MTrading Review 2024 with Rankings by Dumb Little Man

By John V

May 14, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.2 1.5/5 | 142nd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies MTrading as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

MTrading Review

By providing access to currency markets, forex brokers make it easier for traders to trade foreign currencies. These brokers enable both novice and expert traders to participate in the forex market by serving as middlemen and facilitating trades between clients and the currency market. In order to profit from fluctuations in exchange rates, forex traders speculate on the movement of currency pairings.

MTrading is an FX and CFD broker renowned for providing traders with competitive trading conditions and a wealth of support. MTrading stands out from the competition with features like Social Trading, high IB payouts, and a deposit bonus of up to 200%. This review emphasizes MTrading’s dedication to security, education, and client happiness, which makes it a recommended option for traders.

What is MTrading?

Aiming to help traders of all skill levels navigate the financial markets, MTrading is a forex and CFD online broker. Offering competitive trading conditions, an award-winning Partnership program and a variety of instructional tools are some of the ways that MTrading sets itself apart. These consist of both online and offline news, articles, and webinars.

The broker is highly respected for its many affiliate benefits, which include large IB payouts with additional awards and a revenue-sharing rate of up to 60%. Additionally, MTrading advertises its Social Trading platform, which enables users to easily mimic the transactions made by seasoned pros. They also provide alluring benefits including a deposit bonus of up to 200%.

In the ten years since it launched, MTrading has expanded to work with over 5,000 partners and service over 260,000 active clients. The company takes great pleasure in its high client satisfaction rates, as seen by the 60% five-star evaluations it has received on Trustpilot. Additionally, MTrading guarantees the safety of customer cash by closely adhering to global regulatory requirements.

Safety and Security of MTrading

MTrading carefully points out the significant dangers associated with trading Forex and CFDs, particularly because of the significant leverage that can magnify profits as well as losses. Because of this leverage, trading strategy results can be greatly impacted by even slight changes in the market, which could result in huge losses.

MTrading suggests that before beginning any trading activity, prospective traders evaluate their financial capability and risk tolerance. They also make it apparent that margin trading has a risk level that may not be appropriate for all investors, emphasizing the necessity of carefully weighing investing objectives and expertise level.

In order to protect its customers, the broker is eager to teach them the value of keeping sufficient margin levels and regularly checking open positions. MTrading cautions that in the event of market volatility, extra cash can be needed quickly to maintain positions, which could be important in averting significant losses.

In order to educate traders on the possible financial risks and obligations connected with leveraged trading, this comprehensive analysis of MTrading’s risk disclosure and security procedures is founded on in-depth research and professional insights supplied by Dumb Little Man.

Pros and Cons of MTrading

Pros

- Leverage up to 1:1000

- Education program for various experience levels

- Trading terms ideal for all skill levels

- Regulations that define broker-trader relationships

- Insurance on client funds up to 20,000 euros

- Public access to accreditation and documents on the website

Cons

- Limited trading assets

- No stop or limit orders

- Minimum deposit of $100 may deter beginners

- Withdrawal issues occur frequently

- Lack of Islamic (swap-free) accounts

- Unresponsive client support

- Trading platform reliability issues

Sign-Up Bonus of MTrading

One easy way to get started with trading without having to worry about money is to sign up for the MTrading $30 Welcome Bonus. The “Get your bonus” button, account registration, and successful verification process are the steps required for new customers to receive this offer. The bonus can be accessed by traders right away, as there is no need to make a deposit.

New users can experience trading in actual market conditions with this promotion, which is specifically designed to help them avoid risking their own money. Before it is deleted from the account, the $30 bonus has to be used within 40 calendar days. You may withdraw profits—up to a limit of $200—from trading the bonus.

