Opening Range Breakout Strategy: In-Depth Explanation Of An Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best stock brokers for traders are Tradestation and Tradier

The #1 Stock and Forex Trading Course is Asia Forex Mentor

Many traders have questioned the opening range breakout strategy's viability and how to profit from it. We've got Ezekiel Chew, a well-known authority in the financial industry, to share his take on the Opening Range Breakout Strategy.

As its name suggests, the opening range refers to the period immediately following the market's opening. Trading requires choosing a timeframe that best fits the trader's profile, and the opening timeframe is a common choice. The first 15 minutes to 1 hour after the market opens for trade are referred to as the opening time frame.

We will discuss the topic in this post, which will aid traders in developing a better grasp of ORB trading strategies.

What is the Opening Range Breakout Strategy

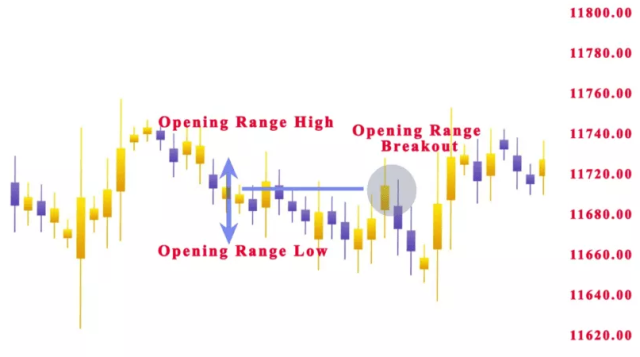

Time and pricing are the two elements that make up The Opening Range Breakout Strategy. The time component is the distance measured from the start of the current trading day and, while there are rare exceptions, is typically the first 30 minutes of trading activity.

On the other hand, the highest and lowest prices recorded throughout the Opening Range are considered to be the pricing component of the Opening range.

There is a lot of trading activity and volatility during the market's first hour. There are lots of trading chances at this point in the trading session. In this manner, traders employ the opening range to establish entry targets and anticipate and forecast the day's price movement.

Example: The first candle in the 5-minute time period and standard trading hour contains the following features:

High: $121 = opening range high

Close: $120 = opening range close

Open: $110 = opening range open

Low: $109 = opening range low

How to Use Opening Range Breakout Strategy

By identifying essential price points at which you can anticipate a market reaction, the opening range breakout strategy provides a road map for many trading strategies.

However, the fundamental premise of your trading strategy should be simple and intuitive. Measuring the opening range should be your first step before making any trades. You must see two candlesticks forming when the market first opens to gauge the size of the range.

The first candle is the final one from yesterday's trading range, and the second is the first one made when the market opened.

Take the high or low of yesterday's final candle and the high or low of today's first candle to get the range size. The magnitude of the opening range is what separates this two pricing.

Selecting the Time Frame

The time frame must be selected carefully to trade the opening range breakout effectively.

It's completely acceptable if every trader has a different preferred time frame. The time limit could be anything from seconds to months, depending on the type of trader you are or how much information you want to review. The chart gets more detailed with a shorter time frame.

However, the most widely used time frames, especially for day trading, are 15 and 30 minutes because they are the most efficient.

The fundamental idea behind the Opening Range strategy is the same regardless of time frame, though some day traders also choose to stick with 10-minute or 5-minute charts, which is relatively reasonable.

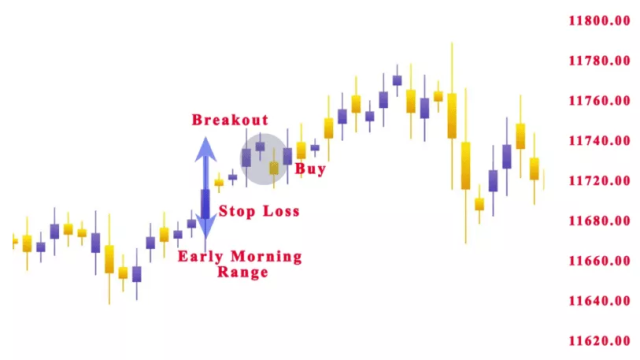

Early Morning Range Breakout

With the help of the early morning range breakout signal, traders can profit from the frantic buy and sell orders that occur when the market opens.

The early morning range breakout emphasizes the width of the gap as well as the high/low of the breakout.

When identifying the gaps' borders with this method, we must trade in the direction of the breakout. Later in the day, breakouts should be handled carefully. A stop-loss order should always be used, while the midpoint of the gap should serve as the stop loss.

