Sector Rotation Definition and Strategies – An Expert’s Take 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

The stock market is highly dependent on the ongoing economic cycle and social conditions. If the economy is booming with rising demand, the stock market may reach an all-time high, but if a recession occurs, the same market may go wrong. However, stocks have different relations to market movement as described by their Beta.

A positive beta suggests a positive correlation between the market and the company, while a negative beta means the opposite. Hence, while some industry shares may rise with the market growth, others may see a decline.

For instance, Amazon had a massive surge between March to August 2020; its share price went from $92 on the 20th of March to about $164 on the 21st of August. The examples highlight the significance of investing in the right sectors. The sector's growth tends to change as the economic cycle changes; every industry takes a different impact from ongoing news, and the share prices may react differently.

Therefore, investors need to know when to invest in a particular sector. Are you interested in learning more about it? If yes, the blog has everything you'll need to succeed in sector rotation.

We have Ezekiel Chew with us to share his take on the subject; he is a renowned investment mentor and has helped thousands of newbies turn into full-time traders and make six figures per trade. We shall use his expertise to learn about the best sector rotation strategy and how it works.

What is Sector Rotation

A stock market is based on various aspects of an economy, including investor sentiment, sector profitability, and market conditions. Usually, share prices vary with market news and rumors; positive information about tax leverage is bound to raise the share price for majority stocks, and similarly, an import ban may slow the growth of foreign companies. Nonetheless, some news may impact an industry more than others; hence, the company's share value change would be significant to alarm the investors.

Sector rotation is a self-explanatory term; it refers to various strategies employed by investors to invest in the most profitable sectors. It involves withdrawing investments from loss-making industries and building a portfolio of high-potential sectors.

A financial crisis may be alarming for commodity-based businesses, but it will induce a sentiment amongst people to save; thus, banking and credit institutions will have an increased price. Therefore, intelligent investors may look to withdraw their investments from commodity businesses and invest a greater chunk in the banking business.

Sector rotation can be regarded as a unique strategy used by investors to benefit from short-term trades; usually, swing traders focus on sector rotation, while long-term traders are more interested in the foundations and past performance of the potential company.

How does Sector Rotation work

Every industry has its ups and downs; a company may perform well during an economic cycle but collapse in the next cycle. Investors must be aware of industrial production to perform perfect sector rotation. Sector rotation has been widely used amongst investors to minimize their losses and make high profits. They use market information and technical analysis to determine a company's future performance.

Every sector has a different reaction time; product-based sectors, such as real estate, are highly reactive to market news; therefore, investors need to be quick to step in and out of their trades concerned with the sector.

Traders must keep a close eye on market rumors while dealing with highly reactive sectors. Other sectors are less reactive and may take time to adapt to a change; sometimes, the market may give false signals, and a hasty decision may not bring the best results.

Sector rotation involves rebalancing your portfolio based on market conditions; it allows traders to make the most of market cycles without owing high risks to their investments. Various economic factors determine the performance of a sector. Once investors look to use sector rotation strategies, they must be well aware of the upcoming economic phase and its impact on the potential industry.

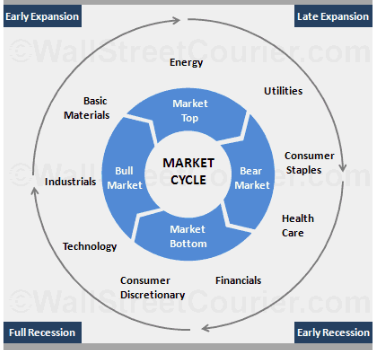

Business Cycle that Triggers Sector Rotation

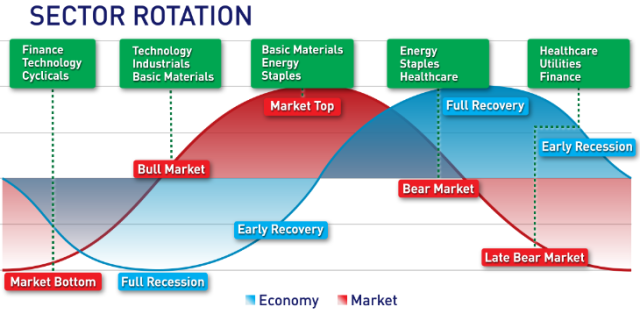

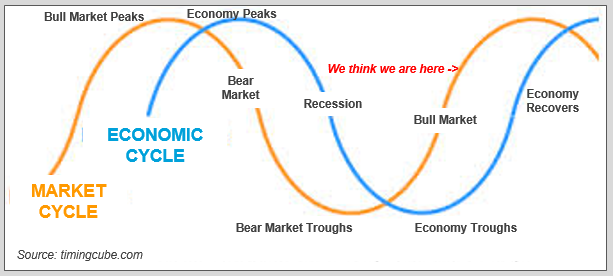

We talked a fair deal about economic cycles in the last section, and it is vital to have a clear understanding of how the economy moves before diving deeper into sector rotation. A stock market has cycles; it goes through the accumulation phase with low investor confidence to the markup phase, distribution, and finally, markdown.

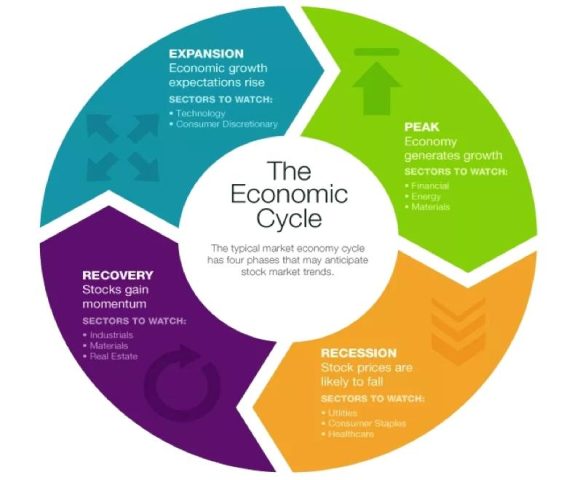

The changes in stock market cycles result from a more significant change caused by economic conditions. Generally, an economy has four phases or cycles- economists use different names to identify the phases, but their traits stay the same.

