What is Slippage Tolerance And How It Works

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best cryptocurrency brokers for traders are Coinbase and Gemini

The #1 Crypto and Forex Trading Course is Asia Forex Mentor

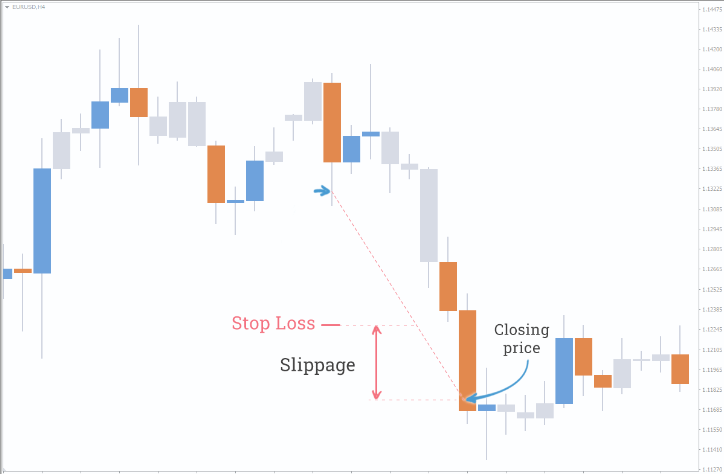

Traders are hurt every time the market “slips” and their order is executed at a price different from what they expected. Slippage occurs when the market moves away from the price at which crypto traders place their orders, and it can happen in both directions – for long and short positions.

While some slippage is unavoidable, it can be costly if not managed properly. As a trader, you need to learn what slippage tolerance is and how you can stay ahead of the market. Market volatility is not fun; however, you can still make money if you know how to trade with a stop-loss.

To understand the concept of Slippage Tolerance, we have Ezekiel Chew (Forex trader and Trainer) to share his take on the matter. He is the founder and CEO of Asia Forex Mentor, a company that provides Forex trading education and training to individuals. So, before you embark on your next crypto transaction, learn what slippage is, how it works, and more.

What is Slippage

Slippage is the difference between the anticipated price of a trade and the actual price at which the trade is executed. It can happen in both directions – for long and short positions.

Slippage mainly occurs when several bulky orders are carried out, but there is a limited volume of sellers or buyers in the market. As a result, the next best price is taken when this happens, leading to slippage. Also, note that slippage happens in the crypto markets on any decentralized exchange (DEX) like Uniswap and Pancakeswap. Also, it happens as a result of high-level price volatility.

How Slippage Works

The Slippage isn't positive or negative; it results from any change in the proposed value and real execution cost, which passes for a slippage. You can buy or sell assets at a commendable cost in the current market whenever the purchase order is complete.

Slippage occurs when the implementation price is lower than the proposed implementation price. It's described as no slippage, negative, or positive slippage depending on whether there is any departure from the planned timetable. This term is used when a trade is placed and then delayed due to market movements.

If you place an order for 100 CFDs of Apple at $200 per share and the next best possible price is $201, you will experience a positive slippage of $1. On the other hand, if the next best price is $199, you will experience a negative slippage of $1.

However, a limit order helps to prevent slippage. The order transmits the potential risk of the trade not being completed if the anticipated price fails to return to the barrier level. So, the risk of slippage is always present wherever market fluctuations occur. A trade's price may move significantly in a short time, restricting the amount of time left for the proposed execution price to be met.

How to Increase Slippage Tolerance Percentage

In simple terms, slippage tolerance is the maximum amount of slippage you are willing to accept on a trade. Below are a few ways to increase your price slippage on the crypto trading platforms.

Max Slippage Tolerance

The first thing you need to do is increase the max slippage tolerance in your trading software. Doing this will give your trade more room to breathe and increase the chances of executing it at the price you want. If there is no max slippage, you can set your desired rates.

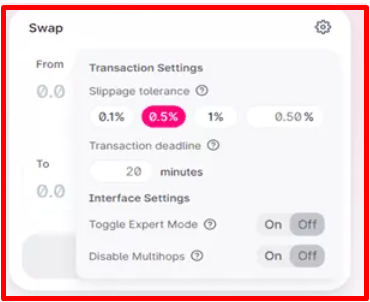

Adjust Slippage Tolerance At Uniswap

If you are trading on Uniswap, you can adjust your slippage tolerance. Just click on the gear icon in your browser and adjust it wherever you want.

Adjust Slippage Tolerance At Pancakeswap

In Pancakeswap, the default slippage tolerance is 0.5%-1%. You can increase this by setting and adjusting the percentage to your desired level.

How to Evade Dispersed Exchanges Slippage

Price slippage happens after you approve the deal and the transaction is confirmed on the blockchain. The blockchain is a decentralized ledger that records all cryptocurrency transactions. When it is heavily utilized, miners evaluate and route transactions to obtain the optimum gas.

If you're on a budget, spend more money on gas or a quick gas sum that guarantees the transaction is completed as soon as possible to prevent price slippage. Look for a layer two solution that saves you money by enabling faster transactions.

However, the transaction on layer 2 is lower priced than on ETH. Therefore, you can easily adjust the slippage tolerance level from high to low depending on the different situations to ensure that your transaction gets selected. Moreover, you can also break large buys into small chunks of transactions.

