Forex vs Futures? Investing in Forex vs Futures

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

If you have been trading on the currency market for some time now, you must have come across a term called “Futures Trading” or “Currency Futures“. Now, traders often get confused between these two terms because Currency futures is quite similar to currency exchange, yet they both are quite different at the same time.

The main difference between the futures and the forex is that forex trading comprises buying and selling the currency. On the other hand, futures trading is a method you can create thousands of different financial markets, including different commodities, forex futures, and shares.

Even if you are not a trader or a broker, it is possible that you must have traded currencies on the Forex platform at some point in your life. Common people usually trade on currencies when they are planning to visit another country. For example, if you are a US resident, and you are a French citizen, and you are planning to visit the US for some work, or for your vacation. In such a case, you must convert Euros into US Dollars because your Euros are practically useless in the US.

Whenever you convert one currency into another, you are trading on the Forex exchange market, and each such transaction leaves an impact on the market. Now there are millions of people who trade on various currency markets every day, which is why the average transaction value on the Forex currency market is said to be around 5 trillion dollars.

Now we have already discussed a lot about trading Forex in the past, and we are not doing to dwell on trading on the currency market today. Today we are going to discuss Forex vs Futures. We will tell you everything you need to know about Forex vs Futures trading.

We will analyze both these trading types using broker comparison between them. We will also talk about how Forex vs Futures is similar, yet different at the same time. Moreover, in this article, we will also be having an in-depth look at the advantages and disadvantages of both. So stay tuned with us to find out which is the best Forex course for you to start learning to trade futures and futures markets right now.

But before we can discuss Forex vs Futures, it is important for us to know What is Forex and What is Future? So we will start with discussing both of them, one by one.

Forex vs Futures: What's the difference

We have already discussed what do you mean by Forex and Futures trading. But what is the difference between Forex and Futures trading? For a lot of people, the only major difference between Forex and Futures trading is the stock market. Although stock investment is one of the major differences between the two financial institutions, it is not the only difference. Let's discuss some of the major factors that differentiate both these financial institutions.

Market Cap

Market cap is one of the major distinguishing features between Forex and Futures trading. The Forex market is the largest financial institution in the world with an average daily trade volume of over 6.5 trillion dollars. The Forex market is the largest investment platform in the world, and the average daily trade volume is nearly 8% of the entire world's GDP combined. That is why it is the most significant liquid market in the world. The characteristic of this market is that it can absorb all the trading volume along with different transaction sizes.

On the other hand, the average daily trade volume for the Futures market is about 30 billion dollars, which places it just inches above the largest stock exchange in the world: the New York Stock Exchange. Although the popularity of the Futures market is increasing constantly, the average daily traded volume is expected to grow rapidly in the near future.

Although both these financial institutions are liquid markets, both of them have a huge difference in terms of average daily traded volume. In terms of pure numbers, the Forex Market is roughly 200 times larger than the Futures market.

Market Stability

Another major difference between both these financial institutions is their stability. Forex market is considered to be one of the most stable markets in the world primarily because of its daily average trade volume, and millions of Forex traders. Because the Forex market is the largest financial institution in the world, it is quite stable because there are not a lot of trends that can affect the market significantly. This is one of the major reasons why the Forex market is the preferred investment destination for a lot of traders.

On the other hand, the average daily market cap of the Futures market is above 30 billion dollars, it is negligible when compared to the Forex market's daily market cap. The Futures market is also a pretty stable market, but when compared to the Forex market, it is a volatile market because of its small market cap when compared to the Forex market.

Commission

The commission is another major reason why a lot of traders prefer Forex over Futures. On average, a Futures trader has to pay a lot of commission when compared to Forex traders.

One of the major reasons behind the low commission charges is that there is a lot of competition among spot Forex brokers. This is the reason why there is always a way thanks to which you can get the lowest transaction charges.

However, the number of Futures traders when compared to Forex traders is marginal, and there are few brokers that deal in the Futures market. This is the main reason why the commission charges of Futures trading are higher than the Forex markets.

Price Certainty

When we talk about Forex trading, there is a price certainty when the market condition is average. In contrast in futures trading, the market does not offer a price certainty. It also means that in future studying, you will not get any instant trade executions, and that is why you should see that in your mind when you are trading by using futures for currency futures trading.

