How To Trade With Wolfe Wave Pattern (2024)

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The Wolfe Wave pattern is a price chart pattern consisting of five wave patterns in price that indicate an underlying equilibrium price and predict the trend reversal in the market. The Wolfe Wave pattern is a naturally occurring trading pattern that will work in every market, and fortunately, it is not difficult to identify those Wolfe Wave patterns.

For this article, we have a renowned and seasoned forex mentor, Ezekiel Chew, to further elaborate on the whole concept of the Wolfe Wave pattern in simple terms. Scroll down the paragraphs below to learn more about the Wolfe Wave pattern, the rules, and how to spot the Wolfe Wave pattern.

What is Wolfe Wave Pattern

The Wolfe Wave pattern is a chart that shows the pressure and action that occurs with the price; this price action comprises five waves that indicate the demand and supply within the market as the price pushes to get an underlying equilibrium price.

This Wolfe Wave pattern is a trading strategy that investors use to set a time frame for their trades based on the resistance and support lines indicated by the chart pattern. This Wolfe Wave pattern doesn’t have a specific time frame as it can happen anytime.

The Wolfe Wave trading strategy is the best technical analysis tool for indicating specific patterns that show a price change; essentially, it predicts the estimated price destination by following the price trend and the expected time with which it will get there.

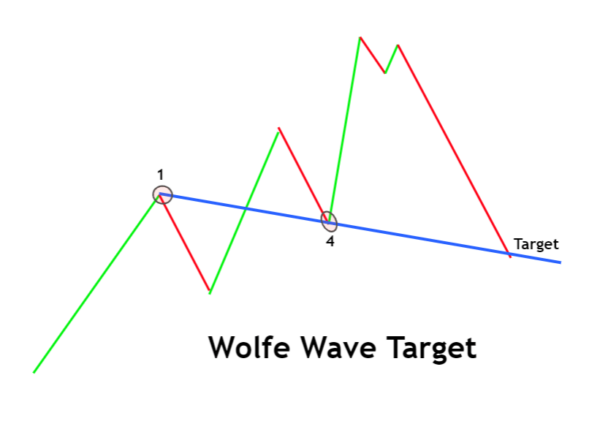

Most experienced traders use the Wolfe wave pattern for long-term predictions and trade in the predicted direction but on lower timeframes. For example, they predict that a fifth wave will occur after the first four waves. Hence, they draw a profit target line between the first and fourth points.

For clarity on the Wolfe Wave trading strategy, there are a series of price oscillations and rules to follow; these rules will indicate if the Wolfe Wave pattern is the outcome of random price oscillations.

Wolfe Wave Pattern Rules

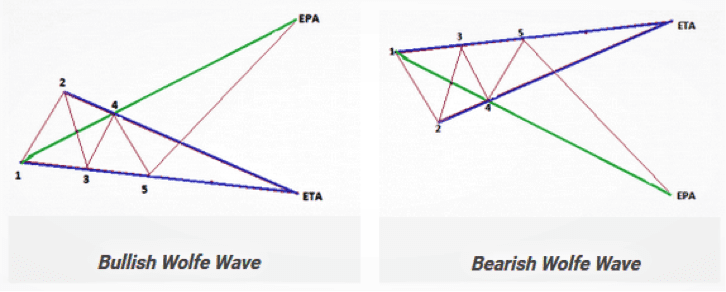

The Wolfe Wave pattern rules apply to both the bullish Wolfe Wave and the bearish Wolfe Wave patterns. In addition, the harmonic pattern of the Wolfe Wave also helps identify some chart patterns; harmonic patterns can be seen in the bearish Wolfe Wave pattern, the bullish Wolfe Wave pattern, and on horizontal channels.

For chart patterns to be called the Wolfe Wave patterns, they must strictly follow all the rules outlined below.

- The wave cycles must occur at a consistent time interval. This implies that wave cycles take the same time to complete from low to high. A consistent time interval exists between the first, third, and fifth waves.

