Momentum Trading – A Complete Expert’s Guide 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

Momentum trading is all about taking advantage of stocks on the move. It is a driving force behind the different stock price trends that keep an asset moving in a particular direction. Some investors and traders do not consider momentum to be an investing method. However, it is more of an automatic response owing to market volatility.

If you are a trader, you may understand buying winning stocks and selling the losing ones. The goal is to make money from the stocks that are going up in price and lose less money from the stocks that are going down. Also, most traders believe that “the trend is your friend,” and that is the main concept of momentum trading.

The basic idea behind momentum trading attempts is to buy stocks that are rising in price and short sell stocks that are falling. To better understand its concept, we have got Ezekiel Chew to share his momentum day trading strategies and knowledge. Ezekiel is the founder and CEO of Asia Forex Mentor, a leading forex education company. He is also a professional forex trader with over a decade of experience in the financial markets.

In this guide, we will discuss momentum trading, how to benefit from this strategy, momentum indicators, and much more. So without further ado, let's get started.

What is Momentum Trading

In a nutshell, momentum trading is about taking advantage of stocks on the move. Momentum investors seek to capture the fast profits generated by large price movements.

Momentum stocks have larger price fluctuations and massive volume, often resulting in big gains with equally rapid losses. The high-risk/high-reward nature of momentum trading attracts investors, but it can also lead to a trail of broken accounts. Fear of missing out (FOMO) and panic are common motivators for these firms, both up and down.

Remember that some stocks are inherently momentum driven while others are not. A company like Tesla or Netflix will have a lot of price momentum because investors believe in the company's long-term vision. A rising double to triple digits percentage on relative volume spikes in the 10X or higher range may transform ordinary equities into momentum stocks, which rise by double to triple digits percentages.

How can you Profit from Momentum Trading?

After excellent news regarding profits in a previous quarter or a short squeeze that can last several days, a stock may rise for many days. This is because traders believe that trends tend to build on themselves, which makes investors confident in riding a wave that might continue for some time. When the forecast is fulfilled, investors can make profits.

Brokerages typically search for good earnings reports and news that suggest it's the ideal moment to begin momentum trading. It's beneficial to start buying early in a market trend when the price is still low and keep in mind that the goal is to buy low and then sell high later on for a profit.

To gain maximum profits, you can use a system trading method for Momentum trading.

System trading is a method for automating your trading according to predetermined rules. This means you will not need to make any decisions when trading. Instead, all you need to do is follow the rules that you have set for yourself.

The advantages of system trading are that it takes out the emotions from trading, is disciplined, and is consistent.

Momentum Day Trading Strategy Explained

For a day trader, momentum investing is everything. They must use different technical indicators to know when to enter and exit the market. Of course, stocks are moving daily, but how can a trader find those stocks before they make a big move?

The simple answer is that the stocks are making 20 to 30% moves and share a few common technical indicators. And that's what is required for momentum trades. On the other hand, trading for a moving stock is preferable to investing in assets that are simply maintaining their present positions.

The majority of investors use stock scanners to find stocks on the move, and there is an unofficial guideline that you should concentrate on the most extreme cases since they are unusual and not a result of a false signal that might begin a stock's rise only to have it fall a few days later.

There are a few elements that you can use to determine the best prospect for momentum trading. First, the strong daily charts indicate the moving averages and resistance stocks. The peak volume is roughly double the usual.

Momentum is generated by a fundamental factor such as earnings reports, government announcements, or breaking news. These factors are not required for momentum; a stock may rise without them, termed a technical breakout.

Traders using Momentum Indicator

In volatile markets, where there is a continual flow of traders, momentum methods are most beneficial. Below are the few key factors that can help you determine if the momentum of a stock is going to develop or not.

#1. Volume

The first thing to look for is the volume. Volume is a quantity of given stock traded at a specific time. The volume, not the amount, indicates the number of assets traded. For example, eight customers buy one stock. Each looks the same as if one trader purchases eight individual securities.

For momentum traders, volume is crucial as it helps them enter or exit positions quickly. It also depends on the buyer's and sellers' flow in the market. If a market is jam-packed with traders on both sides, it's a liquid market where you may exchange an asset for cash with ease. However, if there are fewer buyers and sellers than normal, the market is said to be illiquid.

#2. Time Frame

Momentum trading strategies are based on the short-term time frame. The strategies are designed to take advantage of the price changes that happen in days or weeks. However, the time spent on trade depends on how long it takes for the target price to be hit.

Day traders must be focused and always looking for new momentum plays. Therefore, they use different technical indicators to know when to enter and exit the market. On the other hand, swing traders take a more relaxed approach as they don't need to monitor the market all day long. Instead, they focus more on catching the bigger price swings over days or weeks.

#3. Volatility

Another key parameter momentum traders use is volatility which measures the change in the stock price. An extremely volatile market indicates large price fluctuations, while a market with little volatility is more steady.

Momentum traders seek out volatile markets to profit from short-term increases and declines in the value of a commodity. Therefore, to protect transactions from unpredictable market conditions, it's critical to have a solid risk management plan in place. Stops and limits are the best approaches to do this.

