How to Use Overweight Stocks: A Complete Guide for Beginners

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

Traders face many terms along with their trading careers. While grasping each of the terms is not mandatory, it surely plays a great role in clarifying many quagmires.

One among the many terms is Overweight stocks. Of course, while making attempts to clarify the terms, the meanings of each may be approached from a layman's point of view. In our case with Overweight stocks – something worth – heavy.

In the course of making efforts to always provide clear and helpful content, we'll seek the indulgence of experts. And in this particular case – Ezekiel Chew. He has more than twenty years of expertise in trading financial markets. Besides, he gives back to society by sharing his knowledge with learning traders.

There's nothing more inspiring to learner-traders than receiving insights from someone who starts from zero to expert levels in forex trading arenas. More so, especially when it comes from a trainer. Other than inspirational, it generates very positive energies – which traders need to face the markets.

Along in the post, we'll guide investors into more in-depth scenarios regarding Overweight stocks. Specifically, we'll seek to share why Overweight stocks are a key target by investors. But more especially, why they are to be diversified along with others into a portfolio.

What are Overweight Stocks?

In very simple terms, an overweight stock has expectations to outperform others into the foreseeable future.

The foreseeable future, according to CMT Association, applies to the period not less than six months but not exceeding 12 months.

If we take a practical scenario, when a chartered market technician or technical analyst rates a stock as overweight, they mean – investors need to hold more of it.

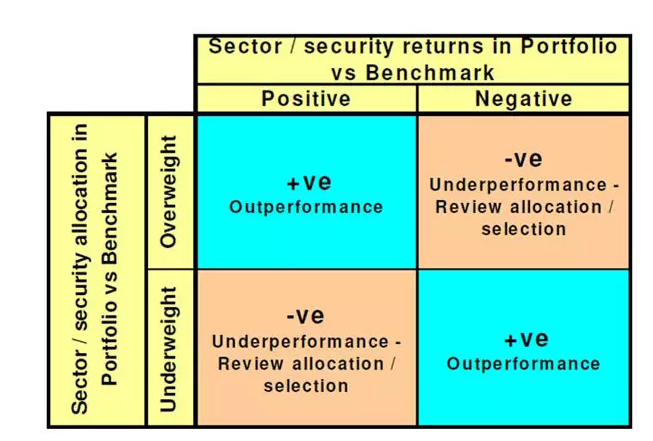

In that context, if an investor holds an overweight stock in tech stocks. Assume the valuation of 15% holding vis a vis a 10% valuations benchmark.

The portfolio is therefore 5% overweight in tech stocks (market valuation minus the generic valuations, or 15% less 10% – 5% overweight).

Overweight, therefore, is a nod or thumbs up to hold or buy more of an overweight stock.

Conversely, it's reasonable to consider an underweight stock in a portfolio. Analysts believe that an underweight stock will score poor results in the future. And the future here ranges from 6 months to 12 months.

Brokers or financial analysts guide that investors hold fewer percentages of stocks deemed as underweight.

To these extents, investors may ask how the analysts actually do the weighting. And they rely on many metrics or variables happening concurrently. Since markets always keep changing, so do the values.

So before attaching the weight, it takes into consideration may expectations of a stock in relation to its future performance. Agreeable, whether a stock is over or under-weighted is more of a fundamental analysis. There's little to nothing to do with technical analysis.

The last point here is it's important for investors to have reasonable comprehension of the weighing. More so, the implications it has after taking investment decisions of whether a stock is over or under-weighted.

Pro-investor tip: While an overweight stock attracts prospects, Investors have to approach it rationally. It's not an avenue to increase the holding without balancing other factors. The realistic fact with diversification in a portfolio is to cover an investor – should anything go wrong.

Reasonably, market analysts or valuers are able to gauge and rate current stock value in light of future expectations. It's that foresight from formal courses and experiential work that helps an analyst give a probable rating.

Why do Analysts Weigh Stocks?

Analysts weigh stocks as part of their duty to help investors understand the underlying issues with regard to valuation.

Investors look for the best returns out there. Therefore, analysts help dig deeper into what is finally a price tag of a stock over time. In simpler terms, analysts look for information about stocks, and the information helps investors position themselves appropriately.

At the bottom of the stock-analysis pyramid is the information. Investors who get the information at the right time are able to take the opportunities arising from the markets.

Analysis of the stock market is complex – it takes on a futuristic angle. Let's take the example of Bitcoin. Assuming you knew Bitcoin would get valuable ten years down the line, you could have bought as much. Stock analysts' tasks revolve around such, albeit the complex environment in the markets.

Weight Ratings in the Stock Market or Mutual Fund

Stock market analysts find employment within investment firms or like-minded organizations – like mutual funds. And their specific job is evaluation of financial performance.

