7 Best Online Brokers for Options: Top Brokers for Options Review of 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Whether you are an active or passive investor, there is an options traders platform available for everyone. Many brokers are available with account minimums options available for stock trades and reliability. Sounds impressive, right?

Options traders are a kind of account allowing traders to access the computer market without any advice from a complete service brokerage. There are exclusive options traders include a trading platform for account minimum options per contract.

Some options trading brokers are risky, but with the right options strategies, it will reduce the risk to enhance the returns, mainly as an investor. Do you know options trading includes per contract features to link an overlying asset such as another security and stock?

Moreover, options traders are excellent for a time that might be short or long for years. The desktop platform includes account minimum 0 factors to reduce risk tolerance and enhance the overall experience. That's how it functions.

Here, we have illustrated the seven best options for trading brokers to improve the trading experience, mainly for experienced traders. Isn't that reliable? Let's get right into the details!

Best Online Brokers for Options

- Top Overall Online Broker for Options Choice: Interactive Brokers

- Best options trading platform: TastyWorks

- Best trading platforms for stocks: Tradezero

- Best options trading brokers: Tradestation

- Best web-trading option: E*Trade

- Best for beginners: TD Ameritrade

- Best exchange-traded funds: Gatsby

7 Best Online Brokers for Options

#1. Top Overall Online Broker for Options Choice: Interactive Brokers

Interactive Brokers are the institutional investors that promote commission-free trading while providing the most accessible brokerage services for decades. This sophisticated publicly-traded company has got the top rankings for the best online brokers for stock and ETF.

Interactive brokers offer the customers global as well as US-based trading. The two plans that the company thought about are IBKR Pro and IBKR Lite.

The IBKR lite customers are available to trade forex, options, stocks, bonds, funds, and options on up to 135 markets, not more than one trade accounts. for the convenience of the customers to easily evaluate assets among the socially responsible investing lens

The IBKR Lite does not offer any trading fees or commissions. For all the experienced active traders who need a wide variety of investments, these brokers are the best choice making them the best online broker.

How does it work?

Like all the online brokers, IBKR also produces interest earnings with the difference between what it earns on the customer's cash backs and what it pays on their idle cash.

The company also offers market research. Like most, the brokers produce income when they accept payment from the market makers to direct orders to the trade venues. That is known as the payment for the order flow.

When the stocks held in the client's account are lent to other hedge funds or traders, the stock loan program produces revenue for interactive trading brokers.

From all the loan shares, the company provides 50% of the total income that it receives to the client. A mobile app is available for the customers who are approved for cash account or margin account with 50000 dollars. The trading interactive brokers offer exclusive benefits.

Pros

- Low fees and commissions

- Impressive platform stacked with multiple features

- Incredibly decent and effective trade execution

- A broad range of investment features and offerings

Cons

- The platform is a bit intimidating, mainly for beginners

- It utilizes highly daunting tiered pricing plans

Commission & Fees

You will find the pricing scheme for these brokers a bit complicated. That's because it includes three different types of commissions named fixed, tiered, and lite programs. Firstly, let's talk about stocks and ETFs. It costs $0 for IBKR lite accounts and ranges from $0.005 to $0.0035 per share for at least 300,000 shares per month or a minimum of $0.35 per trade.

Moreover, depending on the trade volume, the commissions are $0.15 to $0.65 per contract. When trading 15 contracts, it will cost 32.50. Mutual funds are lessening than 3% of total trade value costing $14.95 for funds. When we talk about the future trades, it costs $0.85 per contract with additional regulatory and exchange fees.

Click Here to Open an Account with Interactive Brokers (Official Page)

>>Read more About Interactive Brokers Review: Is it the Lowest Cost Online Stock Platform?

