Best Binary Options Strategies – A 2025 In Depth Guide for Traders

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best options brokers for traders are Tradestation and Tradezero

The #1 Forex Trading Course is Asia Forex Mentor

With the rapid influx of investment in the digital asset market, various new investment routes have opened for traders. They don't have to limit themselves to crypto or stocks only. Binary options are the latest investment path that can help you go from rags to riches. It is similar to the conventional options, but there is a slight difference.

An option is a derivative asset, and its value depends on that of the primary stock. Hence, the trading has high risk and return. On a good day, a 1% rise in the base stock can convert to a 5% rise in your options portfolio. Unfortunately, the opposite is also true. Due to high risk, investors aren't always willing to invest in options; they are afraid of incurring an uncalculated loss on their investments.

Binary options trading came as leeway for such investors. The trading basics stay the same; the value of the binary option is still derived from the primary asset; however, the losses and profits are limited to either a zero or a hundred. With the right binary options trading strategy, you can make money with no bounds.

However, it is challenging to create the best trading strategy, and beginners often find themselves helpless. Do you feel the same? Well, then you don't need to worry, as, in this blog, we will help you with 10 different binary options trading strategies that can help you make a fortune. Let's go!

10 Best Binary Options Strategies

Trading strategies are based on trade signals– the indication of whether the underlying asset prices would rise or fall. Several indicators will be used in collaboration for each trading strategy to determine how the eventual result may turn.

Usually, trading signals are reliable as they are based on technical analysis of historical data, but sometimes they might differ from the future. Hence, in our case, we will also focus on what the indicators imply.

Binary options strategies are applicable for both the short and long term. However, their application would differ based on different assets. Sometimes, different indicators might show contradictory results, but it eventually comes down to your money management strategy.

The binary options trading strategies mentioned later in the section consists of a variety of investor mindset, and they are appropriate for different risk appetites and investments. So, without waiting any further, let's dive into them.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through TradeStation website |

| Broker | Best For | More Details |

|---|---|---|

| Beginners

| securely through Tradezero Strategies website |

#1. Going Along with Trends

Using the trends to determine the prices of an underlying asset is the easiest and most fundamental technique that doesn't often go wrong. Every asset follows a zig-zag pattern throughout its market life. If it's rising, the pattern won't be a straight line; it would have a mix between more rises and fewer lows.

Trends are based on market speculation regarding how a stock would perform over the long run. If the underlying assets show prospects for investors, they shall invest in it, resulting in a price rise. Consequently, the price rise tempts other investors to sell their assets for a better price, creating downward pressure on the asset. In a rising pattern, the investments in a share will often overpower the outflow.

How to Apply

Unlike conventional traders, binary options traders don't have to analyze the past performance of their assets; instead, the main focus goes on the underlying asset. You need to look at how the share has performed over time and whether it is in a rising fashion or a falling one.

Asset line graphs can come in handy for this purpose. They provide valuable insights into how the share is progressing. You must also check the timeline of the chart. Usually, hourly options are hard to predict based on trends.

The option value can change instantly if a hefty investment is received or withdrawn for the asset. However, for options that expire several days or a week, trends can be helpful. You need to adjust the timeline to a suitable scale, which in our case should be a week.

Then, note how the asset has been performing. Understandably, the line graph won't be a straight line; however, it would get smoother as you increase your time scale. Once you look at the weekly projection, you will notice a pattern in the asset's price movement, which can provide valuable information about its future.

#2. Following News Events

When talking about investments, world affairs and market news can't be ignored. A little rumor in the market can hit the reputation of the asset, and its price would hit a slump. Similarly, positive speculation from a popular broker may uplift investors' morale, who will add more savings into their accounts.

News events have unprecedented importance to share price, and as they are unpredictable, options holders won't wish to trade in an uncertain environment.

A popular incident about news events can be the fall in the price of Bitcoin and its derivatives. After the interview of Elon Musk at the ‘Saturday night' show, Bitcoin started falling out of fashion.