- The third and fourth waves formed must remain within the channel created by the first and second waves.

- The first wave should be either greater or equal to the third wave.

- The third and fourth waves must show a symmetry pattern with the first and second waves, which implies that they must be approximately equal.

- In the Wolfe Wave pattern, the last wave, the fifth wave, breaks out of the channel such that it breaks and surpasses the trend line created by the first and third waves.

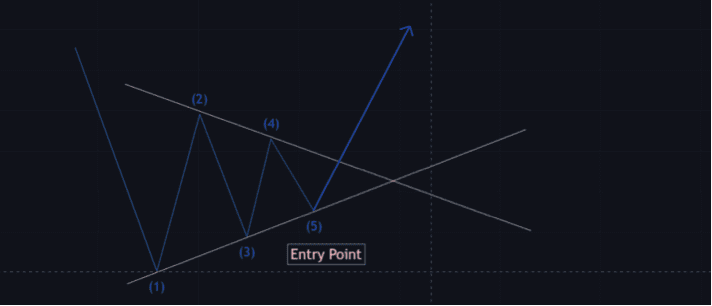

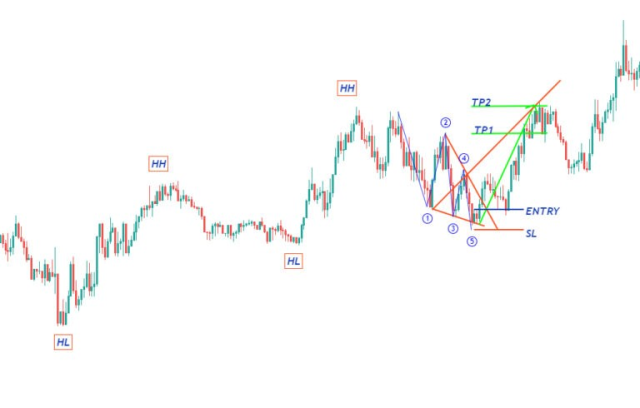

According to the theory behind the Wolfe Wave pattern, from the beginning of the first wave, a line will be drawn passing through the beginning of the fourth wave; this predicts a target price for the end of the fifth wave. Also, the fifth wave is used in triggering the entry point.

For experienced traders who can properly identify a Wolfe Wave pattern as it forms the beginning of the fifth wave represents an opportunity to either take a short or long position. The target price predicts the end of the wave, and it is at this point that the trader aims to profit from the position.

Important Reasons for using Wolfe Wave

There are many important reasons for using the Wolfe Wave pattern, but the most prominent reason is to get an estimated price and a better price action estimation.

- To predict market movements, price destination, and time frame of trades for maximum profit.

- To determine the short-term price action reversal.

- For reading the market trends with trading entries.

How to Determine Wolfe Wave Pattern

Trading chart patterns would not ordinarily show you where the Wolfe Wave patterns are; with the aid of the rules mentioned above, you would be able to figure out a Wolfe Wave pattern within the channel created.

Knowing that the Wolfe Wave pattern is a naturally occurring trading pattern, traders need to know how to spot a Wolfe Wave pattern and apply it to maximize profits. However, not all spots are Wolfe Wave patterns. Hence, you must be able to identify price oscillations.