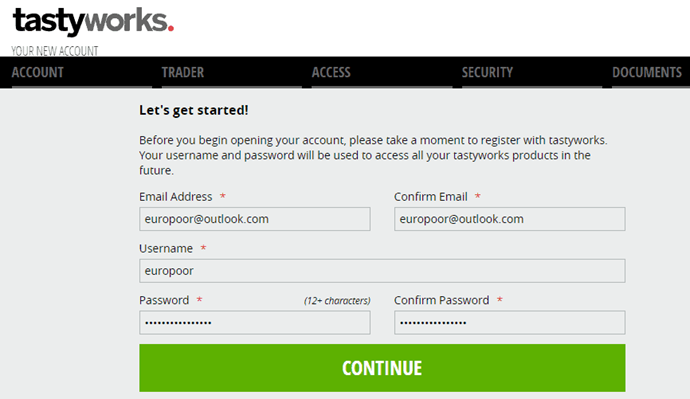

#2. Best options trading platform: TastyWorks

Tastywork is one of the best options trading platforms as it is designed primarily to trade options with a minimum amount of trading fees. Moreover, research and educational materials are responsible for supporting your trading and learning efficiency.

It mainly concentrates on futures trading and options. You can trade with ETFs and US stocks, but it is quite complex compared to other brokers. It is not possible to make credit and debit card deposits, and the bank transfer withdrawal is costly. Due to eliminating a demo account, Tastywork can be overwhelming for beginners but is a great choice for options trading.

It has various options, whether it be the contents offered on the site or the trading platform. As compared to all other major brokerages, no one has as many options as Tastywork.

Tastywork platform is based on an options trade and trading derivatives. The platform consists of an advanced set of tools for active traders with an efficient design that is easy to operate—contrasting to large competitors, Tastyworks has a low trading expense. The niche approach of the platform is reflected by its limited range of investment selections and offerings.

How does it work?

Tastyworks offers its users three different trading platforms: a desktop program, a web-based system, and a mobile application. All three platforms consist of several customized features such as position details, including watchlists and trade page descriptions like theta, delta, volume, and wholly downloadable and customizable charts.

From the Tastyworks active traders to the platforms cater, most of its tools concentrate on helping the users evaluate the probability and volatility of profit. The desktop and website also have identical user interfaces, specifically around the trade options.

If you are far away from your desktop during the trading hours, Tastywork has backed you up with its mobile application, which offers similar functions compared to the desktop and web-based platforms. The mobile application comes in an advanced design and is easily available on Android as well as IOS.

Compared to other competitive online brokers, Tastywork has a limited range of offerings as it is mainly manufactured for options trading. However, Tastyworkers include various mutual funds to help you trade without any transaction fee, and some are only available on request.

Pros

- Incredibly innovative trading options

- Minimum options commissions

- You will get access to IRAs and trusts

- No opening balance requirement

Cons

- Lack sufficient resources for investors

- It does not include mutual funds

Commission & Fees

The pricing of Tastywork is one of its most appealing features, especially if we talk about options trading. First of all, like every other broker, Tastywork offers no commissions on ETF trades and stock.

This options trader has a standard commission fee of $1 on each contract. Does it sound a bit high? Well, it's not as the competitors have different contract prices of $0.50-$0.75 range. Commissions are only charged on opening trades; all the closing options trading is free.

Click Here to Open an Account with TastyWorks (Official Page)

>>Read more About Tastyworks Review: Is it the Best Derivatives Only Broker?

#3. Best trading platforms for stocks: Tradezero

TradeZero is a free stock trading platform and online broker that enables traders to do free trading successfully, including round-the-clock customer support. TradeZero offers the clients four types of modern programs with services, commission-free trading, real-time streaming, and a locator as a source to share shorting, to name some features promoted on the website.

It has remarkable ratings for its performance. The software gives a reputable, navigable, solid platform for the dealers to stay on top of the stock market trend. It is a great option for new and experienced active traders.

The user can choose among one 0f the three TradeZero platforms, ZeroPro, ZeroWeb, or ZeroFree, which are all different tiers and have particular functions. Along any of these three tiers, the ZeroMobile is included automatically.

