7 Best Genomics Stocks – A Complete Expert’s Guide 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

The field of genomics is one of the most fascinating and rapidly-growing areas in all of science. And with the advent of new technologies like CRISPR, it will only become more important in the years to come. But what are gene editing stocks? And how can you invest in this exciting new field?

Genomics is basically the study of genes and how they function. It's a relatively new field, but it's already having a major impact on medicine, agriculture, and even forensics. Genomics is the study of genes and how they function. It's a relatively new field, but it's already having a major impact on medicine, agriculture, and even forensics.

The Human genome project, for example, has led to major breakthroughs in understanding diseases like cancer. And as our understanding of genetics continues to grow, the potential applications of genomics will only increase.

There are a few different ways to invest in genomics. For example, you can invest in companies that are doing cutting-edge research in the field, in companies that are developing new genomics applications, or in the infrastructure necessary to support the field's growth.

To better understand Genomics Stocks, we have got Ezekiel Chew, the CEO, and Founder of Asia Forex Mentor. With over a decade of stock market trading experience, Ezekiel is undoubtedly an expert in his field. In this article, we will discuss what genomics stocks are, their categories, and the best genomics stock options to consider for 2023. So, let's get started.

What are Genomics Stocks

Genetics stocks are publicly traded companies that are involved in the field of genomics. This includes companies involved in DNA sequencing, genetic engineering, and gene therapy.

The genomics industry is growing rapidly, and investors are taking notice. In recent years, several high-profile IPOs in the space, including Illumina (ILMN) and 23andMe (DNA).

Despite the hype, investing in genomics stocks is not without risk. The industry is still in its early stages, and many companies are losing money. Furthermore, the regulatory environment is still uncertain, and there is always the risk of a scientific breakthrough that renders a company's products obsolete.

That said, for investors with a high tolerance for risk, genomics stocks could be worth a look. Below, we'll take a closer look at some of the most promising categories of genomics companies.

Categories of Genomics Companies

Genomic investors and others interested in the megatrend can look at genomics companies from 3 categories:

1- Genetic Testing And Diagnosis

Genetic testing and diagnosis companies take sequencing data to discover genetic variations. These are then organized into categories of general conditions. According to clinical data, at least one in six people have a variant spelling an underlying health condition. Consequently, the testing services market will be over $17 billion by 2026.

2- Genetic Editing

Gene editing is like having molecular scissors. It can target a specific DNA variant and slice it by cutting the nucleotides that hold the defect in place. This action fills the gap created by the cut.

According to recent projections, the gene editing therapies market will reach $15 billion by 2028. This entails companies dedicated to finding cures for diseases caused by genetic variations.

3- Genetic Sequencing And Analysis

Sequencing companies provide the scientific backbone and foundation for genetic research. Sequencing looks for variations or flaws in a DNA sequence by reading a 3.05 billion base pair sequence, which is not identical to the normal sequence.

Sequencing is necessary for genomic research. Sequencing is also a component of genetic testing. Because of technical progressions, sequencing costs have decreased by 28% each year. Also, the global sequencing market will grow to $35 billion by 2030.

7 Best Genomics Stocks

Below are the seven best gene editing stocks that you can consider buying:

#1. Invitae

After seeing many other companies producing more stringent genetic tests for one specific variation, Invitae is coming up with a method to allow customers to test for hundreds of genetic variants for less than $250. In July, Invitae and PacBio agreed that PacBio's HiFi sequencing and SBB chemistry would be used in whole-genome testing.

Invitae's sales increased to $116 million in the second quarter of 2022, up 152 percent from the previous year. The company is expected to generate between $475 and $500 million in revenue in 2022.

#2. Pacific Biosciences of California

PacBio's long-read sequencing technology is transforming how scientists can map genomes. Using long sections of DNA, the PacBio platform allows researchers to sequence an entire genome with high fidelity (HiFi). This whole-genome sequencing approach provides a cost-effective and accurate solution for characterizing previously unsequenced or “missing” genes that represent up to 8% of the total genomic content.

