Varo Bank Reviews: Is Varo a Good Bank?

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Aren't you tired of navigating a clunky app or searching for a branch that you need to manage the bank account? If you haven't used any online bank before, Varo can be a genuinely convenient option for banking and reliability. Varo offers premium features for the user to provide on-the-go services that may provide an effective online route.

Are you searching for complete basic savings and checking transactions while planning daily life? Varo makes it an effortless option to bank through its vast ATM network and mobile app. Varo is a convenient way for anyone who wants to deal with finances. If you're going to use a checking and savings account, you can easily enjoy Varo bank's benefits.

But wait! If you intend to use Varo as a secondary account, you shouldn't plant for a steam transaction or other deposit activity. It offers you exclusive perks such as overdraft protection and high deposit cash features with increased yield savings.

One of the outstanding Varo bank features is to provide customers with a convenient and suitable way to manage their banking services and finances. It is second to none with many valuable features, a handy mobile app, and a vast ATM network. This Varo bank review will explore everything about this online bank to decide whether it's a good fit for you. Let's get right into the Varo bank review!

Varo Bank Reviews: Topic Overview

Understanding how bank accounts work can be overwhelming at first glance but we're here to help break it down so that anyone can understand it!

Check out our comprehensive review of Varo Bank's services below: -What are the benefits? -How does it compare against other banks? -What are the Pros and Cons -Who is it best for?

Everything you need to know about Varo Bank in one place. We've got the details for you.

What is Varo?

Varo Bank is an all-versatile ledger application that worked with top-tier innovation to assist individuals with excelling monetarily. Besides a realistic plan and client experience, Varo bank offers clients protected and branchless banking, early immediate cash deposits and direct deposit, and no monthly maintenance fees.

Varo Bank Accounts are proficient enough to work reliably, and all their checking account and online savings accounts are FDIC-safeguarded up to $250,000 through Varo bank, N.A; Member FDIC. The cash deposits and direct deposit features include foreign transaction fees with this mobile-only bank for assistance.

Early admittance to direct deposits coordinates store reserves relies upon the timing of the payer's accommodation of stores. The cash deposits are gotten on the day, which might be long enough as two days sooner than the payer's planned installment. That's how the account balance and fee-free features work in this bank account.

How do Varo Checking Account and Savings Account work?

Varo conveys no-monthly fees or expenses on checking accounts and savings accounts. You will pay no upkeep expenses, no overdraft charges if qualified, no in-network debit card charges, no unfamiliar exchange charges, no check card substitution expenses, and no exchange expenses. And no monthly maintenance fees.

The most significant case is a $2.50 out-of-network debit card expense, which is not difficult to keep away from by utilizing one of the 55,000 in-network All point ATMs. Savers with Varo can expect a base annual percentage yield of 0.50% APY. However, it may fit the bill for as much as a 3.00% APY.

Varo Checking accounts

The Varo Bank account is the standard financial record, and it comes without month-to-month support fees. There's no base equilibrium prerequisite, either, so you're allowed to put a lot or minimal in the record to set it up.

You will require a couple of things to make a financial institution with Varo. However, precisely a Social Security number and a substantial government-provided ID. Direct store reserves are made accessible rapidly.

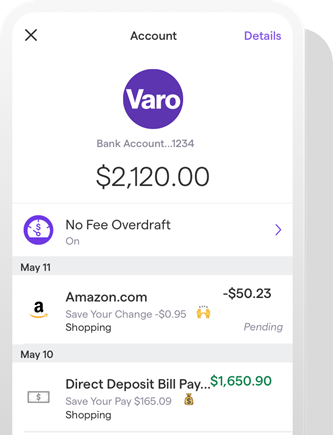

There's a No Fee Overdraft giving you five charge buys a month and consistently getting immediate stores of $1,000 or more. Access to large Allpoint ATM network Future expanded services, now that Varo has its national bank charter Cons High-yield savings account only available to checking account holders Varo to Varo transfer is only available if both parties are Varo customers 24/7

Varo Bank Account With the Varo Bank Account, you can get your check with the direct store and access it as long as two days sooner than the average direct store. Direct deposit funds depend upon the timing of the payer's accommodation of stores.

