Best Backtesting Software in 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Primarily, investing involves significant sums of money, both the amount invested and the related costs. Forex market form of investment can be risky as some people say 80% to 90% of forex traders tend to lose their money in the process and end up quitting. The risk is mitigated by getting proper training and mentorship from experts like The Asia Forex Mentor.

Another way is to invest in fundamentals and the right backtesting software, which helps forecast future trade using historical data. This article will inform you about what backtesting is, how it works, how it can better advise your forex trading decisions, and the various best backtesting platforms available with their pros and cons, both paid and free versions

Best Backtesting Software: What is a Backtesting Software?

Backtesting determines how well a strategy or model would have performed without the design or model. It is a method used in assessing the viability of a trading strategy by checking how it would have performed in the real world using previous data. If backtesting proves to be effective, traders and analysts may be more willing to use it in the future.

Backtesting software evaluates the efficacy of a trading or investment technique that has been used in the past and assists in predicting its future performance. Simulation runs on a trading strategy using historical data from financial instruments such as options, stocks, and more, based on backtesting code in the software.

The model’s returns are tested in various market circumstances and datasets. Institutional investors and money managers can experiment with different trading strategy variables and analyze the viability of different trading strategies to find the one that performs the best based on historical data.

By using the right backtesting software, traders can acquire information on prospective net profit/loss, market exposure, volatility, risk-adjusted return, and return without risking any money.

10 Best Backtesting Software

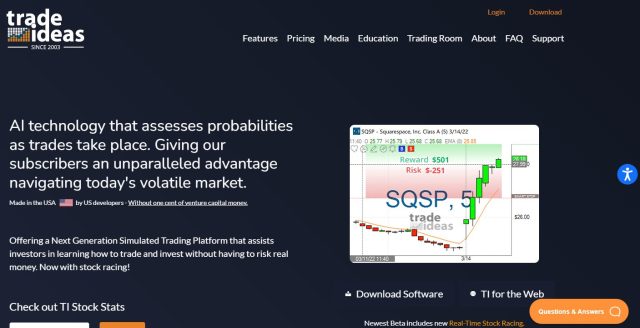

#1. The Most Advanced AI-Powered Backtesting Software: TradeIdeas

Formed in 2003 by FinTech entrepreneurs to assist investors and intra-day traders in catching stocks in real-time. Scanners for stocks and options manage a large quantity of data and filter out stocks worth following daily. It is a web-based software tool that delivers stock market profit chances and recommendations.

Trade-Ideas is a sophisticated trading tool that allows traders, investors, and fund managers to analyze the stock market quickly for trends, reversals, and execution indications. It monitors every stock trade during the day and alerts the user in real-time to potential setups based on your pre-defined filtering criteria. The software also distinguishes the vast range of fundamental and technical filters. It also allows you to configure event triggers to be the first to act on an opportunity.

How it works:

Every day, the software runs millions of trade scenarios on a computer to see which market relationships have predictable consequences. The Trade Ideas stock scanner software determines what is working in up and down markets, advising you on what to purchase, sell, and when to quit the trade.

The A.I.-powered Robot-advisor comprises several dozen separate investment algorithms that examine over 1 MILLION trading situations each night to determine which subset has the best chance of generating alpha in the next market session.

Holly is the trade ideas’ investment discovery robot that does all the analysis for you. A.I. Holly will analyze everything that happened on that trading day once the market closes. Holly’s strategies are divided into at least 35 separate concepts, and each thought has a distinct purpose in helping Holly outsmart the competition.

Pros

- With the Oddsmaker tool, you may optimize custom strategy scans.

- There are numerous training courses and videos accessible to users.

- There is a live trading room featured.

- The auto-trading tool gives you a lot of options and flexibility.

Cons

- Learning takes time.

- When compared to other tools, it’s quite pricey.