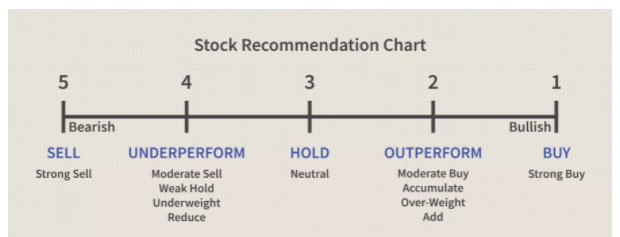

The result of a stock analyst's job is to rate a particular stock. And a particular stock can only fall within 3 generic categories:

One is an overweight – probable buys

Second rare the underweight stocks – probable sells

Thirdly are the neutral stocks – probable holds (equal weight)

Agreeably, before arriving at the three, much effort has gone into everything.

Equal Stock Weights

Stocks with neutral or equal weight stocks are perceived for holding purposes. And to be more specific, the performance expectations are they will be equal to those similar to them within a portfolio.

Critics to Overweight Stock Rating

Investors often offer criticism to analysts regarding their interpretations. And in light of this, investors feel the weighing of stocks misses one key thing – the numbers or units an investor can purchase of an overweight stock.

Of course, It may be too high an expectation of the investors from stock analysts. And one varying thing is the portfolios, and capital amounts investors hold.

Therefore, the guidance for buying specific, say 10 or 500 shares of stock X, isn't clear other than the tag – Overweight.

One other hurdle investors face is the unique portfolios they hold. Every portfolio is unique as regards the individual stocks it holds.

Therefore, any prospective overweight stock out there may not be a perfect fit. More so when the risk minimization aspect of a portfolio comes into consideration.

To make more emphasis, investors and traders should not simply buy more because an analyst rates a stock as overweight. It may actually be reducing the diversification of the portfolio.

The tag overweight stock may, therefore, only be too overrated. Simply buying more of it may end up tying too much capital within a single company or its shares.

On the most adverse end, if the analyst was purely wrong, or if things happen as they do, an investor may lose capital arising from an over-exposure.

So overweight ratings only offer minute guidance regarding how much an individual investor can pick relating to purchasing the shares into their diversified portfolio. Utmost, other than chasing the overweight stocks, an analyst believes it's more important to work with a well-balanced portfolio.

Special Stock or Mutual Fund Weighting Considerations

One important to put on the table is the timespan a stock analyst expects the term – Overrated to be valid.

So over and above accepting the term overweight, it's important for an investor and trader to get to know how the analysts go about their analysis. Further, seek to know the benchmark stocks they use. In particular, the analyst could be following long-term investors in the overall market. Or following short-term trade investors.

Other unlikely but key metrics include the time span of the investments and the age brackets of investors. These two are very likely pointers as to how long a stock remains in the portfolios.

Let's pick on two scenarios:

One is a retiree, and they may want to hold a stock for a few months. Else, they may take several years. And the stock or overall portfolio must be cashed at some point in time.

From another point of view, millennial investors may hold a stock for a very long time horizon. Also, they may have a more risk-tolerant nature.

Examples of Overweight Stocks

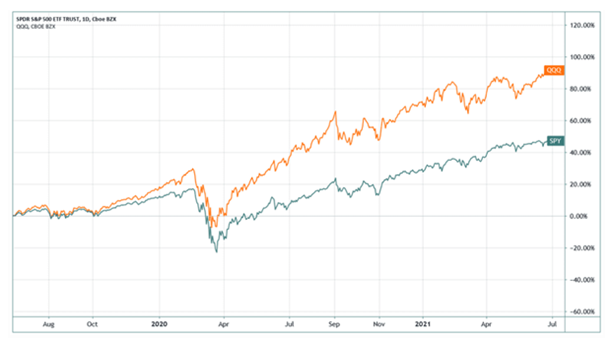

Stock prices are always changing, and one way to analyze and hit profits is by spotting underweight or overweight ratings. One example of good performance is the tech stocks in the entire stock market. It has been so for a few years now.

In particular, the ETF at QQQ weighs more if you compare it with tech companies on S&P 500. Its scores hit an extra four percent profit over the standard ones on the S&P 500 ETF. An extra percent counts for investors, especially for years with slightly high inflation.

One reason explaining the high returns is the coincidence of a period with high technology investment demands. The reality is traders buying QQQ had to face high volatility and risks, though with great returns.

