What Is Capitulation In The Stock Market: Explained By An Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex brokers for traders are Avatrade and FXCC

The #1 Stock and Forex Trading Course is Asia Forex Mentor

To understand capitulation better, we've got Ezekiel Chew, the founder and head of training at Asia Forex Mentor. He is not just some ordinary forex trainer but a renowned forex expert who has been in this industry for quite some time. He has not only trained individual and retail traders but has also trained professionals who are associated with esteemed banks, fund management companies, and trading firms.

Therefore, his insights to understand capitulation is most worthy and essential for the readers. According to Ezekiel Chew, market Capitulation is a term used for a situation where an investor completely surrenders all his assets and exits the market due to market uncertainty. However, He suggests that market capitulation is more of a psychological phenomenon than realistic. So with proper training from the experts, it can be tackled easily and can create possibilities for high returns.

In this regard, this review is intended to create awareness among readers regarding market capitulation. Moreover, it guides retail investors who usually panic due to market instability, to make market capitulation an investment opportunity rather than an obstacle.

What is Capitulation in the Stock Market

Capitulation in the stock market is a noticeable rush among the investors to sell their stocks when the market is falling. It is not a surrender of assets not only by several investors but a huge chunk of investors are pressurized into giving up on the market. As a result, the market faces strong turbulence, there arises a point where the market hits bottom. Therefore, investors completely lose hope in their assets and forget about getting any capital recovery.

Market capitulation occurs mainly because of the fear of the investors. When the market is volatile, investors usually buy or sell stocks at this time. During extreme market uncertainty, investors lose their confidence and tend to have selling pressure out of fear. This is the time when the market drops even further and a flow of investors start selling the stocks which makes their price fall even more.

Therefore, capitulation results in a complete upside-down shift in the investor's position in the market. Consequently, the fearful sellers are replaced by risk-tolerant buyers. However, since there is no indication of the end of the market capitulation, it is very much possible that even the risk-tolerant buyers are bound to sell at some point. Nevertheless, sooner or later the market reverses causing both psychological and financial pain to the investors.

Capitulation is defined as a total surrender by one of the opponents in the war to exit the war or any activity and give up for good. However, in the stock market even after the capitulation, there is always a possibility of prices bouncing back and the market going bullish. Moreover, traders who have once given hope and sold their assets can also make a comeback by buying stocks when the prices go up again.

How does Capitulation work

Whenever capitulation occurs investors are not immediately aware of the situation. However, four indicators assure that either market capitulation has started or they are in the middle of capitulation. The first indicator is a sense of prolonged and intense lack of confidence of the investors in the market. This pessimistic expression can be noticed by the media or financial experts and analysts. Moreover, co-investors themselves may also show a negative sentiment related to the stock price.

The second indicator would be identifying prominent changes in the trading proceedings. A constant pattern of lower prices and trading volumes is a clear indication of a drastic change in the market trends. As a result, panic selling and extended declines of the stocks can help in identifying capitulation easily.

The third sign of identifying capitulation is when investors focus more on put purchasing or there is a lot of short selling in the market. Moreover, during capitulation traders also seem to be hedging to balance the losses in their investments.

High levels of cash held by mutual funds are the fourth indicator of market capitulation. Investors always keep an eye on the cash levels as it dictates the overall positive or negative view of the market. Since a significant number of stocks are surrendered, the insurance companies and banks may keep a high level of cash handy to ensure the payout of distributions.

Technical Analysis to Recognize Capitulations

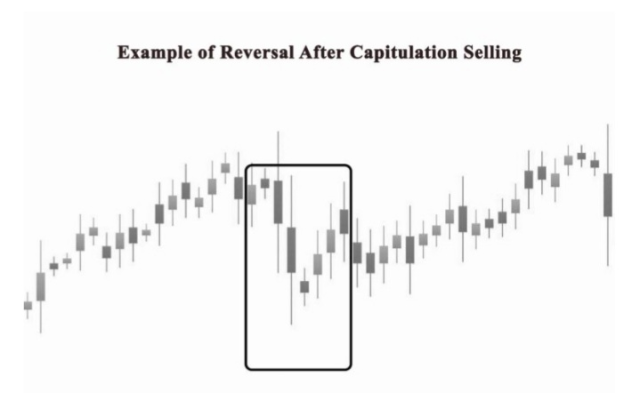

Capitulations often result in the price reversal of the underlying assets and other securities. For this reason, technical analysis is done by financial experts and analysts using standard candlestick charts. By using this method analysts can predict the initiation, positions, and patterns of market capitulation. Moreover, these charts also point out the end of the turbulence and price reversal.

One capitulation price pattern is the hammer candlestick, which shows the transitions of the falling price trends in the market. Through this pattern, analysts anticipate the extended decline of prices below their initial point. And can also configure when the price reverses and bounce back to recover losses by the close. The down trendline in these charts followed by high trading volume indicates that the market capitulation has reached its climax.

In opposition to this, a shooting star candle pattern often suggests a price recovery pattern in which prices go on an upward trendline but then drop down to the opening level. This pattern is usually seen after a major panic buying from investors when the stock price goes down.

However, as the act of buying slows down the price declines again. When the last potential buyers notice the price movement again, the agitation of the buyers relapses in the market. Consequently, prices keep on declining, and buyers who purchased earlier start surrendering their financial instruments to save previous gains or avoid losses. However, the end of capitulation is only market when the price rises again.

Capitulation and Trading in other words

The situation of capitulation takes place rarely still it cannot be neglected altogether. Investors might take it as negative news however it is more of an opportunity if identified promptly. If a trader identifies capitulation on time, then there are various methods and strategies to earn capital gains from this position in the stock market. However, to use these strategies effectively, it is crucial to make a correct analysis of the market as well.