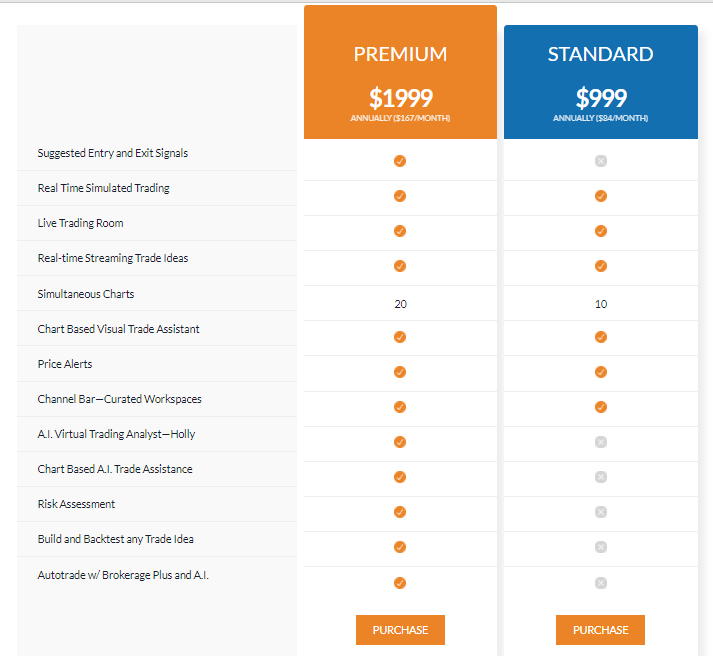

Price and Fees:

- Standard access subscriptions start at $84 per month when invoiced annually at $999 per year.

- You can also make use of the Free version available.

- You can use the Free Trade Ideas strategy to:

- Create any Trade Idea

- Log in to the Live Trading Room (Hosted by Barrie Einarson)

- The Channel Bar can be found here (Curated Workspaces by TI)

- Market data that is delayed (15–20 minutes) is available.

| Broker | Best For | More Details |

|---|---|---|

| Scanning Platform

| securely through Trade Ideas website |

#2. The Best Free Backtesting Software: TradingView

TradingView is a popular cloud and web-based trading software for Forex, futures, and crypto traders in all financial institutions. All of its charts and services are accessible through a website, which you can use to check prices and perform analyses. Installing additional software or registering with a broker is not needed.

TradingView has also incorporated social components that allow you to communicate directly with other traders, follow their chart analyses, share trading ideas, and excellent charting and organizational tools. Conversations take place in real-time, and you can converse with people who are trading the same instruments as you. Send them links to your charts, share your trading ideas, and solicit criticism and comments so that you can all benefit and progress as traders.

How it works:

It has all the necessary information, statistics, and analysis tools to help you. You get basic charting features and access to the TradingView community when you join up for a free account. While Tradingview is free, you need to open a free account to enjoy the full range of features. You can upgrade your free account to one of the paid plans to access more features.

The platform comes with a slew of useful features. You get free access to various enriched features, including TradingView charts, TradingView indicators, TradingView drawing tools, TradingView alerts, TradingView fundamental data, TradingView stock screeners, and much more.

Pros

- It offers one of the most effective stocks and forex screeners available.

- A fantastic collection of trading tools.

- The app is fully working on mobile devices.

- A free package gives you access to a number of amazing features.

Cons

- Customer service is not too satisfactory when compared to industry standards.