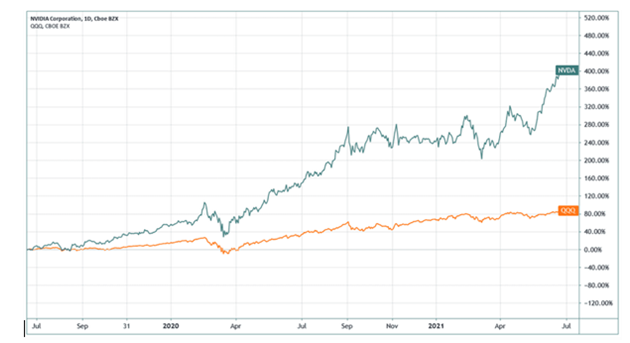

A second overweight tech stock is the NVIDIA. Analysts expect amazing performance from the firm out of its rare products with high market share dominance.

In the above graph, QQQ has good performance. However, NVIDIA stock outperforms the rating with respect to other stocks. The massive outperformance serves an extra portfolio diversification, as opposed to holding QQQ stock alone.

While holding NVIDIA company stocks alone will score high returns, diversity provides extra cover – should anything happen to the case of a portfolio.

In reality, many analysts go for smaller yet promising stocks and merge them with outperformers like Amazon and Apple. Also, stock markets have no sure plans ahead. A company stock that has an overweight tag is not a sure bet that it will perform amazingly.

Therefore, it's best to invest with the correct approaches – checking the trends and placing the right bets.

How to Invest in Overweight Stocks and Other Securities

Spotting overweight stocks to include as part of an investment is easy. The uphill task is the correct sizing or balancing to come up with a diversified portfolio for a given investor. Otherwise, throwing a huge chunk into one overweight stock is a recipe for losing it all in a single investment.

Taking track of stock performance and news around them is an adequate way to pick overweight stocks. Experts say that ratings are simply recommendations from a given benchmark index. Therefore, it's only reasonable to do own specific research before making commitments.

One key approach is to always ask yourself why you commit to the investments. Is it to increase your money or to save for a retirement kitty? It helps you gauge the longest period you want to have more money tied up in the markets.

Accordingly, overweight stocks will favor your prospects in not less than 8 months. Assuming you have 10 years, you have a clearer picture. Plus, other downside risks like tax rate hikes along in the duration.

Therefore, the best approach is to figure out all the above reasons: plans and applicable timelines. More significantly, aim at a portfolio balance with respect to your risk tolerance.

Finally, once you are clear with portfolio diversification, take an extra step. Next, allocate between 5 % to 10% of the funds for speculation. In that order, you may increase the speculation by starting small and increase as you grow your expertise with time.

Best Stocks and Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn't. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It's a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Overweight Stocks

Overweight stocks are easy to track with performance. However, when it comes to picking individual constituents, investors/traders require to be keen enough to Beta or overall risk aggregate they can accept.

Analysts approach their recommendations from varying points. Therefore, on cognition of that, it's important for investors to make efforts to see what metrics the analyst put on the table. It will be incorrect to assume a short-term stock analysis rating will apply to a longer-term scenario.

One key metric should be very clear; the benchmark stocks the analyst or fund manager uses to give recommendations. The idea is to help align the benchmark index with the target overweight stocks to consider as constituent stocks of the portfolio.

Ideally, using overweight stocks pertains to working with the analyst information or ratings. Vetting the results and creating a nexus with individual investor tastes for risk and returns in light of timelines for tying the capital within stocks.

Lastly, there's a note regarding speculation – allowing less than 15% capital in the portfolio for speculation purposes. With liquid capital, inventors can pounce on opportunities that arise on a rare basis. Yet, require liquid capital to take on and profit from. It's a unique and reliable model for growing the portfolio.

Overweight Stocks FAQs

Should I buy overweight stocks?

Yes, an investment portfolio is free to buy more overweight stocks of a particular asset. However, there are key considerations to take note of. And the considerations will help weed out speculation from the approach a trader takes on. Firstly, overweight stocks are simply an analyst's recommendation. It falls within the duty of a trader to research further and see if the stock fits the aspirations.

Other than buying the stock, what aspect will it change within the portfolio? Will it add to the risks or reduce them? What benchmark is the analyst rating upon? What timespan will the overweight tag last? And what are the future timelines for tying the capital? So overbought is simply a recommendation to buy.

What is the meaning of an overweight rating from a broker?

The term overweight simply means the underlying stock has higher chances of gaining in value into the foreseeable future. Experts cite a waiting duration of between 8 to 12 months. On a broader scale, being overweight is a relative condition or estimate. There's no guarantee the stock will rally to score the high values as negating aspects are bound to pull it down at any point in time.

Investors have a duty to dig deeper to see if the stock highlighted as overweight fits their individual investment takes. It scopes the risk appetites among other key portfolio diversification considerations.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.