7 Spreadsheets That Can Help Reach Your Financial Goals In 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

The #1 Forex Trading Course is Asia Forex Mentor

A budget is a plan showing the estimated income and expenses of an individual or 0rganisation, over a period of time. It helps individuals or companies to effectively manage their resources and reach their financial goals rapidly. Budgets are normally prepared for a year or a month ahead of income to serve as a guide in spending.

By allocating funds for bills, emergencies, savings, and other needs before the paycheck arrives, you can efficiently manage debts, avoid late payment fees, save up for a project, make healthy financial decisions and possibly attain financial freedom. Budgeting curbs bad spending habits and helps in planning a financial future which may ultimately lead to financial success.

In the past, budgeting is done solely on pen and paper, especially by individual salary earners. But, with modern technology, you can become your own personal finance expert. There are several spreadsheet applications that can help you manage your money, track expenses, and automatically calculate your financial health at any time.

This article will discuss the best Spreadsheet that you can use for budgeting, expense tracking, general money management, and personal accounting. Finally, we will reveal the best forex training course available on the internet today and what you stand to benefit from it.

7 Spreadsheets that can help reach your Financial Goals

#1. Personal Capital

This is a personal financial software that comes with tools that can help you monitor your expenses, pay off debts, save money and work towards financial freedom. Below are some tools that come with Personal Capital:

- Net Worth Tracker: Monitors and updates your net worth daily.

- Portfolio: This tool tracks and manages all your investments.

- Cash flow: Records and updates all your expenses in real-time. The app collates all your accounts in one place and tracks spending.

- Retirement planner: This presents important data, financial accounts, forecasts, and savings goals required to attain financial independence upon retirement.

- Education planner: This tool lets you know how much you need to pay for education; especially for your children. It keeps you on track by letting you know if you are on course to afford college expenses.

- Free budget templates: Personal Capital is also a budgeting app that can help with planning, categorization of expenses, and setting monthly targets. The app lets you know how well you are doing with your budgets and financial targets at any time.

#2. Tiller Money

This is an automated personal finance tool that integrates your income and expenses and presents them on a spreadsheet. Users do not have to manually input data as Tiller automatically updates the spreadsheet data through aggregation from connected bank accounts, credit cards, etc. The application is web-based and fully customizable.

Tiller money comes preloaded with multiple budgeting spreadsheet templates. This includes a net worth tracker, debt pay-off, financial planning, etc. You can customize any of the available templates or create your own. Since the data is reported via Excel or Google sheets, you can always view your accounts statement at a glance.

The application is web-based; you can have access to Tiller money by signing up for an account on the website. A 30-day free trial with a money-back guarantee is available before you decide to purchase the product or not. Tiller money costs $79 per year or $6.58 per month. Tiller cannot be used to move money and it does not store bank details. American banks are mostly supported.

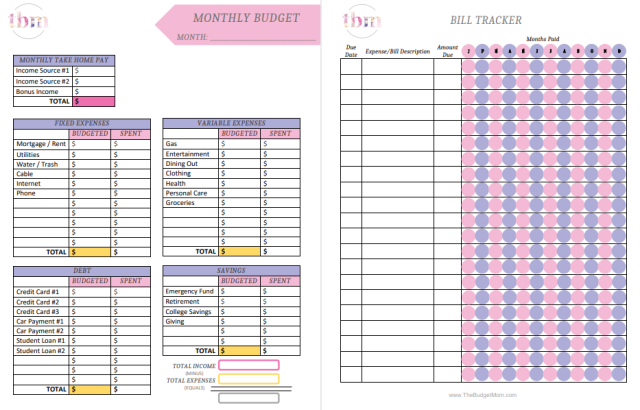

#3. The Budget Mom’s Budget Packet

This is a free monthly budget template that can help novices, mums, home planners, and individuals to plan how to spend their income wisely. It comes as a downloadable pdf file that can be printed and used for planning monthly expenses and tracking its implementation.