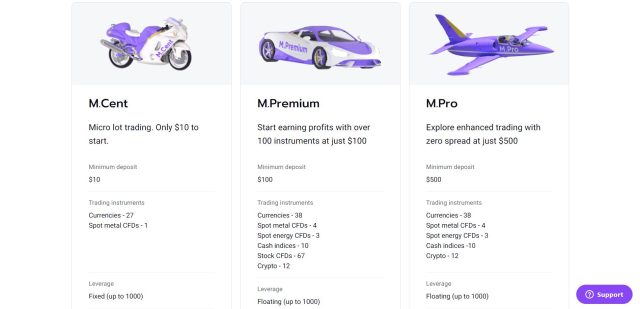

Minimum Deposit of MTrading

To accommodate a range of trader needs, MTrading provides a number of account types with varying minimum deposit amounts. Because it is just a small $10 investment, the M.Cent account is perfect for novices as it allows micro lot trading. Anyone new to trading who wants to start with little money can access it because of its cheap sign-up cost.

The minimum deposit for the M.Premium account is $100, which is required for traders who want access to a wider selection of assets. For traders looking to diversify their portfolios, this account is appropriate because it gives access to more than 100 instruments.

Experienced traders who want better trading conditions—like 0% spreads—should use the M.Pro account. Better trading terms and advanced tools are available with this account, which has a $500 minimum deposit.

The potential gains for partners are further increased by MTrading’s Dynamic IB Partnership Program, which offers an additional reward of up to 10% of the net deposit every day. With the use of an open, flexible architecture, this initiative aims to boost daily IB payouts while rewarding active clients and increasing income.

Also available to traders is a 200% Deposit Bonus, which offers extra margin and greatly improves trading efficiency. With the option to select between a bonus ranging from 25% to 200% of the deposit, this offer is among the greatest available on the market and allows traders to maximize their trading potential. It is instantly available upon deposit.

MTrading Account Types

Based on intensive testing and research conducted by a team of professionals at Dumb Little Man, MTrading offers three separate account types that are suited to varying levels of traders.

Every account gives you access to the MetaTrader 4 platform, which includes features like one-click trading, automatic trading with expert advisors, and mobile trading on Apple and Android devices. Every account has market execution, no requotes, a 0.3 stop-out level, and hedging is permitted.

M.Cent Account

- Minimum deposit: $10

- Trading instruments: 27 currencies, 1 spot metal CFD

- Leverage: Fixed (up to 1000)

- Spread: From 1 pip

- Commission: No

- Minimum/Maximum order size: 0.01 lots (step 0.01) / 1 lot

- Maximum open and pending orders: 5

M.Premium Account

- Minimum deposit: $100

- Trading instruments: 38 currencies, 4 spot metal CFDs, 3 spot energy CFDs, 10 cash indices, 67 stock CFDs, 12 cryptos

- Leverage: Floating (up to 1000)

- Spread: From 1 pip

- Commission: No

- Minimum/Maximum order size: 0.01 lots (step 0.01) / 100 lots

- Maximum open and pending orders: 200

M.Pro Account

- Minimum deposit: $500

- Trading instruments: 38 currencies, 4 spot metal CFDs, 3 spot energy CFDs, 10 cash indices, 12 cryptos

- Leverage: Floating (up to 1000)

- Spread: From 0 pips

- Commission: $4 per 1.0 lots

- Minimum/Maximum order size: 0.01 lots (step 0.01) / 200 lots

- Maximum open and pending orders: 200

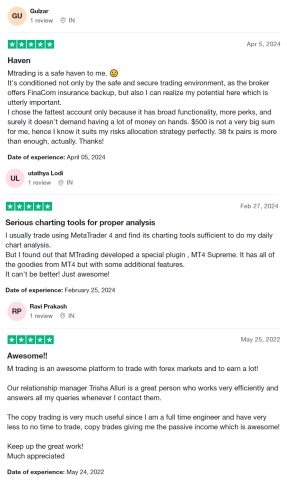

MTrading Customer Reviews

A major factor in MTrading‘s customer satisfaction is FinaCom insurance, which contributes to its safety and reliability. Strong features and compatibility with multiple risk strategies characterize the platform’s higher-tier accounts, such as the $500 minimum deposit choice. In terms of sophisticated charting tools, MetaTrader 4 and the MT4 Supreme plugin are well-known.

The copy trading feature is a useful way to earn passive money, especially for individuals with limited trading time, which is also well-liked by users. Also, the user experience is greatly improved by how quickly and effectively customer support is provided, especially by relationship managers.

