Chase Bank Reviews: Is Chase a Good Bank?

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

It’s no secret that most large national banks offer terrible interest rates and charge ridiculous fees. People go to these banks with the expectation of having a great return from interest rates but end up with dissatisfaction.

There are several banks that can leverage with their services regarding loans, credit cards, saving accounts and can compete with the large national and multinational banks. Among such, Chase bank comes on top with its features and available services for account holders.

Chase bank itself provides generous bonuses for new customers and has been now the option of consolidating loans, your credit cards, and deposits in one place. With a wide range of branches and ATMs, it has covered all types of people.

However, is Chase bank really beneficial for all people and how much does it cost? Let’s look into it with its pros and cons and available features through the Chase Bank review.

Chase Bank Reviews: Topic Overview

Understanding how bank accounts work can be overwhelming at first glance but we're here to help break it down so that anyone can understand it!

Check out our comprehensive review of Chase Bank's services below:

- What are the benefits?

- How does it compare against other banks?

- What are the Pros and Cons?

- Who is Chase best for?

Everything you need to know about Chase Bank in one place. We've got the details for you.

What is JP Morgan Chase?

JP Morgan Chase is the outcome of the union of many large US banking companies such as J.P. Morgan & Co., Chase Manhattan Bank, Bank One, Washington Mutual, and Bear Stearns.

JP Morgan Chase, in its present structure, is a multinational investment bank and the company providing financial services headquartered in New York City. As of June 2021, JPMorgan Chase is the largest bank in the US and the world's largest bank by market capitalization.

Chase Bank has also been ranked as the fifth-largest worldwide in terms of consolidated assets, controlling for US$3.684 trillion. Today, it has expanded its territory having 100+ global markets, and holding over 250,000 employees.

Chase Bank has 5,100 physical bank locations across the US and has been proving services in 33 states and over 16000 ATMs. The bank locations in New York, California, Illinois, Texas, and Florida are easily available with complete services.

The bank has a wide range of financial services for people such as personal checking and savings accounts, credit cards auto loans, business and commercial banking, home loans, investment management, prepaid cards and CDs, home equity services. If the bank isn't available in your nearby location, you can create an account online from anywhere in the US.

How do Chase Checking Account and Savings Accounts work?

Chase Bank provides an extensive list of accounts and services so that customers can have multiple checking and savings accounts, credit cards, certificates of deposit (CDs), and other lending products according to their needs. Customers who have access to multiple Chase products can also enjoy better pricing from the bank and can combine balances to waive fees.

Chase Bank has several checking account options and each account adopts monthly maintenance fees until the account owners meet the measures to waive them. Chase Total Checking account, Chase Premier Plus Checking account, and Chase Sapphire Checking are the most popular checking account.

Let's see the multiple checking accounts available in the Chase Bank.

Chase Checking Accounts

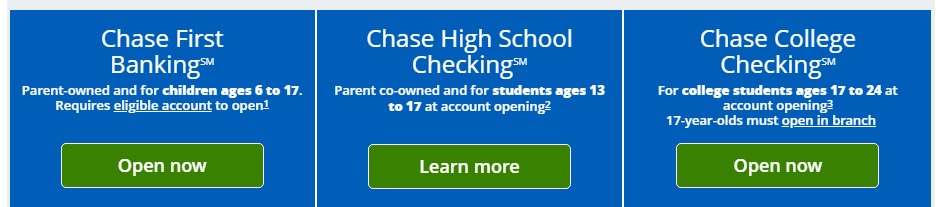

These three checking accounts are designed for everyone focusing on the common financial need for people so all age groups can open these accounts.

- Chase Total Checking account –Customers can deposit $500 or more every month. They can start at least $1,500 as a daily beginning balance or can operate at least $5,000 in eligible linked accounts

- Chase Secured Checking account– With the available services, the bank adds a mandatory monthly fee. This account will be best for a basic checking account with overdraft protection.

- Chase Premier Plus Checking account– In this account, customers can have an average of at least $15,000 as the initial daily balance in the linked accounts.

The main purpose of these three bank accounts is to help parents teach kids and teens how to control money.

- Chase First Banking account- This is a basic parent-owned account for kids 6 years and older. It doesn't charge any monthly fee.

- Chase High School Checking account– Ideal for teenagers.

- Chase College Checking account- This account doesn't charge any fees for 5 years during their college years. Students can deposit every month and can maintain an average of at least $5,000 as an ending day balance. It is ideal for college students who are aged 17 to 24 years old.

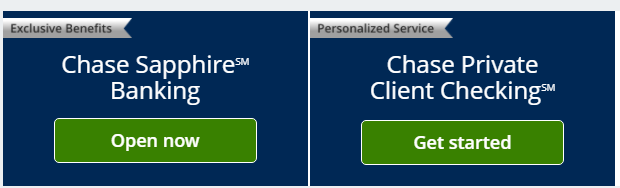

- Chase Sapphire Checking account– Customers can have an average of at least $75,000 as a beginning day balance in the linked accounts.