Within 2 weeks, it was trading at about $43000, which was a 29% decline from its price. Similarly, the acceptance of cryptocurrency by the European Union led to a surge in its cost, and the binary option of the currencies also had a rise.

How to Apply

The above examples highlight the reception of digital assets to the related news. If you are starting to trade binary options, the news strategy is as important as it gets. You need to keep yourself updated with the latest news from the market.

However, it can often get difficult to identify which news pieces are important and should be given importance.

Therefore, you should first start shortlisting stocks based on their trends or prices. Then, search for relevant news about them. Board meetings, product releases, and price changes are powerful news that you should look out for.

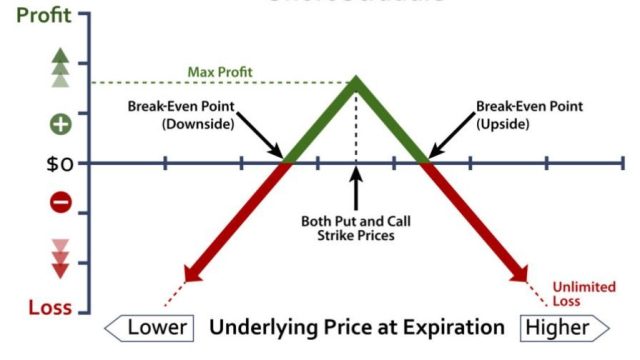

#3. The Straddle Strategy

A volatile market is a haven for experienced traders, and their decisions can help them make profits in a falling market. In the straddle strategy, the goal is to maximize profits by putting options when they are at a low and calling them as soon as their downward spiral begins.

Using the strategy can help investors make money in a fluctuating market. However, the results are dependent on your market information and exercise. The straddle strategy works better when you know something the other buyers don't.

It will give you an edge and put you a step forward from others in the league. Options trading is all about making the decision at the right time, and the straddle strategy magnifies the importance of the ideology.

How to Apply

For the straddle strategy, you need to look out for a market operating under volatility. The fluctuations shall allow you to employ the plan and make money from it. For instance, the global gold market may react after some reserves are found in a new area. The production processes will slow, and the investors will look for the market's reception.

If you are confident about your knowledge, you can employ the straddle strategy in the market. The goal is to excise the call option when the underlying asset's price peaks and starts falling. Once it starts rising again, you can excise the call option.

#4. The Pinocchio Strategy

If you have read the first strategy about trend lines, you might be surprised to hear that doing the exact opposite can churn out profits. Although we are going against the trend, in real terms, the plan is according to the long-term flow of the asset's price.

The Pinocchio strategy is employed when the candle for a stock's performance is small but has a lengthy wick. It means that most asset trading took place in a small range, but the outlier purchases were expensive.

The wick shows a rising trend direction, which might be contradictory to reality. The Pinocchio strategy focuses on going against the market to make a profit. The strategy works best when you have an understanding of the market that nobody else does.

For instance, a sudden surge in the supply of crude oil may reduce its prices, but you still buy it on a high because you know the fall is temporary, and an increase would be gigantic. Similarly, calling the option on a low is also against market norms, but it can be helpful if the underlying assets worsen in the long run.

How to Apply

The binary options market is prone to market news, and any changes in stocks prices are magnified in the prices of options. If you feel that a rise in the stock price is short-lived, you may purchase the call option.

Although the move is against the market, it will be profitable if your inference turns outright and the shares fall in future. However, it is a risky game for a riskier market. If you are new, you should avoid playing it.

#5. Candlestick Formation Patterns Strategy

Candlesticks are an excellent indicator to analyze the performance of your underlying asset. They provide detailed information behind the price movement of the asset. A candle consists of a wick and wax region.

The wax region is the central part that highlights the opening and closing prices of the asset, while the upper wick indicates the highest price of the day, and the lower wick shows the lowest.

Candlestick formation pattern is pretty similar to the trend analysis, and your goal as a trader is to identify what will follow next. In a fluctuating market, you will come across rapid highs and lows.

The waxes are a critical identification of the asset's performance, so you should pay more importance to them than the wicks.