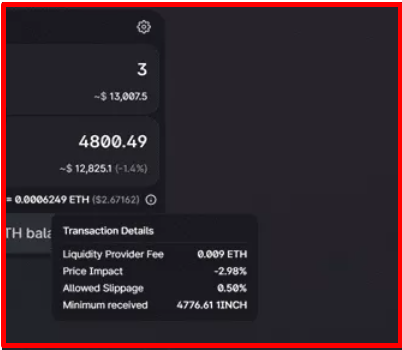

Slippage Tolerance in Crypto

Understand slippage tolerance before executing any transaction on a DEX because it isn't the same as trading stocks. You'll have to deal with slippage when using platforms like Pancakeswap and Unswap. The good news is that once you understand how it works, you can use it to your advantage.

For large transactions, you can use a limit order to prevent slippage. When you place a limit order, the trade is only executed if the price is within the specified range. This protects you from market price fluctuations and guarantees that your trade will be executed at the price you want.

When the price of an asset fluctuates, a trader can trade at a different price from the one shown and expected when trading cryptocurrency. If you are a beginner, slippage can become a frustrating slippery slope. So, always pick an interest and learn as much as possible before trading. The more you know, the more likely it is to find ways to profit from slippage!

Slippage Expected Price: Things to keep in mind

Order and limit settings would always go wrong. However, when dealing with slippage, you should use smaller transactions for exchange purposes. Transaction fees are increasing with ETH gas costs going up. Lower slippage will be apparent when the transaction is completed for popular pairs, so this isn't an issue.

Because of the high slippage tolerance, transactions would be more frequent for coins with a small market capitalization. Keep an eye on this to decrease slippage tolerance. In addition, price volatility will cause liquidity to become tighter, lowering slippage tolerance as a consequence.

Entering Positions

A stop-limit order and a stop-loss are not the same things. You can use a limit and stop-limit order to take a position. When utilizing these orders, you must determine whether you can get the deal you want—limit orders to protect against slippage while allowing missed opportunities.

Use a market order to ensure that your trade may be completed. Although there is a chance of slippage or an inferior price,

Make sure you're confident in your recommendations to take or leave positions. Use stop-limit or limit orders if you're certain of your trades to take or leave a position. Make sure to avoid anything that would result in slippage. Fast-moving market situations require orders for trading strategies. This is done to put you into and out of a trade.

Existing Positions

You have more control over a trade where cash and futures are involved than in one that only involves funds. You have much less power here than when entering a trade with funds. Market orders might be useful; they would speed up your exit from the position. You may use a stop-limit order to leave the market when things appear to improve.

Finding the balance between getting out too early and holding on for too long can be tricky. When you believe the market is about to correct, it is often best to exit the trade. Using a stop-limit order in such a case might be a good idea.

If this is not done, you may lose the deal and not at the price you wanted. A stop-loss order will place an instruction to go in at the price you want unless it is a bad thing for you. This is why you should concentrate on orders to stop loss to ensure that the loss doesn't grow beyond what was anticipated; slippage may be the price.

Best Crypto Broker

| Broker | Best For | More Details |

|---|---|---|

| Earning Rewards Read Review | securely through Coinbase website |

| Altcoin Trading Read Review | securely through Binance website |

| Sign Up Bonuses | securely through Crypto.com website |

| New Investors Read Review | securely through Gemini website |

Best Crypto and Forex Training Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Slippage Tolerance

You should know the slippage tolerance concept, whether a novice trader or an expert. It is a crucial element in trading and can make the difference between success and failure.

Now that you know what slippage is and how to avoid it, you can focus on other aspects of your trading strategy. For example, always use stop-loss to protect your profits, and don't forget to practice risk management. With these tips, you'll be able to trade with confidence and minimize your losses.

Slippage Tolerance FAQs

What should my slippage tolerance be?

It depends on your trading goals and objectives. For example, if you're looking to make a quick profit, you may want to set your slippage tolerance at a higher level, but setting it above your order can lead to extreme loss. However, if you're looking to hold onto your position for longer, you may want to set your slippage tolerance at a lower level.

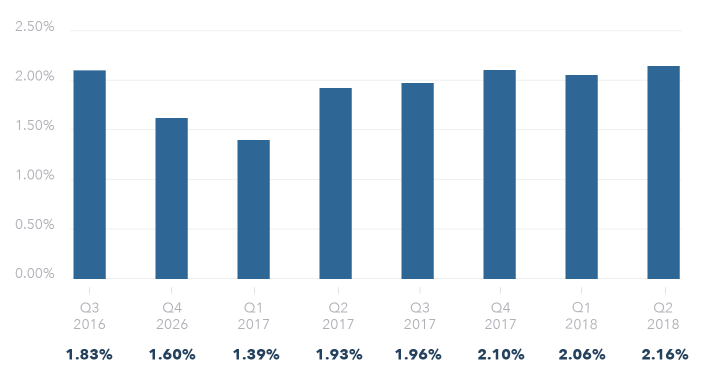

What is a 2% Slippage?

A 2% slippage is the maximum percentage of your order that you're willing to have executed at a different price.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.