PacBio moved to acquire Omniome Inc. to further its Sequencing by Blinding (SBB) chemistry. PacBio also reported a 33% increase in revenue year over year, amounting to $36 million in 2022.

#3. Exact Sciences

Exact Sciences developed the Cologuard home test for colon cancer as a possible alternative to colonoscopies. Cologuard was projected to gross $1.1 billion in sales in 2021, translating into an $18 billion stock market.

Exact is working on technologies to address the multi-cancer screening market, worth $25 billion, and the recurrence tracking industry, worth $15 billion. Exact said second-quarter sales of $435 million were up 62 percent yearly, compared to a deficit of $167 million.

#4. Illumina

This company is the world leader in short-read sequencing technology. The technology breaks a person’s DNA into bits and pieces to help analyze genetic research, medical treatment, and testing.

Illumina controls more than 90% of the world’s sequencing market and has a customer base of over 20,000. The company's recent purchase of Grail, a blood-testing company, caused its stock to drop by 40%. However, Illumina reported $4.5 billion in revenue for 2021–a 40% increase from the previous year.

#5. Fulgent Genetics

Fulgent's revenue growth has reflected the COVID-19 pandemic, with an increase in 2022 as testing ramped up and a slower pace of growth in 2022 as schools and government organizations reopened. This company's rapidly growing stock market for genetic testing for children’s disorders. Management predicts this will result in $110 million in sales by 2021, which would increase 201 percent from the previous year.

According to a document, Scity had planned to have $1 billion in cash by the end of 2021, excluding purchases such as the most recent acquisition of CSI Laboratories. Fulgent also announced a collaboration with Helio Health and an investment in FF Gene Biotech, a Chinese joint venture, to grow its cancer testing capabilities.

#6. CRISPR Therapeutics

CRISPR/Cas9 ex vivo (outside of the body) gene-editing therapy for sickle cell disease and transfusion-dependent beta-thalassemia, CRTX001, is being developed by CRISPR and its partner, Vertex Pharmaceuticals (NASDAQ: VRTX).

In 2022, Vertex paid CRISPR $900 million based on the most recent trial findings, with the potential for an additional $200 million pending regulatory clearance. As a result, vertex increased its proportion of future CTX001 income from 50% to 60%.

#7. Intellia Therapeutics

In 2022, news of Intellia and its collaborator Regeneron Pharmaceuticals (NASDAQ: REGN) successful use of CRISPR-Cas9 gene editing to cure protein abnormalities was made, owing to the scientific evidence that demonstrated in vivo (in the body) NTLA-2001 CRISPR-Cas9 gene editing was safe and effective.

Illumina's quarterly profit fell by $21 million in the second quarter of 2021, compared to the same quarter last year.

5 Top Gene Editing Stocks

Below are five of the top gene editing stocks:

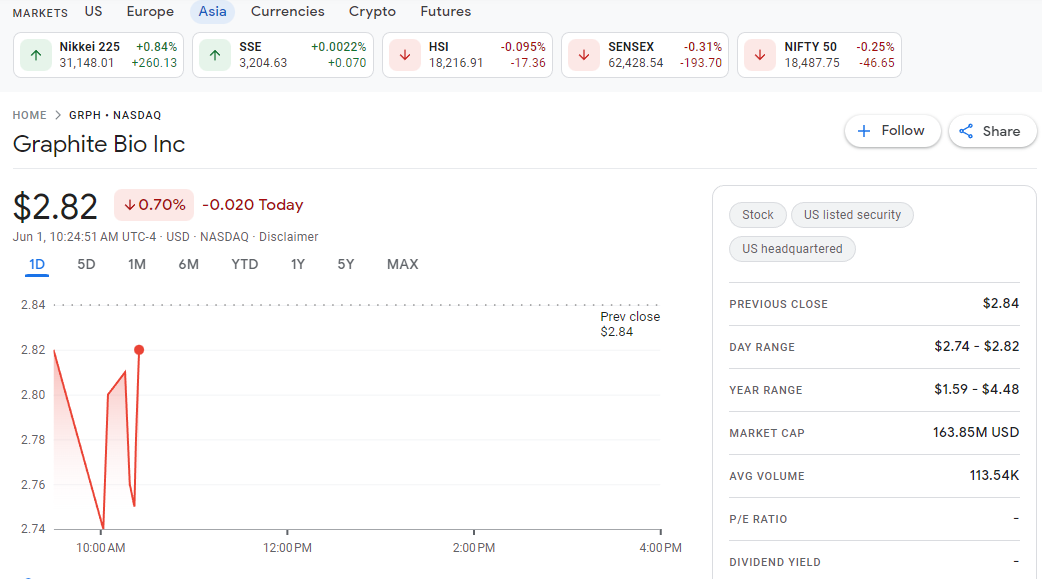

#1. Graphite Bio Inc. (GRPH)

CRISPR/Cas9 and natural DNA repair methods are both utilized by Graphite Bio, a gene-editing technology firm. GRPH stock closed at $9.09 on November 22nd, with Bank of America having a “buy” rating and a $35 target price.

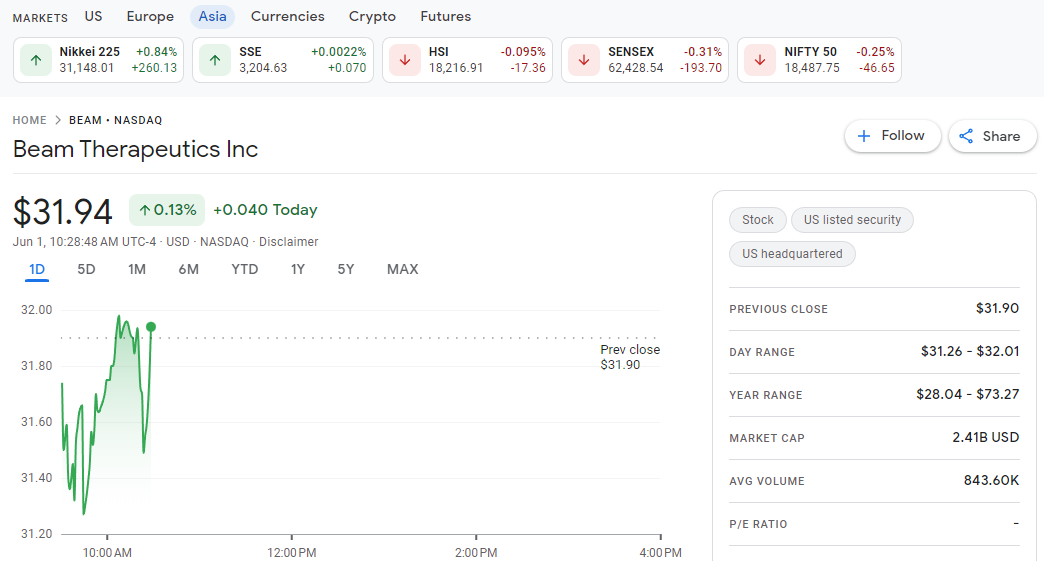

#2. Beam Therapeutics Inc. (BEAM)

Beam Therapeutics utilizes CRISPR technology to replace specific bases in the genome utilizing a method known as base editing, which only breaks one DNA molecule and may enhance cell survival rates. Bank of America has given BEAM stock a “buy” rating and a $150 price target.

