What is Forex Trading

By Dumb Little Man

January 10, 2024

Forex trading is a segment of the financial market where trades are carried out by traders all over the world. Forex trading is a popular form of investment that involves the exchange of currencies for purposes ranging from international trade, commerce, tourism, etc.

The foreign exchange market is the largest market in the world. It is a currency trade market that is more volatile than other markets. In forex, you can trade your local currency against other international currencies.

Forex is the process of changing one currency into another. It is a network in which you buy and sell currencies. It is the means by which individuals, companies, and central banks change one currency into another. Simply put, it is the act of exchanging currencies. A vast majority of these traders may be hedging against future exchange rate fluctuations.

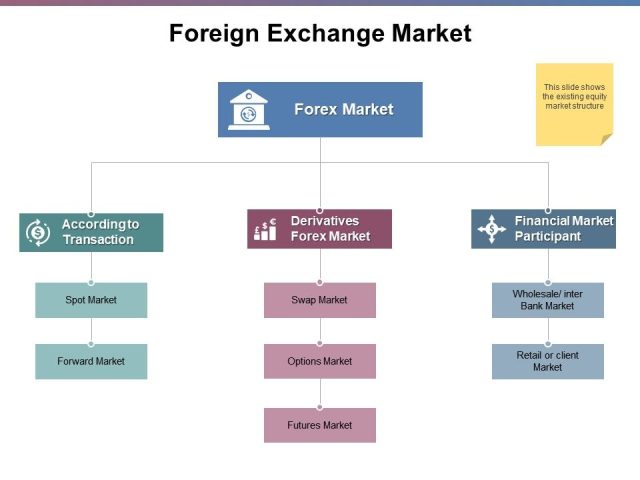

What is a Foreign Exchange Market?

Forex exchange market is a global marketplace that’s open 24 hours a day for exchanging foreign currencies. It is a trading platform for traders to buy and sell foreign currencies.

Forex trading is conducted electronically over the counter (OTC); there’s no physical contact or exchange between the forex traders. All currencies trade in the currency market occur through computer networks among traders across the globe. Commercial banks and other financial institutions oversee the central exchange. The forex market is open 24 hours a day, five days a week. It is very active any time of day.

Brief History Of Fx Trading

Forex has been around for a very long time, dating back to the Babylonian period. There has always been exchanging of goods and currencies in financial markets. The forex market only got modernized and shaped by global events like Bretton Woods and the gold standard.

The barter system is the oldest form of exchange that began in 6000BC. It was introduced by Mesopotamia tribes. Goods like salt and spices were exchanged in this system. In the early 6th century BC, gold coins were produced and served as a currency and a medium of currency exchange. The gold coins were changed into a gold standard but could not hold up during the world wars.

The major transformation of the forex market was the Bretton Woods System which occurred toward the end of World War II. The Bretton Woods system came to an end in 1971, and the Free-Floating System began. Currencies were allowed to float freely against one another. Today, the forex market is the largest market in the world, with more than $5 trillion traded daily.

How to Trade Forex

Foreign currencies are traded against each other as currency pairs. All currencies are given a three-letter code. In most cases, the first two letters stand for the country, and the third letter stands for the currency itself.

The most popular currency is the US dollar. It is involved in a vast majority of forex trades. The three-letter code for the US dollar is USD. The next in line of most popular currencies in the forex market is Euro which is used in nineteen countries in the European Union. The three-letter code for Euro is EUR.

The major currencies in order of popularity include:

- US dollar (USD)

- Euro (EUR)

- Japanese Yen (JPY)

- British pound (GBP)

- Australian dollar (AUD)

- Canadian dollar (CAD)

- Swiss franc (CHF)

- New Zealand dollar (NZD)

Each of these currencies is traded against each other in something called a currency pair. Each currency pair represents the current exchange rate for the two currencies.

The seven major currency pairs include:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CAD

- USD/CHF

- NZD/USD

Currency pairs are split into categories which include:

- Major pair: The seven pairs listed above are the major pairs in the foreign exchange markets. They make up 80% of global forex trading.

- Minor pair: This is a pair comprising major currencies trading against each other. Examples are EUR/CHF, GBP/JPY, EUR/GBP.

- Exotics: This is a pair comprising a major currency and currency from a developing country. Examples are USD/PLN (US dollar vs. Polish zloty), EUR/CZK.

- Regional pair: This is a pair that is classified by regions such as Scandinavia or Australasia. Examples include: (Australian dollar vs. New Zealand dollar), EUR/NOK (Euro vs. Norwegian krona).