- Chase Private Client Checking account– It requires nothing to waive monthly fees as it is available only to the members of Chase Private Client.

After the checking accounts, Chase Bank also provides two saving accounts for customers. They are the Chase Savings account which includes one interest rate for all balances, and the Chase Premier Savings account that offers higher establishing rates for clients who deposit larger balances.

Those who have a Chase Private Client account can have access to the Chase Private Client Saving account that offers multiple interest rates on the basis of how much amount or balance is in your account. Let's look into the saving accounts available with Chase Bank.

Chase Savings Accounts

- Chase Savings – In this saving account, the customers can deposit at least $300 at the initial daily balance. The bank also provides a monthly autosave balance of at least $25 from a Chase checking account and customers can link this savings account to their Chase College Checking. This will be for the purpose of overdraft protection.

- Chase Premier Savings – Account holders can deposit at least $15,000 at the initial daily balance or they can link this account to a Chase Premier Plus and Sapphire checking account separately.

What are the Features of Chase Banking?

Chase Bank offers a pack of features that differentiate it from other banks so let's consider some of the considering features to decide whether this bank fits your need.

Higher signup bonus

Chase Bank offers a generous amount of bonuses to those who create the account for the first time in Chase. On October 30, 2021, Chase is offering up to $500 for new Chase checking and Chase Saving customers.

New Chase Checking Customers can also get $225 cashback if they create a Chase Total Checking account and make direct deposit transactions with the gifted checking bonus.

New Chase Savings account holders can also get $200 cashback as the bank is offering the savings offer. To be eligible for this cashback facility, you need to deposit $15,000 or more amount within 20 business days since the account opened and need to maintain an average $15,000 balance for 90 days.

Easy to use Chase mobile app and website

These days, digital presence is a need to transact for daily and business purposes, however, all banking app and website doesn’t run smoothly.

Unlike others, Chase mobile app and website are quick and intuitive to navigate and they offer all the features you can expect from the digital bank. It helps those customers who don’t have time to visit physical bank locations and for those who are away from the physical bank offices.

Avoidable monthly fee

Chase Bank has made it easy for people who don’t make much money or still depend on others in avoiding the monthly fee. Kids or high school students can skip monthly fees in their checking accounts. In Chase College Checking account, the bank facilitates college students receiving direct deposits each month, with no pay amount specified.

Account tiers

Chase Bank offers multiple checking account options that allow you to choose the one that best fits your need and your lifestyle. This helps space and time to grow with Chase over time and upgrade your accounts to premium ones that might cover your future needs without creating the other bank accounts.

How much does Chase Cost?

Chase Bank offers free checking and saving accounts if the account holders are kids and college students. While other national banks try to increase the monthly fee, Chase opens several ways to waive or skip the monthly service fees for daily or premium checking accounts.

Chase Checking Accounts

| Chase Checking Accounts | Monthly Fees | Waiver Criteria | Minimum Deposit Amount |

|---|---|---|---|

| Chase Total Checking | $12 | Electronic deposits of at least $500, or maintain a $1,500 balance at the start of each day, or a combined daily balance of at least $5,000 across your other Chase bank accounts. | $0 |

| Chase Secure Banking | $4.95 | N/A | $0 |

| Chase Premier Plus Checking | $25 | Average balance of $15,000 across your other Chase bank accounts, or having a Chase mortgage with automatic payments set up. | $0 |

| Chase Sapphire Checking | $25 | Need to have an average balance of $75,000 across your other Chase bank accounts. | $0 |

| Chase College Checking | $6 | No monthly fee for your first five years in college. | $0 |

| Chase High School Checking | $0 | N/A | $0 |

Chase savings accounts

| Chase Savings Accounts | Monthly Fees | Waiver Criteria | Minimum Deposit Amount |

|---|---|---|---|

| Chase Savings | $5 | Maintain a $300 or more balance at the beginning of each day, or have automatic monthly transferred $25 or more into this account from a Chase checking account, or if a Chase College Checking account has been linked to this account as overdraft protection, or if an account owner is below 18. | $25 |

| Chase Premier Savings | $25 | Need to maintain $15,000 or more daily, or Chase Premier Plus Checking or Chase Sapphire Checking account has been linked to this account. | $100 |

Who is Chase Best For?

Chase Bank is ideal for account holders who want a variety of deposit methods, investment options and lending options. The bank is also the best for those who can maintain the minimum daily balance or complete qualifying activities to waive fees.

Thanks to the rewards or cashback features of Chase Bank, people can add their balance for their credit card purchases. Chase also helps grow you with it over time and adds several valuable features if the relationship gets strengthened.

Chase can be the perfect option for those who are listed below.

