Blank Check Company: Overview, What It Is, And How It Works

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

When a private business is turned over to the public, it simply implies that public investors and traders can invest in such companies and buy their stocks as well. But, stocks from these companies are heavily regulated as this can result in a series of processes and procedures. However, there is a company that saves private businesses and companies all these processes.

A blank check company, also known as a special purpose acquisition company (SPAC), is a publicly-traded company founded essentially to acquire or merge with a private business or company but has no established business plan. A “blank check” company is a company with the intention of financing a merger or acquisition opportunity with a private business or company.

Now that we briefly know what a blank check company is, we have Ezekiel Chew, a finance expert, and forex mentor, to further simplify the concept of a blank check company as he sheds more light on it. Scroll down the paragraphs below for more information.

What is a Blank Check Company?

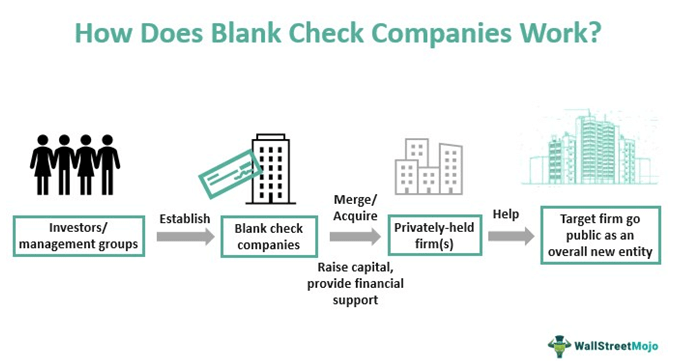

A blank check company, also known as a special purpose acquisition company (SPAC), is a public-traded company established solely for the merger or acquisition of one or more private businesses. A special-purpose acquisition company is founded by management-oriented groups or investors with the intent of integrating the business models of their would-be future business partners.

Majorly, a blank check company is a group of investors with financial strength, skills, and resources that can be utilized to raise funds and boost the financial strength of private businesses and companies. The blank check company supports companies and private businesses that are short of funds but have a good business plan. However, the primary intent of the blank check company is to merge or acquire such companies.

For the merger or acquisition of companies, the Securities and Exchange Commission (SEC) has laid down rules and regulations for special-purpose acquisition companies, which are quite different from those of shell companies and venture capital companies. Blank check companies are considered speculative and are classified as penny stocks by the Securities and Exchange Commission (SEC).

The special-purpose acquisition company is like a shell company that holds funds to finance future mergers or acquisitions.

How does it work?

Having established that a blank check company is a publicly-traded company created with the aim of merger or acquisition of private companies, what is their mode of operation, and how does it work?

A private business or private company becomes private through the Initial Public Offering (IPO), and the transition of a private business or company to the public implies that the private shareholders no longer own the company but the blank check company that purchased it. This creates an avenue for public investors to invest in the company and buy stocks.

However, the initial public offering (IPO) is not the only way for a private company to become a publicly-traded company. The special purpose acquisition company (SPAC) is another means for a private company to become a public company.

The special-purpose acquisition company, or the blank check company, does not have a business model beyond its money and other financial transactions. The investors, or the management-oriented groups, use their money to support the blank check company until their target company is up for public acquisition.

The special-purpose acquisition companies look for a target company that they can either acquire or merge and take to the stock market. The special-purpose acquisition companies then get a position in the exchanges after their merger with their target company. This is to attract other investors. The investors who have shares in the blank check companies then become shareholders of the new publicly-traded company created.

The Difference Between an Initial Public Offering and a Special Purpose Acquisition Company

An initial public offering is a traditional process by which a private company becomes a publicly-traded company. It needs at least 5%-7% in additional fees for financial audits and legal bindings to achieve that. The processes here typically take a longer time frame, especially regulatory filings and financial audits, which can be lengthy.

The private company hires investment bankers to take the role of underwriting. The underwriter helps the company with regulatory filings and awaits approval and deal terms, which can take a longer time than a special-purpose acquisition company. Their deal terms give no room for negotiation, which is often considered rigid.

On the other hand, the special-purpose acquisition company, also known as the blank check company, is a shell company founded to raise funds to merge or acquire private companies that want to go public. Once SPAC sponsors find a company for merger or acquisition, it raises enough capital to acquire the target company. After a merger, it becomes a publicly-traded company, but the entire process takes a shorter time than an IPO.

Special-purpose acquisition companies are preferable to IPOs because the valuation of the target company can be determined before the listings, the deal terms are quite flexible and negotiable, and private companies have access to SPAC sponsors with knowledge of mergers or acquisitions.

Benefits of a Special Purpose Acquisition Company

Over time, there have been discussions and debates centered around blank check companies regarding their benefits compared to an initial public offering. Some think that it is risky to invest in a special-purpose acquisition company because it has fewer benefits, but is that true?

Special purpose acquisition company continues to gain ground and grow in leaps and bounds, especially in recent times, for obviously good reasons, which include

#1. Faster and easier process

Special-purpose acquisition companies involve a faster and quicker process than traditional IPOs, which involve long procedures and take time. Through a blank check company, it is easier for private companies to be turned over to a publicly-traded company without going through a rigorous process.

On average, the blank check company merger usually takes 3–6 months, while the traditional IPO merger takes 12–18 months.

#2. Upfront price discovery

Private companies can negotiate the price and evaluate the company listing with the blank check company before the end of the deal or transactions. This is more advantageous in a volatile market, while for an IPO, the market conditions at the time of listing determine the price.