Base Currency and Quote Currency

A base currency is the first currency in a forex pair. The base currency is the currency on the left. A quote currency is the second currency in a forex pair. It is the currency on the right.

Let’s take the EUR/USD exchange rate as an example. The first currency, EUR, is the base currency, and the second currency, USD, is the quote currency. The currency pair’s price is how much of the quote currency is needed to buy one unit of the base currency.

Forex Account and Types

A forex account is an account that you will use for currency trading. There are three types of forex accounts.

- Micro forex account: This type of forex account permits you to trade up to $1,000 worth of currencies in one lot.

- Mini forex account: This type of account permits you to trade up to $10,000 worth of currencies in one lot.

- Standard forex accounts: This type of account permits you to trade up to $100,000 worth of currencies in one lot.

What is Speculative Trading?

This means trading on assumptions that a currency price will go up or down. In this trading, there’s always a risk because the assumption can be wrong. Bear in mind factors like interest rates that affect prices.

What is Retail Trading?

Retail trading, also known as retail Forex trading, is a segment of the foreign exchange market where investors speculate on the exchange rates between different currencies and aim to profit from it.

Terminologies Used in the Forex Market

In every field, there are a few terminologies related to that particular field that one must learn. The same thing applies to forex. The first thing to do is to learn the language for this electronic trading. It is pertinent to know the terminologies used in foreign exchange trading before you begin the trading process.

- Lot: Currencies are traded in lot, which is a standardized unit of currency. A standard lot is 100,000 units of the base currency.

- Leverage: Because some traders may not have a huge amount of money to trade, almost all forex trading is leveraged. Leverage allows forex traders to trade without the required amount of money.

- Margin: Leverage isn’t free, so forex traders have to put down a deposit known as margin.

- Pip: Pip is the short form of percentage in point. One pip is equal to 0.0001 because forex prices are in at least four decimal places and are influenced by interest rates.

- Spread: This is the difference between the bid price and the ask price for a currency.

- Bid: This is the maximum amount that buyers are willing to pay for a currency. The bid price will tell you how much of the counter currency can be bought when a unit of the base currency is sold.

- Ask: This is the minimum amount that sellers require to sell. The ask price will tell you how much of the counter currency it will take for one of the base currencies to be bought.

- Bear Market: This is a market downtrend in which prices decrease for all currencies due to natural disasters or economic crises.

- Bull Market: This is a market uptrend in which prices increase for all currencies.

- Currency pair: A currency pair comprises two currencies in which one is the base currency, and the other is the quote currency. An example of a currency pair is EUR/USD.

- Exchange rate: This is the amount of counter currency needed to exchange one unit of the base currency in a foreign exchange transaction.

- Forex broker: A broker is an intermediary agent that trades on your behalf.

- Order: An order is an instruction given to your broker to perform a transaction on your behalf.

Types of Forex Trading

There are three ways to trade forex. They include:

- Spot Market: The spot market is the primary forex market where currencies are bought and sold based on supply and demand. The Spot market is based on supply and demand.

- Forward Market: This is a private contract between traders to buy a currency at an agreed-upon price on a future date. An example is the Chicago Mercantile Exchange.

- Futures Market: Futures markets are standardized contracts between forex traders to buy or sell a currency at a predetermined market price on a future date. The futures market is regulated in the US by the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC).

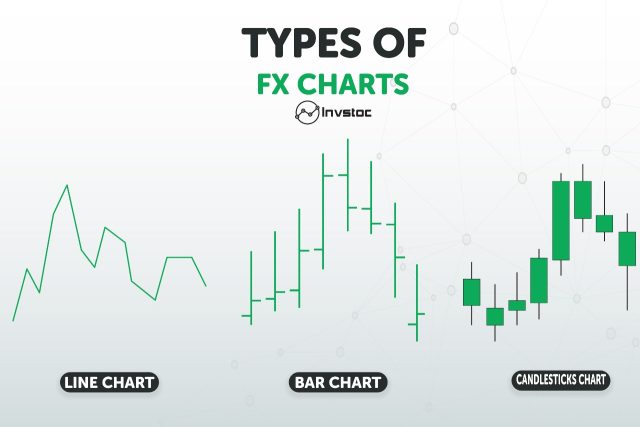

Charts Used in Fx Trading

Candlestick charts: Candlestick charts are one of the charts used in forex. It was first introduced by Japanese rice traders in the 18th century. They are one of the most common components of technical analysis.

