Wash Trading – Explained By an Expert 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Wash trading is a complex form of trading scam. It’s among the key reasons most authorities enforce trading regulations worldwide – like the commodity exchange act.

As part of our duty, our focus in wash trading is to narrow down the key components of was trading. No doubt, we’ve taken the approach to pique the mind of an expert – Ezekiel Chew from Asia Forex Mentor.

Ezekiel Chew has the expertise of over twenty years of trading the markets. In the early years of self-making, he was able to hack a successful way of trading. And he gives back to society by way of training aspiring traders.

Readers will know the step-by-step process of wash trading – we’ll expound using a real example. We’ll also review the key regulation frameworks – and evaluate where they work and fail.

Towards the end will be a conclusion and FAQ section – with hints on how you can avoid awash trading scams.

What is Wash Trading?

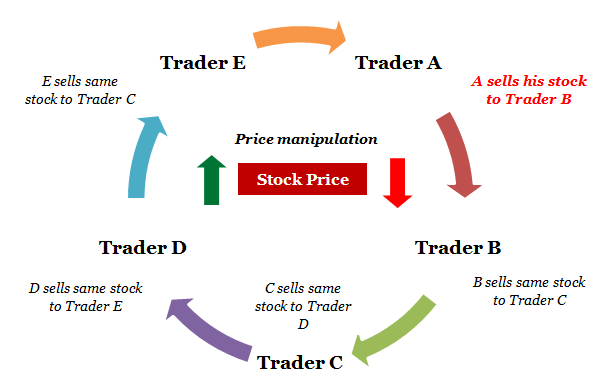

Wash trading is a form of fraudulent trading that builds on deceiving the larger public regarding the value of a financial instrument. Another term for wash trading is – round trip trading. Or circular trading. It involves investors acting as both the buyer and seller and may involve high frequency trading to falsely signal interest.

A buyer and seller being the same individual is an illegal practice with the express purpose of marketing misleading information. The critical ingredient with wash trading is the inflation of trading volumes. And given that the volumes are manipulated, unsuspecting investors fall into the trap of perceiving the high volumes as stocks in high demand.

The other ingredient with round trip trading is collusion with intention – between the brokers and trading parties linked to the scam. Of course, the collusion here cuts deep into the integrity of a broker – by agreeing to take advantage of insider information – which isn’t in the domains of the larger public.

In some rare arrangements, yet illegal, it may take the form of behind the scene agreements to repay brokers for commission fees with securities with very low liquidity in the markets.

How Wash Trading works

Wash trades involve a trader and a broker. But, at other times wash trades investor makes buy and sell transactions simultaneously – with intentions linking to the tax deduction claims or fraudulent profiting.

Process of Wash trades

First, the wash trader has a hidden plan to re-buy the same financial instrument – once their scheme to manipulate the artificial fall in prices takes course. Once the volume perceives the rising demand as the true value, they are lured into buying before prices top.

Here, note that the public is acting in good faith, with the insider job taking place with the knowledge of a broker and some traders. It takes many accounts to manipulate a successful round trip trading scheme. So after the transactions occur in a sequence, according to some insiders, the buy transactions may occur between a single investor or a few actors who know each other – and their target.

At this stage, the point is to show high volumes of trading in the markets. An investor in the public domain has no tools to know that the daily volumes are from a few transactions from a particular broker and traders – so they buy and hold.

The behind-the-curtain scheme is to lure many buyers as the prices increase. Once the scheme ropes in enough buyers, the schemers pull the trigger. They then sell transactions, and the daily spike in volumes vanishes.

Buyers are locked in with low-value instruments- prices stagnate and fall rapidly. As the prices plummet, the schemers – traders and brokers are busy cashing in on the intentionally falling prices.

A common observation is that – a wash trade qualifies if it does not affect the risky portfolios subject to ordinary trading.

Other Key Steps of Round Trip Trading

- First, an investor holds a position in the market while making attempts to sell it. They eventually sell at a loss.

- But within the next 30 days, the same investors open a similar position – with identical exposures.

- However, the second position wins a vast profit – much more than the losses from the first sale.

- Investors file a claim for a tax deduction to offset the losses made from the first transaction.

Looking at the above steps, the investor stands to gain by claiming tax deductions for a separate transaction. It happens within the same month. Unsuspecting authorities stand deceived – tax deduction for the wrong transaction. This also amounts to wash trading.

An example of Circular Trading

To help us go through a practical scenario of wash trading, we’ll work with a hypothetical investor, X, holding shares from company A.

To begin with, X owns 500 shares of company A. Each share is worth $10 as of 20th September 2022.

Next, markets react to the news – negatively affecting the stock prices of company A. Therefore, the prices per share drop to $ 8 for every share. At this point, X hatches plans to sell all his shares under Company A.

At $8 per share, X ends up making a loss of $ 1000 (500 shares X $2)

Again, come 23rd September 2022, X opens a second transaction – this is the second phase of his plan. X now bus aagain500 shares of company A again at the market price.

Note: X now owns the same number of shares with Company A, which amounts to similar exposure – under the first transaction- where he lost the $1000. But wash trading is yet to take effect.

