All You Need to Know About the January Effect – Explained by an Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

Investors make decisions based on factual information. Of course, there are so many claims from every corner of stakeholders. To be on the safe side, it’s always critical to put money into an investment after verifying things.

In light of the above is the January Effect. You may have come across it or not in the past. Yet, it's a hot topic that elicits different views or explanations.

The main purpose of this post is to help investors emerge with clear information about the January effect. And to achieve that, our best shot is inviting a seasoned expert to walk us through the entire post.

Ezekiel Chew, an analyst, mentor, and trader from Asia Forex Mentor, will guide us. He has over twenty years of experience trading in the financial markets.

The post will review the key drivers of stock prices concerning the January effect. You’ll see how investors react to losses and taxation in light of re-invest opportunities. Plus, what new resolutions do they make?

What is the January Effect on the Stock Market?

The January effect refers to a periodic rally of stock prices. Investors have observed this peculiar occurrence for many years. And the perceived bullish rally only offers reliable opportunities within January.

In reality, the increase in prices as a result of the January effect arises in the aftermath of a spell of heavy selling of stocks towards the end of the year- in December, to be precise.

And as part of re-affirming the perception with economies, both stock traders and investors have the drive to upscale investment decisions annually – and they implement the decisions at the onset of every new year- January.

If we approach the January effect from the point of view of an economist, prices are low in December. Low prices come about from low demand for the stocks. So, the holders release them at low values.

Plus, the plummeting value of portfolios sparks sellers to sell them off and take advantage of the tax cushion for the losses they make – selling at low prices and losses.

Following the price dip, investors resume buying in huge volumes in January. Talking advantage of the low prices. Demand stirs up, driving prices up.

Over many years, investors seem to forget about the peculiar occurrence. Instead, they concentrate on taking up the opportunities where stock prices tend to rise in January.

January effect key Drivers and Stock Market Prices

One significant driver of the January effect arises from investors' approach to tax planning. They lower the amounts of tax payable by selling out the stocks at low prices before the close of December.

The tax planning works out for the investors to make tax deductions – ideally, no tax obligations for losses made from investments. And, of course, they can preserve the capital and begin investing as a new year's resolution.

The other powerful trigger of the January effect arises from the end-of-year bonuses of employees. Come the new year; they inject the cash into buying low-value stocks. And, with the increasing demand, prices rally higher in January.

There’s a section of analysts who believe the January effect arises from investor psychology. Being human, they want to start a year with a bang of positives – So they purchase stocks and hold them through the year.

However, come December, they do away with the low-value stocks- hold the capital and seek new avenues to invest over the coming year. So, it’s a cyclical occurrence – and there’s no valid reason to hold low-value stocks as part of prudent financial planning.

How does January Effect take place in Tax Loss Harvesting?

After the observations of the seasonal performances across many years, there’s a link between The January Effect and the taxation cycles.

Earlier, we pointed out the occurrence is more persistent within inefficient markets with small caps. And one theory points out the investor psychology cycle of a wise financial planner in light of the opportunities at hand.

Investors, by December, have had adequate time to analyze and spot winners over losers. So, other than selling stocks with high prices to get capital gains, they also sell off low performers to grab the opportunity for tax deductions.

So the link with Tax loss harvesting arises as investors try to push for wins with both profits and losses. And the cycle of investments picks up again in January.

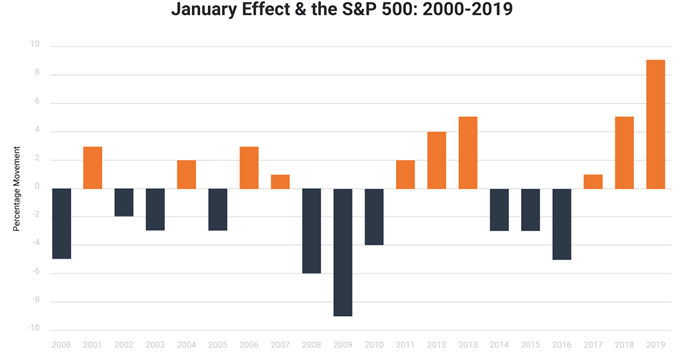

Agreeably, it’s become less prominent over recent years. But some analysts show that from 1938, records indicate that 29 out of 30 years – the S&P 500 scores gains of an average of 20% within the month of January

Some scholars list the January effect as one market anomaly that goes against the Theory of efficient market hypothesis. Plus, some also add any market surges or downturns with a linkage to perceptions of calendar effects.

Other than the above, no analyst can present factual information as to why the January effect must happen. More so, the timing or predicting of the day when the markets start the perceived rally.

Preparations for the January Effect on Purchase Stocks

As you can see, the January effect is a form of hypothesis without clear or precise timelines. So, how can investors prepare to take up the opportunities?

One way is to ensure they hold some small-cap stocks in your portfolio. This should work within the rules of maintaining an optimized portfolio.

Ideally, an optimal portfolio will ensure that the price effects are well spread to avoid missing out on the opportunity versus risking it all on a perception that may not work out.

Therefore, the best bet is to watch the escalations from a safe distance, grab the gains you can and reallocate your assets in the portfolio accordingly. The overarching point here is risk minimization first and taking some gains second.

The other way to prepare for the January effects is almost forgotten. This is not something you can time or bank on. Timing it can lure you into lowering your guard's potential risks.

So, the idea is never to disrupt your optimal portfolio for a perception. After all, it may never happen – as it did in January 2021.

Why does January Effect transpire?

Scholars have floated hypotheses on why investors think the January effect occurs. In reality, it must not happen. No one has the time and reason for or against it.

However, some stock analysts agree – tax-loss harvesting occurs due to January effects. And ideally, they sell out some positions out of lack of liquidity and low stock performance. In the end, they can reduce the tax burdens by taking advantage of the more realistic or predictable tax calendars.

With the above said, there's also another theory from Income tax circles. Many investors hold on to small stocks from small-cap firms. The key takeaways are to sell stocks in the month of December to enable them to claim tax deductions on losses made in investments.

Arising from the above, investors purchase investments in the month of January. The long-term effect of the cycle is that stocks from small-cap companies keep increasing in value over time.

Lastly, the other plausible reason why the January effect transpires arises from two circles. One is staff investing year-end cash bonuses in stocks. And the second is the effect of contributions of employee pensions or the 401K plans towards every year-end.

Best Stock and Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You'll be able to trade forex profitably with a skilled trader's help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew's teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It's not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines' second-largest state-owned corporation.

Due to his strategy's effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: January Effect

It’s a hypothesis. January effect takes place or not.

Investors should carry on investing safely – with minimal risks. Meaning more emphasis on the protection of the value of an investment than the rush for gains or profits.

Lastly, it's reasonable to hold small-cap stocks in an optimal portfolio. From it, you can grab some gains from the January effect safely.

January Effect FAQs

Why does the January Effect occur?

The January effect arises from several hypotheses. One is individual investors selling in December to claim tax deductions on losing investments. And re-investing in stock markets come the month of January.

How do you take advantage of the January Effect?

The best way to gain from the January effect is to allow small portions of small-cap stocks within an optimal portfolio.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.