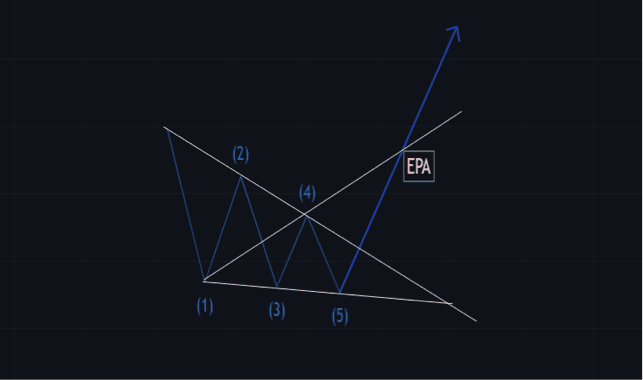

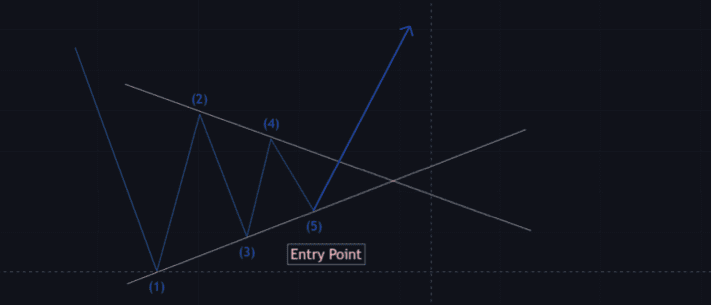

For the bullish Wolfe Wave pattern;

The bullish Wolfe Wave pattern represents a falling wedge pattern that occurs when the upper resistance is broken properly. This implies that a bullish Wolfe Wave pattern is formed after a bearish trend. Once a bullish pattern is formed, you wait till the price hits the fifth wave of the falling wedge pattern.

As soon as the bullish trend reversal candlestick pattern shows up, it is a signal for traders to buy, and at this point in the trading pattern, it is essential for traders to monitor the trend pattern, withdraw the profit made, and once the price reaches the extended point line that extends from the first and fourth points, they can start to sell again.

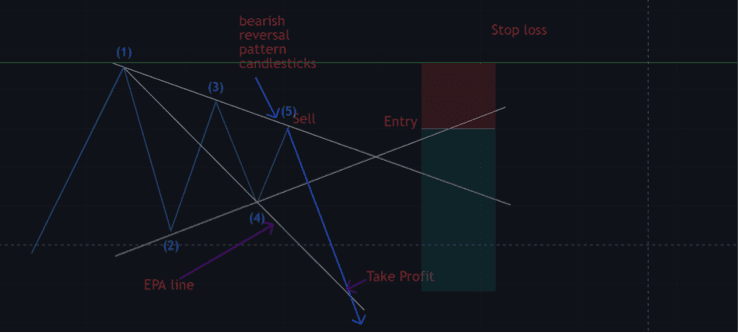

For the bearish Wolfe Wave pattern;

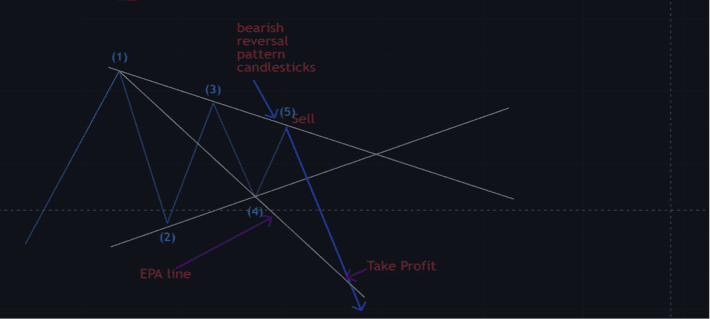

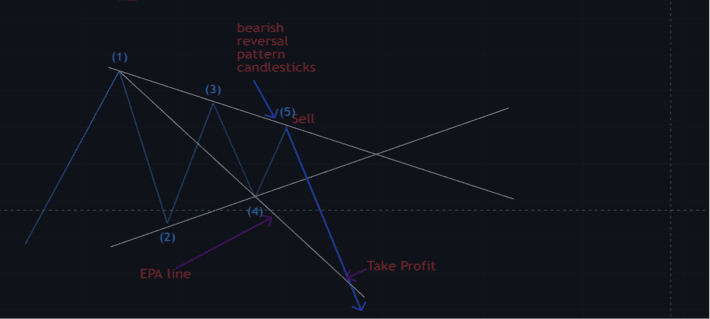

In the bearish Wolfe Wave pattern, an ascending channel will form when the rising channel breaks its support, which consists of the waves. A bearish Wolfe Wave pattern is formed in the fifth wave after a breakout of the channel, and at this point, prices make consecutive higher lows and highs, indicating an uptrend in the trend lines.

