Best Options Trading Strategy in 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best options brokers for traders are Tradestation and Tradezero

The #1 Forex Trading Course is Asia Forex Mentor

Profitable trading results from using best option trading strategies. With so many available trading strategies, it is difficult for options traders to choose from these options, which would lead to maximum profits.

Each strategy is developed keeping in mind the priorities of the trader. Each of these varies in suiting the very nature of a particular trader at a particular time. Hence, if one is looking for the trading strategies to work to gain profit it is essential not to choose the popular but the right strategy for oneself.

To select the most appropriate options strategy, it is crucial to learn about each of them and find out about its pros and cons. Learning about these strategies would allow the traders to make an informed decision before choosing the appropriate options trading strategies.

This article will provide a quick sneak peek into the right option trading strategies so that it is easier for any trader be it a beginner or an experienced, to systematically choose the best strategy for themselves.

Best Option Trading Strategy: How to pick an Options Strategy

Choosing the right trading strategies for beginners can be a tricky task. It can pose a challenge to choose the ideal option because there are numerous alternatives available for traders, making it difficult to identify the most suitable investment strategy.

Moreover, there are dozens of strike prices and expiration dates available for each asset, this makes the overall process of choosing from the options trading strategies more complex.

After identifying the objective the second step is to ascertain your tendency to bear risks. All the investment strategies come with a potential risk factor involved.

The third step is to look up the volatility of the market trends. The implied and historic volatility helps in determining the stock position and thus leads to choosing an appropriate options strategy in the long run.

All these steps would help you to decide on which is the best options trading strategy to go for. The final step would be to set the parameters of your chosen strategy such as the time decay, strike prices, and options delta. Passing through these stages before, finalizing an option strategy helps in following a logical thought process that is essential for a successful selection of the best options strategies.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through TradeStation website |

| Broker | Best For | More Details |

|---|---|---|

| Beginners

| securely through Tradezero Strategies website |

Best Options Trading Strategies

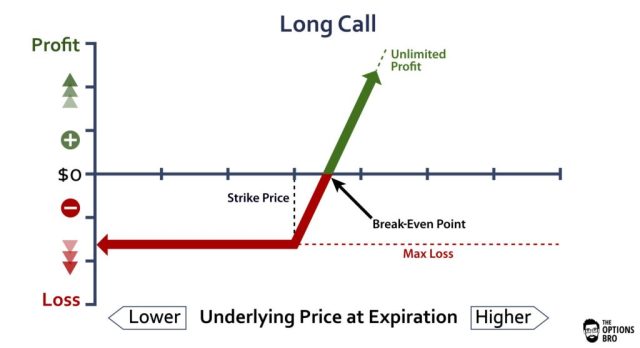

#1. Long Call or Put

A long call or put option is considered to be the safest option, especially for novice traders. With this strategy, a trader has the choice to buy or make a call for any share at the present price and pay at the expiry date.

Moreover, with the help of this strategy, a trader can pay a lesser amount than the underlying share price. If the price of the stock rises as may be predicted by the trader.

The options strategy of long call (buying) or put (selling) of stocks provides an opportunity to the traders to buy or sell stocks by paying an initial premium with an expiry date.

It allows the option traders to face limited risks in case of falling share price and receive unlimited stock gains if the underlying stock price goes up.

With the help of this strategy, the premium paid by the options traders serves as an insurance policy for the options traders as only the premium money is at risk if maximum downside occurs and the trader's prediction of market trends goes wrong.

On the other hand, there is potential for maximum gain of profits if the stock's price shoots of the betted stock. In both cases selecting a strategy is a win-win situation for any options traders.

How does it work?

Since the trading market is all about monitoring the market trends, their fluctuations, and making predictions for future trends, betting on any stock can be very risky. For this reason, choosing the most appropriate options strategy is vital.

Long call or put strategy makes the whole trading process a lot more relaxed as this strategy ensures to involve limited risk and maximum upside for the traders.

With this options strategy, the traders get an edge of leverage to maximize profits by investing minimum amounts that would otherwise be needed if trading the underlying asset itself.

