An Introduction to Carry Trading and How It Works

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

Do you know that one trading strategy can make you money if the stock price doesn't change for long? This trading strategy is known as “carry trading,” which involves holding a high-interest rate and selling a currency with a lower interest rate.

For carry traders, the value of a currency pair is determined by the interest rates and relative interest rates. The interest rate is a measure of how much money it costs to hold money in some form of savings account. This strategy is considered risky, but if done correctly, this type of trading can be very profitable with little risk if positions are closed before too much movement.

To better understand the carry trade strategy, we've got Ezekiel Chew, the CEO and founder of Asia Forex Mentor – one of the leading forex education companies in Asia, to share his take on Carry Trading. He is one of the industry's most popular and respected figures with over 15 years of experience trading forex. We will discuss carry trading, funding currency trade works, risk involvement, and more.

So, without any further ado, let's get started.

What is Carry Trading

Carry trade strategy refers to the strategy whereby a trader invests in a currency with a low-interest rate against another currency with a higher interest rate. The trader will use leverage and try to profit from the difference in interest rates. Central banks commonly use this strategy because they can borrow from other countries at low-interest and higher interest rates.

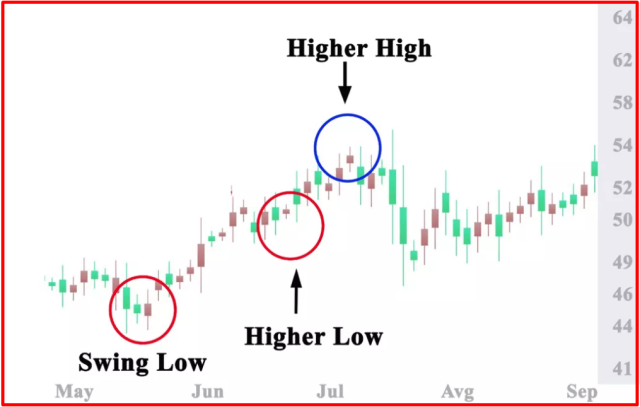

The most frequent carry trades are currency pairs like the Australian dollar/Japanese yen and New Zealand dollar/Japanese yen because the interest rate spreads on these currency pairs are quite high compared to others. Therefore, the first step in building a carry trade is determining which currency has a high yield and which has a low yield.

You can check out the interest rate of different currencies as they are updated on websites like FXStreet. After that, you can mix and combine the currencies by keeping the interest rate in mind. You should monitor these rates on a regular basis since interest rates can be changed at any time. Moreover, forex traders should check in with their country's central bank websites to stay up-to-date on these rates.

How Funding Currency Trade Works

Whenever traders have funds, they have to decide how much of these funds to allocate towards their trade position. In case they are Carry Traders, they will use the difference in interest rates between currencies to determine the amount of money that should be allocated in each trade position.

Carry trade allows traders to buy low and sell high and enables currency speculators to profit by buying low and selling high. This is not something that can be accomplished on a daily basis. Instead, investors who use a carry trade borrow money at a low-interest rate, then sell the borrowed money at a higher interest rate.

After that, the trader purchases a new currency with the profits from the previous sale and makes a profit because of the larger interest rates on the new currency. Because of the big interest rate gaps in forex carry trading, it uses currency pairs.

The central banks typically use monetary policies to reduce interest rates. They do this to promote economic development during recessions. When interest rates fall, investors borrow and invest by establishing short bets.

Best Interest Rates for Carry Trade

The correct currency pairs for a carry trade determine whether the technique is favorable or unfavorable. In a positive trading strategy, investors seek currencies with a higher interest rate than the pair's base currency. Negative carries traders look for currencies with a higher secondary currency and a lower starting rate.

At the start of the century, the Yen carry trade was quite popular. Traders brought the US dollar because it had a higher yield and sold the Yen, which has a low yield. However, it became ineffective to practice the Yen carry trade after interest rates dropped due to the worldwide economic crisis that began in 2008.

Today, the way to trade Yen is to buy Australian or New Zealand dollars while selling Yen. Because of the difference in interest rates between currencies, good pairs for trading are the AUD/JPY or AUD/CHF. The yield on the Australian dollar is significantly higher.

The Japanese yen (JPY) or Swiss franc (CHF) as the secondary currency provides a positive carry trade because of their high yields.