MTrading Fees, Spreads, and Commissions

To meet the needs of traders with varying trading styles and financial capacities, MTrading provides a range of fees, spread, and commission structures. For people who are new to forex trading, the M.Cent account is an accessible choice. It can be opened with a minimum deposit of just $10, offers spreads starting at 1 pip and has no commissions.

A somewhat larger minimum deposit of $100 is required for the M.Premium account, which caters to more seasoned traders and permits trading on over 100 instruments. It has similar features to the M.Cent account, including commission-free spreads starting at 1 pip. For traders who want to access a greater array of trading alternatives at a lower cost, this can be especially alluring.

Because of its zero spread feature and $500 minimum deposit, the M.Pro account targets experienced traders. A $4 charge is added to each 1.0 lot traded with this account, even if it removes the spread cost on trades. Traders with big volumes who are comfortable handling the simple fee cost and like to trade at the interbank rate will find this suitable.

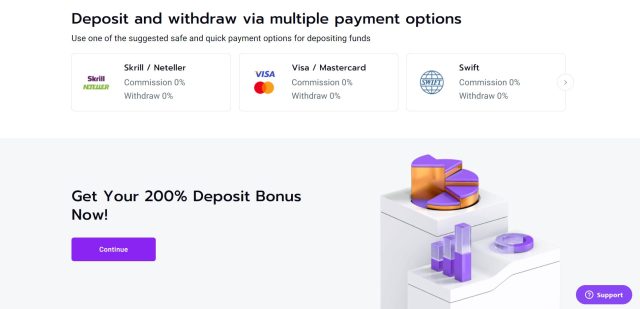

Deposit and Withdrawal

A trading expert from Dumb Little Man attests to MTrading‘s array of deposit and withdrawal choices, all of which are intended to be simple and effective. Popular methods such Skrill, Neteller, Visa, Mastercard, and Swift are commission-free for both deposits and withdrawals, allowing users to fund their trading accounts or withdraw money.

For those who prefer conventional banking methods, MTrading also offers flexibility by supporting Wire Transfers and Local Online Banking, both of which have zero commission fees for deposits and withdrawals. By offering choices like Tether, Local Depositor, Dragonpay, and Perfect Money, the platform further expands its ease and accommodates a wide range of trader preferences.

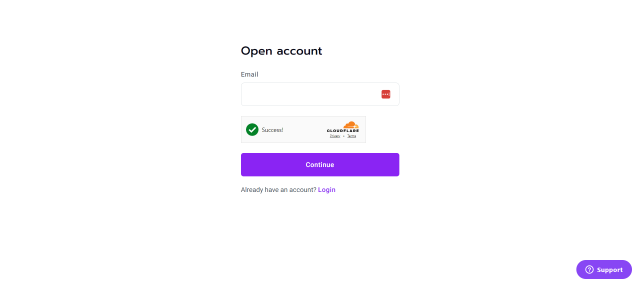

How to Open an MTrading Account

Whether you want to start trading risk-free with a Demo account or get right in with a Live account, opening an account with MTrading is an easy process. Users can quickly register for a Live account, send in the required paperwork, and start trading as soon as the account is paid and authorized.

As an alternative, the Demo account provides a straightforward setup for practicing trading in a virtual setting without incurring any financial risk. With the help of MTrading’s online platform, traders may access both account types and tailor their trading experience to their own requirements and tastes.

Live Account

- Visit mtrading.com and log into your personal cabinet.

- Navigate to the ‘open new account’ tab.

- Choose ‘live trading account’ from the account options.

- Complete the required fields in the application form.

- Submit any necessary identification documents for verification.

- Wait for account approval, which may take a few business days.

- Once approved, fund your account using one of the available deposit methods.

- Set up any trading preferences and tools you need.

- Begin trading on your new live account.

Demo Account

- Access the Dashboard in your Trader’s room on the trading platform’s website.

- Click on the “Open new account” button.

- Select the option to create a Demo account from the available choices.

- Fill out the required information in the account registration form.

- Confirm all the details are correct and complete any verification steps.

- Submit your application to create the Demo account.

- Wait for the confirmation email or notification from the platform.

- Once confirmed, log into your new Demo account.