For instance, a trader would need to invest 1000 $ to buy 10 shares of 100$ each and wait for the share price to go up to generate income from these stocks. However, through this strategy, a trader can get the leverage to make a bet of 2000$ on a call contract with a higher strike price of 10%.

Without using this strategy, a similar strike price can only provide a limited return to the trader or investor which would be under the budget of the trader and their investment on the direct underlying asset's price.

However, with a long call options strategy at hand, the trader or investor gets the leverage of spending more than their capacity to invest maximum capital and consequently gets a much higher return than the former one.

All in all this strategy is best for any trader who is looking for leverage at the money options and simultaneously limiting potential risks to the premium paid.

Pros

- Gives the option of buying desirable options of any underlying stock

- Provides leverage to the investors and traders in investing in the stock market

- Limits the risk if the share price falls to the premium paid

- Allows unlimited opportunity to earn profits at the rising asset

Cons

- A high chance of 100% loss of the premium paid

- Not all stocks have this option available. It limits the number of stock possibilities available to the trader.

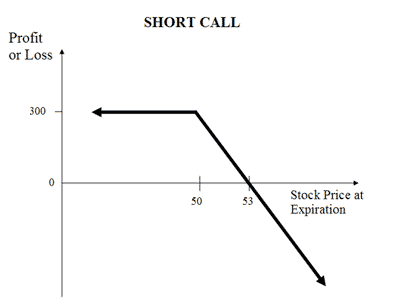

#2. Naked Short Call or Put

The naked short call or put strategy can be used by any trader who has a margin account with a brokerage company, Using this strategy, the trader first looks for a stock that might go down in value for a short period. Then the trader determines a price of that stock which he/she considers would not exceed.

Next, the trader sells or writes options at which the traders sell stock. In a short-call strategy, traders can make money only if the stock price falls or remain the same before the expiration of the contract.

This options strategy involves limited upside which is the premium received by the investor selling. However, the potential losses can be unlimited as the traders will have to buy the same underlying asset to fulfill the options contracts if buyers decide to exercise their selling options.

Even when this strategy involves unlimited losses, a short call or puts strategy can be useful because if the trader or investor is making a bear call and is certain that the stock price will go up then the trader can buy the stock again at a closer price and earn money through the premium received.

How does it work?

When a trader uses a short call or put strategy he/she makes selling put or option calls for an underlying stock before buying or selling it. It is opposite to the other trading options as the trader earns profit only when the call options price does down.

Rather than predicting the stock prices to go up, a trader using the short put or call option consists of buying or selling a stock underlying whose price is anticipated to be decreased within a given deadline.

When a trader makes a short put or options call the premium is received immediately in the trader's account which can also be considered as the trader's maximum profit using this strategy.

If the call option during the expiry date is higher than the strike price then keeping in mind the contract the trader would be bound to sell stock.

In contrast, if the underlying stock remains under the price within the time frame then the calls option expires worthlessly and the trader makes a considerable profit in the name of the premium received.

Pros

- A short call or put strategy is an appropriate strategy as stock prices tend to decline more than to go up.

- It is flexible as a result a trader can determine the strike price of the call option as much as one wants

- It is a bearish strategy that becomes more profitable as the stock market falls.

- Experienced traders who are well aware of the market trends of stock falls can take advantage of this strategy

Cons

- A short put or call is a risky strategy because the loss stands unlimited.

- The maximum gain from this strategy is the price received for the selling calls option

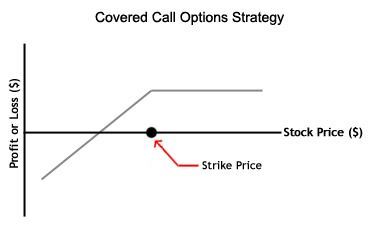

#3. Covered Write

A covered write or covered call strategy is used when a trader sells call or put options against stock they already own. This strategy is covered because it is already owned by the investor that will be sold to the buyer of the underlying stock.

Many traders find this strategy useful when the market trade options are limited by selling covered write. This strategy is also considered to be the safest trading strategy for beginners.