- Some parts of the website are disorganized

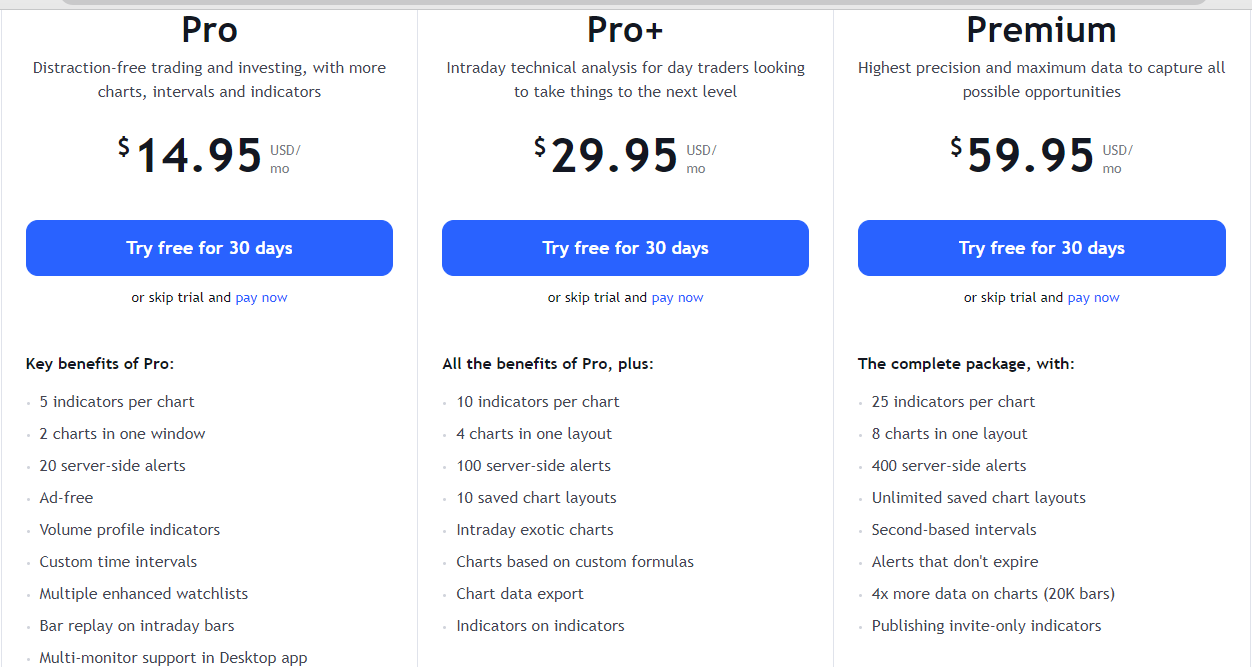

Price and Fees:

Trading View offers three options, each with a 30-day free trial, so you may pick the one that best suits your needs. The free basic account is also available with its numerous features to get a feel for the platform before committing to a paying plan. Each approach has its own set of essential advantages.

- $14.95 per month or $155 per year for Pro

- $29.95 per month or $299 per year for Pro Plus

- Premium ($59.95/month or $599/year)

| Broker | Best For | More Details |

|---|---|---|

| securely through TradingView website |

#3. The Most Beginner-Friendly Backtesting Software: TrendSpider

TrendSpider is a technical analysis platform and software that can assist you in attaining profitable trading results. It saves you time by automating the technical analysis, otherwise done manually. You can choose any chart for technical analysis, and the software will automate it in under 60 seconds.

Because the analysis is based on algorithms and formulae rather than random observations, you will notice a significant improvement in your accuracy. This algorithmically driven analysis aids you in avoiding costly mistakes that could result in severe financial loss.

It’s worth noting that TrendSpider offers free one-on-one training sessions for subscribers who want to learn how to use the software all of its capabilities effectively.

How it works:

TrendSpider shows to be a software-based tool for fully automated technical analysis. It uses practical machine learning tools and algorithms to uncover chart patterns and trends. You can identify the enormous distinctions between TrendSpider and its numerous competitors in the A.I. trading industry just by looking at the site.

This web-based charting tool has a plethora of one-of-a-kind capabilities. However, the center of it is the superbly built charting end-solution, which focuses heavily on historical data transformed into stunning real-time charts.

The platform is fast and does not suffer from the all-too-common lagging that plagues scanners of this type. Most importantly, users can analyze stock, F.X. currency pairs, and also cryptocurrencies with Trendspider.

Pros

- The customer service is outstanding.

- There are numerous automated technical analysis tools available.

- There are settings for personalized alerts.

- One-on-one user training sessions are available for free.

Cons

- It’s only possible to utilize it in one browser at a time.

- There is no option for a desktop platform.

Price and Fees:

TrendSpider provides a seven-day free trial to try out the software and artificial intelligence, charts, trends, and everything else they offer. This deal comes with no conditions attached. After you’ve completed the seven-day trial, you may pick one of their three plans available, which are as follows:

- Premium Membership: This base membership level costs $27 per month or $324 per year.

- Membership in the Elite Group: You can get this service for $47 per month or $564 per year, which they describe as “perfect for aggressive traders who already have a day job and wish to continue with it.