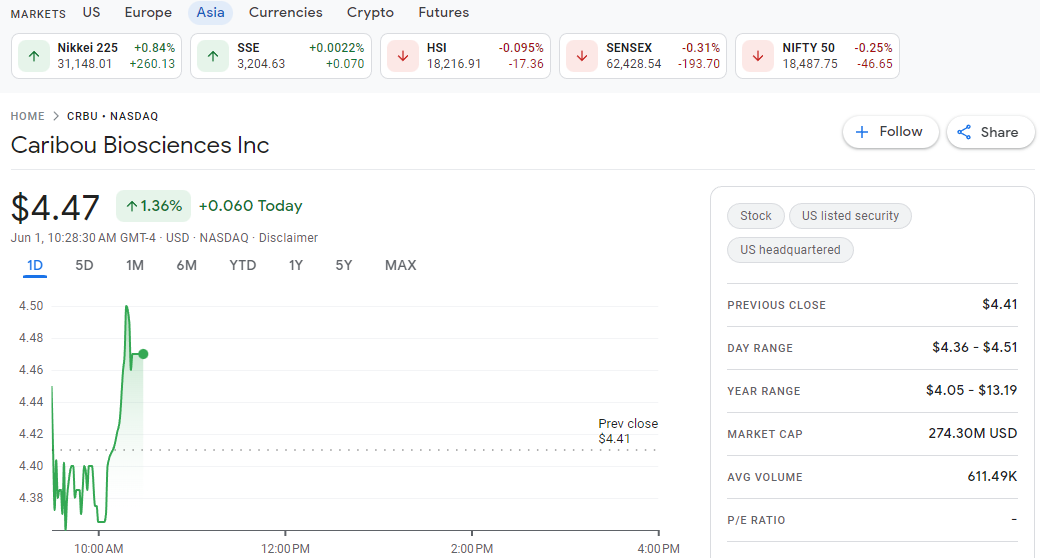

#3. Caribou Biosciences Inc. (CRBU)

Caribou Biosciences is a clinical-stage biotech firm developing allogeneic, or universal, gene-edited cell therapies for cancer. The company went public for the first time in July. Bank of America has given CRBU a “buy” rating and a $33 price target.

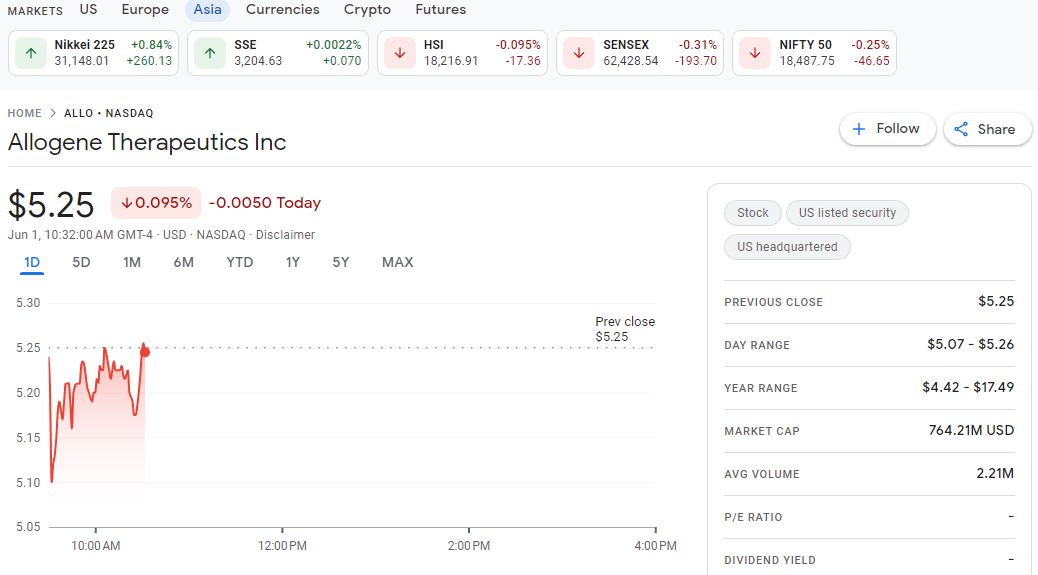

#4. Allogene Therapeutics Inc. (ALLO)

Allogene Therapeutics aims to develop allogeneic chimeric antigen receptor T-cell, or CAR-T, cancer therapy. However, the US Food and Drug Administration has placed the firm on hold.

According to expert Jason Gerberry, a 75% chance of the suspension being lifted by mid-December is a significant bullish stock trigger. As a result, Bank of America has a “buy” rating and a $32 price objective for ALLO stock, which closed at $18.81 on November 22nd.