Through the trading options of covered calls, the buyer of a stock pays credit to the seller of call options to earn the right to buy shares within the determined deadline. The seller gets to keep in the money whether or not the contract is exercised.

For this reason, many investors tend to opt for this options trading because it is profitable if there is a higher price or if the call options sold expires worthless as the seller gets to keep the premium as well.

The premium that the buyer pays is determined after keeping in mind many factors such as the balance between the stock price and strike price, the expiry date of the covered call, and the volatility in the stock price.

Keeping in mind all the investment advice covered call is considered to be low-risk amongst all the trading strategies.

How does it work?

Covered call options work in two steps. First and most importantly a trader needs to own or have to buy shares of any stock. While selecting the stocks to buy it is crucial to do thorough market research and buy stocks that are less likely to fluctuate in prices and seem stable for a considerable time.

The next step is to sell call options against the stocks which the investors own. The call options allow the buyer to buy a share at a determined price under the contract for an agreed timeframe. The price paid by the buyer is the profit that is already made by the trader using this strategy.

This strategy is the most basic trading options strategy for beginners as many brokerage companies allow traders to sell covered call options even with accounts that are otherwise limited to trade other selling options.

Pros

- It generates added income from the owned shares

- The limited loss compared to other trading strategies

- It helps in lowering the risks of potential losses

- Assists in determining a target price for the stock owned by the traders

Cons

- Cannot sell the stocks until the expiry date.

- Maximum profit in the form of the premium is received

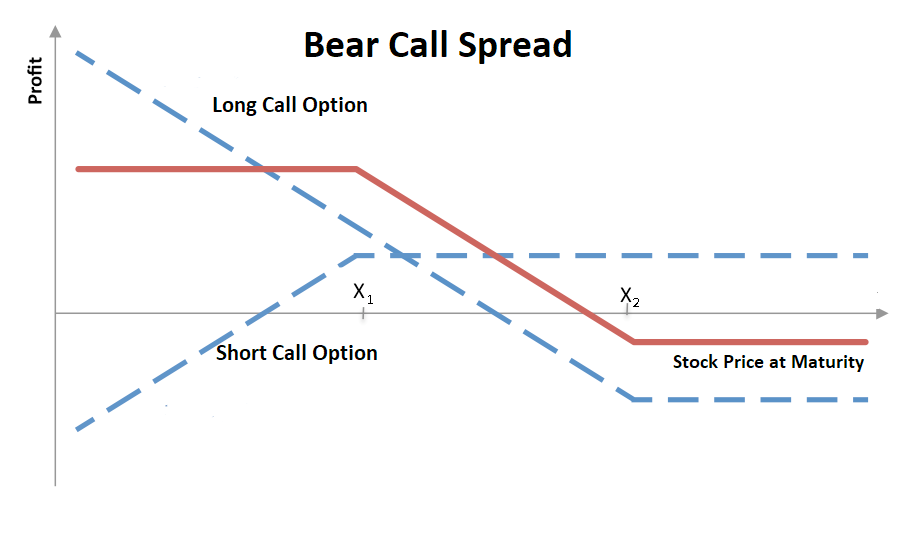

#4. Bear Spreads

The bear spreads or bear call is an options strategy used when a trader is skeptical regarding the stock price and anticipates the falling stock. To avoid the potential losses and earn a profit before the prices fall traders use the bear spreads for short selling and buying of the stocks.

To make most of the bearish options strategy, the traders need to assess the market trends correctly regarding the fluctuation of stock prices and the anticipated timeframe of the stock decline.

There are two kinds of bear spreads. One is the bear put spread while the other is the bear call spread. This strategy involves the buying and selling of puts or calls at the same time within the same underlying contract of the same expiry date but within a different strike price. However, both bears put spread and bear-call spread are considered to be vertical spreads.

The bear put spreads assist the traders to earn maximum profits by buying one put or calls and selling another put or call. Buying and selling are beneficial if the same underlying asset expires at a lower strike price.