The actual wash trade happens when X files for tax deductions for lost capital – that is $1000. However, the claim relates to the losing trade, yet X now owns the same stocks – with similar market exposures – under Company X.

The IRS has set laws barring the trading of most assets in the way seen above. Therefore, it falls upon investors and brokers to follow the set rules to prevent the perpetration of wash trading.

The Commodity Exchange Act and Wash Trading

The CFTC or Commodity futures trading commission prohibits wash sales. Traders would engage in wash trades to manipulate market prices of stocks before the law came into force.

By extension, the law also bars the brokerage firms from taking any benefits that arise from wash trading schemes.

Corresponding restrictions regarding wash trading are also set by the Internal Revenue Service (IRS). In specific details, the IRS does not allow investors to subtract tax for losses made from trading.

Therefore the commodity futures trading commission has no room for tax evaders who file claims for reduction of taxes for wash sales made out of securities.

The Securities and Exchange Commission and Cryptocurrencies

SEC has no absolute control of cryptocurrencies. There’s no direct rule over wash trades undertaken through Cryptocurrency or other digital assets.

Rife debates feature SEC commissioner – Bart Chilton, like-minded regulators and the blockchain transparency institute on the necessary steps. According to SEC, digital assets like the NFTs do not qualify as securities. For one, NFTs are non-fungible; their jurisdiction is not under the SEC.

The other similarly treatment arises with the Internal Revenue Service (IRS). IRS categorizes cryptocurrencies as property and not stocks or securities.

So explicitly, cryptocurrencies and digital assets running on blockchains have no direct supervision from the SEC or IRS. Therefore, the chances of wash trading are very high. Developers and key stakeholders in crypto-asset spaces have high chances of perpetrating wash trades. All they need is to scheme out prices and fake volumes to capture traders.

How to Avoid a Wash Trade

Avoiding wash trades can be simple or difficult, depending on the scenario at hand. And first, it’s important for traders to understand how it happens.

In the instance where traders lose a trade, open a new one with similar exposure and claim tax deductions – a trader can avoid such a scenario. It’s solely within a trader's armbits of integrity to wait for the lapse of 30 days.

The second instance is weird and more complex- where brokers collude with traders to inflate market volumes. This is the most hidden form of wash trading, as the actors act with the benefit of insider information.

Since the average investor is the target, increasing market volumes and security prices are a bug lure. Of course, market pricing depends on information, and wash trade schemers have the upper hand here.

The best way a trader can escape this is by paying attention, doing due diligence and digging into performance history. Taking time to jump into buying the shares, plus taking risks they can afford to absorb, will also act as a mitigation measure – when worse happens.

Best Stocks and Forex Trading Course

Ezekiel Chew is a well-renowned figure in the Forex trading scene in Asia. He is a highly sought-after speaker and trainer, featured in numerous events and seminars. His trading methods are backed by mathematical probability and have succeeded in helping many students make 6-figures in annual profits.

He is the founder of Asia Forex Mentor, which offers several programs designed to help people make consistent profits in the Forex market. His flagship program is the One core program, a comprehensive course covering everything from basic to advanced concepts.

The program includes several modules delivered in a step-by-step format, making it easy for even beginners to follow along and start seeing results quickly. In addition, the program comes with a money-back guarantee so you can try it out with no risk.

If you're serious about successfully learning to trade Forex, Ezekiel Chew's Asia Forex Mentor program is one of the best courses available. So, what are you waiting for? Enroll yourself in this amazing course and kickstart your Forex trading journey today.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

4 Best Stock Broker

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Wash Trading

Wash trading is also the round trip or circular trading. It is a financial crime that arises from two key things: the intention and the outcome. Statutory bodies like the SEC and IRS have set laws prohibiting brokers and traders from taking part in wash trading. It takes the form of taking gains with fraudulence aligned with market performance.

The first category claims deductions for losses made in transactions, yet they resurface by re-purchasing the same asset within 30 days of the loss-making trade. The second category is a cartel riding on insider information and collusion.

Traders and brokers connive to display fake market trading volume, which traders take for valuable securities – so they buy and are locked in with worthless securities as the perpetrators cash in on their loss.

Wash trading is among the reasons why regulations apply for trading via regulated marketplaces for stocks. SEC and IRS do not classify crypto-assets as securities. So NFT wash trading and other Crypto-assets have many wash-traded instances.

One significant way the authorities have managed to regulate cryptocurrency exchanges is via KYC or know-your-customer for the exchanges.

Wash Trading FAQs

Is Wash trading prohibited by the securities and exchange commission?

Yes. SEC prohibits wash trading. You and or your partner cannot claim tax deductions for losses made trading securities with similar exposure within the same month.

How do you identify wash trades?

An audit of trading logs can help identify wash trades. They have similar exposure and symbols within a single account. In case it involves many accounts with similarity of exposure and symbols still applies.

Can day traders avoid a wash trade?

All wash sale rule is subject to the CIR Section 1101 of the Internal Revenue Service -policy regarding wash-sales. Traders may not claim tax deductions if they have re-purchased a similar stock with exposure within the first 30 days.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.