In the bearish Wolfe Wave pattern, traders are to sell at the fifth wave with a price target fixed at the extended point line drawn; the extending point line drawn must extend to the future to ensure accuracy because, at this point, traders cannot determine an exact price target for profit the moment they start to sell. Also, traders should wait until the bearish trend reversal candlestick shows up as a confirmation.

At this point, traders need to monitor the trend pattern of the chart, withdraw the profit that is made, and once the price hits the extended line drawn, leave the trade.

Power of Risk Management

No trading investment is risk-free, but it is now the choice of each trader to know how to properly manage risks. However, it is not a technical analysis tool, it’s a technical analysis skill that a trader must possess.

For traders to be safer, they must know when to leave the trade and when profit should be withdrawn irrespective of the Wolfe Wave extended point line to reduce their own risk.

The Wolfe Wave trading platform will help traders to know how to secure their profits and monitor the market movements by setting a stop-loss below the last wave to protect their trade. This is because the last wave, which is the fifth wave, signals the end of either a bullish or bearish Wolfe Wave pattern with the breakout at the end of the channel.

Any trader who abandons risk management and stop-loss is planning to fail at his own risk.

How to Set the Profit Target

There are two ways to set the profit target, namely;

#1. The specific price

The specific price is obtained from the line between the starting point of the first and the fourth lines, and once the fifth point crosses the line, it indicates that the price action is favorable for sales.

#2. The time frame

When the trading chart is at the point of connection of two lines, it indicates it is time to sell and leave the trade room.

Other Examples of Wolfe Wave in a Chart

The other examples of Wolfe Waves pattern are;

Best Forex Trading Course

Asia Forex Mentor is one of the most credible forex trading courses available today. It is headed by Ezekiel Chew, a trader making six figures per trade for over a decade. The trading methods are backed by mathematical probability and the trainer behind banks and trading institutions.

AFM PROPRIETARY ONE CORE PROGRAM is the core program that covers from beginner to advanced, and every segment must include the above points. The program is designed to make you confident and earn as quickly as possible in live markets.

It starts with the basics of forex trading and moves on to more advanced topics such as risk management, market analysis, and trade execution. The course also includes a live trading session where you can see the techniques being applied in real-time. If you’re serious about learning forex trading, sign up now!

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Wolfe Wave Pattern

The Wolfe Wave chart pattern is a pattern that forms a harmony pattern with the five waves and lines. Once a trader can apply all the rules outlined above and spot all the five waves present, the trader can then trade with the risk-reward ratio available, a precise stop-loss, and a target price.

The Wolfe Wave indicator is an analysis that takes either the bottom or top-picking approach, while the Wolfe Wave pattern is about the price channels and trend lines. However, I do hope that you can make the best of your trade with the outlined Wolfe Wave definition and other processes explained.

Wolfe Wave Pattern FAQs

Is Wolfe Wave Pattern Profitable?

Wolfe Waves’ potency has consistently been demonstrated. The Wolfe Waves may be the best you’ll use if the patterns and charts are made correctly. The dominant factor in determining this pattern is symmetry.

These patterns are relatively flexible in terms of time yet narrow in their application. For instance, Wolfe Waves can last from a few minutes to several weeks or months, depending on the channel. The scope, however, can be predicted with astounding accuracy. Because of this, Wolfe Waves can be very powerful when used correctly.

Who Invented the Wolfe Wave?

The Wolfe Wave pattern was identified by Bill Wolfe, a prominent S&P500 trader, and his son, Brian Wolfe. Like the Elliott Wave pattern, Wolf Waves are naturally recurring patterns across all time frames and diverse asset classes. The Wolf Wave only illustrates the markets’ regular ebb and flow.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.