Expenses are divided into fixed and variable expenses with some inputs already made to give you ideas in case you are a complete newbie. There are provisions for managing various debts and also savings towards retirement, college budget, etc. It also includes a bill tracker designed to help you manage your bills and view due dates and payments on a sheet.

After printing, you have to manually record all financial data into the template with a pen. This means that you will be constantly calculating expenses manually or using a calculator to obtain totals. This is a major snag as there can be errors. Also, viewing your quarterly or yearly expenses will require compilations and manual calculations of several monthly sheets.

#4. Google Sheets

This is a free cloud-based spreadsheet program that comes from Google; the American multinational internet software company. It is available on the web; which can be accessed via browsers. Its mobile apps are available on iOS and Android devices which can be downloaded from the respective app stores.

Google Sheets come with several templates suitable for a wide range of users. Do you need a weekly or monthly budget, a yearly budget template, or perhaps for specific events such as vacation, party, or wedding budgets; Google sheets budget has everything. You can simply customize an existing budget template to serve your budgeting needs. Some templates integrate charts and advanced statistical formulas.

You can easily create a budget from scratch if you do not find a budget template that meets your specifications. Being a cloud-based application, you can start working from the desktop version and continue on the mobile app. With Google Sheets, you can share your budget worksheet with colleagues, partners, or family members and set limits for viewing, commenting, or editing as you desire.

Google sheets can be viewed and edited offline via the Google Chrome extension known as ‘Google docs offline' which also supports similar Google documents applications. All Google sheets files are saved to Google Drive; a cloud-based storage platform from Google. You can download Google sheets files in multiple formats such as pdf, xlsx, csv, etc. Microsoft excel is compatible with Google Sheets.

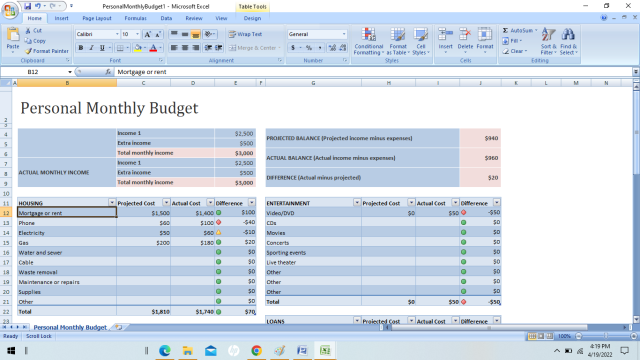

#5. Microsoft Excel

This is a popular spreadsheet software application developed by the American computer software giant “Microsoft Corporation” as part of the Microsoft Office suite of applications. It is available on Windows computers, macOS, Android, and iOS devices. It is well known for analyzing numerical and statistical data. Excel is popularly deployed in accounting, data management, etc.

Microsoft Excel comes with various templates such as invoices, forms, receipts, timesheets, budgeting templates; as well as other templates used for other purposes. You can also customize your own Microsoft Excel budget template by designing your own spreadsheet, adding your monthly income, fixed expenses, etc, and saving it as an Excel template.

Microsoft Excel is one of the best budgeting templates because it has no restrictions; you can create a monthly budget estimate and actual income estimates, and later input the real figures in the same budget spreadsheet. Multiple calculations can be done anywhere on the budgeting worksheet as it comes with inbuilt formulas, functions, and even statistical graphs.

#6. Vertex42

This website has been creating professionally designed templates for Microsoft Office and Google docs applications for over a decade. They have over 30 budget templates designed that can be downloaded and used on Microsoft Excel or Google worksheets.

There are free budgeting templates for personal, family, kids, and other users specified on a weekly or monthly basis. Some other templates include:

- Travel budget worksheet

- Savings goals tracker

- Cash flow worksheet

- Home budgeting worksheet

- Business budget template

- Budget calculators

Anyone can freely download, customize and use these free budget templates from Vertex42's website. The important rows and columns are beautifully designed with different colors to give it that professional and appealing look.