Momentum Trading Strategy Explained

Investors use fundamental analysis in both development and value stocks to make an analysis. In addition, fundamental analysis is utilized by investors attempting to profit from the trends in a few instances.

Day traders looking for momentum stocks often use special criteria to identify possibilities, such as focusing on small firms, having uncommonly high volatility, and having a lot of volumes. Chart patterns are also utilized with technical analysis to get a sense of the momentum.

Traders favor the popular idea that an asset's price reaching a new peak indicates that it will rise even higher. Finding momentum equities is filtering stocks trading within 5% of their highs.

Best Time to Trade

The momentum trading strategies are most beneficial in volatile markets with a continual flow of traders. The best time to trade is when the market is most active, and it is the morning time when the market is opening.

You should be active between the time frame of 9:30 am to 11:30 am. However, it doesn't mean you can relax afterward; you still need to keep an eye on the market as news can break at any time and influence the market.

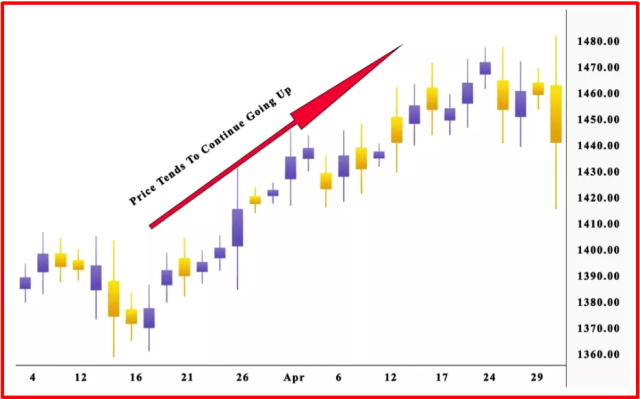

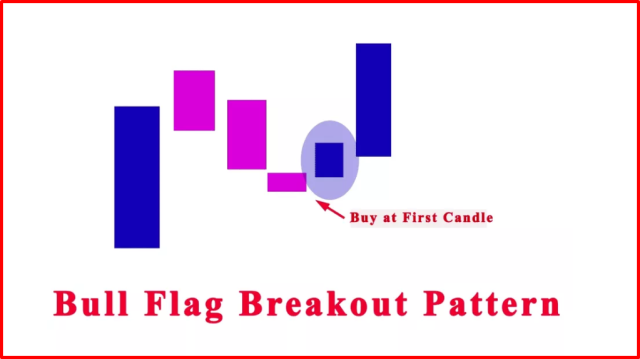

Stocks that looked dull at the start of the day might be a fantastic trade opportunity on the first pullback. The typical bull flag is formed on the initial pullback.

Momentum Trading Risks

When a trend is moving, momentum is expecting it to continue on its path. The problem with this thinking is that no assurance is given that the movement will continue in the same direction. Market trends reverse daily, momentum has an expiration date, and the challenge is to predict when momentum will lose steam, and the price will fall in value.

The ideal momentum trade is to buy an asset gaining momentum and sell it at its peak. It's theoretically simple, but it isn't easy in practice. The difference between success and failure hinges on investment timing.

Seconds can make a difference in a stock's success. Stocks may establish a trend that continues for months, but jumping on board after it has gained momentum is not a wise plan; you get on the train at the station, not when it's en route.

The main danger with momentum trading is that it may be done in both directions. For example, brokers who have acquired the assets might reverse their position and sell it, setting off a wave of other desperate sellers attempting to sell off the stock, resulting in declining trends and lower prices.

It's a challenging business to work with stocks. Momentum trading may be rewarding but can also result in serious losses.

Best Stocks and Forex Trading Course

Ezekiel Chew is a professional forex trader and trainer. He is the founder of Asia Forex Mentor, one of the largest forex education companies in the world. He has 2 decades of experience in the forex market and is respected for his knowledge and expertise.

Ezekiel's core program, ‘AFM PROPRIETARY ONE CORE PROGRAM,' is the Complete Program, which covers everything from beginner to advanced. The program is designed to give you the best possible chance of success in the forex industry. It is backed by mathematical probability and has been used by banks and trading institutions for years.

Ezekiel is a highly credible figure in the forex industry. So, if you are trying to make money in forex trading, you should check out his program to start your forex career.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Momentum Trading

Momentum trading is a high-risk, high-reward strategy that can be difficult to master. Like any strategy, it has its pros and cons. Conversely, momentum traders can lead to quick and profitable trades. On the downside, it can be difficult to predict when momentum will change, leading to losses.

However, this strategy is not recommended for beginner traders, but if implemented correctly, it can lead to success. Being a successful momentum trader takes a lot of focus and discipline. Before implementing this strategy, ensure you are comfortable with the risks and have the necessary experience.

Momentum Trading FAQs

Is Momentum Trading profitable?

Yes, a momentum strategy can be profitable if you know how to identify the right stocks and get in at the right time.

Why is momentum trading important?

Momentum trading is important because it allows investors to profit from trends in the market. Also, trading is based on anticipating the market's direction and momentum signals, indicating that a stock will continue in one direction for an extended period.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.