The upper portion of a candlestick chart shows the opening price and highest price point used by a currency, while the lower portion shows the closing price and lowest price point. A down candle illustrates a period of declining prices. It is shaded red or black. An up candle illustrates a period of increasing prices. It is colored green or white.

The patterns are used to predict directions and movement of price movement.

Bar charts: Bar charts represent time periods of forex trading. Each bar chart includes the opening price, highest price, lowest price, and closing price for a trade. Like candlestick charts, they have colors that indicate price movements. Green or white indicates a period of increasing prices, while red or black indicates a period of declining prices.

Line charts: Line charts are the most common type of charts used by traders. They identify currency trends, and traders use them to strategize and identify increasing and decreasing prices.

Forex Trading Strategies

Forex trading strategies are strategies or systems devised by traders to determine when to buy or sell a currency pair. Forex trading strategy can be based on technical analysis or fundamental analysis. Individual traders have strategies that work well for them

Swing trading: Swing trade is speculative trading in which the trader holds positions for a few hours or days.

Scalp trading: Scalping is a trading strategy that involves taking small profits each from a large number of trades. The profits are restricted in terms of the number of pips. It is focused on smaller market movements. Most liquid forex pairs are used in scalp trading.

Day trading: Day trading is a trading strategy in which currencies are traded within one trading day. They’re short-term trades with a duration of hours and minutes, and all positions are closed that same day.

Position trading: This is a long-term strategy. In this type of trading strategy, traders are focused on fundamental factors. Traders who use this type of trading strategy monitor central banks monetary policies. Patient traders do this strategy because their positions may take a while to play out.

Trend trading: Trend trading is a strategy that involves trading in the direction of the trend of currency prices. Traders need to know the trend direction and duration to determine the strength. Trend trading is a reliable and consistent strategy.

Tips for Beginners in the Fx Market

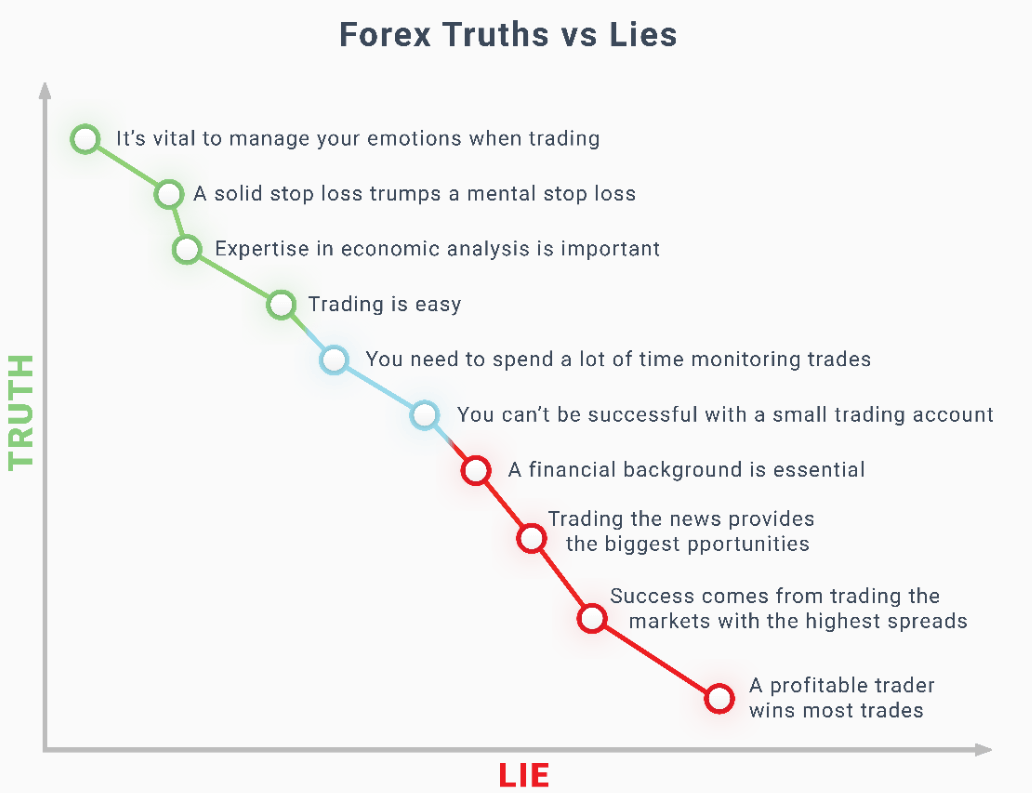

Forex is highly risky, with a large percentage of forex traders losing money. There are a few tips below to help you minimize significant risk and learn how the foreign exchange market works.

