Prospectus Stock Investing: Overview, Uses, And How To Read It

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

The world of the financial market is full of updated information. For this reason, not only new investors and traders but also experienced forex players need to be well informed. As new data keeps on coming into the market, investors need to be updated to make profitable decisions in stock investments.

It is also true that financial information is available everywhere from blogs and, articles, to websites and reviews. However, just like being informed is crucial it is equally important to have accurate and verified information. For this reason, a stock prospectus is of utmost importance for financial information.

A stock prospectus is an authentic document that is affiliated with the Securities and exchange commission SEC. The purpose of this document is to provide relevant and bona fide information to the people. The stock prospectus contains the investment offering of stocks, bonds, and mutual funds.

In this regard, this review aims to inform readers about a stock prospectus's purpose, use, and importance. Furthermore, readers will also be able to learn about different types of stock prospectus and their uses. Hence, after reading this review the readers will know exactly where to look whenever they need authentic financial information.

What is Prospectus Stock Investing

A stock investing prospectus is a legal document that is aimed to provide all background and financial information to the investors regarding a company's profile. The U.S. Securities and Exchange Commission (SEC) is the authorized government department that ensures firms update their financial statements and other relevant information through the prospectus. Similarly, initial public offerings (IPO)s and all investment offerings are bound to file a prospectus by the SEC.

Likewise, there is also a mutual fund prospectus which also guides the investors regarding various financial details and investment offerings. Moreover, with the help of this prospectus, the investors can compare various companies' charges, past performance, future objectives, reward policies, fund management, etc.

The best part about a stock or mutual fund prospectus is that it serves as a windscreen to the investors prior to making any final investment decision. Investors can weigh the pros and cons of each company and can make an informed and wise decision. Additionally, the possible risks involved in the investment offering are also mentioned in the prospectus. Therefore, it guides the investors to give their final word after gauging their risk tolerance which in turn makes their investment safer.

How do you read Prospectus

There are two types of prospectus; a preliminary prospectus and a final prospectus. Both are similar but their contents have slight differences. However, the SEC requires companies to update their final prospectus to be able to enroll in the investment offering. The preliminary prospectus contains all background, business, and financial data of a company. However, it does not include the statistics such as the investment offering price or the number of shares offered by the company.

Although reading a stock prospectus may seem like a complex and boring task, however, it is as simple and interesting as reading a book. Like any other book, the stock prospectus also starts with a list of key contents to guide the readers about the topics which are covered. Hence. rather than going through the whole prospectus word by word, it is recommended to skim and scan and note the key information.

A typical stock prospectus starts with the introduction through its business name. Next, it continues to summarize a company's vision and mission, plans, goals, business strategies and models, and explanation of their business product or services. Then the most essential information is shared is the company's potential risk factors. Usually, at the very beginning of a prospectus, the risks involved are mentioned which at a later part of the document is explained in detail.

Additionally, to reflect the credibility of a company, the management team is also highlighted in a prospectus. The company intends to allure its potential investors by showcasing its influential management teams and Co-founders.

Towards the end of the prospectus, the company explains its intended use of the proceeds. This section can guide the investors on how the company plans to use this investment to further the company's objectives rather than filing their own pockets. Finally, the prospectus mentions the investment offering whether it is private or public.

Overall, reading an investment prospectus carefully is crucial before choosing the right candidate for investment. The key information lies in the explanation of the potential risk factors. For this reason, no matter how concealed they may be it is important to pay close attention or take help from a financial expert before making a decision.

Examples of Prospectus

An example of Google's prospectus from 2022 is shared here for the reader's reference. The entire document is available on the SEC official website. The document is divided into many sections and it is a final prospectus including their price offering and the number of shares available to the public.

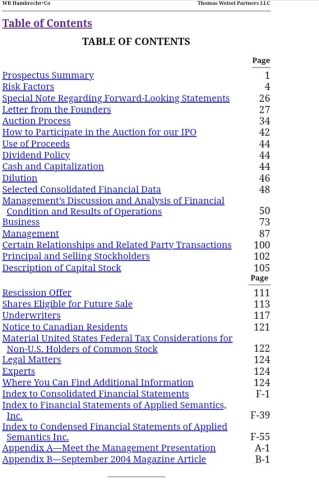

Below is the table of contents from Google's prospectus. The document is deemed to be an important tool for investors in learning about the company and making an informed investment decision. This table of contents guides the readers regarding what to expect in the prospectus. Furthermore, it can be clearly seen that the prospectus contains detailed information regarding every aspect of the investment objectives.

Like any other book, the prospectus also provides a synopsis or summary regarding the perspective of the company. Google's prospectus also starts with a summary that informs regarding the company's services, how they generate its revenues, its mission and future vision, and other corporate information. The summary provides a quick glance at the company however, as the prospectus suggests in the very beginning, the summary should not be the basis of an investment decision. As much crucial information like risk factors is missing from the summary.

Next, the document provides the balance sheet, statement of cash flow, and other financial statements showing strong growth in revenue, net income, and earnings per share. Furthermore, Google also describes its dividend policy, where it is clearly stated that the company has no intention to pay dividends to its shareholders now or in the near future.

Most companies that aim at presenting an enticing picture of their company obscure the risk factors. However, Google has put up a thorough and detailed risk section in its prospectus. More than 20 pages are dedicated to the risk factors and now and again it is mentioned to read the significant risk factors before investing in the company. This clearly reflects the genuine concern of the company for the investor's risk tolerance.

