Supply and Demand Forex – An In-Depth Expert’s Guide 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

The two major forces determining foreign exchange prices are supply and demand because the rate of supply and demand affects the activities of the bulls and bears in the market. While the bears push for supply pressure, the bulls push for demand pressure. Because the current price is affected by the past performance of price moves, technical analysis is easy to understand and apply to make successful trades as an investor.

Supply and demand in forex trading is an easy method of technical analysis that allows traders to identify an entry price as well as supply zones or demand zones. In simpler terms, buying and selling in forex depends on supply and demand, where the demand represents buyers and the supply represents sellers.

In this article, we have Ezekiel Chew, a world-renowned and seasoned forex expert and mentor, to take us through the supply and demand concept in the forex market. To further understand the principle of supply and demand in forex trading and start applying this trading strategy as an investor, carefully read through the paragraphs below.

What is Supply and Demand Forex

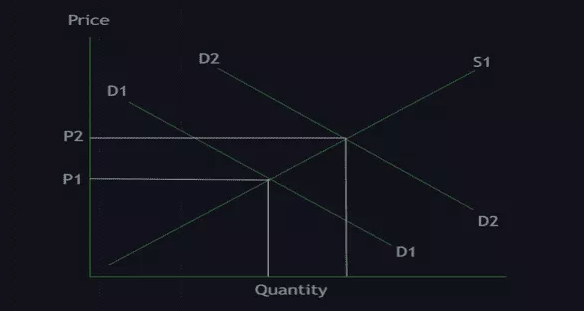

According to the economic theory of supply and demand, if the supply of a commodity increase and the demand for the same commodity decreases or remains constant, the commodity’s price is expected to decline, and vice versa. The commodity’s price is determined by supply and demand, and the same is applicable in the forex markets, such that the price of currency pairs depends on the level of supply and demand for those currencies.

There is supply and demand in the forex market if the supply of a currency pair is low. The demand for the same currency pair is high, and the higher demand pressure forces the price movement up. Suppose the supply of a currency pair is high. The demand for the same currency pair is low; the higher selling pressure forces the price movement down.

As a result of the activities of the big players in the forex market, such as the government, institutional traders, and banks in forex markets, other traders and market participants in the market are continuously shifting the supply and demand of currency, which causes price fluctuations in the foreign exchange market.

Supply and Demand Zones in Forex Explained

Supply and demand zones are a popular technical analysis tool that is useful in daily trading to determine price moves because it is from these zones that prices approach and react. Also, the supply and demand zones can be marked on the price chart to inform traders of the next price action in the market.

For example, when the price of a currency pair is in a strong bullish trend, i.e., the price is moving upwards because of buying pressure, range traders can position sell orders at specific levels, especially the supply zones above the price. Then, as the price returns to the supply zones, the selling pressure will force the price in the opposite direction as it drops sharply.

On the other hand, when the price of a currency pair is in a strong bearish trend, i.e., the price is moving downwards because of selling pressure, range traders can position buy orders at specific levels, especially the demand zones below the price. The buy orders placed at the demand zones assume the price drop won’t fall beyond their buy limit order.

In this case, if more traders or an institutional trader place similar pending buy orders at the demand zones as the price approaches the limit, it can cause the demand to increase and prevent the price drop, pushing the price action up as it approaches this level.

As the price moves towards the supply and demand zones, it has a higher tendency to return, and because of that, range traders use this opportunity to influence the price trend by taking positions in the desired direction. Supply and demand zones change easily and can be forced upwards or downwards depending on the price levels of interaction.

Supply Zone

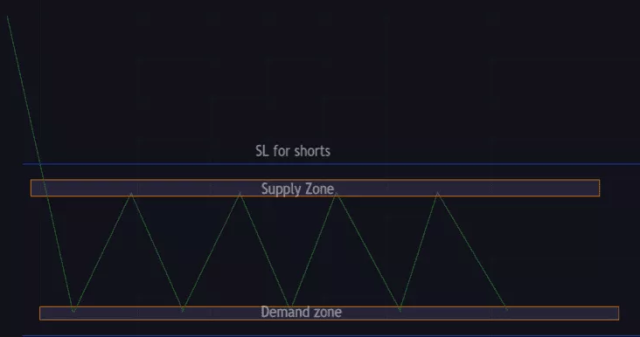

The supply zone is a trading range that is always above the current market price on the forex trading price chart, with a lot of selling interest. A large number of waiting selling orders are usually around the supply zone, and once the price action hits this zone, orders are sold immediately.