1. Choose the right forex broker

Forex brokers are agents in the currency markets. They are intermediaries that trade on your behalf. Be careful not to fall for those who disguise themselves as forex experts. Most forex brokers have the license listed on their websites. Read through them thoroughly and check out reviews from others before you begin to trade with them.

2. Start small

If you’re a newbie to the forex market, it would be wise to begin with a small trade and a micro forex account. Test the waters first and trade one at a time. Don’t be in a hurry to make it to the expert level. Most experts in the forex market started small before they began to use a strategy and began multiple trades.

3. Stay Updated

Since you are dealing with foreign currency and currency exchange, the exchange rate is affected by the state of the country’s economy. Currencies are very volatile and can drop without warning. Make sure you stay updated about the currencies you are trading in to know if it’s beneficial or not.

4. Practice

As they say, practice makes perfect. Constant practice will gradually get you to the expert level. Before you begin actual trading, you must first trade with a demo account to learn the ropes. A demo account allows you to trade with virtual money. This way, you can practice forex without risking anything. Begin practice with the EUR/USD pair.

5. Trade the majors

As a beginner in forex markets, it is advisable to stick to trading a major currency pair. Examples are EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs are generally stable. The EUR/USD is the best option.

6. Don’t be afraid to explore

Most times, brokers advise you to trade only the currencies you are familiar with, which is not a bad idea. But sometimes, you have to explore the forex market and try something new. If you explore a particular currency pair that you have never traded before, you can become familiarized with it.

7. Keep your emotions in check

Avoid being too emotional when trading forex. Do not let your emotions affect your trade. Being too emotional can make you take unnecessary risks that will cost you a lot. When you’re losing a trade, don’t go in with full force to make it back.

Don’t bite off more than you chew. As a beginner, it’s best to stick to one trade at a time. Don’t feel too confident and begin to engage in multiple trades.

8. Choose your strategy

All traders have a trading strategy that is effective for them; you have to find yours too. As you advance, choose a trading strategy that fits you.

9. Make a plan

In everything you do, you need a plan. Similarly, you need a plan in the forex markets. Creating a trading plan is a good step toward a well-seasoned forex trader. Your trading plan should include your profit goals, money management, methodology, and risk tolerance level. It’s better to trade with a risk management plan in mind.

10. Know your limits

Know how much you’re willing to risk on a particular trade. As a beginner in the forex market, it is better to keep your leverage low. Begin with leveraged trading with a 1:100 leverage ratio to avoid risking more than you can afford to lose.

Forex Trading Tutorial

Asia Forex Mentor’s founder, Ezekiel Chew who is a top forex trader, gives us a tutorial on how to trade forex and become successful. Chew abides by his mantra, “Win big, lose small.” According to him, “Forex trading is all about having an edge in the game and knowing the mathematical probability behind each trade.”

Ezekiel Chew shares with us his three key aspects of trading forex successfully.

1. He says it is pertinent first to learn how to read the charts. The first step to becoming a successful forex trader is learning how to read and decode the forex trading charts, which include candlesticks charts, bar charts, and line charts. You can trade successfully if you don’t know what each of these charts encodes. Understanding the movements in the forex market will help you choose a strategy that’s best for the situation.

2. Ezekiel advises trading with one or a combination of trading strategies. He suggests trading with a proven strategy that is tested by other traders and has been proven to be consistent.

3. Finally, Ezekiel recommends that you have a solid and defined trading system. A good trading system contributes vastly to becoming a seasoned forex trader.

To learn more about Ezekiel’s method of trading backed by mathematical probability, you can check out his one core program

Pros and Cons of Forex Trading

Pros

- It is can be very profitable.

- It can be done in any part of the world at any time on any device.

- There’s no need for physical exchange between the buyer and the seller.

- You can learn and practice on a demo account before starting the actual trading.

- Forex market is more decentralized than the stock market.

- Forex market requires less capital than every other financial markets.

- Forex market is easier to trade compared to the stock market.

Cons

- There are a lot of risks involved.

- Currency prices and exchange rates are constantly fluctuating.

- Leverage trading can put you at a risk sometimes.

- You could lose a lot of money in a blink of an eye.

- Forex trades are much more volatile than other markets.

