How To Trade Using Smart Money Index – Explained By An Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Stock market indicators are crucial to understanding the market as a whole. The emotions of traders are reflected in indicators.

You can gain some insight into the market by considering the behavior of these indicators. Additionally, day traders can base their choices on stock market indicators. Making any trading decision requires an awareness of the stock's composition and construction.

The smart money index also referred to as “the SMI,” is a crucial technical indicator used in the stock market. It is referred to and regarded as the “smart money flow index” by many day traders.

Based on intraday price patterns, this indicator is frequently used by traders to check for chart divergences or to validate market trends.

Each investor's success in the stock market, which may be a volatile environment, depends on both their plan and their techniques. Investors must also strike a balance between reducing risk and maximizing returns. Smart investors understand how to deal with changing pricing and track market trends.

To make wise decisions, they rely on factual information. For instance, many traders base their decisions on resources like the Smart Money Index (SMI). We've got Ezekiel Chew, a foremost trading expert in Asia, to share his take on the Smart Money Index, a description of the SMI's operation, and how to decide if it's the best tool for you.

This article will explain what SMI is and how it works.

What is Smart Money Index

Don Hayes made the Smart Money Index well-known in the 1990s. It is a technical indicator that seeks to determine how the U.S. stock market's “smart money” is performing compared to the “dumb money.”

In this context, the distinction between “smart” and “dumb” traders does not always correspond to their intelligence. Instead, they are employed to help separate knowledgeable and predictive traders (smart) from those who are reactive (dumb).

The Smart Money Index recommends that investors and day traders follow the “smart money” rather than the “dumb money.”

According to this indicator, experienced traders typically enter the market toward the end of the day when trades are less influenced by emotion.

The theory is that most traders (news-driven, emotional) make their deals at the opening bell because of the overnight economic data and news.

How to Trade using Smart Money Index in the Stock Market

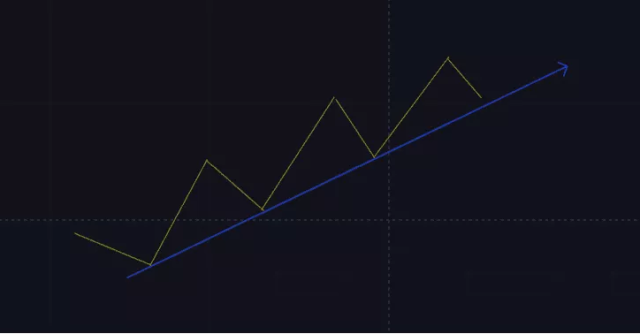

The Smart Money Index has two uses for day traders. They can first utilize it to validate a stock's trend.

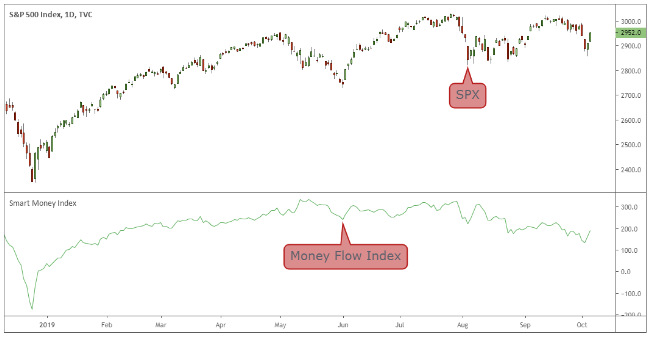

The pattern will continue if the Smart Money Index, or SMI, moves in the same direction as the market. This serves to validate the general trend of the stock market.

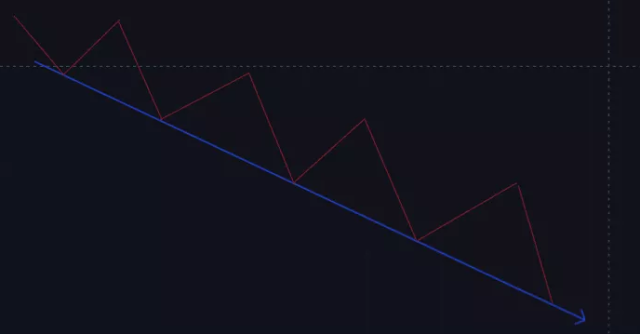

When the Smart Money Index declines and stock prices decline, this can be viewed as a bearish indicator and predicts that the SMI will continue to decline in direction and value.

