What Is Risk Reversal – A Complete Expert’s Guide 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

In the Forex and stock market participants are always looking for safe investments with minimal risks. For this reason, many financial advisors suggest implementing risk reversal strategies to overcome the anticipated market volatility.

Among these forex experts, we've got Ezekiel Chew, who is both a top-notch forex trainer and a successful forex trader. He has not only trained numerous retail traders and finance personnel but has proved his skills in the forex market by making six-figure trades on the ground. Hence, His insights regarding risk reversal strategies are most relevant.

According to Ezekiel, risk reversal is an integral element of any profitable investment in the financial market. Consequently, traders use this strategy to hedge risks by using call-and-put options. Hence this strategy involves buying and selling an asset under the same maturity date to avoid risk and gain limited rewards.

This review aims to provide traders with a clear understanding of how risk reverse strategy can work for them and how long and short option trading can help them in hedging risks. Overall, this review is a comprehensive guide to the basics of risk management for traders.

What is Risk Reversal

Risk reversal is used as an options strategy by traders to avoid the possible risks from the fluctuation of the financial market. Through this strategy, the investors get the advantage of buying and selling options at the same time considering the implied volatility. As a result, the investors buy an option and can also sell an option however, they are bound to complete the transactions before the set maturity date.

The first step to a risk reversal strategy during anticipated market fluctuations is to buy an option by paying a premium and then sell an option at the same time and earn profit from the received premium. However, this profit is temporary if the market outperforms the expected trends then there is even a possibility of substantial monetary losses. Hence, in that situation, the income earned may result in credit for the investor.

In this scenario, we can say that risk reversals can work at their best to hedge risks for the investors however it is not complete protection. Since the stock or forex market is always unpredictable much of it depends on the investor's market projection for the asset price.

Consequently, any wrong projection can lead to monetary losses or increased capital gains. Hence, risk reversals can turn out to be rewarding if the investor gauge the market trends correctly however it can also multiply losses if the investor misinterprets the situation.

When to use a Risk Reversal

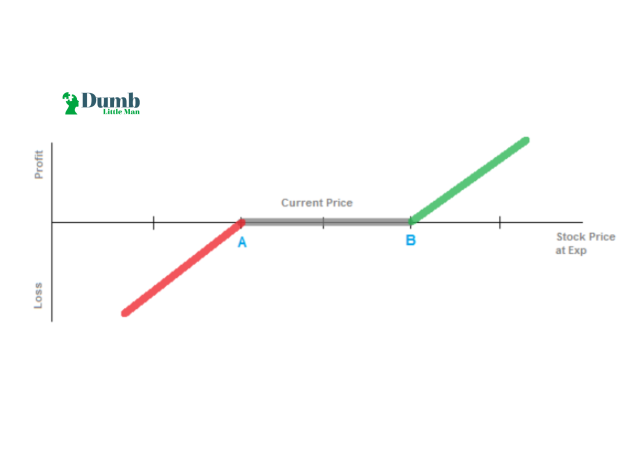

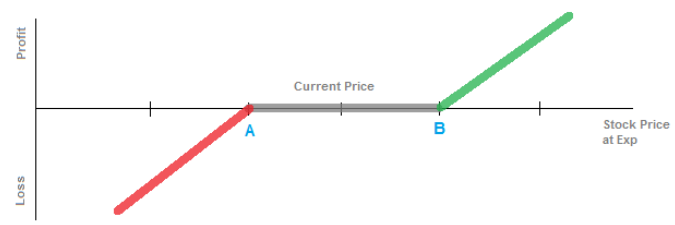

Risk reversals are usually used according to the long or short position of the underlying securities. Therefore, an investor would buy options of any asset and would sell it at the same time, if a probable price decline is anticipated. The asset could be any stock, currency, commodity, or other underlying security.

If the asset that has been bought increases in price the value of the call option will also increase however only to a certain limit. Similarly, if the price declines even further than the estimated projection, then the losses will be minimal. Hence, an investor will be able to hedge against the possible deficit in the short position however, the chances of earning massive rewards in the long position will also be restricted.

There are two forms of risk reversal strategies. In one variant an investor would opt for a put option where the price is below the strike price and at the same time buy a below-the-strike-price call option. In such a situation, the investor tries to earn money through the bullish approach, projecting that the prices of the asset are going to rise.

In opposition to this, there is the bearish approach where the investor aims at earning capital gains assuming that the price of the assets is going to fall. By calling and put options below the strike price, the investor gets their hands on the premium received and also hedges against the possible losses.

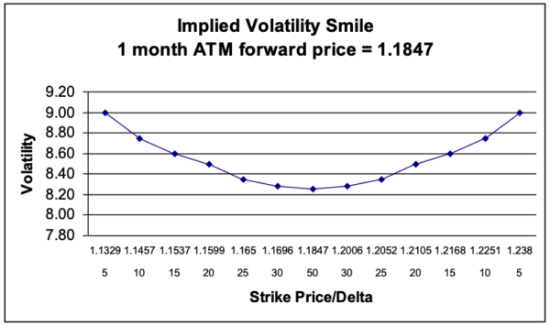

Implied Volatility

Implied volatility refers to the estimated projection of market trends. Through implied volatility, an investor predicts the bullish or bearish approach of the market and figures the price of any asset accordingly.