Hence, with the help of this strategy, the initial investment of buying the first put or call is covered by generating money from the lower strike rate of the sold put or call.

How does it work

The first requisite of using this strategy is that the trader should be bearish regarding the price of any stock. This means that the trader should have the capacity to anticipate the potential downfall or decline of the stock options at a predetermined time frame so that the stocks are in the money when the expiration date arrives.

Keeping in mind the volatility of the stock prices, the next step for the trader would be to choose a strike price to buy a put. The strike price needs to be below the market price even lower than the breakeven price of the strategy.

Then selling a put at even a lower price than the bought put. This step would help the trader to keep the profit of the sold put and set aside some of the cost of the put and the potential losses.

Pros

- Bear spreads limit the losses to a minimum

- It reduces the cost of buying the underlying assets

- This strategy even works in slightly rising markets

- Simultaneous buying and selling is more cost-effective than just buying a single put directly

Cons

- This strategy limits the potential profits gain

- Risk of short-call buyer exercising option

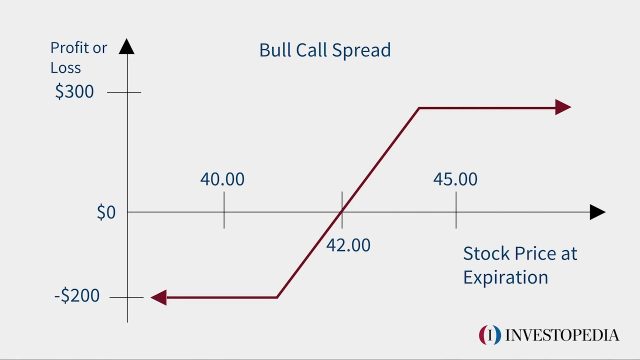

#5. Bull Call Spreads

The strategy of bull call spread is another variation of vertical options strategies. This strategy also involves the collection of premium by selling an option call to marginalize the investment made in buying an options stock.

This strategy is used by traders when they expect a moderate rise in the price of the underlying asset. Like the bear, call spreads the bull call also involves the buying and selling of an asset at the same time with the same expiration date, however, at different prices.

This strategy is a positive and straightforward strategy where the asset with a lower strike price I bought and the stock with a high strike price is sold. As soon as the trader uses this strategy they receive a debt amount which is made through the short and long strike price difference minus the initial cost, this is considered to be the profit. Similarly, the maximum loss limit is the premium paid for buying the options call.

How does it work?

The bull call spread works best when a trader has a bullish outlook and is trying to gain maximum benefit and minimum losses for the predicted high strike prices of the assets.

Since this strategy involves buying, underlying assets it requires a low initial cash outlay to begin trading options. However, at the same time, the trader also sells call options assets at the same expiration date and receives a capped profit, in terms of a premium, which to an extent compensates are for the cost of the buying asset.

It is crucial for any trader using a bull call spread to sell and buy call options that have the same number of options with the same expiration date and the same strike price of the underlying stock.

Pros

- It is an easy strategy to use

- It requires little cash flow compared to other strategies

- With premium received it is less expensive to buy the call options than the direct purchase

- The maximum profit and loss are visible to the trader.

Cons

- There is a possibility of two commissions being charged for simultaneous sale and purchase

- The profit gain is very limited

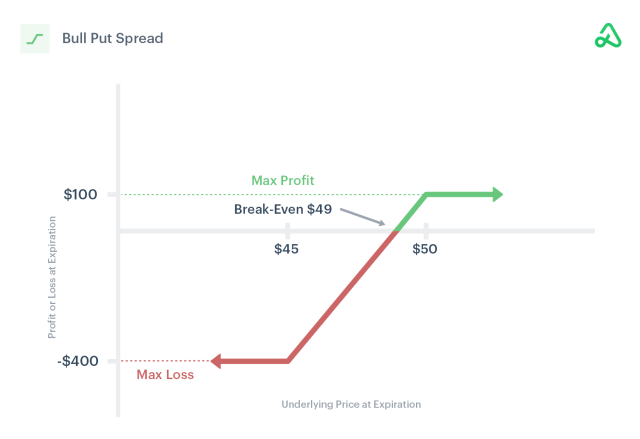

#6. Bull Put Spreads

The bull put spread is similar to the bull call spread with only one difference in the strike price. Unlike the bull call spreads, bull put spreads consist of two transactions where one put has a higher strike price and the other has a lower strike price.