How does it work?

TradeZero is featured to be a limited investment strategy platform. It means that it offers the sets of assets in a limit for the investors. Over here, the trader can trade funds, warrants, exchange-based materials, meaning products, and options contracts. The only excluded major assets are mutual funds, foreign exchange, bonds, and futures contracts.

This online brokerage firm is based in the Bahamas. The U.S can use TradeZero U.S while the global investors are allowed to avail TradeZero's core brand; this is because the American service of the company is updated and meets the U.S securities investor protection corporation.

TradeZero's features and services are well-regarded for shorts locating features that help the dealers so that they can find a lender for short stocks that are hard to borrow. This online stock brokerage firm provides customer support 24/7 via live web chat. All the users of any type of software tier can access convenient and quick support anytime.

If you are trying to find a mobile app as an online trading option that can work smoothly and allow you to easily buy and short sell stocks, it is worth it t explore the TradeZero stock trading application. This online stock broker provides commission-free stock trading and an intraday that is up to 6 ratios one and enables the customers to be accessible to mobile trading.

Pros

- live customer support 24/7

- Enables users to explore multiple stocks

- You can trade in real-time with the mobile app

- Provides the best investment advice

Cons

- Enforces Trading restrictions

- The mobile app lacks some advanced features

Commission & Fees

This online account costs a withdrawal charge of 70 dollars and a deposit charge of 30 dollars for all international clients. Moreover, trading commissions with an agent will be 20 dollars. This is one of the best trading options which provide commission-free options.

Only two platforms on TradeZero trading cost a monthly fee, which is the Zero web along with level 2 with 59 dollars and ZeroPro with 79 dollars. If you get the ZeroWeb without a level two order book along the ZeroMobile, both are free of cost.

Click Here to Open an Account with TradeZero (Official Page)

>>Read more About TradeZero Review 2025: 0 Commissions! Is it Real?

#4. Best options trading brokers: Tradestation

Another option on our list is the TradeStation that focuses on experienced and active trading facilities. Moreover, it has no minimum funds requirements or platform fees such as crypto, TradingView, YouCanTrade, etc.

And you know what? The clients can effectively trade from different platforms or multiple devices such as exchange funds, futures, bonds, options, and other offering markets.

The fully customizable options make this an ideal choice for technicians who need sophisticated charting and other capabilities.

How does it work?

Here's how the TradeStation works! This trading platform offers high-quality data and fast execution to make it a beneficial choice for active traders.

You can consider the gold standard as an essential one against serious traders. The company tried to put maximum effort to ensure customers and investors premium services to improve the overall skills. That's how this trading option works!

It might look daunting, but it is a much accessible platform with intuitive workflow and customizable features. You can easily research or trade by setting up defaults and workspaces to get a customizable experience.

Pros

- Pro-level and reliable platform

- Competitive pricing

- Advanced and premium order types

- Effective scanning tools and sorting's

Cons

- Steep learning curve

- It might be intimidating for some users

Commission & Fees

The TradeStation's minimum account is $0, mainly for TS Go. The TS select needs a total of $2,000 balance. It also includes commission-free trades on options, stocks, and other exchange-traded web and mobile-based platforms.

The standard account includes complete access through the desktop app and offers $0.01 per share on the initial 500 shares and $0.006 after every trade.

Click Here to Open an Account with TradeStation (Official Page)

>>Read more About TradeStation Review: Is it the Best Platform for Advanced Traders?