Example of Currency Carry Trade

Suppose a trader wants to enter the foreign exchange market and deposits $2000 into his forex account. He chooses to trade AUD/JPY for a positive carry trade with an interest rate gap of 8%. The trader opens a position valued at $40,000 in the currency pair with a leverage ratio of 20:1; the deposit rate is only 5% which is a low-risk investment.

However, the potential scenario depends on how the market moves and if the currency pair grows in value. The investor will be paid 8% on the full position value; any additional gains are derived from it. However, if the currency pair's price declines, the trader must close his position. Therefore, he will keep his $40,000 margin buffer.

If the pair's interest rate remains the same, the investor receives a return of 8%. He will not incur any additional gains or losses.

Risk Involved

In most cases, the forex carry trades involve two risk factors. First, when there is a big shift in the exchange rate, the exchange rate affects significantly and may result in significant capital loss. The interest rate reflects the profit of Carry trade positions. The bigger the difference between interest rates, the more enticing the opportunities are.

Carry trading allows you to acquire assets you would otherwise be unable to purchase. Trading carries interest and allows for interest earnings. The leveraged amount is used to compute daily interest payments. It's possible to earn a considerable return with a little investment.

Although the uncertainty in exchange rates is risky, regardless of how much ROI you may make with this approach. Any little changes in currency rates might result in significant losses if traders do not hedge their position. You can practice Carry trades with a demo account before using your real money. This will give you a gauge of how much you are willing to lose in the real market.

Traders typically do not use Carry trading as their primary stock market trading but rather employ it to supplement other methods.

Emerging Currencies Market

Carry trades are more common in the emerging currencies market. The global economic situation can bring many opportunities for trading currency from emerging markets.

Countries like Russia, Chile, Poland, and Malaysia are seeing interest rates based on the Federal Reserve's promise that they would not raise theirs. This is a fantastic opportunity for an extended market rally. Carry trade may resume in emerging markets if there is any movement in developing nations.

The Best Stock and Forex Trading Course

Bankers, hedge fund managers, prop traders, and others have all learned from Ezekiel Chew how to make money by trading forex, stocks, indices, commodities (including gold, silver, and cryptocurrencies), and everything else that can be traded.

In a short time, his course will reveal how to earn more money in a month than most individuals do in a year. His course will demonstrate how you may achieve the same financial success that his proprietary approach has brought him and many students. On the same day you sign up, you will have the option of making a real money deposit into your account.

His approach to teaching is built on the principle of return on investment, where you invest $1 and get $3 back. It's not about gimmicky tactics or spectacular methods. He has a trustworthy system that banks and experienced traders employ.

He is responsible for many banks' achievements, notably DBP, the second-largest state-owned bank in the Philippines with more than $13 billion in assets. His course is simple enough for seven and eight-year-olds to understand. If they can understand it at such a young age, anyone can learn this technique if they put in the time and effort.

This strategy is so helpful that it has produced many full-time traders who were new to trading when they entered the program. Visit Asia Forex Mentor to learn more.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Carry Trading

Carry trading is a simple yet effective strategy that can generate profits in the forex market. However, it is important to remember that this strategy is not without risk. Therefore, before employing this strategy, test it on a demo account first. This will give you a feel for how the strategy works and how much risk you are comfortable with. Then, once you understand carry trading, you can begin implementing it in your trading.

When done correctly, carry trading can be a very profitable strategy. However, it is important to remember that risk is always involved in any type of trading. Therefore, use proper risk management techniques when employing this strategy. This will help you to protect your capital and maximize your profits.

Carry Trading FAQs

Is Carry Trading profitable?

Theoretically, carry trading is profitable but still risky. However, in reality, many factors can affect the profitability of carry trades, such as interest rates, currency values, and global economic conditions. Therefore, this high-risk trade succeeds only if the interest in the high-yield currency does not counteract the currency's declining value.

The currency with a higher yield drops in value to reduce the higher yield, which is inefficient. According to studies, the higher-yielding currency usually rises versus the lower-yielding currency in most cases. Collecting the difference in yields.

Why is it called a carry trade?

The term “carry trade” comes from traders essentially carrying or holding the position for an extended period of time. The carry trade is a long-term strategy; it can take weeks or even months before the trade is closed. The idea behind the carry trade strategy is to capture the difference in interest rates between two countries.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.