Traders are selling the currency pair, and the price returns to the downside. There are multiple supply zones in the price chart. Hence, the supply zone has no specific level.

Demand Zone

The demand zone is the exact opposite of a supply zone, and it is the trading range that is always below the current market price on the forex trading price chart where there’s a lot of buying interest. So there are a lot of pending buying orders around the demand zone, and once the price action hits the demand zone, there’s immediate action.

Understanding Supply and Demand Zones

The bars that mark the beginning of a strong downtrend are called the supply zone, while the bars that mark the beginning of a strong uptrend are called the demand zone. Supply and demand zones occur when there is an imbalance between the buyers and sellers.

With the knowledge of what supply and demand trading means, traders can easily identify supply and demand zones on the chart in any timeframe because the supply and demand concept is centered on analyzing and defining supply and demand zones in past performances.

The supply and demand zones are visible areas in the price chart that prices have visited many times even though it looks like other specific lines in the chart. However, it is quite different from the support and resistance levels.

Finding a Supply and Demand zone in a chart

Having known the supply and demand zones in the forex trading price chart, the next question is how to find the supply and demand zones on the chart. Identifying the supply and demand zones becomes straightforward once traders know what to look for.

Follow the steps below to locate the supply or demand zones on your chart;

Set your timeframe

The first step in finding a supply or demand zone is to set your timeframe. Then, zoom out your trading timeframe to the next higher time frame, which should be 4x / 5x the initial trading frame, to see a clearer picture of the price action. Most traders usually prefer a higher time frame for a clearer view of the price movements.

Identify price reversals

The trade zones in the chart where price moves frequently or reacts quickly might be supply or demand zones. A demand level is a turning point where the price rises quickly away from the level upwards, while a supply level is a turning point where the price moves quickly away from the level downwards.

Draw out that zone

With a rectangular shape drawing tool on your trading platform, stretch to the right once you can identify the turning point zone. Then, draw out these zones and check the past performance of the price within them and the number of times it reacted.

Alternatively, there are supply and demand zone indicators on some trading platforms such as Trading View that automatically map out the supply and demand zones for forex trading. The supply and demand indicators are helpful tools for traders in identifying supply or demand zones.

Trading Patterns of Supply and Demand

There can be several periods of accumulation during an uptrend and several periods of distribution during a downtrend. This implies that, like every technical analysis of price patterns, supply and demand reversal and continuation patterns exist.

The knowledge of these trading patterns is important in forex trading because it gives an insight into the current market phase, which determines the best supply and demand zones to look for.

Supply and Demand Reversal Patterns

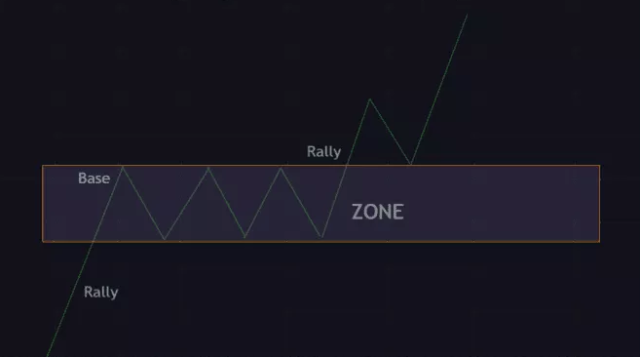

The Drop-Base-Rally is a bullish reversal pattern that begins by rallying downwards until it gets to the base, which is a strong buying interest zone. Price may remain in this zone for a while or bounce off immediately. After that, the price will start a bullish trend, leading to higher and lower highs.

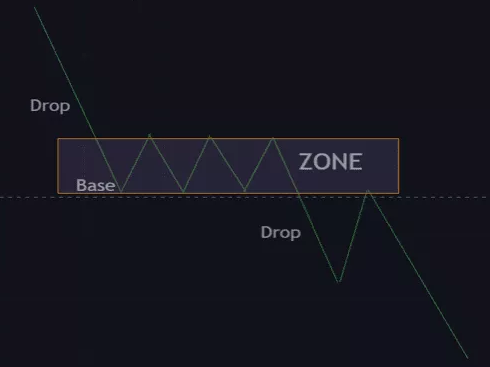

The Rally-Base-Drop is a bearish reversal pattern that begins on an upward trend and then reaches a strong supply zone. Price may remain in this zone while forming a reversal pattern or bounce off immediately. After that, the price will start a bearish trend, leading to higher and lower lows.