- Master Membership – With a monthly cost of $77 and a yearly cost of $924, you get the best experience

| Broker | Best For | More Details |

|---|---|---|

| Tool for Charting and Analyzing

| securely through Trendspider website |

#4. The Best Free Broker Connected Solution: TradeStation

TradeStation is a stockbroker based in the United States created in 1982. The Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) regulate their activities. Investor protection of up to $500,000 per account (including cash up to $250,000) is available to clients.

TradeStation provides active individual and institutional traders throughout the world with excellent trading technology and online electronic brokerage services. TradeStation’s trading and analysis platform allow clients to build, test, optimize, monitor, and automate their own unique stocks, options, and futures trading strategies, with one-click access to all major exchanges and market centers.

How it works:

TradeStation refers to its trading tools as apps. These apps are built within the platform and can be launched with a single click. There are over a dozen trading apps built-in, including “Chart Analysis,” “Hot List,” “RadarScreen,” “Matrix,” “Time & Sales,” “TradeManager,” and “OptionStation Pro,” and more. The TradeStation TradingApp Store also offers hundreds of third-party tools for free or for a monthly charge.

TradeStation’s window linking is another helpful feature on the platform. You can link one window to another (or numerous windows) using a similar symbol or interval. Assume you have a RadarScreen window, a Chart Analysis window, and a Matrix window linked together.

Conditional orders (including one-cancels-other and order-sends-order), bracket orders, and trailing stops are available on all TradeStation platforms, and you can input numerous orders at once. Additional advanced order rules, such as activation rules that allow orders to be issued to the market based on price or time, are available on the TradeStation 10 desktop platform.

Pros

- Trading platforms of the highest caliber.

- Advanced tools are available.

- A vibrant community of traders.

- Trade stocks, ETFs, and options without paying a commission.

Cons

- Deposit and withdrawal are inconvenient.

- Customer service is mediocre.

Price and Fees:

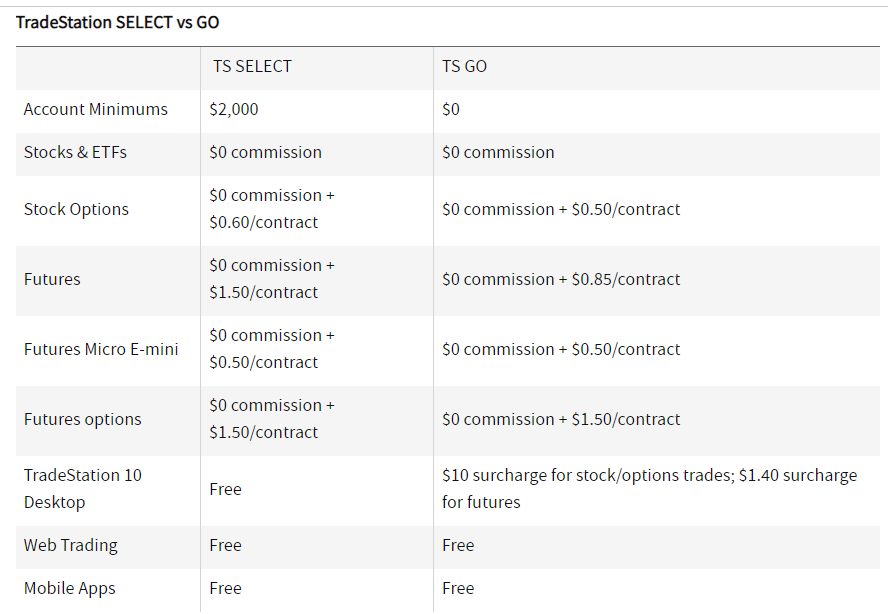

TS SELECT and TS GO are TradeStation’s two primary price levels. Both plans offer commission-free stock, ETF, option, futures trading, free-market data, and no monthly platform fees.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through TradeStation website |

#5. The Best Fundamental Backtesting Software: Interactive Brokers

Interactive Brokers has the most comprehensive portfolio in the market, and it dominates in several categories, including international trading. Customers can trade in over 135 global markets in 33 countries worldwide. Interactive Brokers is a leading online trading platform for traders, investors, and advisors, offering direct access to stocks, options, futures, currencies, bonds, and mutual funds from anywhere in the world.