Best Futures Broker

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Beginners Read Review | securely through TD Ameritrade website |

| High Volume Traders | securely through Tradovate website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

What is Futures Trading

Before we can start discussing Future Trading, we need to understand what the term “Derivative” means. Derivatives can be referred to as financial contracts that derive their present value on the basis of the price trends recorded by different financial institutions. Futures trades are contracts, and it is financial instrument.

Before we can start discussing Future Trading, we need to understand what the term “Derivative” means. Derivatives can be referred to as financial contracts that derive their present value on the basis of the price trends recorded by different financial institutions. Futures trades are contracts, and it is financial instrument.

It can also be called an agreement between two people, which are buyer and seller. In Futures trading, the buyer and seller enter into a financial agreement in which the buyer agrees to purchase a derivative at a pre-defined time in the future date at a fixed price.

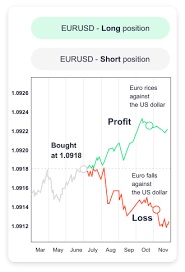

In this contract, the buyer has a long position, and the seller is the one who has a short position. In futures trading, the buyer generally agrees on derivatives, but the trade can also take place in the form of an index at a particular period for forex trades and futures traders. The Futures prices of the contract change relative to the fixed price when the contract was finalized, and this is how the trader makes a profit or loss on the contract.

Why is Futures Trading gaining popularity

One of the major reasons why Futures trading is gaining popularity is that Futures trading allows traders to make money using price movements rather than purchasing/selling cash commodities. The Futures market deals mainly in four commodities or assets: Indices, Stocks, Commodities, and Currency pairs. Futures are utilized for hedging the commodity price fluctuation risk and help in avoiding complications.

A futures contract is made for the future, which is why it always has an expiration date. There are two participants in futures trading: hedgers and speculators. Hedger is mainly comprised of individuals or businessmen who use futures as protection against rapid or irrational price fluctuations when dealing with cash commodities in the future. On the other hand, speculators comprise investors and independent floor active traders that trade in futures or foreign exchange products.

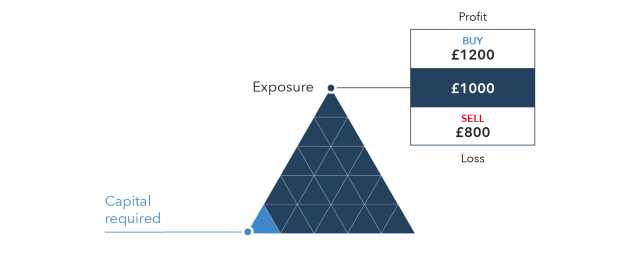

One of the major differences between the Futures market and other forms of investment is that the investor is not required to pay the entire amount when the contract is initiated. You can enter into a Futures contract with just a small upfront payment. It can also be referred to as the initial margin of the total value that was used to start the contract in the first place. This is one of the major distinguishing features, and the key difference between the futures products or contracts, and other financial instruments.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

What is Forex Trading

In simple terms, Forex or Foreign Exchange Trading means investing, and trading in different currencies from across the world. You might be a Forex currency trader based in Australia, and you might be trading in the US dollar and Great Britain Pound. There are millions of traders from across the world who show up at the Forex exchange markets every day, and they trade currencies on this platform.