- Start exploring and practicing trading in the simulated environment.

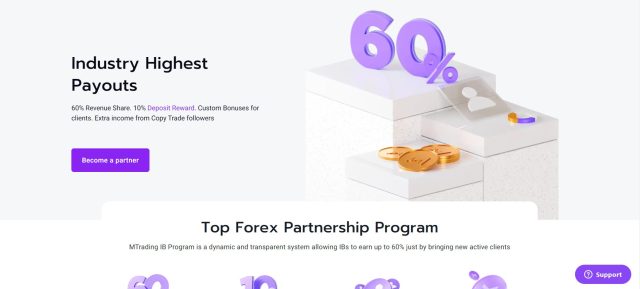

MTrading Affiliate Program

With an attractive revenue-sharing scheme, MTrading‘s Affiliate Program provides some of the best payments in the market. Together with extra perks like a 10% deposit reward and personalized bonuses for clients they suggest, affiliates can earn up to 60% of revenue.

Because of its clear and dynamic system, the MTrading IB Program is regarded as one of the best Forex partnership programs. Offering up to 60% revenue share as well as further benefits including 10% of net deposits and 10% commission from sub-IBs, it encourages Introducing Brokers (IBs). The program offers fully detailed information, an intuitive dashboard, and automated daily rewards.

Customizable incentives and marketing support are offered to IBs to help them draw in and keep customers. The program’s design includes multiple partnership tiers, from the Family level to the Diamond level, which promotes expansion by raising the proportion of engaged clients.

Partners can get increased commission rates based on the trading activity of the clients they recommend as they advance through various stages. This tiered system provides a clear and gradual incentive structure that encourages affiliates to grow their network and maximizes their earning potential.

MTrading Customer Support

Quick and effective service is guaranteed by the way MTrading‘s customer care is set up. In order to get prompt assistance with any queries or issues, customers can contact [email protected] or use the website’s handy live chat tool. Accessible and responsive communication channels are made possible by this dual strategy.

MTrading also has an office in No 5, Jalan Anggerik Vanda 31/166C, 40460, Kota Kemuning, Selangor, for those who would like to communicate more personally or want in-person services. The aforementioned data is derived from Dumb Little Man’s experience and serves to underscore the organization’s dedication to offering its consumers all-encompassing assistance across several channels.

Advantages and Disadvantages of MTrading Customer Support

| Advantages | Disadvantages |

|---|---|

MTrading vs Other Brokers

#1 MTrading vs AvaTrade

Although they serve various trader needs and preferences, MTrading and AvaTrade are both well-known FX and CFD brokers. For traders who want an easy-to-use platform with competitive spreads and a strong affiliate network, MTrading provides a plain and efficient trading environment. However, AvaTrade offers a wider selection of tradable instruments and more sophisticated trading platforms that can be used for both manual and automated trading programs. AvaProtect, an insurance option for deals, and negative balance protection across all jurisdictions are two of AvaTrade’s most notable features. For traders seeking a wide range of trading environments and substantial support, AvaTrade is a preferable option due to its global presence and abundance of training resources.

Verdict: For traders looking for a large selection of trading instruments and extra security features like trade insurance and negative balance protection, AvaTrade might be more enticing.

#2 MTrading vs RoboForex

Users of RoboForex and MTrading get different experiences. With a selection of trading platforms that accommodate different trading styles and preferences, including MT5, MT4, cTrader, and R Stock Trader, RoboForex stands out in the market. It has established a solid reputation for having a wide range of trading tools and accommodating trading circumstances. MTrading prioritizes competitive spreads, an easy-to-use interface, security, and customer service over platform versatility. It has established a solid reputation for having a wide range of trading tools and accommodating trading circumstances. MTrading prioritizes competitive spreads, an easy-to-use interface, security, and customer service over platform versatility.

Verdict: Though MTrading is a good choice for traders who value a simple trading environment with strong customer support, RoboForex is probably a better choice for traders seeking technological diversity and customization in their trading platforms.