How to Apply

The goal of the candle strategy is to predict what's going to happen with the share prices. When you look at a candle pattern, you will notice a cycle of ups and downs; every high is followed by a subsequent slump and a recovery. The asset's overall performance is summarized in the tiny zig-zags on the asset's line graph.

You should focus on the cycle of the candlestick pattern. If it is reaching a high, it is time to exercise the put option, and if it's in the falling fashion, use the selling option.

#6. Fundamental Analysis

The returns involved in the derivatives market make it tempting for active traders to invest in them. However, the chances of losses are as high as the rewards. A technique employed by experienced traders is fundamental analysis. Traders would usually look for options that have a balanced strike price to be below risk.

A series of such loss-risk assets are created and are understood in every financial aspect to attain important information about their future performance. Once the shortlist is reduced further based on the brightest prospects, the next goal is to understand the related binary options with a low investment.

A trader usually invests a limited component of his overall investment in identifying how the options work in the market. The strategy lowers the risk for binary options traders and allows investors to make informed decisions for the long run.

How to Apply

The strategy reduces risks of losses in exchange for added efforts. You need to shortlist a series of companies or financial assets that look lucrative prospects. Then, they are future shortlisted based on their financial statements and information in the market.

Finally, a small investment is made in their options to understand how their market performs to news and speculation. The procedure takes longer than usual, but with the right decision, your profits will be a reality, and losses will be minimized.

#7. The Hedging Strategy

Realistic investments can help you make money by trading binary options. Greed is never a good trading strategy, but hedging is its opposite. Although you won't make loads of profits by employing the strategy, your risk won't exist.

The hedging strategy focuses on buying both the call and put options of an underlying asset for the same date. With this strategy, you will be able to make the right deal at the right time.

If an underlying asset has been falling along the timeline and is expected to follow the same pattern at its expiry, it is better to sell the call option for anything they bring. In this case, you will still have the put options with you, and the profit can be made.

How to Apply

Hedging is a vital strategy for investors with a significant investment who doesn't want to lose it to speculation. Hedging is a unique trading style that guarantees you profit regardless of the asset price.

To apply hedging to your binary trading, you would need to buy equal amounts of both call and put options. The movement of the underlying asset will determine which options to sell or keep till expiry.

If the price has been rising all along, it is pretty visible that a put option will incur a loss, so you need to get rid of them for a low price. However, you will still have the call options that can be excised for higher profits. Therefore, you won't face the loss.

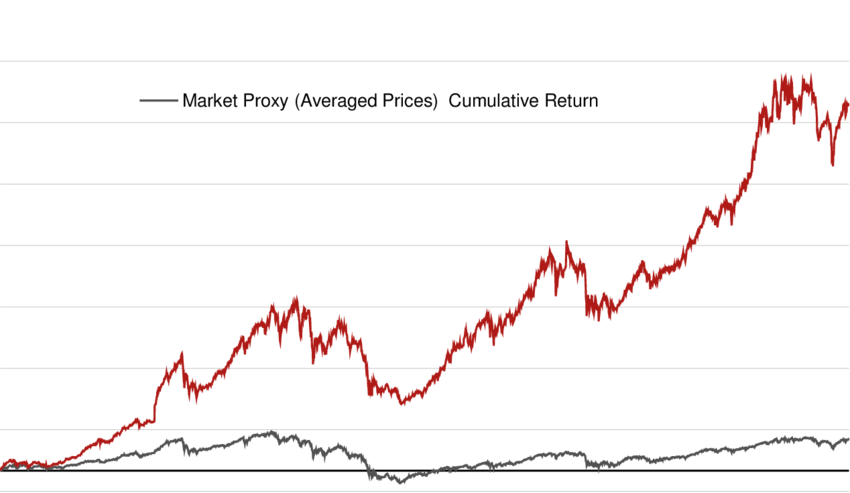

#8. The Momentum Strategy

Buy low, sell high is the simplest definition to succeed in the digital asset market. You can't go wrong with it, but it isn't as easy as it sounds. The momentum strategy focuses on selling winners and buying losers; the overall results churns excellent profits.