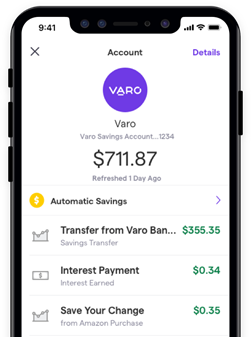

Varo Savings Account APY

The current APY is 0.20%. All Varo Savings Account holders get this rate paying little mind to their record balance. Neither the ledger nor the bank account requires the least stores to open, and you really want only $0.01 to begin procuring revenue with your web-based investment account.

You can acquire 3.00% APY if you open a bank account and meet specific month to month necessities:

- Account-holders should make at least five buys utilizing their Varo Bank Visa Debit Card. Moreover, it has deposits adding up to $1,000 or more each passing time frame and keeps a bank account surplus no higher than $5,000 without any minimum balance required.

Varo savings account maintains their daily savings balance within each qualifying period for $ 5000 entire calendar month.

The Varo savings account works effectively and is a highly innovative option among different online savings accounts to provide exclusive savings benefits to direct deposit customers. Here's what Varo savings account includes:

Varo Advance

If you get essentially dollar 1,000 indirect stores each month and make somewhere around five check card buys each month, you are naturally qualified for Varo Advance, permitting you to get loans of up to $100. Varo can control its own deposits from 2017 /2019, and this was managed by Bancorp bank.

Save your change

Varo financial records to have naturally moved to your Varo bank account. Save Your Change – With this program, Varo will gather together the buy to the nearest dollar and move that sum from your Varo financial records to your Varo bank account whenever you make a buy with your charge card.

What are the Features of the Varo Bank Account?

Your Varo Bank Account will accompany a Varo visa debit card charge that includes an EMV chip for security. In case you need cash, Varo has collaborated with the 55,000 all-point ATMs organization, which claims 55,000 expense-free ATMs all through the U.S.

Notwithstanding, Varo has established a $2.50 out-of-network ATM expense. You'll cause this charge, notwithstanding any ATM administrator expenses, on the off chance that you utilize a non-All point ATM.

Admittance to your money

To open a Varo investment account, you should initially open a Varo financial balance. The check card can be utilized for the two records, and record holders can make expense-free withdrawals from Varo's organization of 55,000+ Allpoint ATMs.

There are multiple ways of adding cash to your record, including direct store, moving assets from a connected outer financial balance, utilizing an advanced wallet like Venmo, saving a check through the versatile application or a money store.

Perks

Notwithstanding Varo's layered reserve funds APY program, the web-based bank offers two projects that naturally move cash from your ledger to your investment account. Varo offers significant benefits. Varo bank has no monthly expense and least less bank with cutthroat APYs for its investment account, alongside an upgradeable rate.

Clients can computerize their reserve funds through Save Your Pay, which moves a level of your check into your reserve funds from your ledger. They can save the change, which gathers your financial records exchanges to the closest dollar, and moves the distinction to your investment funds.

Varo overdraft fees

There are no overdrafts with Varo Bank. There is the option, however, to use Varo Advance. Varo Advance is a way of instantly accessing extra funds so that you can purchase without going into overdraft on your account. There are no overdraft fees, just a requirement to save your pay the Advanced Plus and any Varo advance Fee within 30 days if you wish to secure another Advance.

How much does Varo Cost?

| Varo Bank Accounts Types | Monthly Fees | Waiver Criteria | Minimum Deposit Amount |

|---|---|---|---|

| Varo Checking Account | $0 | N/A | $0 |

| Varo Savings Account | $0 | N/A | $0 |

There are no monthly fees and minimum deposits on Varo Accounts. That's why it's a great bank to open your savings and checking account.

Who is Varo Best For?

Varo Bank is a genuine web-based bank. It has procured a standing as a dependable mobile-only bank and can be a brilliant choice if you're keen on online banking. Then, at that point, there are generally the advantages that an online-no one but the bank can propose in addition.

What's more? The Varo bank includes several accounts, financial records, and other premium options to promote effectiveness. The direct deposit funds depend on early student loans or personal loans with 55,000 Allpoint ATMs.