#3 MTrading vs FXChoice

Although they cater to slightly different market niches, both MTrading and FXChoice provide forex and CFD trading. An attraction for traders interested in emerging markets is FXChoice’s selection of exotic forex pairs, which include the South African Rand, the Norwegian Krone, and the Russian Ruble. Trading on important commodity CFD markets, such as those for gold, silver, and crude oil, is another feature that FXChoice offers. There aren’t as many exotic and commodity alternatives on MTrading, despite providing a reliable trading environment.

Verdict: MTrading offers a less diversified portfolio than FXChoice, making it a better option for traders wishing to investigate chances in rising forex markets and major commodity markets.

Choose Asia Forex Mentor for Your Forex Trading Success

If you’re eager to embark on a successful career in forex trading and are aiming for significant financial success, Asia Forex Mentor is the top pick for comprehensive forex, stock, and crypto trading courses. Ezekiel Chew, a prominent figure in the trading world known for his involvement with trading institutions and banks, leads Asia Forex Mentor. Personally, Ezekiel regularly secures trades in the seven-figure range, marking a notable distinction from other educators in this sector. Below are the key reasons we endorse this choice:

- Comprehensive Curriculum: Asia Forex Mentor provides a thorough educational program that spans forex, stock, and crypto trading. This structured curriculum is designed to equip emerging traders with the necessary skills and knowledge to thrive in various markets.

- Proven Track Record: The reliability of Asia Forex Mentor is well-documented through its consistent history of developing profitable traders across different markets, showcasing the success of their educational strategies and mentorship.

- Expert Mentor: Asia Forex Mentor offers the expertise of an accomplished mentor, Ezekiel Chew, who has an impressive track record in forex, stock, and crypto trading. His personalized guidance helps students confidently understand and navigate market complexities.

- Supportive Community: Enrollment in Asia Forex Mentor includes joining a community of ambitious traders focused on succeeding in the forex, stock, and crypto markets. This community encourages sharing ideas and collaborative learning, greatly enriching the educational experience.

- Emphasis on Discipline and Psychology: Achieving trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to assist traders in managing their emotions and stress, fostering decision-making that is both thoughtful and well-informed.

- Constant Updates and Resources: Recognizing the dynamic nature of financial markets, Asia Forex Mentor ensures that students stay current with the latest trends and strategies through ongoing access to essential resources.

- Success Stories: Many students at Asia Forex Mentor have dramatically transformed their trading careers, achieving financial independence with the help of the program’s comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the foremost choice for those seeking an extensive course in forex, stock, and crypto trading, aimed at forging a lucrative career and securing financial growth. With its detailed curriculum, experienced mentors, practical approach, and collaborative community, Asia Forex Mentor equips budding traders with the tools and guidance needed to become successful professionals in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: MTrading Review

With high leverage of up to 1:1000 and an extensive education program for traders of all skill levels, MTrading is renowned for its competitive offerings in the FX and CFD brokerage space. Strict rules that protect trader-broker interactions are followed by the broker, who also offers insurance of up to 20,000 euros to guarantee the security of client assets.

Risk-averse traders may be discouraged by MTrading’s drawbacks, which include a limited variety of trading assets and the lack of stop or limit orders. The platform has a reputation for frequent withdrawal issues which may put off some novice users. Despite these drawbacks, however, MTrading still emerges as an option for traders looking for a viable forex broker.

>> Also Read: Interstellar FX Review 2024 with Rankings By Dumb Little Man

MTrading Review FAQs

Is MTrading a legit broker?

MTrading broker is considered a legitimate broker. It operates with compliance to international regulatory standards, ensuring that client funds are protected like a bank account and trading strategies adhere to legal requirements. The broker also provides transparency through public access to accreditation and documents on its website.

How long does it take to withdraw money from MTrading?

The time it takes to withdraw money from MTrading can vary based on the method used, but some users have reported frequent withdrawal issues. Generally, withdrawals should be processed within a few business days, but delays can occur, and it’s recommended to check specific withdrawal timelines directly with the financial services authority.

Is MT4 trading safe?

MT4, a tick chart trader, is widely regarded as a safe trading platform. It employs robust security measures, including data encryption and secure communication between client and server. However, the safety of trading on MT4 also depends on the reliability of the broker using it, so it’s important to choose a reputable broker to maximize the platform’s security features.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.