The easiest and most promising method, of making profits from capitulation, is short selling. Short sellers sell their assets when the prices go down at the beginning of capitulation in the hope to buy them back when the prices fall even further. The most important criterion for benefiting from short selling is the ability of the trader to identify capitulation at the earliest. Only then they will be in a position to sell the stocks and buy again when the prices take a plunge again.

Another method through which traders can take advantage of market capitulation is by calling the bottom. This means that the investors buy stocks and trade assuming that the price of the stock has reached its bottom. Therefore, the capitulation has ended and as a result, the prices will move towards an upward trendline. If the assumption of the trader turns out true then there would be a high possibility to earn great profits.

Conversely, if the assumption is wrong and the trader invests before time then it could result in massive losses. An investment in stocks that are hitting bottom could be a nightmare for a trader. For this reason, calling the bottom is a risky method to play with and traders who are absolutely sure of the situation can only take this risk.

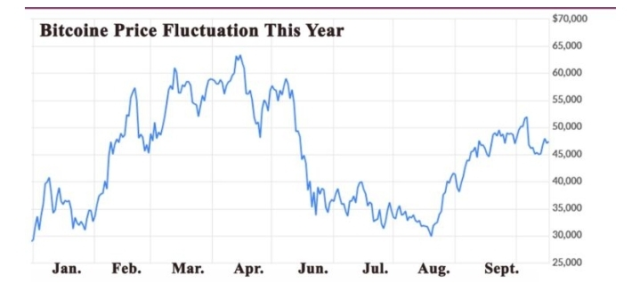

Capitulation of Bitcoin

It has been observed that market capitulation has been more intense in the cryptocurrency domain compared to other underlying assets in the stock market. Since the cryptocurrency market is still influenced by media exposure and cryptocurrency whales, the prices of cryptocurrencies like bitcoin and Ethereum, etc., fluctuate more often than other stocks in the traditional market.

The reason that Capitulations happen more often in cryptocurrencies is that market volatility is more common in new and smaller markets. However, it does not necessarily mean that the market will never recover. As a result, market capitulation should not be taken as an instrument to measure the future performance of the market.

For this reason, the best part about the capitulation of bitcoin is that it is always followed by an upward trendline. The prices of bitcoins go up soon after the decline and recover quickly. Similar to the stock market capitulation cycle, when excessive bitcoin assets are sold in the market due to lower prices the values bounce back forcefully as more and more traders start buying the assets. For instance, it has also been observed that within a day there was a spike just as strong as the preceding drop, recording a 38% increase in one day.

A recent example of bitcoin capitulation was last year. The price of bitcoin crashed when China's government banned cryptocurrency trading and mining. It resulted in panic selling by the investors and it was even assumed that the market may never recover again. However, the bear market was soon turned into a bull market. As the investors used the strategy of calling the bottom and started investing more into bitcoins, it changed the market cycle altogether.

Best Stock and Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You'll be able to trade forex profitably with a skilled trader's help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew's teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It's not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines' second-largest state-owned corporation.

Due to his strategy's effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: What is Capitulation

The literal meaning of the word Capitulation is surrender or submission and so it is often used in a war context. However, in traditional markets and financial trading capitulation is generally referred to as a situation where investors liquidate their assets when the market prices decline steadily due to the fear of facing massive losses. Moreover, it is very difficult to spot capitulation without the help of technical analysis. As a result, a large number of investors surrender their assets in the hope of minimizing losses.

Even though market capitulation may sound like a discouraging market position, it is considered a golden opportunity for trading by many investment advisers and financial experts. Considering that capitulation allows higher sell volumes, most sellers get out of the way when the prices drop.

As a result, the market is left with only buyers who would bring the price up again. Thus, traders who have good market analyses can read the situation and understand the psychological position of the traders. Such traders can seize the opportunity and wait for the right moment to buy assets resulting in tremendous profits.

The biggest drawback of capitulation is that it is tricky and the most difficult to put one's finger on. There is no specific timeframe or price position that would indicate that capitulation has taken place. The only successful reading of capitulation would be the constant analysis of the market patterns and looking for signs. Mostly, investors will only agree in hindsight as to when the market actually capitulated.

There are also technical indicator charts with patterns such as hammer candles and shooting star candles which are used by an investment adviser for a trader who prefers to trade capitulation markets. These charts and patterns can assist in assessing the rapidly changing stock prices to point out the position of the capitulation. Most useful are hammer indicators that help position the bottom of a capitulation.

Stock Float FAQs

Is Capitulation the same as surrender?

By definition, capitulation means surrender or submission. However, the word surrender is often used in a situation where a group or an individual has surrendered their position for good and has accepted their defeat. As a result, that group or individual will not participate in the activity in the future.

However, in the context of finance, capitulation is used a bit differently. Traders who surrender their assets or securities because of low prices and fear of facing losses may again buy the stocks in the future when the market position is better. This is also called short selling where traders buy the stocks back once the price hits the bottom.

What does capitulate mean?

The literal meaning of capitulating is to surrender or total submission. This term is taken from a military context where one opponent surrenders in the war to their rival. Therefore, the word capitulate has a negative connotation where a group or an individual loses hope and decides to give up for good and exit their situation.

In the stock market, Capitulation occurs when a large number of investors give away to fear and sell their assets over a short period. This action results in bringing about the price of a stock plunging sharply in the middle of the high trading volume. The end of this price decline is only when the price reverses to an upward trendline. Until the price rebounds, it cannot be said the capitulation has ended completely.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.