Investors look for securities that are under a decline, and when their historical support and resistance levels are achieved, they make their decision. Once security reaches its support level, it is historically bound to rise, so investors will buy. Similarly, if an asset has reached its resistance level, it has traditionally fallen from it. So, it is time to sell.

How to Apply

Employing the momentum strategy is easier for stock traders than for options traders. With a high reception rate, an option may take time to respond, and a logical win may turn into a loss. As an investor, you need to focus on buying a put option when the share is at its peak, so you can make a profit when it starts falling.

Similarly, you should buy a call option when security is at its lowest; therefore, you will make a profit when the stock rises.

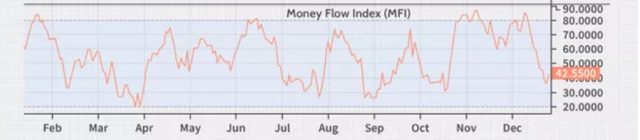

#9. Money Flow Index Strategy

We are now getting closer to the underlying asset by interacting directly with its price changes. Money Flow Index is an indicator that uses the share price and volume to determine whether the share is underbought or overbought. The same indicator works for currencies and forex. Understandably, a particular asset is overbought when its price rises to a period-high due to increased demand.

The indicator graph shows the average price-volume values on an index between 0-100. The centre part of the graph shows the average value of the asset over time. Every time the index crosses the top average value line, that indicates the asset is overbought. Similarly, if the security's index drops below the average value line, it suggests the security is underbought.

How to Apply

Before applying the money flow index, the first goal is to identify the underlying assets for the respective option. Once you are done with the step, the next step is applying the money flow index. It is pretty simple, and you need to locate the pattern of the graph and interpret the situation.

If the index is rising close to the average value line, it is time to buy a call option. You need to exercise it right when the downfall starts; otherwise, the profit will turn into a loss instantly. On the other hand, if a share is close to its lowest average value line, it is time to buy a put option, as the future rise is on the cards.

#10. Rainbow Pattern Strategy

The rainbow pattern strategy is a popular binary strategy for experienced traders. The use of moving averages is often challenging to understand in the beginning, but as soon as you explore the contents, the average gets simpler. The rainbow strategy consists of three moving average indexes representing different time periods.

Usually, the red line is used to indicate the moving average of 26 weeks, the yellow line is used to indicate the moving average of 14 weeks, and the blue line indicates 6 weeks. The colors may vary depending on your trading platform or selection. Nevertheless, the graph's legend will reveal the color for each moving average-period line.

How to Apply

If we are talking about a graph in a falling fashion, it will usually have the red line on the top of the yellow line and the yellow line above the blue line. The graph's 26-week moving average is higher than the other averages. Hence, there is a high probability that the price will rise in the near future.

Similarly, if the blue line crosses, the other two lines roar above them. It suggests that the share is trading at a price higher than the average; hence, it has a fair chance of coming down. While trading binaries, you must note the moving averages for each underlying asset. If a share has the former situation, it is better to get a call option.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

How to Choose the Best Binary Options Strategy?

After discussing ten different strategies, you would have attained a fair idea of how the strategies are driven. The ultimate goal of each strategy is to minimize losses and maximize profits. The uncertainty involved in Pinocchio and straddle strategy makes them risky for most investors. The yields are generally low for hedging strategy and money flow index, so the investors might not be tempted to use it.

Fundamental analysis and rainbow strategy are solid, and they can get good results over time. However, their over-dependence on technical indicators is quite apparent. After the sorting process, it comes down to trend analysis and market news for new investors. As options are based on underlying assets, the efforts involved in other strategies make them cumbersome. However, studying patterns and news is easy on the mind and can bring good results.

Conclusively, there isn't a successful trading strategy that attracts all investors. You need to understand different strategies and how they work before eventually employing them in your portfolio. A demo account can be useful in interpreting the profitability of a strategy before you invest your hard-earned money into the account. You should also measure your risk appetite and profit requirements to reach better conclusions. Usually, you will have to create a mix between different strategies for the best results.