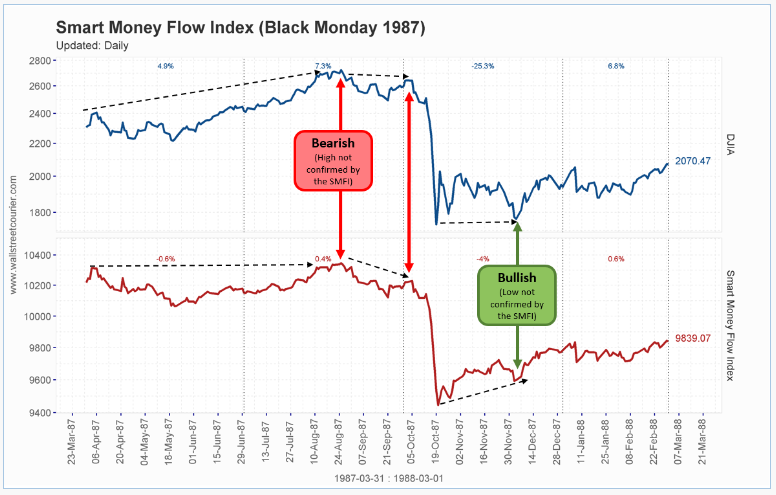

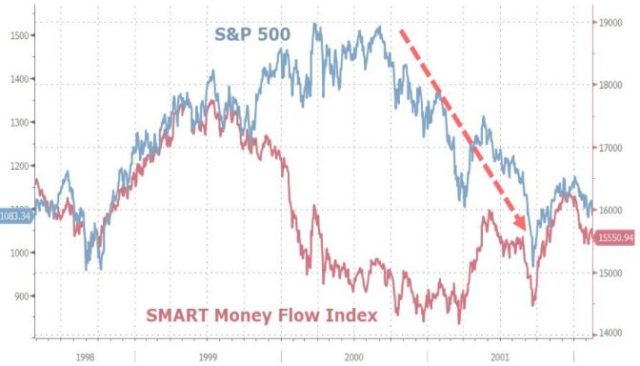

In addition, they can use it to spot divergences by observing whether market trends depart from the Smart Money Index. The indicator can alert you when the trend direction is about to change if the stock has been trending higher.

For instance, it is typically a warning that the price may rise if the stock price declines and the SMI increases.

If the market surges ahead of the index, it is considered a bearish indicator.

It's crucial to realize that the SMI does not clearly indicate whether the market is bullish or bearish.

Additionally, no consistent absolute or relative readings indicate a trend.

Trading professionals should therefore consider the indicators' dynamics along with market dynamics.

How do you calculate Smart Money Index

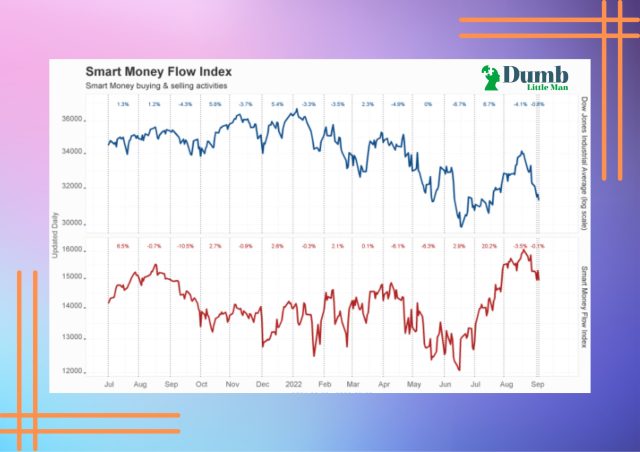

The Smart Money Index can theoretically be computed for any market index or the stock market. The Dow Jones Industrial Average, however, is the one that is frequently cited in mainstream media.

However, we have determined the SMI for the S&P 500 because it is a better indicator of the overall U.S. stock market.