Position Sizing

Trading the beginning range breakout does not make sense when trading a fixed number of shares or a specific dollar amount. Instead, you must alter the position's size following the reference candle's range.

Calculating position size using the high and low as a guide: Number of shares = $Risk / (Opening Range High – Opening Range Low).

When day trading stocks, the size of your position or trade, is more significant than your entry and exit. The best strategy in the world won't make up for a wrong transaction size; you'll either assume too much or too little risk. More worry is an excessive risk than low risk, as extreme risk can quickly deplete a trading account.

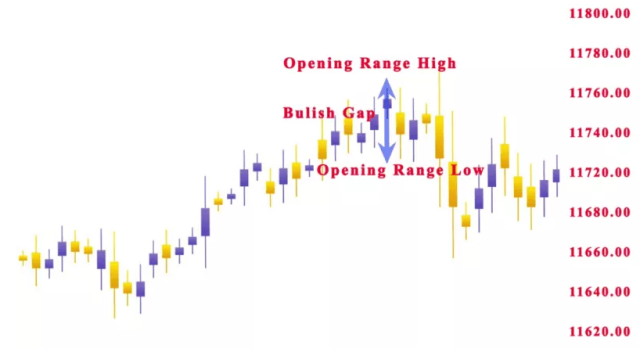

Chart Pattern Gap Pullback Buy

Each trader understands how the market moves and the trading strategy with which such movement should be traded. As we previously mentioned, although some traders would buy the breakout as soon as it happens, others will sell it after a new swing high is made.

When traders spot a bullish gap on the chart, the price immediately begins heading in the opposite direction of the gap.

Best Markets to Trade Opening Range

What are the best trading opportunities for the opening range breakthrough? As we hinted, the one prerequisite we like to see for opening range breakout methods is that a market has a clear opening and closing time. Thanks to computerized trading, several markets operate on weekdays for approximately 24 hours straight. Applying opening range techniques may become more challenging as a result.

It's crucial to realize that while some markets may trade continuously, the volume transacted during overnight sessions is typically relatively low. As a result, this nighttime activity accounts for only a tiny portion of the trading during the regular session. As a result, trading using the opening range technique would still be possible with these kinds of securities.

The US stock market and a few futures markets are a few markets that make strong candidates for opening range breakout tactics. When there is a catalyst event, like an earnings release or an FDA statement, before the opening bell, individual stocks perform well with opening range strategies. Opening range methods are also a strong fit for some futures markets, including futures markets for financial instruments, commodities, and stock indexes.

Best Stock and Forex Trading Course

Ezekiel Chew has been a professional Forex trader and mentor in the financial markets since 2005. He is the founder and CEO of Asia Forex Mentor, a company that provides Forex trading education and mentorship to individuals around the globe.

Ezekiel is known for his unique and highly effective Forex trading methods, which are backed by mathematical probability. He has helped thousands of students worldwide achieve financial freedom through Forex trading. His core program, “AFM PROPRIETARY ONE CORE PROGRAM,” is a complete program that covers everything from beginner to advanced and has been used by banks and trading institutions worldwide.

So, if you are looking forward to learning from one of the best in the business, Ezekiel Chew’s Asia Forex Mentor program is worth checking out. Sign-up for his course now to kick start your forex trading career.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Opening Range Breakout Strategy

Investors use their opening range breakout calculator to check the high and low from the previous day and begin practicing the opening range breakout strategy when the opening bell signals that the market is open.

The market's hours of operation are crucial. It frequently provides clear cues about the trading pattern for the day. Such signals are sought after by intraday traders who plan their trading strategies. An opening range breakout provides a precise entry point and aids in developing a robust trading plan.

By subtracting the high and low of the closing candle from yesterday's trading session from the high and low of the beginning candle of the current trading day, traders may determine the size of the range. The breakouts function better on stocks in play with a larger volume for that time frame, for 5 minutes or 30 minutes.

Opening Range Breakout Strategy FAQs

How do you determine an opening range?

Traders must consider the distance between the high and low of the completed candle from the previous trading session and the high and low of the beginning candle from the current trading session to calculate the opening range's size.

The price movement during the first hour of trade is referred to as the opening range. By comparing the high or low from the previous day to the high or low from the trading day, one may quickly determine the range. The gap between the two candles forms the opening range size.

What is initial range?

The initial range is a well-known technique for identifying critical support and resistance levels. When a security trades between a set of high and low prices for an extended period, supposedly, it is within a trading range.

Day traders pay attention to a stock's opening range since it can reveal information about the day's price trajectory and the market mood.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.