Google has not only put up the details of the risk factors at length but has also provided the notes of the lawyers regarding the potential uncertainties and negative assumptions which are highlighted by the lawyer in the light of the technological competition from various media companies. All in all, this is an example of a comprehensive stock prospectus that fully prepares the investor before making any investment decision.

What Prospectus Tells you

A stock prospectus is just like having a demonstration class where all the elements of the investment which will be undertaken by the investors are explored. The prospectus enlightens an investor about all the positive future aspirations of the company which would eventually turn into a reward for themselves. Simultaneously, it also prepares for the risk and uncertainties which they may encounter in the investment process.

Moreover, all the minute details regarding any company which the investor may not be sure about such as the competency of their leadership, the experience of the management team, or their past performance, everything is highlighted for the prospective investors. Similarly, if the investor is unsure about the charges of the investment offering such financial data is also available in the prospectus.

Additionally, the final prospectus of a company also allows the potential buyers to weigh multiple companies at the same time. The buyers can compare and contrast different prospectus of companies and can pick and choose the one which best reflects their financial interests.

An important thing to remember while going through any company's prospectus is to go through every detail of the risks involved. The example prospectus given here is an exemplary document of how a detailed prospectus should be. However, many business prospectuses try to brush off the risks and highlight the unrealistic goals more. This can become misleading for investors for making an informed decision.

Keeping this in mind, one should understand the importance of the document and not consider it a burden. It is even more crucial to read the entire document if an investor is investing in an Initial public offering as much information regarding the company's future objectives is highlighted here. Thus, it is better to read a boring document carefully than face the regretful disappointment later.

Best Forex Trading Course

The best forex course which is most effective is provided by Asia Forex Mentor. Through this amazing course, traders do not just make some profit, on the contrary, the pro-traders make massive profits making 6 figures per trade, with the help of financial experts, every time through their amazing strategy of mathematical probability.

This may sound unrealistic and impossible. However, there is no miracle or bragging here but the magic of mathematical probability through, the proprietary system of the one core program provided by the Asia Forex Mentor. The one core program is the recipe for ingenious trading results to humungous profits. All of this is possible due to the expert traders and trainers of the one core program who have designed strategies and know-how to edge out the market every time from basic to advanced level.

The developers of the Proprietary One Core Program are not just ordinary traders but are financial experts equipped with research-based trading strategies. These trainers have years of experience behind banks and successful trading institutions. As a result, these experts have come up with a comprehensive trading course ranging from beginner to advanced level.

Moreover, the One Core Program is not just a set of strategies to learn from but a complete trading solution with expert advice and tweaks and customized expert solutions for every individual client whether a beginner or an experienced trader. Hence, the AFM Proprietary One Core Program is the ultimate solution to all your trading needs

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Featured Investing Broker of 2024

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Prospectus Stock Investing

When it comes to investing your hard-earned money, one cannot just blindly invest in any company without attesting to the company's financial and other relevant information. Along with this, finding authentic and reliable information regarding any company can also be a hassle. For this reason, a final prospectus is published by the SEC department which aims to provide genuine data related to various private and public investment firms.

A stock or mutual fund prospectus not just includes the financial statement, registration process, or distribution policy. It also helps investors to gauge interest by informing them about their investment strategies, securities offerings, capital gains, and most importantly the potential risks. Hence, the prospectus is the company's best effort to attract more buyers by giving them pages of long details about their investment offerings.

Even though in this review we have given an example of a stock prospectus there is also a prospectus available for other assets. There are mutual funds prospectus as well as documents available regarding companies for investment in EFTs. Moreover, there are two types of prospectus the preliminary prospectus and the final prospectus. However, to get a more detailed document it is recommended to look for a final prospectus on the SEC website.

Investors who are interested in investment offerings of various upcoming IPOs should also keep track of the company's prospectus on the portal. These prospectuses are the best resources to provide the most up-to-date information on soon-to-be public companies.

Even when a matter of money is concerned, people tend to outlook the necessary provisions to save themselves from massive investment pitfalls. It should be taken into consideration that prospectus may seem like a complex and tedious task but it is equally important. For this reason, reading for the sake of reading should be avoided. Hence, one should read and fully understand the document including the offering costs, risks, securities offered, and other relevant information.

Prospectus Stock Investing FAQs

How do you get a company’s Prospectus?

Mostly any big company's prospectus is available on the Securities and exchange commission (SEC) online portal. It is quite easy to find the prospectus of corporate giants like Amazon, Google, Apple, etc. However, for small companies, one can simply look up with a Google search. It should be kept in mind that finding these documents on an SEC's portal serves as proof of their authenticity.

The stock prospectus is usually available at the SEC’s EDGAR (an acronym for electronic data gathering analysis and retrieval) system. Use the keyword search function to type the stock’s ticker symbol and the word prospectus.

For instance, if one is planning to invest in Google, one can type the “GGL prospectus” into the search bar. The EDGAR system will retrieve every prospectus the company has filed as far back as its Initial public offering IPO.

What’s the difference between a preliminary vs final prospectus?

Preliminary prospectuses are more of an informal document that is aimed at buyers to attract them into buying their shares. These documents are not accepted by the SEC department, as it does not provide the complete detail related to the financial statistics. The document includes similar information found in the final prospectus, however, it does not include the offering costs, price per share, and other transactional information to the investors.

The final prospectus, on the other hand, is approved by the SEC. It provides a complete picture to the investors along with the numbers. With the help of the final prospectus, a buyer can calculate the costs of the investments and the potential capital gains. Hence, every relevant detail, including information associated with the amount of risk tolerance and its percentage can be assessed through this document. It usually includes more details or updates to the information found in a preliminary prospectus.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.