Supply and Demand Continuation Patterns

The Rally-Base-Rally is a bullish continuation pattern that begins with an uptrend before the price action moves to a supply or demand zone. The price reacts to this zone and eventually continues its uptrend.

The Drop-Base-Drop is a bearish continuation pattern that begins as the price moves in a downtrend and approaches a demand zone where there are pending borders. The price reacts to this zone and eventually continues its downtrend.

Trading Strategies of Supply and Demand

Proper understanding and application of supply or demand zones help traders to effectively implement a trading strategy because the supply and demand zones are the key determinants of price trends.

Traders can use different trading strategies to take advantage of the supply and demand concept to make profitable investments.

Breakout Strategy

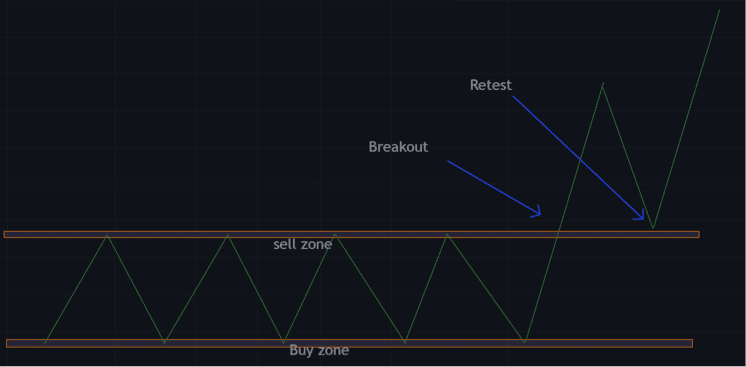

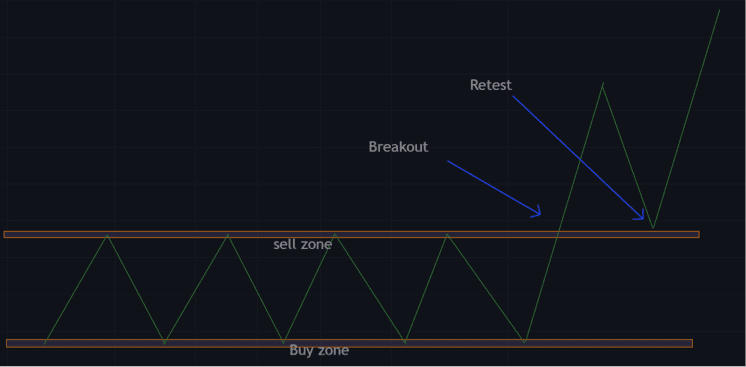

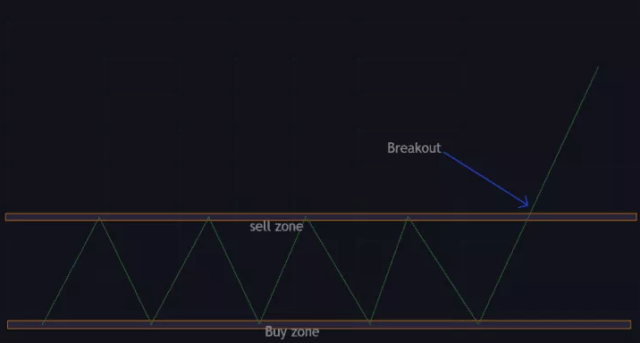

The breakout strategy is one of the forex market’s most popular supply and demand trading strategies. This trading strategy involves price to trade range and a breakout of its range. After the breakout, retail traders take positions in the direction of the breakout because it might be the start of a strong trend.

Retest Strategy

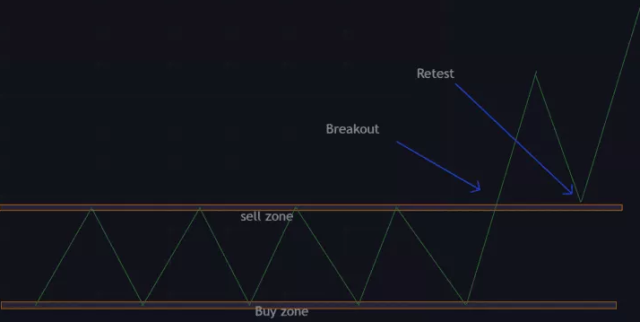

The retest strategy involves taking a trade when the demand zone reverses to the supply zone or when the supply zone reverses to the demand zone. While some traders immediately take positions in the direction of the breakout after a breakout occurs, others wait for another price like a retest.