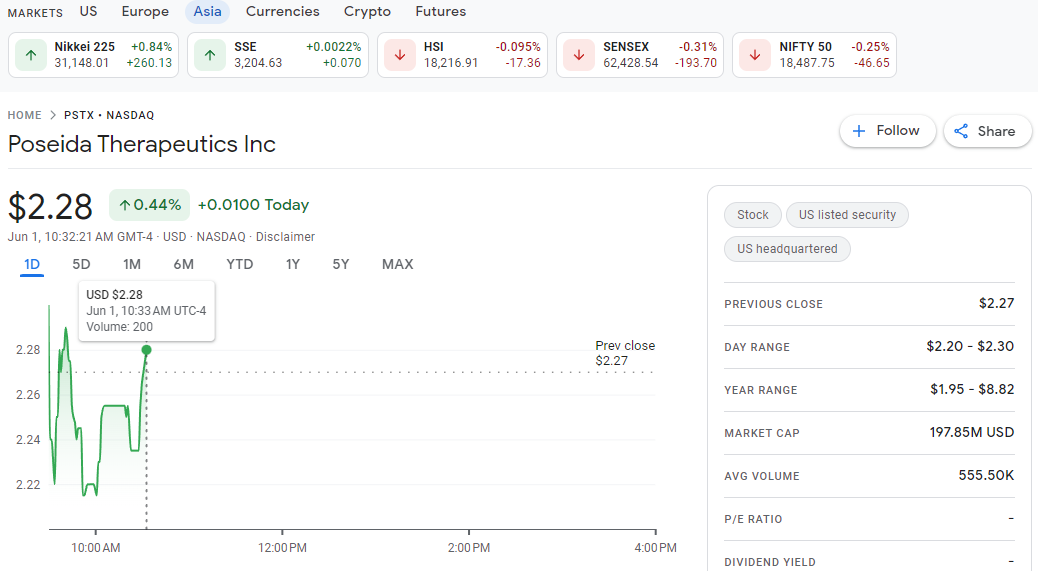

#5. Poseida Therapeutics Inc. (PSTX)

Poseida Therapeutics is a clinical-stage biotech company that employs cutting-edge gene-editing systems to develop cellular and gene therapies. PSTX stock, which closed at $7.60 on Nov. 22, has received a “buy” rating and a $20 price target from Bank of America analyst Wamsi Mohan.

Best Stocks and Forex Trading Course

Ezekiel Chew is the founder and head trainer of Asia Forex Mentor, a forex education company based in Singapore. He is also a professional currency trader and has been trading for over a decade.

Ezekiel has trained hundreds of students worldwide and is considered one of the industry's best forex traders and educators. His students have become successful traders at major banks and financial institutions. Ezekiel’s trading method is based on mathematical probability and is backed by years of historical data.

The Asia Forex Mentor program is a complete program that covers everything from beginner to advanced trading strategies. The program includes online courses, webinars, and one-on-one coaching sessions. Ezekiel’s core program is the only one you need to become a successful trader. Sign-up Now!

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

6 Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Trading Platform | securely through Tradier website |

Beginners Non-US Traders Read Review | securely through Interactive Brokers website | |

| Beginners Trading Platform Read Review | securely through Robinhood website |

| Advanced Banking Products Read Review | securely through Sofi website |

| securely through eTrade website |

Conclusion: Genomics Stocks

Genomics is an important and rapidly growing field with huge potential. It is gaining a lot of faith in the medical community. Although the study may pressure people who want to learn more about it, there are several advantages to knowing it. One can play a role in groundbreaking discoveries and make good money through genomic stocks.

However, you need to do proper research before you start investing. This way, you can be sure that your money is going into the right hands.

Genomics Stocks VIX FAQs

What is the best Genomics Stock?

There are many stocks to choose from; it can be tough to discern the best investment. With that in mind, fund managers should consider the top-performing stocks with the greatest potential for returns in 2023.

Will Genomics Stocks go up?

According to forecasts, genomics will increase by 18% over the next decade, reaching $54.4 billion by 2025. Therefore, Intelligence Pharmaceuticals, Inc. (NYSE: ILMn) is one of the most prominent genetic stocks.

What is the Best Crispr Stock?

The best CRISPR stock for 2023 is Intellia Therapeutics, Inc. (NTLA)

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.