The Smart Money Index is calculated by subtracting the gain or loss in the first 30 minutes of trading from the previous day's smart money reading and adding the change in the index during the last hour of trading.

Here is how to compute it:

- Determine the nominal gain or loss for the S&P 500 within the first 30 minutes of trade (9:30 a.m. ET – 10 a.m. ET)

- Determine the nominal gain or loss for the S&P 500 during the final trading hour (3 p.m. ET – 4 p.m. ET)

- The market's gain (or loss) in today's first half hour of trading plus the market's gain (or loss) in the final hour of trading equals yesterday's Smart Money Index.

For instance, assume that the SMI was worth $3,000 yesterday. The S&P added +45 points this morning, and this afternoon, it added +25 points. The current value of the Smart Money Index is 3,000 – 45 + 25 = 2980.

Importance and Purpose of Smart Money Flow Index

The SMI indicator determines what knowledgeable and seasoned traders are doing in the market. According to this indicator, traders should place bets on the stock market's direction near the day's conclusion because that is what the “smart money” is doing, and place bets against the stock market's direction at the beginning of the day because that is what the “dumb money” is doing.

Smart money typically holds off until the very end and tests the market in advance by severely shorting to see how the market will react.

Because they frequently have access to the most incredible information available, these professional traders have an advantage over all other market participants.

As a result, the fundamental betting strategy is to wager against the morning market trend and favor the evening market trend.

Pros and Cons of Money Flow Index

Pros

- Aids in locating the chart's divergence

- With its help, it is much easier to find overbought and oversold levels on a chart

- It functions well when the market is in a trend

- Money Flow Index readings build on the traditional strategies associated with the Relative Strength Index

Cons

- If utilized improperly, this lagging indicator might result in several whipsaws

- Using it in conjunction with another indicator or piece of technical software is advised because it lacks some of the information required for accurate price action analysis

Best Forex Trading Course

The best forex trading course on the internet today is the ‘One core program' by Ezekiel Chew. It is available on the Asia Forex Mentor website. Ezekiel affirms that the program was designed with the same system that he has been using to train bank workers and institutional traders for several years. This trading system is highly effective as it yields 6-figures per trade for him.

The best part is that prior knowledge of the financial markets or trading experience is not needed. One core program is a comprehensive program that covers everything from scratch to advanced levels of forex trading. You only need to be a committed learner. Ezekiel developed this proprietary trading system after several years of learning, trading, and teaching.

Like all traders, he started by blowing his accounts, but over the years, he developed a highly rewarding system based on mathematical probability. His fortunes changed and he began generating millions of dollars from forex trading. Over the years, he has taught numerous students who are equally millionaires courtesy of the one core program. He is also a renowned speaker at major forex events.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Smart Money Index

Investors have access to various technical analysis tools, including SMI. You can use it to follow other investors' intraday trading trends, which can guide your own decisions. It may also reveal whether you engage in “smart money” or hasty trading.

It is up to you whether it functions as an index for you. Though it doesn't display data helpful for long-term investing, some investors might not find it beneficial. Active day traders should assess whether or not the SMI aids in the improvement of their trading judgments.

The Smart Money Index is a line that often follows price movement. As previously indicated, this indicator is crucial since it provides a snapshot of the market and, in the event of divergence, can show indicators of a trend reversal.

But unlike other indicators, the SMI does not provide a buy or sell indication. It prepares you for what to anticipate shortly. As a result, you should always combine it with other technical indicators like momentum, the Parabolic SAR, and the Relative Strength Index (RSI).

Furthermore, a paper trading simulator is an excellent idea to study and practice.

Smart Money Index FAQs

Is Smart Money Index Profitable?

Having a tool that shows you what savvy investors are doing makes sense. A closer examination of the SMI index reveals that it is not a very reliable indicator, particularly for day traders who open and finish deals during a single trading day.

How do I get a Smart Money Index?

The smart money data from the previous day and profits or losses throughout the first 30 minutes are used to calculate the Money Flow Index (SMI). Changes in the indexes are computed during trading hours.

Finally, you may create the smart money index using the YSMI – FHG/L + MG equation. YSMI, FHG/L, and MG represent yesterday's SMI, first-hour gain or loss, and market gain, respectively.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.