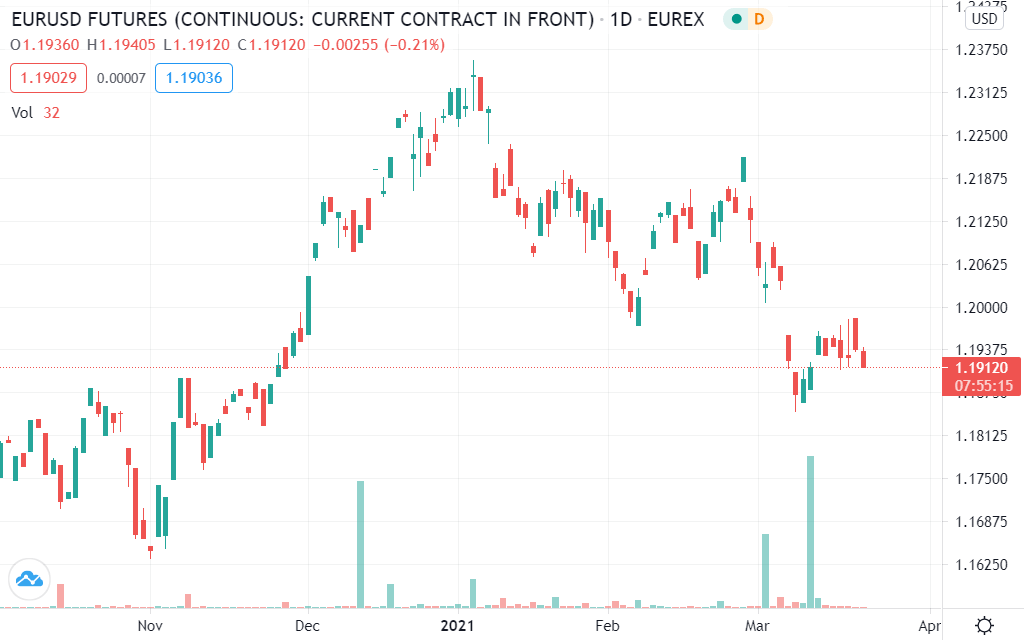

One of the major properties of dealing in foreign currency is that its value keeps fluctuating. The Foreign Exchange market is open 24/7, which is why traders trade on any currency pair almost every second of the day, from any corner of the world. It is the reason why the price of a currency pair changes continuously on the currency market, and no one can accurately predict the future trends of the market.

Foreign Exchange markets are extremely important for the global economy because they play a vital role in global trade. The average daily market cap of the currency exchange market is about 6.5 trillion dollars, which is nearly 8% of the global economy. If the currency exchange market is down for a day, it could impact global trade significantly, and the world economy could easily lose billions of dollars.

Forex vs Stock Trading

A lot of people often confuse currency trading with stock trading. However, they both are different from each other, and their working methodology differs a lot.

The major difference between Forex and Stock Trading is that in the Forex market, you invest in currency whereas in the stock market, you invest in stocks or the company itself.

In the Forex market, you bet your money against a currency pair like USD/EUR(US Dollar and Euro). It means that you are selling one currency and purchasing the other. Traders make a profit when the demand for the currency they own increases, and the difference between the values of individual currency in the given currency pair is your profit.

On the other hand, in stock trading, you buy the stocks of a company, and you make profits when the price of these stocks increases. For example, you bought “X” number of shares of a company “Y” at a rate of “Z” dollars per share. Now lets say that after “N” number of days, the price of each share increased to “Z+5” dollars. If you decide to sell your shares now, you will make a profit of 5 dollars/share.

Similarities Between Futures Trading and Forex Trading

When we talk about Forex trading, you should know that it involves selling and buying currency. On the other hand, futures trading is a bit different. It is a method by which you can trade or invest your money on different financial assets including forex, stocks, currencies, and more.

You can do this on different Financial Institutions and platforms available online and in many different markets. You can find a suitable price for you and trade forex at future prices. Forex trading is also called currency trading, and it is a process that you can use when you want to convert one currency to another currency and make a profit out of it.

It is a mechanism that is easy to understand, and different individuals and companies trade more than 6.5 trillion dollars every single day in Forex trading. Let's talk more about the forex and futures markets!

But when we discuss, it is essential to keep in mind that it is a contract or an agreement between two parties. Those two parties are buyer and seller, which is an agreement between them. If you are a buyer and you will have to buy the underlying market, and the seller has to sell is before the date of expiry because the date of expiry is set at the initiation of the contract.

These are the similarities between them; however, there are not many similarities between them because they are opposite each other. There is no difference in the size of the market because forex is the biggest market in the entire world, whereas futures does not have any comparison in front of it. The Chicago mercantile exchange makes trading currency futures easy among the foreign exchange.

Pros and Cons of Futures Trading

Pros

- Extremely liquid market

- Fixed costs

- Great potential gains

- Great leverage

Cons

- Risky

- No standard for fees and commissions

Pros and Cons of Forex Trading

Pros

- Sizeable leverage

- Major profit

- Very liquid

- No central exchange

Cons

- Price determination is tough

- Volatility exists

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Forex vs. Futures

In this article, we have already discussed how forex trading and futures trading differ from each other. We have discussed the major differences between the two, and also discussed how are both these financial institutions similar to each other in a few ways. However, both these financial institutions differ significantly, and their working methodology is different, which is why we should not compare both of them.

To sum things up, the following are the major differences between Future and Forex markets:

- Transparency: Forex is a financial institution where the currency is traded over the counter which results in lesser transparency when dealing with currency pairs. On the other hand, the Futures market is a centralized trading platform. This not only increases the transparency when trading on the platform, it also reduces the risk of financial fraud.

