possible even if the orders are filled immediately.

Market orders are also preferred by traders and investors because brokerage firms charge a low commission for market orders compared to limit orders. This makes the trading process affordable for the traders. Therefore, traders who opt for long-term trade are in favor of market orders as they are concerned with long-term profits and not with the current market price.

How does it work

Market orders are simple instructions given by the investors to the broker or the automated trading system to buy or sell a security. When an investor wants to buy a stock, the price bid will be posted. Conversely, while selling stocks the price is asked. Therefore, the market order will include all these bid/ ask directions by the investor.

After a market order is placed the broker or the system would execute the order immediately. The asset will be bought and sold according to the current bid/ask price of the market. For this reason, market orders are effective for investors who want to trade without any hold-up at the best price possible.

The biggest advantage of market orders is that they fill or execute almost all trading transactions. The only orders which might be delayed are the ones that face no trading liquidity in the market. Consequently, investment firms that trade hundred of stocks per day also find market orders most beneficial as they can trade in quantities per day.

#2. Limit Order – Explain what is Limit Order

The limit price order, as the name suggests allows investors to limit the price of their trading transactions. Unlike market orders, limit orders are not executed immediately and will only be filled when the set price level is reached. In a way, it is a customized stock order where investors can choose their desired price action.

Limit price orders are best placed when investors are taking long positions. Therefore when investors want to sell stocks at a profitable price, they would limit orders so that the stock is sold only when the price reaches the profitable price level for the investor.

Limit orders are only filled when they reach their defined price limit or if they are canceled or expired. Therefore, there are more chances that all limit orders might not be filled. Moreover, the drawback of limited orders is that investors might not be able to trade for a long time until they reach the order specifications.

Investors and traders who prefer to trade focusing on the short-term market trends will be concerned with the current market price and so limiting price orders will be the best option for them. Moreover, investors looking to reduce their investment risks also encourage limit orders.

How does it work

A limit price order is also referred to as a pending order, as the order is not executed at the current market price but would take place later in the future. Limit price orders are not as easily filled or executed as the market orders as it requires certain stock price specifications by the investors.

The advantage of limit orders is that the investor can be assured of the exact risks and profit involved in each trading transaction. For instance, if an investor wants to buy a security at $ 20 the limit order ensures that trade can take place at less than $ 20 but not a penny more than the specified price.

On the other hand, the flaw of a limit order is that the trading results are not quick compared to the market order. Moreover, many brokerage firms limit order costs to more commission than market orders. For this reason, it is wise to be sure of placing a limited order so that the additional costs are worthwhile for the investor.

#3. Stop Order – Explain what is Stop Order

The stop price order is the third type of stock order which has completely different functions than the market and limit price order. As market orders and limit price orders are instructions to perform trade within the given price and time specifications, stop price orders remain inactive. They are only executed when a certain price level is reached and the trade bounces back to market orders.

Investors usually use stop orders to hedge against potential risks. Whenever the market situation is uncertain or volatile investors do place a market or limit order however financial experts advise them to put a stop order in between. Hence, with a stop order, there will be a pause to the market and limit orders until a certain set price limit is passed.

More than an order within itself, a stop order is a way to restrict the market and limit orders. Since market conditions are unpredictable and price reversals cannot always be accurately anticipated, stop orders comes in very handy for investors in such a scenario.

How does it work

The ideal time to use a stop order is when an investor's trading transactions are in greater numbers or when the investor is unable to keep an eye on the market price at all times. In such a case, when the investor is unavailable it is best to put a stop limit order to avoid risky situations. There are four types of stop orders which vary according to the trading needs of the investors.

The first is a buy-limit order. This order is specifically placed when investors are looking to buy an asset. However, the limit price order is only profitable when the investor gives instructions to buy an asset at or below the market bids. The second type of limit price order is the sell limit order. This is opposite to the buy limit order and so the order should consist of a price limit at or above the ask.

The third and fourth type of limit order is the buy-stop and sell-stop order. The stop orders are opposite to the buy and sell limit orders. These stop orders are mostly used by investors to hedge against investing risks. Hence, the buy-stop order is filled when the buying price reaches above the market price and the sell-stop order is executed when the stock reaches below the market price.

What are Price Gaps

Price gaps mean when the price of an asset rises or declines from the last closing price without any trading activity. This usually happens when certain news regarding an asset is circulated in the market due to which investors are ready to buy or sell the asset when the market opens. Consequently, the price falls or rises than the previous day closing even after the trading discontinuity.