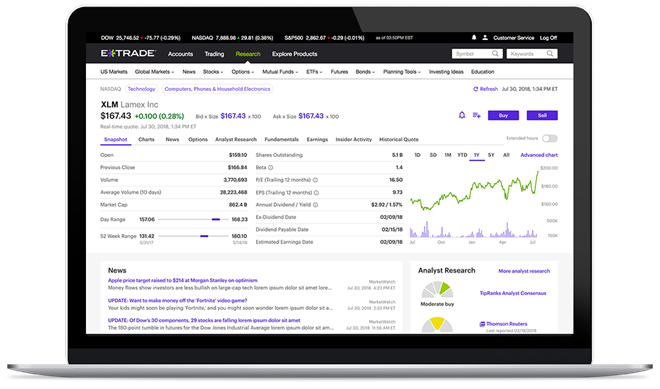

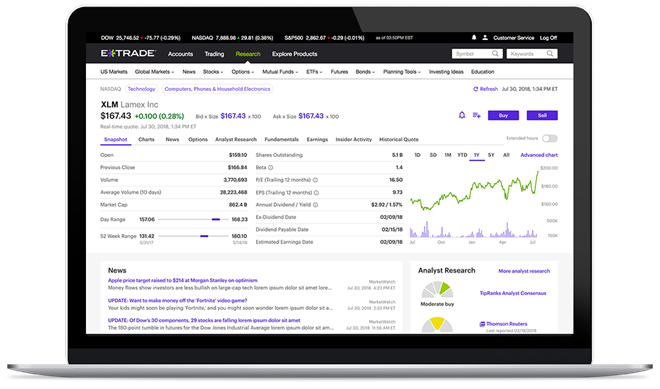

#5.Best web-trading option: E*Trade

E*TRADE has managed to position itself among the ideal online brokers. For the advice, it is a well-rounded and a solid pick for professional and new investors.

For the people interested in active trading, this industry has now pushed to attain the attention of active traders along with two quality trading platforms, a span of investment selections, amazing options trading tools, and a full-featured mobile app. The power ETF trades platforms are packed with options, tools that are simple for intuitive and futures trading.

If you have a passion for tracking trade stocks and the market, this trading is made for you. Its etrade.com flagship website provides educational materials and researches and a large span of no-free funds. Like all the other established brokers, this platform brings value to the investors.

How does it work?

Do you know this brokerage account includes a wide range of investment options and interests? It includes a robust power platform with an incredibly advanced mobile app and is effortless to use.

These brokers include in-depth options of educational resources while providing a complete range of investment selections that undoubtedly appeal to both investors and traders. It also includes an extended track record and is known for easy-to-use factors.

Undoubtedly, it is beginner-friendly that aims to provide portfolio analysis, educational offerings, market commentary, and other streaming quotes with all necessary tools for a trader. Moreover, it involves involved trading tools and helps users select the bonds, funds, stocks, and ETFs to meet the investment objectives and requirements.

Pros

- Power options with the platform

- Two different mobile apps for different interests and investors

- Automated builder and portfolio option with online brokerage platform

- Effective fees and trading options

Cons

- No access to international exchanges

- Options trading is more expensive for less frequent traders

Commission & Fees

Like many other brokers, E*TRADE's charges are now more competitive since the race to 0 charges ensured. E*TRADE costs 0 dollar commission on the options trades, online stock, and ETF trades. There is an unlimited number of shares that are traded on such a base commission rate.

The bond transaction charges are 100 dollars with a maximum of 250 dollars and a minimum of 10 dollars. Future transactions charge 1.50 dollars per contract, fees+ per side and per bitcoins future contract 2.50 dollars, fees+per side. When you transfer an account out of E*TRADE, there will be a 75 dollar charge for a full transfer while 25 dollars for a partial transfer.

Click Here to Open an Account with E*Trade (Official Page)

>>Read more About E*Trade Review: Is it the Best Web Platform?

#6. Best for beginners: TD Ameritrade

Undoubtedly, TD Ameritrade is one of the ideal online Brokerages available on the market that's effective for beginners and customers. The award-winning platform is ideal for traders who offer an intuitive and powerful tool design making it ideal for beginners and professionals.

Moreover, the comprehensive educational resources also include high-grade customer support to secure the position among some best brokerages.

The account also provides a depth of education that's second to none, seriously. When we talk about educational programming for the customers, TD Ameritrade is our top choice.