- Currency Used: The Forex market deals with currency pairs, and you can deal in almost every currency on the planet. On the other hand, the Future contracts are drafted in US dollars.

- Expiry Date: Because the Futures market has a contract, it has an expiry date. The deal would be completed at the contract's worth on the day when the contract expires. On the other hand, there is no fixed time period involved in the Forex market, and you can complete the trades whenever you want.

- Market Stability: Forex market is considered to be one of the most stable markets in the world primarily. Because the Forex market is the largest financial institution in the world, it is quite stable because there are not a lot of trends that can affect the market significantly. This is one of the major reasons why the Forex market is the preferred investment destination for a lot of traders.

Now, if you are looking for the answer to which is the better financial institution between Futures and Forex markets, then there is no concrete answer to this question. Both the Forex and Futures market have their own characteristics, advantages, disadvantages, and trading methodologies.

Different traders have different needs, and only you can decide in which market should you be investing your money. Different traders have different requirements, and what suits a particular trader, might not be beneficial for you.

This is one of the major reasons why you should try to gain experience in both these markets, and learn about the ins and out's of both Forex and Futures markets. Once you have gained enough knowledge, you would be able to decide for yourself whether you want to invest in Futures contracts or Forex currency pairs.

Best Forex Trading Course

Investing in the Forex market might seem to be a daunting task especially if you are a beginner, and have just started exploring the Forex market. Although experience is said to be the best teacher when dealing in the Forex market, it is good to learn about the Forex market briefly before making your first investment.

There are several ways in which you can start expanding your knowledge of the stock market. You can either start reading books or ask for tips from your friends or family members who have prior experience of trading on the Forex platform. However, the former is a time-consuming method while the latter is not always a credible learning source.

If you want to learn about investing in the Forex market that would help you gain knowledge, and tell you all you need to know about the market, then you can opt for some professional courses available on the internet. These courses are developed by Forex markets experts who have years of training Forex traders.

Now, there are thousands of courses on the internet that claim to teach you about Forex investment. However, not all of these courses are reliable and give accurate information. So which is the best Forex course for learning the ins and out's of the Forex market?

Asia forex mentor course by Ezekiel is by far one of the best Forex learning courses on the internet, and they are one of the best learning sources if you want to expand your Forex trading knowledge.

They have been featured on multiple different leading forex platforms and Forex events happening around the world. Ezekiel's platform is the perfect solution for you to learn because their clients include multiple trainees and bank traders from private trading institutions around the globe.

It is the number one course available on the internet because it also reaches new bank traders and has fun managing if you want to make money from trading forex stocks and other commodities.

You can get a great return on investment by indulging yourself in this systematic course. Even if you are a beginner in the field and do not have enough experience and knowledge about Forex trading, you still join this program with zero knowledge. Everything will be taught to you from scratch, and you can enroll yourself in this program right now to get started.

Check out the testimonials on the website and start your Forex trading journey right away. The good thing about this course is that you will be crystal clear about what you need to do from day one.

They are using a return on investment approach to teaching their students. It is a scientific method of beating the market, and you will not be taught this somewhere else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Forex vs. Futures FAQs

Are Futures more profitable than forex?

Yes. If we talk about futures trading, it is much more profitable than Forex trading. If you are trading futures, then the difference between the selling and buying price will be a lot greater.

This difference is not more significant in Forex trading, and that is why you will be able to earn a lot of revenue with futures trading.

For example, if you keep the same position open all night, you will have to pay overnight funding charges with Forex trading of spot trading. But when you are trading with futures, you will not have to worry about these costs because they will be irrelevant.

Is forex better for day trading?

Yes. Forex trading will be a perfect solution for you because it is a 24 hours day trading option and a very liquid market. There is always a currency that will be more suitable according to the time zone of your country.

That is why you need to keep that in mind when you think about which trading option will be the best one for you according to your time zone.

Forex is available 24 hours per day, and that is why it is more flexible when you are thinking about how much money you need to get started and Forex trading.

You are not going to require a lot of money in the stock exchange compared to Forex trading, which is why it is a very profitable option for you out there.

Is forex more profitable than options?

If you are a Forex trader, you will be betting on the rise and fall of the international currency. But when it comes to options trading, it will just focus and centralize on the stock and commodity option. But when you compare both of them, you will find out that both have their benefits and disadvantages.

The 24-hour trading option is available, and it is a good liquid market with excellent execution speed. The commission is also low, so it is better than options.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.