The bull put spread works best with the rising stock price. the trader buys a put to sell at a higher strike price in the market, however, if the price rise at the expiration date then the put expires worthless leading to a loss of the premium paid by the trader at buying the put.

However, since the vertical options trading strategies like bull put spreads are designed to allow two stock transactions at the same time. As a result, the trader does not suffer the loss of premium as by selling the put option at the same time the trader receives a premium as well even if the stock falls

How does it work?

The bull put spread is amongst the trading strategies which work for those traders who are looking for a stable or moderately declining stock position during the put options trading.

After monitoring the stock price the trader would require to buy one put while selling the other put to lower the overall upfront cost of buying a put option. The trader would usually profit if the stock price moves lower as anticipated.

The potential profit is limited however, such trading strategies like a bull put spreads lowers the chance of losses if the market fluctuates unexpectedly.

Pros

- Traders earn income from the premium received at the initial stage of the strategy.

- The maximum loss on this strategy is capped and is known upfront.

- The investor can change the profit/loss boundaries by selecting different strike prices.

Cons

- The strategy has limited profit potential

- It does not offer a chance for future gains if the stock price rises above the upper strike price

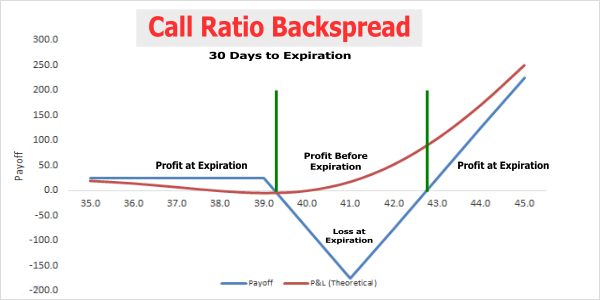

#7. Call Ratio Back Spread

The call ratio back spread is very much like the bullish trading strategies as it also involves the same features of buying and selling of call options or putting of different strike prices within the same expiration date.

However, as the name suggests this strategy works in a ratio of 1:2, 1:3, or 2:3. Moreover, in the back spread more option calls are bought compared to those which are sold.

This strategy has potentially unlimited upside profit because the trader is holding more long call options than short ones. Moreover, it limits the risk at the money also.

Another value of this strategy is that it allows the traders to have more time to make decisions and work in the investor's favor.

How does it work

To make the back spread strategy work the investor firstly needs to write or in other words, sell a calls option at a low strike price and buy two or more call options with a high strike price. It should be ensured that all the buying and selling options have the same expiration date.

The trade can be made successful and would make a net credit at the money received from selling call options at a low strike price is more than the money spent on buying two high strike price call options.

Whether the trade leads to net credit or net debit depends on multiple factors such as the volatility of the stock price, the difference between the stock strike price, and time decay.

Pros

- This strategy supports limited risk when compared to just buying calls, but unlimited potential profit to the upside.

- It allows a longer expiration date which helps the traders in making successful trading moves

- Stock market risks are substantially minimized

- With the help of this strategy, profits can be made in both cases of stock fall and market volatility

Con

- This strategy has a level of complexity calls that requires a good amount of stock market experience.

- Expects a high level of volatility in the stock prices

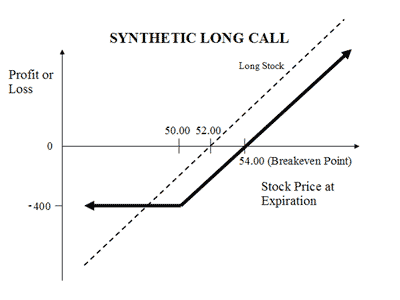

#8. Synthetic Call

The synthetic call strategy involves traders who acquire assets and are bullish on them for the long term. However, the investor may have doubts about it in the coming future. In this situation, a trader can use the synthetic call strategy to gain unlimited profits with minimum risks.