Residents from New York, California, Florida, and Illinois

Though Chase Bank has extended its territory throughout the world, it best fits people in the US. It can make it easier for people who belong to a brick-and-mortar location.

Existing Chase customers

Incentives are the additional benefit for account holders and Chase has provided the same. The bank allows the mortgage customers to create a Chase Premier Checking account if they're enrolled in AutoPay with no monthly fee.

Students

As Chase Bank has leveraged while opening current and saving accounts with no monthly fee, students can take much out of it. Students don't need to worry about being charged service fees to keep their money secured.

Chase Pros and Cons

Though Chase has provided several banking services and leveraged people with lower income, it has also some pros and cons. Let's know about them.

| ✅ PROS |

|---|

▶ Large territory to serve the banking needs. Chase covers almost 4,900 retail branch locations throughout the US and 16 Chase Bank ATMs. If the branch location or ATM is unavailable in a certain area, people can make transactions through a mobile app or website. Chase has offered several ways for customers to waive a monthly fee. So customers can skip their monthly fees by direct deposit, maintaining a minimum balance, or linking some eligible Chase accounts, depending on your chase bank account. The Chase bank provides 30 credit cards; 24 for individuals and 6 for small businesses. It also offers a wide range of credit card options, depending on the customers’ purposes including cash back, balance transfer, or travel rewards. |

| 🚫 CONS |

|---|

✖ Unavailable Chase branch in some parts of the US Still, Chase hasn’t covered the US completely. Some states in the US lack Chase branch offices, including Arkansas, Maine, Iowa, and Mississippi. Chase offers one option to waive monthly fees by maintaining a minimum daily balance but balance is not so easy. If your minimum daily balance falls, the bank will charge the monthly fee. Chase makes it difficult for Chase credit cards approval through this unwritten rule. If the customers have taken more than 5 new credit cards from any other bank in the past year, Chase will disapprove them if they apply for a credit card in the Chase. |

Chase Compare to other Banks

| Bank | Minimum Deposit | Monthly Fee | Savings APY | Overdraft | Number of Branches |

|---|---|---|---|---|---|

| Chase Bank | $0 | $12 | 0.01% | $34 | 5,100 branches |

| CitiBank | $0 | $25 | 0.04%-0.15% | $34 | over 2,649 branches worldwide |

| Bank of America | $100 | $0-$12 | 0.01% - 0.02% | $35 | 4,300 worldwide |

| Chime | $0 | $0 | 0.50% | $34 | N/A |

Chase vs. CitiBank

Though both Chase and CitiBank are top competitors to each other, Chase blows CitiBank out of water in terms of number physical presence. Chase has 5100 branches in 33 states of the US while CitiBank is reserved at 700 branches.

Chase also also allows customers to waive the monthly fee and if they need to pay the monthly fees in their saving accounts, it is less compared to CitiBank. There is no limit to making deposits in the Chase Bank for any customer unlike CitiBank

Chase vs. Bank of America

Chase allows new customers to open an account without an initial deposit, while they need to have a minimum balance of $100 to create an account in the Bank of America (BoA). Also, BoA has limited a monthly deposit whereas Chase has kept it limitless.

Customers can largely access the Chase branch in many countries, making a visit to 5100 branches while BoA has fewer branches. Chase also offers signup bonuses which is unavailable in BoA.

Chase vs. Chime

Chase and Chime both have joined online banking, making transactions digital but Chase has more to offer. Chase offers a total of 30 credit cards for both individuals and business owners.

Besides, online presence, Chase has a wide network of 5,100 branches and over 16,000 ATMs while Chime lacks a physical presence and Chime's customers need to use ATMs from other banks.

Find out more About Chime Banking Reviews: Is Chime a Good Bank?

Conclusion: Is Chase a Good Bank?

Chase Bank provides a wide range of banking services or products that meet the customer's needs. With its welcome bonus, it is a great bank for new customers, kids and students can also leverage the personal banking services from Chase.

Also, low-income earners can waive monthly fees if they can meet the required criteria. Unlike other banks, Chase has expanded its banking network worldwide both physically and online.

So, if think you can avoid the monthly fee, there must be a chase account in your banking gallery.

Chase FAQs

What are the pros and cons of a Chase savings account?

Chase saving account has several advantages such as online and mobile banking, FDIC insurance protection, automatic savings program, and good APY after some years of relationship. But it has also a few disadvantages including only 2 saving accounts compared to Chase's 8 checking accounts.

What are the advantages of a Linked Chase checking account?

Linked Checking accounts help the customers to waive the monthly fees.

Is Chase bank the worst bank?

No, Chase can be limited to benefit customers who expect higher APY at some point but due to its availability in-branch and ATM is quite satisfactory along with a Signup bonus.

Is Chase better than Bank of America?

Yes, Chase fits better than any other bank including Bank of America, those who need a wide range of physical presence. Customers can also enjoy limitless deposits in the Chase Bank account.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.