Institutional investors and sophisticated, active traders who want a robust trading platform and access to various asset classes may consider Interactive Brokers. The broker has tried to appeal to a broader audience by delivering new products, services, and educational content geared at less active traders and investors. IBKR’s reputation as a professional-level platform, on the other hand, may deter inexperienced investors. Clients can come from more than 220 nations and territories, and they can trade on 135 marketplaces in 33 countries using 23 different currencies.

How it works:

In recent years, IBKR’s onboarding procedure has become more user-friendly. You can even open an account without immediately funding it (you have 90 days). The website design and the Client Portal are nice, and IBot (an AI-powered digital assistant) can aid you in locating the information you require. Interactive Brokers offers a variety of trading platforms, including desktop, online, and mobile (IBKR Mobile) apps for Android and iOS devices.

On any platform, you can trade the same asset classes. You may access real-time streaming data, charting, sketching tools, research, and news on all devices. Benzinga, Dow Jones, Morningstar, Seeking Alpha, Thomson Reuters, Refinitiv, and in-house commentary are just a few news sources. A monthly cost is charged for premium news subscriptions. Your mobile watchlists are synced with your browser and desktop platforms.

Pros

- Wide range of offering around the world and across assets

- A superior way of executing orders

- Excellent trading instruments

- Low-interest rates on margins

Cons

- SmartRouter is not available to IBKR Lite customers.

- For inexperienced and inactive investors, it can be scary.

Price and Fees:

The pricing mechanism at Interactive Brokers is convoluted. There are three types of commissions:

Fixed per-share pricing of $0.005 per share; with a minimum of $1.00 and a maximum of 1% of the trade value. All exchange and regulatory costs are included.

Per-share price is tiered based on monthly purchase volume. The minimum per trade is $0.35. Per-share price varies from a high of $0.0035 per share for less than 300,000 shares per month to $0.0005 per share for more than 100 million shares per month. Exchange and regulatory costs are not included.

The IBKR LITE plan is only available to clients in the United States. They can trade US-listed stocks and ETFs commission-free with this service plan.

| Broker | Best For | More Details |

|---|---|---|

| securely through Interactive Brokers website |

#6. Advanced Forex Backtesting and Popular Trading Software: Metatrader 5

MetaTrader 5 expands on the MT4 platform’s already impressive analytical capabilities, giving traders a complete set of tools for in-depth price analysis and movement forecasts. MetaTrader 5 is a trading platform for multi-assets that supports Forex, stocks, and futures trading. It has advanced capabilities for price analysis, algorithmic trading (trading robots, Expert Advisors), and copy trading.

It supports the classic netting system and the hedging option scheme for order accounting. Four order execution modes are available: Instant, Request, Market, and Exchange execution. Trade orders, including market, stop orders, pending, and trailing stop orders, are supported by the platform.

How it works:

Traders can have up to 100 charts active on their screens at any given time, which is enough to keep track of their whole trading portfolio. MetaTrader 5 has a twenty-one-period charting system that ranges from sixty seconds to thirty days. This breadth of time intervals allows for much more in-depth price and trend monitoring than retail trading platforms.

The trading platform comes pre-loaded with eighty technical indicators and analytical tools for deep price analysis across your assets. Additional technical indicators, both free and commercial, are available for download. There are three versions of MetaTrader 5: A desktop version is available for Windows and Mac OS X; A mobile version for iOS and Android smartphones is also available and A browser-based version is also available.

Pros

- Order types and execution models that are extremely advanced

- Non-forex CFDs are getting more support.

- Compatible with both Windows and Mac computers.

- It’s also available on the web and as a mobile app.

Cons

- The number of brokers who support MT5 is significantly lower than that of MT4.

- Beginners should avoid this game.

Price and Fees:

There are no charges or fees associated with using the platform. Your broker, on the other hand, will charge you a commission. The amount varies according to your broker; you can see it in the ‘charges’ field. You may be charged when withdrawing money from the site by wire transfer.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through MetaTrader 5 website |

#7. The Best Free Backtesting Software for Futures Traders: NinjaTrader

NinjaTrader, founded in 2003, provides active traders with software and brokerage services. The NinjaTrader software is free for charting, market analysis, and live trading with a funded account (the SIM version is accessible even without a funded account).