A synthetic call option can also be used if the trader only wants one transaction to change the pre-existing position of the stocks.

So rather than changing the position of stock with two transactions of first selling the stock and then buying a call option, by using synthetic call option the trader can buy a put option. As a result lesser transactions lead to an efficient and cost-effective trading process.

By using the synthetic call option a trader does not have to worry about the problem of a call option being expired worthlessly. Moreover, negative market trends work in favor of the synthetic strategy because time decay, strike price rate, and volatility does not much affect the trading outcomes in a synthetic strategy.

How does it work?

A synthetic call strategy starts with a trader buying or holding stocks. To be safe from any potential loss in those stocks, the trader further buys a put option on the same stock.

In this regard, a synthetic call serves as an insurance policy for the trader to secure themselves from any financial risks during the stock downward fall.

In contrast, the synthetic put works with a combination of short stock position and long call option on the same stock. For instance, the investor buys a call option on the same stock which has a short position in the stock purchases.

This synthetic put strategy works as a shield to protect the investor from further losses from the potential rise in the stock price.

All in all the good time to use synthetic strategy is when the investor wants to continue the ownership of the stock but fears the risks of the upcoming downside risk.

Pros

- The reward is unlimited and the risks are minimum

- Synthetic strategies help the traders in simplifying trading decisions

- It makes trading cost-friendly by allowing fewer transactions

- It assists in managing trading positions efficiently

Con

- Given market inactivity, the call option can begin to lose value due to time decay

- It is a double-edged sword because it comes with both unlimited profit as well as loss

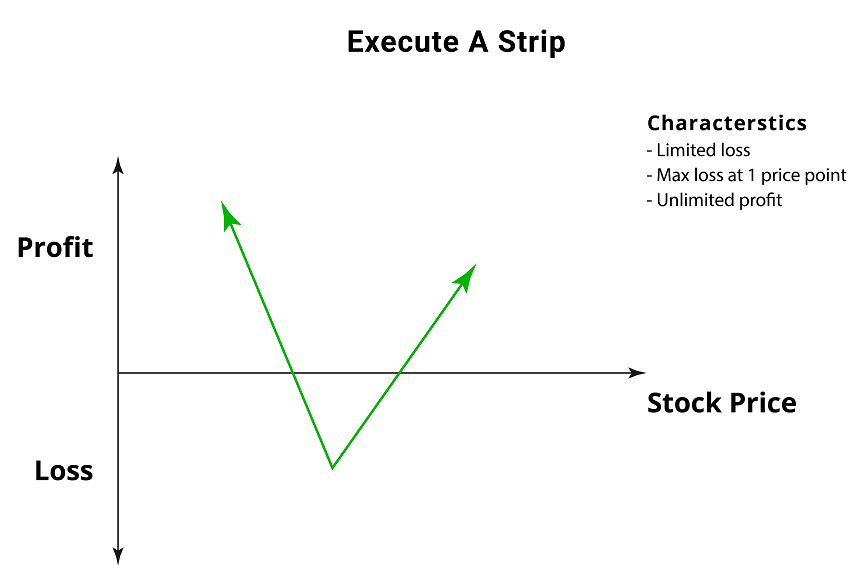

#9. Strip

With the help of a strip strategy like other bearish strategies, massive profits can be attained if the underlying asset price drastically fluctuates either upwards or downwards. However, the ratio of profit is higher when the stock price drops or declines.

To get the maximum benefit from the strip strategy the trader needs to buy two put options on the stocks and one call option instead of one each. This may be a bit more expensive than other strategies however the potential reward is also higher than others.

Under the strip strategy all three transactions should be on the same underlying asset, the same strike price, and within the same expiration date to work successfully for the trader.

How does it work?

The strip strategy works well for short-term traders who can predict the volatility in the underlying price fluctuations either going upwards or downwards.

In contrast, long-term traders might not get many benefits from this strategy as buying three-position transactions can lead to making the trading process very expensive.