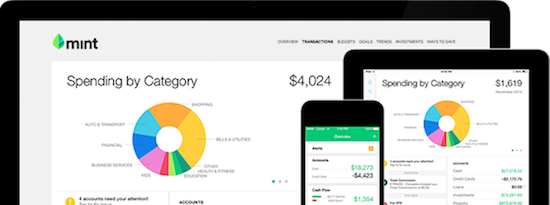

#7. Mint

This is an online money management app that collates transactions, categorizes them, and presents the financial accounts on one platform. Below are some of its features:

- Mint is one of the best budgeting apps as it comes with monthly budget templates that are fully customizable. You can set limits and get notified before you spend. This is to avoid overspending and encourage good spending habits.

- The Bill and subscription tracker organizes your payments and lets you know the due dates as well as price increments.

- Once you verify your account, Mint displays your credit report along with some info about your credit score status.

- It has up to 10 calculators including calculators for student loans, traveling, investment, credit card pay-off, retirement, etc.

- Through its partners, Mint app users can access personal loans, insurance, credit card, and investment opportunities.

Mint premium costs $4.99 per month and it comes with extra features like money spotlights, spending projections, and no in-app adverts. Subscriptions can be canceled anytime.

Featured Investing Brokers of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Training Course

Asia Forex Mentor (AFM) is a website owned by Ezekiel Chew. He is well known for training individual and institutional forex traders from all over the world. He trains bank staff, money managers, and professional forex traders. From his years of trading and training, he has developed the “One core program' which is so far the best forex training course on the internet today.

One core program is delivered as a package of over 60 video lessons prepared by Ezekiel. He teaches proprietary trading strategies backed by mathematical probability. His strategies are highly effective because his students have already generated millions of dollars using the strategies learned from the course.

The one core program is available on the AFM website for a fee. There is no prerequisite knowledge required before you can sign up for the program. It is comprehensive and suitable for only committed learners irrespective of previous trading knowledge or experience.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Spreadsheets that can help reach your Financial Goals

A budget is very important because it helps you plan ahead on how to spend your income for a defined period. Having a comprehensive budgeting system can help improve your overall financial status.

The “Budget packet” is a free monthly budgeting template that can be printed and customized for our expenses. Its disadvantage is that data entry and calculations must be done manually which increases the chances of errors and cancellations.

Google Sheets and Microsoft excel are spreadsheet applications widely used in preparing financial accounts for individuals and companies. They come with in-built budget templates and are numbered among the best budgeting spreadsheet applications. The two applications are similar and compatible except that Excel is typically an offline application.

Vertex42 has beautifully designed budget templates that can be downloaded and used on spreadsheet applications. Tiller money app connects all your accounts and updates them on a spreadsheet. The application comes with several tools which include some of the best budget templates that can be used to manage your finances.

Mint is a comprehensive personal finance app that manages your income and expenses. It features one of the best budget templates that can be customized and actively monitored to ensure strict implementation.

Personal Capital is an all-inclusive financial app that helps you manage your money effectively. It comes with a free budget planner, savings and retirement planners; and other tools that keep you informed about your financial position at any time.

Spreadsheets that can help reach your Financial Goals FAQs

How you can use a budget to help you reach your financial goal?

Typically, budgets are prepared prior to earn in order to properly channel the expenses to achieve a financial goal. A budget lets you know exactly how and where to spend to achieve your target. By sticking to your budget, you can reach a defined financial goal.

Assuming you want to save to acquire a property, you can prepare a budget that will help you determine how much to save and for how long before having enough money to buy the property. With a good budget and strict financial discipline, you are likely to reach your goal.

How do you create an effective budget spreadsheet?

The first step is to calculate your total income. Then, list your important bills, subscriptions, expenses, and savings requirements. Find a suitable budgeting template or budget spreadsheet to help with calculations and proper categorization of expenses. Remember that income minus expenses should be equal to zero.

When you eventually earn and start spending, update the budget spreadsheet accordingly if you are not using an automated application. Always analyze the budget implementation and ensure strict compliance.

Can a spreadsheet be used for budgeting?

Of course! Spreadsheets can be used for budgeting. Already, there are numerous budget templates designed for spreadsheets that can be edited and used for budgeting.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.