What's more? You can enjoy highly extensive investment selections and get a complete range of products from funds, trades, options trading, stocks, and different bonds. The Bitcoin future is a beneficial feature this platform offers.

How does it work?

Let's dig a little deeper! This trading option will provide you with a completely customizable experience with TD Ameritrade's thinkorswim, mobile applications, and others. Moreover, the web platform enables users to trade bonds, options, and funds.

Besides this, the platform is highly intuitive and effortless to use while providing you extra characteristics such as third-party research and other streaming news features.

This broker is also fully-features and suits experienced and novice investors searching for a premium quality broker with excellent resources.

Pros

- Commission-free and reliable stock

- Free research and reliability

- High-quality platforms

- Lacks account minimum

Cons

- Lacks fractional shares

- Higher account fees

Commission and fees

It will charge you zero trading commission for buying online the ETFs and other stocks like other competitors. The commission fees have reliable rates compared to other accounts on the market. The options will cost $0.65 per contract, with future options costing $2.25 per trade.

The OTC stock trades are budget-friendly and will cost users $6.95 per contract charges. However, broker-assisted trades have a withdrawal fee of $25 per transaction.

Click Here to Open an Account with TD Ameritrade (Official Page)

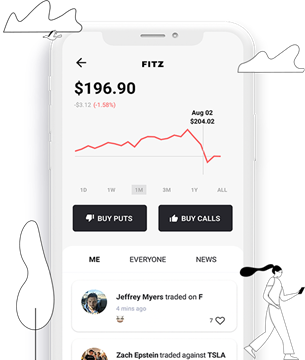

#7. Best exchange-traded funds: Gatsby

Gatsby, a trading app, is offering no commission on stocks and options trade. Although, its main drawback is its options due to the insufficiency of contact fees. Gatsby is the latest trading platform that provides free options trading.

It is a mobile application that offers free commission stock trades and options. Jeff Myers founds Gatsby. Gatsby Securities are used in making investment offerings. In addition to this, it also includes LLC that is a SIPC registered dealer and broker.

If you don't know much about options, they can offer you a good deal of purchases for your investments. They can also help you by being a shield against the downfall in ETFs or stocks you own. Gatsby allows you to trade options on ETFs and huge companies. Gatsby also includes social trading for you to look for ideas from other options traders through the mobile phone app.

Investing in stocks and options becomes easier using Gatsby as it has a widespread. Gatsby permits its customers to win reward points with every trade and redeem them to get retail store gift cards.

How does it work?

Gatsby does not allow trading during the daytime. Retirement account as compared to margin account is not a regular feature. Email support is necessary if customers want to use retirement accounts.

To determine the account price, Gatsby uses bid price. The interactive brokers also use other methods like asking price, midpoint price, or last trade price. Gatsby believes that the more accurate technique for determining the account's cost is the bid price.

Accessing Gatsby is quite easy; you just simply need to enter some of your personal and contact information, and that's it. Most of the users can completely open their accounts in just 5 minutes.

The FAQ section works beyond question to troubleshoot the problem on this trading platform. All the options are easy-to-follow and simple, with functionality for further convenience.

Pros

- Basic risk meter offers the new investors a convenient way to measure their trade's profiting

- The intuitive layout is perfect for investors

- Investing in Gatsby can make you earn gift cards

- Gatsby is a commission-free option

Cons

- Provides particular educational resources

- Limited ways to notify customer service

Commission & Fees

Different brokers aimed to work at younger investors, but Gatsby has let users get rid of traditional commissions, making it worth investing. The plus point is that Gatsby is used to selling and buying shares within options brokers, and you will only pay $0 during the broker commission. Aren't options contracts the most reliable?

The fee schedules apply to commission-free options and educational resources for both stock and options trading platforms. It will cost you no minimum money on ETF and stock trades that must be spent per contract. It only needs a $10 initial deposit for opening an account.

Click Here to Open an Account with Gatsby Trading (Official Page)

How we rank the Best Online Brokers for Options?