Futures, options on futures, and FX trading are all supported by NinjaTrader. You can trade stocks on the NinjaTrader platform through NinjaTrader’s sponsoring brokers, such as Interactive Brokers or TD Ameritrade.

How it works:

When you fund your account with ($400 for futures; $50 for forex), the NinjaTrader platform is free for charting, market analysis, and live trading (you don’t need a funded account to use the platform for SIM trading). The installation is a simple process, and you can open charts, modify colors, and add indicators and strategies as soon as you launch the platform.

Type a symbol into the chart to add it to the chart. Rolling is also simple if you’re trading futures: Select the Rollover function from the Tools>Database>Rollover menu. NinjaTrader provides attractive charts with a high level of customization and flexibility.

Pros

- Excellent charting and technical analysis tools are available.

- Strategy automation, both partial and complete

- Thousands of apps and add-ons from third-party developers are available in the NinjaTrader Ecosystem.

- Guides to the platform, a video library, and free daily webinars are all available.

Cons

- Premium features are paid for.

- Futures and FX traders will find it simple to set up, but equities traders will need to utilize a supporting broker.

Price and Fees:

To use the platform’s premium capabilities, such as sophisticated order types, automated trading, and backtesting, you’ll need to lease or buy the program (leasing costs $60 per month; buying costs $1,099 one-time). Only a lifetime license gives you access to the Order Flow+ package of premium features, which allows you to evaluate trade activity using order flow, volume bars, and market depth.

NinjaTrader offers free charting, analysis, and simulated trading if you have a funded account with their brokerage. A minimum deposit of $400 is required for a futures account, and for an FX account, a minimum deposit of $50 is required. An inactivity fee of $25 is applied to your account

NinjaTrader’s third-party trading requires either a license or the purchase of the program. The cost of ownership, or “lease,” is $720 per year. The pricing of NinjaTrader is $1,099. There’s little need to purchase the leased version of the software because it comes with substantially fewer data features and costs almost as much.

| Broker | Best For | More Details |

|---|---|---|

Advanced Charting, Market Analysis and Trade Simulation

| securely through Ninja Trader website |

#8. The Best Software for Backtesting and Forecasting Combined: MetaStock

According to the MetaStock review, the software excels at system backtesting, forecasting, and real-time financial news. MetaStock features unrivaled charts, indicators, and drawing capabilities, but it could be more user-friendly.

MetaStock is for traders who require advanced scanning, screening, system backtesting, and forecasting capabilities. The MetaStock Refinitiv Xenith service adds worldwide financial news in real-time. MetaStock is one of the best technical analysis platforms you can have on the market.

How it works:

MetaStock is a PC program that may be run on a Mac using a PC emulator software. You’ll need to download and install MetaStock and configure your data feeds for the markets you’d like to trade. As a result, the software installation isn’t as smooth or rapid as competitors’. Nonetheless, the program is helpful because it allows you to configure several data providers, such as your broker.

MetaStock encompasses all stock exchanges, including stocks, ETFs, Mutual Funds, Options, Futures, Forex, and Bonds. Metastock differs from other providers in that their software runs locally on your PC, and you can purchase one-time licenses rather than paying monthly. They also run a marketplace where expert traders may sell MetaStock add-ons such as stock trading strategies and signals.

Pros

- A large number of automated “expert advisors” are available.

- Deep backtesting is excellent.

- Stock price forecasting is unique.

- Professional Strategies with a Large Library of Add-Ons

Cons

- Learning takes time.

- The design of the Windows app is old-fashioned

Price and Fees:

MetaStock D/C daily charts start at $59/m and include end-of-day data and technical analysis services. MetaStock R/T adds real-time data to charts for a monthly fee of $100. The Xenith add-on costs $150/m for real-time news and robust global fundamental screening.

MetaStock D/C is a valuable alternative for traders who want to do chart analysis and backtesting on end-of-day data. MetaStock R/T will be chosen by demanding traders since it is the most powerful trading solution available outside of a Bloomberg terminal, which costs seven times as much.

MetaStock R/T with Xenith costs $250 a month and includes real-time data, news, and fundamentals powered by Refinitiv, a subsidiary of the London Stock Exchange and has a market capitalization of $29 billion.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Metastock website |

#9. The Best Backtesting Solution for Traders and Portfolio Managers: MatLab

If you know how to program, the possibilities with MATLAB are endless. You can use algorithmic trading to create autonomous solid trading strategies, deploy computationally intensive mathematical models, detect and exploit market opportunities, etc. It is favored by professional traders such as scalpers, high-frequency traders, and others.