Price gaps are frequently observed occurrences in the price chart of an asset. These instances are called gaps because the price opens with reversals or upward trends without any trading activity during the close trading hours.

There are partial gaps when the opening price is within the range of the last closing price. Whereas there are complete gaps when the trends entirely change from the last price action.

There are four types of price gaps in the trading market. These are common gaps, runaway gaps, breakaway gaps, and exhaustion gaps. The similarity in these gaps is that all of them occur due to some kind of correspondence regarding an asset within the investors. The difference is that all gaps have contrasting investment consequences for the investors.

Price gaps are a common occurrence and do not specifically indicate any particular market trend. However, frequent price gaps are a sign of a price reversal or a new trend. Moreover, there is no known reason for these gaps other than the news that spreads in the market.

Best Stocks and Forex Trading Course

Profitable trading requires assistance and training from a great mentor. However, not all good traders are great trainers. It is one thing earning substantial other profits for each trade and another thing training others to do the same. However, the founder of Asia Forex Mentor, Ezekiel Chew has proved himself both as a trainer as well as a successful trader across the world.

The secret behind this triumph of Asia forex Mentor as a forex training platform is that its teaching course is based on the concept of mathematical probability. This phenomenon makes sure that the investors and traders get the same expected results in each trade. Since the mathematical calculations do not change under any circumstances so the trading results remain the same for the traders.

In addition to this, the trainers in the AFM one core program are experienced traders who know the science of trading and have the skills to train new as well as seasoned investors. Moreover, the trainers have also proved their worth in multiple banks and trading institutions which makes a competent team of trainers for this course.

The one core program is not intended just for traders who are new to forex trading but it is aimed at anyone who wants to polish their trading skills. Moreover. those accomplished investors who have the experience yet are looking to learn about new strategies and updated trading tools can also join this course. All in all the AFM one core program offers a comprehensive course from basic to advanced level training to a range of traders.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Stock Order

The sign of competent and successful investors is that they always take necessary precautions and gauge the risk/reward ratio before making any investment decisions. Therefore, technical analysis helps traders and investors to evaluate the current market price and then invest accordingly. Once the market is assessed the final step is to choose an appropriate stock order for execution.

Stock orders are instructions that are given by the investors to the brokers or the automated trading system to initiate the trading process. These orders have a great impact on the outcome of the trade for investors, therefore it is important to choose the right type of stock order.

There are multiple types of stock orders, however, the most commonly used stock orders are market orders, limit orders and stop orders. Each of these types has a different function as it provides a different set of instructions for trade execution. Therefore, all three types of stock orders are effective depending on the trading situation.

Investors and traders who want to earn a profitable trade should be familiar with all three types of stock orders. Investors who deal in multiple trading transactions for the long term might go for market orders as it involves a low commission fee and can execute trading transactions immediately.

In contrast, traders who want to avoid risk would prefer to limit order even if it costs more. And those who like to control their trading transactions will favor stop orders. All in all each stock order type serve a different purpose and so all are equally important in the financial market.

Stock Order FAQs

What is the best order type when buying stock?

There are three types of stock orders namely market order, limit order and stop price order. All three types have different functions and they help traders in providing appropriate trading instructions for execution. However, the most commonly used type of stock order is the market order.

Mostly traders and investors are looking for immediate trade execution to buy or sell an asset. Therefore, market orders are the best order type because they are cheaper compared to other orders and also provide instant trading results.

How do you categorize shares?

Shares of any public trading company are categorized into two different groups. These groups are commonly known as class A shares and class B shares. The difference between these two groups depends on many components such as the right of votes that a share receives from the board of directors and also the lack of votes in each category of shares.

Moreover, the dividend payment is also a factor that is accounted for while classifying shares. Class A shares offer fixed dividend payment to shareholders while Class B share allows voting rights to the board of directors.

How do you categorize stocks?

Investors look for stocks that are suitable to their investment needs and involve minimal risks. However, stocks are categorized according to the sector of business with which a company deals in, the size of the company as well as the number and types of shares which are offered in public.

There are many different categories of stocks including common, preferred, value, growth, income, and IPO stocks to name a few. Investors who have prior knowledge regarding different categories of stocks can make better decisions about stock investments. Moreover, they would be able to earn considerable profits with diversified portfolios.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.