The best options trading platform makes things effortless for advanced traders to trade seamlessly within the trade securities without charging any fortune for the entire options trading strategies. The global markets have evolved trading brokers to trade stocks with the right trading costs.

How do we rank the best trading platform? Let's take a detailed look at the factors we considered while considering the brokers for options trading.

Online access

The first thing we concluded is the online broker platform that will help you invest online with commission-free trades to many active traders. It also allows investors with different means to manage the options trading process. The options trades offer trading platforms with the right options brokers to get the stock trading options.

Low Trading Fees

Another thing we considered while ranking the best brokers for options trading is the low trading fees. We considered discount brokers with minimum cash account fees and options trading options to make it reliable for experienced traders. Low-cost options trading is

We only considered online stock trading platforms that charge low trading fees or none at all. Options trading allows users to get a minimum balance or minimum deposit for fractional shares to offer commission-free options trading.

Access to Investment Tools and Research

The options trading platforms come with educational resources, different tutorials, multiple investment options for an account for the most reliable options trades. Have you got that?

The right investment support will help you with free stock options making multiple brokers ideal for options traders. Comprehensive research is essential with beneficial research tools and test strategies to help users with the stock market.

Smart Automation Technology

We also considered in detail the active options traders for the type of technology every platform utilizes with a trading style with higher automated investing tools.

How to choose the Best Online Brokers for Options?

Let's consider in detail how we choose the right options trading platforms and know how much money it requires for options trade per contract. Let's consider in detail how options trading will help you!

Commissions

Generally, the options brokers offer different investment options like funds, stocks, options exchange, bonds, and paper-trading features to get the maximum benefit. Many people will get complete access to foreign exchange markets and crypto-currencies while offering the maximum benefit.

Reliability

You will find a broad range of options brokers within the market while costing per contract fee and different options trades feature. Many options traders are known for years and relatively offer incredible services for stock trades if you get into the right educational tools. Don't consider newcomers untrustworthy as they might offer options strategies with the investment advisor fir increased performance.

If the companies offer handling trades, then it is regulated by the Securities and Exchange Commission making it a member of a self-regulatory body. The minimum deposit and options strategies make each options broker more reliable and beneficial.

Account minimum

Have you considered different ranked brokers with an account minimum of 0? Many options trades brokers will include any minimum deposit when opening as it might skew within $500 or more. Moreover, many options contracts also require account minimum investments allowing you to open any brokerage account with the least money.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Best Online Brokers for Options

Overall, advanced traders use options trading features to access financial markets while investing in the hope of reaching financial goals. Are you getting it? When we talk about choosing options traders, it might be difficult due to the multiple choices available.

Many options traders offer their no-fee basis or services for commonly traded assets allowing investors to investigate these trading platforms. They will also find significant differences in trading technology, user experience, and account features, etc.

What do we conclude? We examined the perfect options traders depending on the specific characteristics of active traders, including account minimum, stock trades, free research, fees, and other options. We considered seven top-quality options traders in detail with their pros and cons to help advanced traders know the maximum about them. Here's our detail on the best options trades!

Interactive brokers are our top choice with top-quality trading and reliability. It provides different options traders services to get the maximum trading benefits.

Best Online Brokers for Options FAQs

What is Options Trading?

Options trading will provide lower-cost techniques to go short and long throughout the market with the least risk. It also provides investors and traders to get more complex and intimidating strategies and flexible patterns such as different combinations to provide potentially profitable features.

What is the best Options Trading Platform?

Although there are many options for trading facilities available, some are far more effective than others. An interactive broker is our top choice when we talk about options trading, as it involves multiple features and strategies to help investors trade up to a greater extent.

What do Options Traders do?

Options traders opt to enjoy options trading and make money. That's because it's an option contract with 100 shares to represent underlying stock, helping you to control profit through different shares and choose the favorite growth stock. These traders set up an exclusive account and sell or buy specific securities for reliability.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.