Best Online Options Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Powerful Services at a Low Cost | securely through Tradezero website |

Web Platforms Read Review | securely through eTrade website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Trading Course

Investing in the Forex market might seem to be a daunting task especially if you are a beginner, and have just started exploring the Forex market. Although experience is said to be the best teacher when dealing in the Forex market, it is good to learn about the Forex market briefly before making your first investment.

There are several ways in which you can start expanding your knowledge of the stock market. You can either start reading books or ask for tips from your friends or family members who have prior experience of trading on the Forex platform. However, the former is a time-consuming method while the latter is not always a credible learning source.

If you want to learn about investing in the Forex market that would help you gain knowledge, and tell you all you need to know about the market, then you can opt for some professional courses available on the internet. These courses are developed by Forex markets experts who have years of training Forex traders.

Now, there are thousands of courses on the internet that claim to teach you about Forex investment. However, not all of these courses are reliable and give accurate information. So which is the best Forex course for learning the ins and out's of the Forex market?

Asia forex mentor course by Ezekiel is by far one of the best Forex learning courses on the internet, and they are one of the best learning sources if you want to expand your Forex trading knowledge.

They have been featured on multiple different leading forex platforms and Forex events happening around the world. Ezekiel's platform is the perfect solution for you to learn because their clients include multiple trainees and bank traders from private trading institutions around the globe.

It is the number one course available on the internet because it also reaches new bank traders and has fun managing if you want to make money from trading forex stocks and other commodities.

You can get a great return on investment by indulging yourself in this systematic course. Even if you are a beginner in the field and do not have enough experience and knowledge about Forex trading, you still join this program with zero knowledge. Everything will be taught to you from scratch, and you can enroll yourself in this program right now to get started.

Check out the testimonials on the website and start your Forex trading journey right away. The good thing about this course is that you will be crystal clear about what you need to do from day one.

They are using a return on investment approach to teaching their students. It is a scientific method of beating the market, and you will not be taught this somewhere else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Best Binary Options Strategies

Binary options are a risky investment. With the win or zero condition, your investments are always at the stake of ending as ‘0'. However, it can't be denied that numerous individuals have found their livelihood in trading binary options, and it has been a game-changer for them. The success in binary trading comes down to your strategy. The goal is to select a trading strategy that works.

The fundamentals of each trading strategy are the same. Their ultimate goal is to help you generate profit and uplift your income. The 10 strategies discussed earlier in the blog were suggested by experienced investors. However, you need to keep on educating yourself about the latest trading styles so you can strive in the business world.

Digital investments aren't as simple as most people like to think. There are tons of complexities involved, and your income is dependent on your mentality. You need to keep on learning from experienced mentors and understand how you can correct yourself to success. Quitting is easy and takes nothing; the real courage is to learn from your mistake and be the best version of yourself.

Best Binary Options Strategies FAQs

Is there a strategy for binary options?

Your success in binary options is dependent upon your trading strategy. With the best binary options strategy, you can turn your fate and make a fortune of it. There are tons of strategies for investors to select, and we have discussed 10 of them earlier in the blog. You can learn them to improve your profitability.

You need to select a trading strategy that is in line with your trading expertise and risk appetite. Some strategies demand additional knowledge about the market, which is rare for new investors. Similarly, some strategies have a high risk and reward, so you must identify if the reward is worth your investment or not.

What is the best indicator for binary options?

The best indicator is subjective for each trader. The money flow index is robust; it is based around two critical components of the asset- volume and price. The understanding and interpretation of the index are easy for novice investors, and the results are reliable too.

Similarly, moving averages are equally trustworthy too, and they rely on a securities value over the long run. The indication by the averages is pretty accurate and can result in healthy gains.

How do you master binary options?

You can excel in binary options by attaining the correct information and practising it in real-time. Good results only follow hard work and dedication. You must keep on learning about different indicators and market analysis. Also, avoid sticking to a single binary options trading strategy. If a strategy isn't working out, change it and move to the next one. However, some strategies are profitable in the long run, so you should only opt-out once you're sure about its inefficacy.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.