Backtesting is an essential component of MATLAB-based auto trading algorithms. All trading models are tested before being used to ensure that they are as efficient as possible. The capabilities of MATLAB are so extensive that it even enables self-optimizing ML-trained models.

How it works:

In just eight lines of code, you can backtest a strategy using the features of MATLAB and Financial Toolbox. This includes the following:

- Data preparation

- Trading signal generation

- Portfolio returns, Sharp ratio, and maximum drawdown calculations

- Plotting the equity curve

MATLAB has a wide range of capabilities. For example, you can download market data directly from numerous data providers using Datafeed Toolbox, Econometrics Toolbox, or Statistics and Machine Learning Toolbox to generate trading signals and use Trading Toolbox to execute your strategy automatically.

Pros

- Simple to use.

- Platform Independence.

- Functions are predefined.

- Graphical User Interface.

Cons

- It consists of an interpreted language, which may run more slowly than compiled language

- Subscription cost is high

Price and Fees:

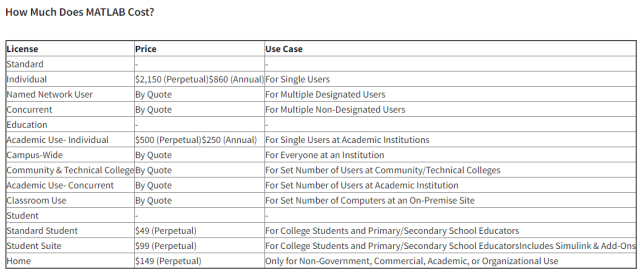

Individuals can purchase a permanent license for $2,150, or an annual subscription for $860, under regular pricing.

Education subscription plans cost $500 for an Individual perpetual license and $250 for an annual permit.

The Student license is $49 at its most basic level. Simulink and other popular add-ons are included with the Student Suite license, costing $99.

The Home license from MATLAB costs $149, which is less than many other licenses. It is, however, illegal for use by the government, academia, business, or any other body. This license is appropriate for personal projects or learning/practicing MATLAB outside the classroom.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Matlab website |

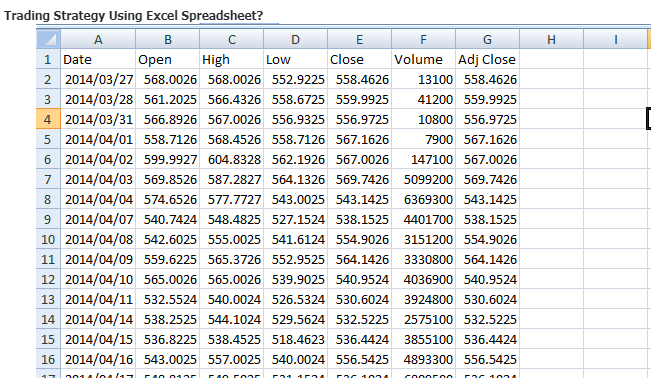

#10. The Best Backtesting Solution if You Want to Do it the Old-School Way: Microsoft Excel

Backtesting with excel is one of the oldest methods available for traders. Basic VBA expertise is required to create a backtesting function in Excel. For example, if you’re looking to do some basic stock or forex backtesting, a handful of Excel formulas will suffice.

Fortunately, there are dozens of instructions on performing backtesting in Excel, so you’ll have no trouble getting started if you’re serious about learning it. Some brokers, such as Interactive Brokers, will even let you incorporate an Excel-based trading system. The procedure is simple and begins with installing the IB Excel API.

How it works:

BacktestingXL Pro is a Microsoft Excel 2010-2016 add-in for creating and testing trading strategies. BacktestingXL Pro allows users to create strategies using VBA (Visual Basic for Applications). VBA knowledge is not required; you can make trading rules on a spreadsheet using conventional pre-made backtesting codes instead of VBA-created trading rules.