The retest strategy is more effective than the breakout strategy because it gives room for pullbacks and decreases the risk. However, this trading strategy is best for better entries and higher probability trades.

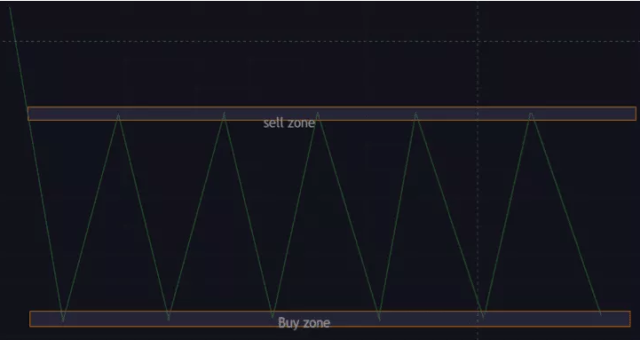

Range Trading

This is a supply and demand trading strategy used for a trading range once the supply and demand zones have been properly established. With this trading strategy, traders can use indicators like the Relative Strength Index (RSI) to identify the supply and demand zones.

Trading support and resistance levels are similar to trading supply and demand zones because there’s no direction to price movement and no clear price trend. In simpler terms, range trading is buying and selling at support and resistance levels until the price breaks out of the trading range.

Risk Management plus Supply and Demand Zones

The demand and supply zones are similar to the support and resistance zones, which traders can use to determine where to put stops and limits. And also, traders can use the demand and supply zones to apply a good risk-to-reward strategy to their buy and sell orders.

Range traders and retest traders who sell at the supply zone can set stop loss above the supply zone as they aim to take profits at the demand zone. There are other risk management parameters that demand and supply zones can be used for.

Strengths of Supply and Demand Zone

Identifying the strengths of supply and demand zones gives traders a higher probability of making profits because the information from the zones can help with pending orders, taking positions, and risk management. There are a few factors to consider to determine the strengths of supply and demand zones

• Trend direction

Market trends need to be understood to know the strengths of supply and demand zones. Therefore, traders should monitor the price charts daily to ensure that the general trend is upward before they take trades in the demand zone.

• Time within the zone

The number of candlesticks or bars shows the timeframe of a price within the zone. Any price that takes longer in the zone implies a weak zone that is not strong enough to hold.

• Frequency of tests

This factor is important if the supply and demand zone is in a new region or if the price has visited the region in the past. For example, this happens in weekly supply zones when prices make new all-time highs. However, if the price keeps recurring, the zone is weak to test a potential supply zone.

Best Forex Trading Course

Asia Forex Mentor is one of the most credible forex trading courses available today. It is headed by Ezekiel Chew, a trader making six figures per trade for over a decade. The trading methods are backed by mathematical probability and the trainer behind banks and trading institutions.

AFM PROPRIETARY ONE CORE PROGRAM is the core program that covers from beginner to advanced, and every segment must include the above points. The program is designed to make you confident and earn as quickly as possible in live markets.

It starts with the basics of forex trading and moves on to more advanced topics such as risk management, market analysis, and trade execution. The course also includes a live trading session where you can see the techniques being applied in real-time. If you’re serious about learning forex trading, sign up now!

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Supply and Demand Forex

Price movements in the financial markets are basically due to the instability in supply and demand at any given time. Therefore, identifying supply and demand zones and applying these levels within a trading strategy is a path to successful trades in the forex market.

Apart from a good trading platform, the proper understanding of the supply and demand concept and the supply and demand zones can help traders make successful trades in the forex market.

The supply and demand concept explained in the paragraphs above is one of the best technical analysis tools to use as a trader to improve your trading strategy and become continuously profitable. I hope you find this article helpful as you apply all the techniques and strategies.

Supply and Demand Forex FAQs

Is Supply and Demand a good strategy?

The supply and demand concept is a good and effective technical analysis tool that allows traders to discover a specific entry point, stop loss, take entry point, and identify the supply and demand zones.

What timeframe is best for supply and demand?

Trading supply and demand zones are ideal for daily traders who trade daily supply or demand zones. Usually, most traders prefer the 4-hour timeframe because it has stronger demand and supply zones.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.