Risks of forex trading

Forex trading requires leverage and traders use margin; this can cause losses. Currency prices are constantly fluctuating, and traders will have to execute large trades using leverage to make money. Leverage is like a loan from a broker. It’s very dangerous if the broker l does not provide a margin call. Margin carries significant risk if there’s no margin call from the broker, and you will end up owing the broker.

Also Read: 5 Best Forex Brokers

FAQ on Forex Trading

Because forex trading is global trading, there are frequently asked questions from every corner.

What does forex mean?

Forex means foreign exchange. It is the exchange of one currency to another.

Are forex trades volatile?

The forex market is liquid. Hence it is less volatile than other trading markets.

Why is forex traded?

Companies and individual traders trade forex for hedging and speculation.

Where is forex traded?

Forex is traded in spot markets, forwards markets, and futures markets.

What currencies should I trade in?

It’s advisable to trade in currencies with high liquidity. As a beginner, it is better to trade in major currency pairs like EUR/USD. The EUR/USD is considered as one of the most stable ones in the market.

How do I get started with forex trading?

To get started with forex trading, you need to learn the basics. Open a demo account to learn the ropes and trade with virtual money. Try all strategies out before sticking to the one that’s best for you.

What are the working hours of the Forex market?

Forex market is open 24 hours a day and five times a week, Monday to Friday.

What are the long and short positions?

A long position is a buy position which means that the position will be in profit if the currency rate goes up. A short position is a sell portion which means the position will be in profit if the currency rate goes down.

Can I start forex trading with $100?

You can start trading Forex with as little as $1. The minimum amount is $100 to $10,000. $100,000 and more is the required amount in the interbank market. There is hardly any limit to how much you can go. The Bank for International Settlements said the average daily turnover stood at $6.6 trillion in April 2019.

Is Forex Trading Good For Beginners?

Anybody can venture into the forex market but with proper education about the field. There are reasons why forex can be an attractive market, including people with little or no experience. One can learn and understand how forex works.

If a beginner has little knowledge about forex trading, he can understand what it’s all about to an extent. If you are considering trading forex, it’s pertinent to guard yourself up with the knowledge required for the field.

What Is Forex Trading And How Does It Work?

Forex trade is buying and selling of currency. When you make a Forex trade, you profit if the currency you buy moves up against the currency you sold. For instance, if the exchange rate between the euro and US dollar is 1.40 to 1. If o8ne buys 1,000 euros, you will pay $1,400 US dollars.

Can I Teach Myself To Trade Forex?

There are many websites, books, and resources one can take advantage of in learning Forex Trading. As they say, experience is the best teacher, so getting experience would help if you want to trade forex. To trade effectively, it’s critical to get a sound forex trading education from traders who have already done it. Ezekiel Chew the founder of Asia Forex Mentor is one of them.

Is Forex Really Worth It?

Forex is worth it for someone who has a good system and management technique. Forex should be done consistently and diligently without letting your emotions get in the way.

Because of the nature of forex, one must be focused and diligent, and ready to take all the risks to achieve something from it. Banks and multinational corporations engage in forex trading for easy transactions and all.

How Much Money Is Traded On Forex Marketing Daily?

$5 trillion worth of forex marketing takes place daily, which is $220 billion per hour. Forex is an international market made up of institutions. Luckily, Forex has no governing body ruling it, so one can make as many transactions as he wishes. Forex makes up to 90% of trading volume, and the vast majority of it relies on dollars and euros.

Is Forex Safe?

It’s safe to trade a particular currency against another. Most people might not consider forex trading as safe because of the high risk and great losses involved. But, if you have good risk management skills, you’re good to go.

Also Read: 8 Best Forex Trading Courses

Conclusion

Forex has gained a reputation for giving quick profits. It is as complex and competitive as any other market.

When you participate in forex trades, you stand a chance to participate in the global marketplace. To do this, you need to understand the forex market and develop your trading strategies. Choose a trading strategy that’s suitable for your level.

Don’t just go straight into currency trading without testing the waters. Open a demo account and learn how forex trading works. Learning the ropes takes time, so you have to be patient and consistent. Make sure to keep your emotions in check even if you are on a demo account.

As a beginner to forex trading work, begin by trading a major currency pair before going out to explore. Remember, practice makes perfect. Constant practice puts you on the path to becoming a successful forex trader.

Dumb Little Man

At Dumb Little Man, we strive to provide quality content with accuracy for our readers. We bring you the most up-to-date news and our articles are fact-checked before publishing.