Pyramiding (changing position size during an open trade), short/long position limiting, commission calculation, equity tracking, out-of-money controlling, and buy/sell price customizing (you can trade at Today’s or Tomorrow’s Open, Close, High, or Low prices) are all features available in BacktestingXL Pro. This type of feature allows you to create “natural” trading methods.

Pros

- Excel is widely available

- One of the best ways to backtest for free

- Your own costume data can be inputted and programmed

Cons

- Not as strong as other backtesting platforms

- Tedious and time-consuming

Price and Fees:

Backtesting with excel is available for use freely.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Microsoft Excel website |

What to look for in a Backtesting Software

When it comes to backtesting software, the most crucial requirement is to choose packages that allow you to use data that would have been available on time; you’ll run into a statistical problem known as a postdictive error if you don’t do this. Your analysis won’t reflect how a trader would make judgments when executing a strategy. One example would be if the program only operated with closing prices; this isn’t a realistic situation because the market would have closed by the time that price became accessible for the hypothetical trader to decide!

The most precise technique to avoid postdictive error is to perform all backtesting manually. Because this is rarely realistic, choosing software that allows for as much customization as possible is critical. The more automated and inflexible the software is, the more postdictive error it is likely to contain.

Looking for programs that simplify and rerun the study with one variable altered is another valuable technique to use backtesting software. A trader might, for example, devise a strategy that includes selling any stock that has lost 35% of its value. A robust program will be able to demonstrate what the outcomes would be.

Best Forex Training Course

Thousands of people from the United States, the United Kingdom, Hong Kong, India, Indonesia, Japan, Malaysia, Vietnam, and other nations have been trained in Singapore, and other locations across the world have been trained and mentored by The Asia Forex Mentor.

They have the greatest forex trading education in Asia. Their course is designed to allow you to make money while learning. With the assistance of a skilled trader, you will be able to trade forex profitably.

They’ve advised not only individual students but also corporations and financial institutions on foreign exchange, including the DBP, the Philippines’ second-largest state-owned bank with assets of more than $13 billion.

The course is reasonably priced, and it is backed by a money-back guarantee. You can begin the course by registering for a free trial. You can decide whether or not to continue with the course after the free trial period.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion:

Backtesting determines the accuracy of a strategy or forecast model by applying it to past data. It is used to evaluate and compare the viability of trading strategies so that traders can implement and fine-tune effective ones.

TradeIdeas is a fully regulated and transparent forex broker with high operational standards, minimal trading costs, better service delivery, and a focus on assisting investors in achieving their goals. Other backtesting software with great specific features was discussed in the article. Such as Tradestation, Trandingview, Trendspider, NinjaTrader etc.

There are several versions of backtesting software that are free and some paid versions. There are ones that can backtest and forecast simultaneously. Most importantly, look out for one that is easy for you to use and does the job you require well.

Best Backtesting Software FAQs

Which software is best for backtesting trading strategies?

Trade-Ideas, MetaStock, and Tradingview are the top stock backtesting software for traders. Trade-Ideas was chosen as the finest stock backtesting software for traders; it is a wholly automated AI trading system that handles all the backtesting for you.

MetaStock is the most powerful stock backtesting and forecasting software for broker-agnostic traders. Tradingview provides a free stock backtesting tool that is clever and reliable. TrendSpider is an advanced AI-powered automated backtesting and chart analysis tool.

Which platform is best for backtesting?

You can get a lot of excellent backtesting software on the internet. However, some free ones may not have all your required capacity for forex backtesting. Some software, on the other hand, is paid and valuable.

We’ll see both commercial and free software in the top 5 stock backtesting software, so there’s something for everyone. The top 5 stock backtesting software are underlisted:

MetaStock’s Backtesting Software, Tradingview, MetaTrader 5, Interactive Brokers Portfolio Manager, and The TrendSpider.

Where can I backtest forex for free?

For free Forex backtesting software, the TradingView platform is a fantastic choice. The powerful charting tools are the most well-known feature of this Forex trader program. Real-time data and browser-based charts enable research from anywhere because there is no software to install and no complicated settings to worry about.

It’s a social platform that allows you to discuss, monitor, and collaborate with other traders and broadcast your methods on social networking sites like Twitter and blogs. The Bar Replay Feature is one of the most helpful backtesting tools on this platform.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.