#3. Access to SPAC sponsors and operational expertise

SPAC sponsors are often seasoned financial professionals with operational expertise, and their presence on the management board can help influence decisions to expand the company. In the traditional IPOs, however, private companies independently recruit professionals.

Risks of a Special-Purpose Acquisition Company

When a special-purpose acquisition company decides to merge or acquire a private business, they meet to strike a deal to avoid confusion and potential conflicts. Does this imply that the blank check company has no cons? Find out more below.

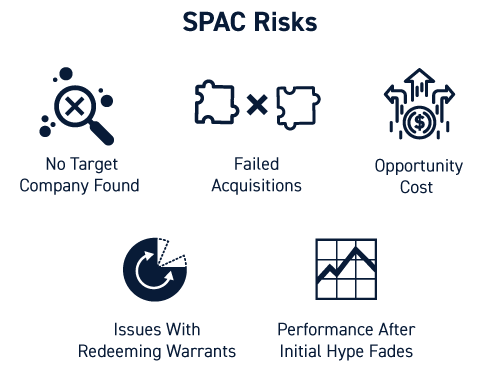

#1. Collapse of the deal

Despite the blank check company and the private company coming together to strike a deal and agreeing on certain terms and conditions, on many occasions, the blank check company does not take full control of the operating company.

The deals are often not concluded for various reasons and financial transactions either as a result of a change of mind from the investors or a withdrawal of shareholder approval, which hinders the deal’s approval.

#2. Capital shortfall from potential redemption

SPAC investors may redeem their shares, and if the redemptions exceed the expectations, then cash availability becomes uncertain. This forces the blank check company to raise private investment in public equity financing to fill in the gap created by the shortfall.

How to Invest in Blank Check Companies

Blank check companies are publicly traded companies created by investors who raise capital for the merger or acquisition of private companies or businesses. The founders will form a blank check company, list it as a publicly-traded company, and list shares for public purchase.

Investors can invest in blank check companies by purchasing shares that contribute the money needed by the special-purpose acquisition companies. Blank check companies are like the average public companies, which you can trade on different exchanges.

To protect investors’ money, the Securities and Exchange Commission considers SPAC as penny stocks and subjects them to additional restrictions on how they use the investor’s funds in the company. And sometimes, they require the money to be in an escrow account until the merger with the target company. Investors are also advised to understand all the rules and regulations of the companies before investing their capital.

What is the Current State of Blank Check Companies?

Blank check companies have gained more ground in recent years, and private companies have considered it a better option to become publicly traded companies instead of going through the traditional IPOs.

The first time blank check companies launched, most investors classified them as a scam. Even financial advisors considered the companies to be fraudulent penny stocks. Many investors were advised against investing in blank check companies because of a lack of credibility.

But now, the blank check company we have today differs from the one that existed in yesteryears due to the new laws and regulations. Blank check companies have regained their lost credibility among investors, and their actions help investors invest in them.

The blank check company is now part of the trend in the stock market world for this era as more big multi-million dollar companies are now becoming publicly-traded companies through special-purpose acquisition companies.

The Best Stock and Forex Trading Course

Bankers, hedge fund managers, prop traders, and others have all learned from Ezekiel Chew how to make money by trading forex, stocks, indices, commodities (including gold, silver, and cryptocurrencies), and everything else that can be traded.

In a short time, his course will reveal how to earn more money in a month than most individuals do in a year. His course will demonstrate how you may achieve the same financial success that his proprietary approach has brought him and many students. On the same day you sign up, you will have the option of making a real money deposit into your account.

His approach to teaching is built on the principle of return on investment, where you invest $1 and get $3 back. It’s not about gimmicky tactics or spectacular methods. He has a trustworthy system that banks and experienced traders employ.

He is responsible for many banks’ achievements, notably DBP, the second-largest state-owned bank in the Philippines with more than $13 billion in assets. His course is simple enough for seven and eight-year-olds to understand. If they can understand it at such a young age, anyone can learn this technique if they put in the time and effort.

This strategy is so helpful that it has produced many full-time traders who were new to trading when they entered the program. Visit Asia Forex Mentor to learn more.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Blank Check Company

A blank check company, also known as a special purpose acquisition company, is a publicly-traded company without a prepared business plan funded by investors or management-oriented groups who invest money until a target company is acquired.

The main objective of special-purpose acquisition companies is to acquire or merge private businesses or companies with a business plan but struggling with insufficient funds. They take over the business and take its place in the stock market as they encourage public investors to invest in it.

Even though the blank check company has been moving forward in recent times and gaining popularity in the stock market, some investors still doubt its authenticity. It sounds like it is the best option for companies to become publicly traded, but it is advisable to check with a financial advisor before investing; SPAC also has its cons.

Blank Check Company FAQs

Is SPAC a Good Investment?

Individual investors have seen lower returns while investing in SPACs. Most SPACs do worse than the stock market, dropping below the IPO price. Most investors should be skeptical of investing in SPACs, given their dismal track record.

Why are they called “blank check companies”?

Blank check companies (BCCs) are publicly traded companies with no specific business objectives other than merging with or purchasing unannounced private companies to help them go public. They also raise money for start-ups whose identities are kept secret until the goal is achieved.

BCCs are created by management or investor groups to safeguard their interests through mergers and acquisitions. To increase the productivity of the cooperating enterprises, these organizations also provide financial support and market knowledge.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.