-

Recovery- early cycle phase

An economy takes time to stabilize itself after a slump; usually, the phase is marked by rising employment and increased industrial investment. The economy finds improving investor confidence, but the general public still awaits the confirmation of improvement and is afraid to step into the business world—the decrease in unemployment results in increased aggregate demand that creates a favorable environment for businesses to produce. However, the cumulative demand is still relatively due to slow economic growth.

-

Growth- mid-cycle phase

Growth is marked by the increase in public investors in an economy; the general public finds improved confidence during the growth phase and is ready to enter the market in the hope of profits. Countries experience high foreign direct investment causing an increase in production, and overall, high employment causes a surge in aggregate demand that leads to inflation. Banks are usually offering low-interest rates in the growth phase that allows expansion for existing firms.

-

Boom- late-cycle phase

During the growth phase, the increased aggregate demand causes inflation. As the interest rates stay low, the demand gets increasingly higher than the supply, resulting in high inflation during the Boom. It provides an inefficient environment for businesses to invest as the higher costs shrink their profits. Also, the central banks are alarmed by high prices and look to increase interest rates to promote savings and shrink aggregate demand.

-

Recession- End cycle phase

The procedures taken to reduce aggregate demand result in an unattractive business environment; FDIs look for a way out, leading to unemployment in the country. High unemployment means businesses have to cut their prices; thus, inflation is controlled, but firms either close down or set their operations elsewhere. The decline in production leads to a reduction in gross domestic product, low available credits, and low investor confidence.

Sector Rotation Strategy

After studying market cycles, you would have realized that specific sectors perform better than others in different phases. A sector rotation strategy focuses on identifying the ongoing market cycle and predicting industries that will perform better in it. Of course, other economic factors may come into play while filtering the perfect sectors.

For instance, as an economy approaches the growth phase, utility and real estate sectors would start bouncing back from the declining share prices, and they present a favorable buy option.

The health care and financial sector would usually stay unchanged, and the investors will prefer holding them for later parts of the cycle. However, the energy and material sectors may take some time to return to their original levels as the GDP is still far from its optimal point.

Despite the market changes, established companies, aka blue chips, are remarkable at countering the market hits, and their values tend to stay consistent over market cycles. A long-term investor can hold on to a blue chip for their horizon, and it may perform significantly better than other stocks. Investors need to focus on blue chips when rotating sectors in a recession or boom.

How can Investors take Advantage of Sectors Rotations in the Stock Market?

Investors enter the market with a single aim- to proliferate their fortune. However, studies show that more than 75% of investors quit their trading journey within three years, and 95% don't even last a year. It is partially due to a lack of information about market tactics used by experienced traders.

Sector rotation is an effective strategy for investors to boost their returns and reduce risk. They can use the strategy to enter profitable trades at the perfect time and avoid missing out on good deals. The market cycle is a slow process, and a phase may last up to 36 months; however, a market may change trends several times during the period. Hence, the first step is to identify market news and analyze the impact it creates.

Market research allows you to identify the current investor sentiment and how the reactionary forces may act. If you can foresee the possible changes in different sectors, the next step is to confirm your analysis with indicators and expert communities. The right mix of expert advice and technical indicators will put you on the right track.

Finally, blue chips should be your preferred choice in a falling market; the shares are comparatively less reactive and will retain their value in the long run. Transaction costs can also impact your profits, so keep an eye on them while fixing trades.

The Importance of Sector Rotation Strategies

Sector rotation strategy sounds simple, but it can be challenging to practicalize in real-time. It is mainly due to mixed indications that confuse the investor about possible market movements, and they may end up making the wrong decision. The primary test of a trader occurs during a recession or falling market- during the other three phases, the market would rise as a whole, and most investments would bring positive returns.

However, in a recession, it's challenging to keep the present value of your portfolio, let alone increase it. Investors look to enter non-cyclical stocks, such as health care, utilities, and staples; these stocks hold their value over the long run, and changes in the economic cycle don't significantly impact them.

Investors usually benefit by entering a sector during the accumulation phase and exiting the trade during the markup or distribution phase. The information can be obtained by using market data about share price actions; the growth stocks can come in handy to boost your profits with minimal risks.

Best Stock and Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You'll be able to trade forex profitably with a skilled trader's help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew's teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It's not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines' second-largest state-owned corporation.

Due to his strategy's effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Sector Rotation

The surge in online investors has seen rapid growth in the stock markets; however, the new entrants fail to realize their dream returns and have to quit the market with empty hands. The right information about the market is essential to succeed in it.

Sector rotation involves reinvesting your capital into different sectors to prevent additional risks and make profits. Economic cycles trigger sector rotations and provide multiple opportunities for investors to make profits.

Traders must be well aware of growth stocks and market phases to maximize their returns. They should analyze market data and indicators to drive critical changes impacting different sectors.

Sector Rotation FAQs

How long does sector rotation take?

Changes in economic cycles trigger sector rotation; a recession or boom may last for about 2-3 years, and growth/recovery lasts about twice the time. Thus, you can focus on particular sectors during a phase and change them as the market cycle changes.

Does Sector Rotation beat the Market?

The sector rotation strategy focuses on bringing the most profitable stocks forward while eliminating the loss-making stocks. If done right, the strategy will always beat the market and can produce excellent results with minimal risks.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.