Here we will see how Varo payer's scheduled payment date and foreign transaction fee works within an account holder.

Someone Who Needs a Fee-free Banking Experience

It is no longer an exception for people who desire to get a fee-free ATM network or get into total qualifying direct deposits.

It appeals to clients who want to get a mobile banking experience or open an account online and avoid fees. Moreover, people who look for debit card replacement fees or online banking transactions with minimum deposits will choose Varo.

Someone Needs High-interest Rates on Savings Accounts

Varo savings account features direct deposits for checking and savings accounts and offers joint accounts to people qualifying direct deposits.

Student and personal loans are also available within the savings account balance to provide you exclusive benefits. The bottom line Varo bank is ideal for people with tech-savvy and helps enjoy handling the banking on the phone. The member FDIC or debit card replacement fees will offer such deposits or 1,000 direct that might include green dot network and minimum deposit within 3.00 APY.

Varo Bank Pros and Cons

| ✅ PROS |

|---|

▶ Cutthroat APY The foremost thing is the yearly yield rate on Varo investment that's reliable at 0.40%. Furthermore, the extra measures it includes are reliable, and you can acquire as much as 2.80% APY. ▶ No-monthly-fee checking and savings accounts Varo includes no monthly fee for a savings account and checking account. YES! You won't pay any additional charges for the Varo savings account or any deposit cash fees. Moreover, it has no minimum balance requirement and overdraft fees. The plus point is that it will not cost you any in-network ATM fees or no debit card replacement fees, transfer fees, and no foreign transaction fees. Isn't that amazing? You can avoid the out-of-network ATM fees through the 55,000 in-network Allpoint ATMs. Therefore, it's one of the best online savings account available within the bank or credit union. Varo bank ensures almost $100 as an advance for people who passed the qualifying period. The $20 advance is fee-free, but the betterment of the above can have fees between $3 to $5. You have to pass the qualifying period to avail of the Varo advance program by getting a direct deposit of $1000 monthly or making five debit card transactions. |

| 🚫 CONS |

|---|

✖ Charges for cash stores Do you know Varo includes different charges for storing cash? YES! You heard that right. If you want to store cash, it will have an expense between $4.95 or $5.95.

Another downline is that Varo will not permit you to send paper checks through the application or checkbook. ✖ Limited services Lastly, Varo bank will offer you limited services like those provided by traditional banks like deposit certificates, etc. Moreover, it doesn't include joint accounts services or students loans. The student loans service is limited up to an extent. |

Varo Compare to other Banks

| Bank | Minimum Deposit | Monthly Fee | Savings APY | Overdraft | Number of Branches |

|---|---|---|---|---|---|

| Varo | $0 | $0 | 0.20%-0.30% | $0 | N/A |

| Chase | $0 | $12 | 0.01% | $34 | 5,100 |

| CITBank | $100 | $0 | 0.50% | $34 | N/A |

| Chime | $0 | $0 | 0.50% | $34 | N/A |

Varo vs. Chase

Let's compare Varo to chase. Varo is an online-only bank, whereas chase has physical branches and 16000 ATMs. Varo has a high-interest rate compared to chase. Besides this, Varo has no minimum balance requirement or monthly fees, whereas chase will cost you a lot.

Varo has effective savings account APY compared to chase. Chase deducts $12 every month and offers low-interest rates than Varo. Checking accounts include no withdrawal charges in both banks, and you have to pass a qualifying period to eliminate fees in chase bank.

Chase Bank has an unwritten guideline for Visa endorsements that is one of the most severe businesses. If you've opened more than five new Mastercards from any bank in the beyond two years, you won't be supported for a large portion of its charge cards.

>>Read more About Chase Bank Reviews: Is Chase a Good Bank?

Varo vs. CIT Bank

CIT Bank is web-based keep money with a remarkable currency market investment account, financial records, testaments of the store, and high return reserve funds choices. In contrast, Varo Bank's banking and investment funds items have no month-to-month charges or least equilibrium necessities.

Varo likewise has a charge-free ATM organization and programmed reserve funds apparatuses. However, you will not pay monthly support charges with CIT, and large numbers of its loan costs are costly.