As a result, short-term it is advisable to use the strip strategy for short-term trading profit targets and exit when the targets are achieved.

Pros

- Profit gains when the share price goes up or down

- Limited loss

- The profit is potentially unlimited when share prices are moving

- Low bid spread can have a positive influence on the position

Cons

- It is more expensive than other strategies

- Dependence on volatility is significant to generate profits

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Online Options Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Powerful Services at a Low Cost | securely through Tradezero website |

Web Platforms Read Review | securely through eTrade website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Trading Course

Investing in the Forex market might seem to be a daunting task especially if you are a beginner, and have just started exploring the Forex market. Although experience is said to be the best teacher when dealing in the Forex market, it is good to learn about the Forex market briefly before making your first investment.

There are several ways in which you can start expanding your knowledge of the stock market. You can either start reading books or ask for tips from your friends or family members who have prior experience of trading on the Forex platform. However, the former is a time-consuming method while the latter is not always a credible learning source.

If you want to learn about investing in the Forex market that would help you gain knowledge, and tell you all you need to know about the market, then you can opt for some professional courses available on the internet. These courses are developed by Forex markets experts who have years of training Forex traders.

Now, there are thousands of courses on the internet that claim to teach you about Forex investment. However, not all of these courses are reliable and give accurate information. So which is the best Forex course for learning the ins and out's of the Forex market?

Asia forex mentor course by Ezekiel is by far one of the best Forex learning courses on the internet, and they are one of the best learning sources if you want to expand your Forex trading knowledge.

They have been featured on multiple different leading forex platforms and Forex events happening around the world. Ezekiel's platform is the perfect solution for you to learn because their clients include multiple trainees and bank traders from private trading institutions around the globe.

It is the number one course available on the internet because it also reaches new bank traders and has fun managing if you want to make money from trading forex stocks and other commodities.

You can get a great return on investment by indulging yourself in this systematic course. Even if you are a beginner in the field and do not have enough experience and knowledge about Forex trading, you still join this program with zero knowledge. Everything will be taught to you from scratch, and you can enroll yourself in this program right now to get started.

Check out the testimonials on the website and start your Forex trading journey right away. The good thing about this course is that you will be crystal clear about what you need to do from day one.

They are using a return on investment approach to teaching their students. It is a scientific method of beating the market, and you will not be taught this somewhere else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Best Options Trading Strategy

There are numerous options trading strategies available and learning about all of them can be a tedious task. However, each strategy is custom-made and might or might not work according to specific trading needs.

For this reason, it is crucial to deep dive into these strategies to learn about which strategy would suit your trading needs.

Options trading strategies seem complicated however, with some effort the traders can learn about the basic strategies and use them by their need to increase their profits, generate additional income, bet on the market's volatility, or hedge existing positions.

Some of the basic strategies also have many common elements which make them similar to one another. The traders have the choice to choose the strategy which seems most likely to earn profits in their specific trading situation and market predictions.

For instance, Covered calls, and synthetic puts are used when the investor already has an existing position in the underlying shares. Whereas ratio back spreads or bull spreads involve buying one (or more) options and simultaneously selling another option (or options).

Hence, each strategy is tailor-made for a given trading scenario and can only be successfully implemented when intelligent trading choices are made by the investor.

Best Options Strategy FAQs

What is the best strategy for options trading?

There is no one for all formula in selecting the best strategy for options trading. To find the one successful strategy, traders first need to define success for themselves.

If gaining unlimited profit is successful trading, then a long call or long put strategy aims at the unlimited gain potential. Conversely, if doing risk-free trading is defined as successful, then strategies like the covered call are the best option.

Which option strategy is best?

Option strategies are just a means to provide flexibility and management to the trade based on multiple factors. These factors involve the trader's view of the market, time frame, and strategic use of leverage.

At the end of the day, a good options strategy to deploy takes into consideration the investor’s goals as well as the overall market climate.

What are the safest options strategies?

The covered call strategy is one of the safest option strategies that any trader can execute.

This strategy requires an investor to purchase actual shares of a company while simultaneously selling a call option.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.