Varo has no branches, and money stores are just accessible through outsider retailers that charge expenses. On the contrary, the Savings account in CIT bank requires a base store of $100 to open, same as the Savings Builder record, and lower than what some other banks' investment accounts require.

Varo offers automatic savings tools with high annual percentage yield APY and other factors that promote effectiveness and direct deposits. In contrast, CIT bank is about a money market account with 0.50% APY and no expenses.

>>Read more About CIT Bank Reviews: Is CIT a Good Bank?

Varo vs. Chime

Let's compare Varo with Chime. Varo and Chime are both online banks with a savings account and checking account features. In the two cases, you'll naturally apply for this record when you set up your record in the application. If you want to get an emergency fund, Varo is an excellent choice, Chime.

Both Chime and Varo shun conventional financial expenses, including month-to-month support charges, least equilibrium expenses, and overdraft charges. The two records let you get your check as long as two days ahead of schedule contrasted and a customary bank since they discharge the assets when your boss starts the store.

Besides this, Varo saves the pay rule and will let you make aside any paychecks percentage you desire to let it almost above Chime's 10% when you get paid as it helps reach the saving goal rapidly compared to chime. A chime will spot you for an overdraft up to $200 and take it out of your next deposit.

Lastly, Varo is far more convenient and ensures six times interest rate than time on saving and qualifying account holders though it comes with minimum balance requirements. Both Chime and Varo charge no overdraft fees and offer optional overdraft protection, but eligibility and details vary.

>> Read more About Chime Banking Reviews: Is Chime a Good Bank?

Conclusion: Is Varo a Good Bank?

Varo Money is a legitimate and famous banking application upheld by FDIC-safeguarded accounts through Varo Bank. The versatile bank is a decent choice for anyone who likes web-based banking and has basic financial necessities that don't need all monetary administrations to live under one rooftop.

Varo Bank, N.A. gotten endorsement for a U.S. bank sanction in July 2020 and is an FDIC part. It is an entirely claimed auxiliary of the monetary innovation organization Varo Money, Inc., which works the Varo bank app. Varo is providing the best banking services in town.

Though Varo is a versatile just bank, there is a powerful assistance area on its site that is set up as a simple to-utilize FAQ and effectively accessible. Varo bank app is working 24 hours.

If you can't find an answer for your concern through the assistance area, you can email Varo or call its client support line from 8 a.m. to 9 p.m. ET Monday through Friday and 11 a.m. to 7 p.m. E.T. Saturday and Sunday 1-800-827-6526. This Varo bank review will help you know everything about this online bank.

Varo Bank FAQs

Which is better, Chime or Varo?

There's some savage contest in the online-just bank stakes concerning loan costs, low expenses, and simple admittance to reserves. Whether Varo is superior to Chime, for example, it relies upon what you want for your deposit cash. Varo account could be better in case you're searching for a high return of 0.50 APY.

If you satisfy monthly standards, you can get a pace of 3.00% contrasted with the 0.50% that Chime offers for its reserve funds account. The toll can be a decent decision if you're keen on a client's cordial financial experience. Both are online fee-free banks with checking and savings account options and no monthly fees.

Who is Varo bank owned by?

Colin Walsh and Kolya Klymenko established Varo to make a bank that would draw in twenty to thirty-year-olds and more youthful individuals who were baffled by conventional banks.

This is essential to justify why the bank just works through an application and not the site to ensure the client experience functions admirably. Since it's the primary way that individuals access their banking services. Up until October 1, 2020, Varo was an organization with the Bancorp Bank to supply the spine for their financial records.

Is Varo bank secure?

Here's a big YES! Varo money achieved the goal of a mobile-centric national bank with the minimum balance required and effective annual percentage yield, no doubt. It is a member FDIC offering you an effortless process to open an account. The minimum deposit green dot network makes it more stable.

Such a Varo visa debit card offers additional protection from zero liability that works in case of unauthorized charges. You will find maximum deposits as FDIC insured to $250,000. The federal government protects your money for up to $250,000 per depositor for each account ownership category during a bank failure.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.