Moreover, the implied volatility has a contradictory relationship with the market trends. When the market prices are going up the market volatility falls and vice versa. However, investors always in a need of higher implied volatility to earn profits from their long put options trading.

Implied volatility is the basic need for an options strategy. The higher the volatility, the more chances of capital gains for the investor. Right after an investor applies a risk reversal strategy the next step is to wait for market fluctuations.

The movement of prices can either result in better leverage or the achievement of potential profits. In either case, market volatility is a win-win situation for the investor when it comes to a successful risk reversal strategy.

Higher implied volatility means lower asset prices. This situation is beneficial for the call options strategy. However, such approaches are usually favored by corporate investors rather than retail traders.

As financial institutions have comparatively larger investments their need for risk reversal strategies is greater. Hence, such investors realize that even if the profit margin with reversals is low but the risks are minimized cost-effectively with the help of this strategy.

Volatility becomes a defining factor in options trading because, considering the market situation, investors decide to either invest or back out from the investment. Keeping in mind, the bearish or bullish trend of the market participants make their next move in the forex or stock market.

Risk Reversal Strategy and Underlying Asset

There are many upsides to risk reversal strategies. One of them is that when an investor assumes the market trend to be going on a downward shift, they tend to benefit from this condition by taking a bearish move. Therefore, investors go for options calls for an asset so that they can sell an asset before the prices declines and can also earn some premium.

Simultaneously using the premium, such an investor would also go for out-of-the-money put options for the same value asset. Hence, by using this strategy, the investor will be able to save and earn money using both options at the same time.

An alternative risk reversal approach is to short trading position. In such a case, the investor tries to hedge risk by buying a call option assuming that the price of the asset will rise considering the market volatility.

Therefore, the same result will be expected as the increased prices would cover the losses in the short position of the investor. In this situation, the profit will be minimal however, the investor would be able to dodge the substantial pitfalls which may be massive.

All in all, a risk reversal strategy can be effectively used either way to hedge risk from a long or short position of trading. However, the key element here is the implied market volatility, if the investor's projection of the market trends is wrong then the substantial risk can be disastrous.

Risk Reversal and Strike Price

There are two types of prices in options trading. The first is the market price and then there is a strike price. The market price is the actual price of an asset at which it is bought or sold. furthermore, the market price is bound to be affected by different factors and can fluctuate at any given time.

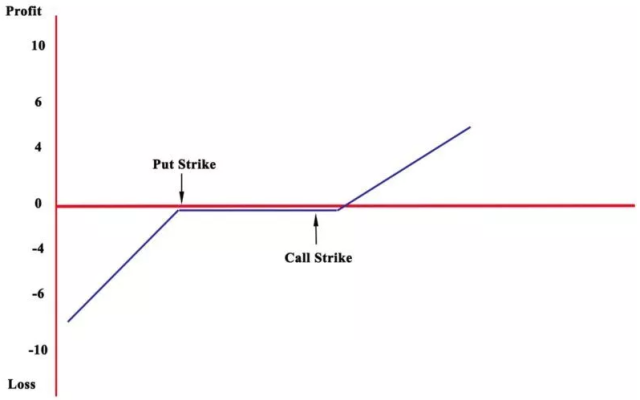

Conversely, strike prices are the set price in the contract at which the asset may be traded in the future. Since the strike price is set by the investors it is fixed and predetermined.

In options trading, there is a strike price for the call options and also for the put options. In the call options, the price that is laid down in the contract is the strike price at which the asset can be bought. Similarly, for the put options, the assets are sold at the given strike price in the contract.

Additionally, in a put option when the strike price reaches above the market price at the time of contract maturity, the buyer earns the return. Similarly, in a call option, if the strike price declines at the expiry date then the market price of the seller makes a profit.

The concept of strike price in risk reversals can be better understood with the help of an example. For instance, an investor is looking forward to buying a call option for a stock that has a market price of $5 and is selling at a strike price of $4. The low strike price indicates that the seller assumes the stock price to decline even further in the market and to hedge future risks it is being sold at a lower rate.

Now if the market price moves to a downward trend, the stock price might fall to $2 and the seller will earn revenue by selling it at $4. However, if the situation turns out the contrary and the price goes up to $10 the buyer will earn a profit as it was bought for a much lower price. In either case, the strike price remains constant and it is the market price that wavers repeatedly.

Stock Price Application

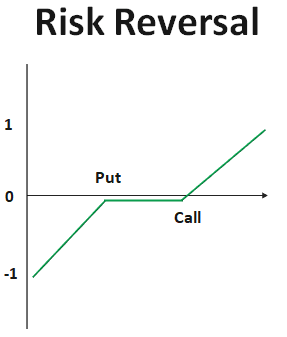

Risk reversals reflect how investors use trading manipulation with their peer investors in currencies. If options trading for an asset is in high demand this would mean that its price and volatility will also be increased. Hence, the main function of risk reversals is the comparison of implied volatility between call-and-put options trading.

.When it comes to the application of risk reversal strategy, it can be seen in two ways; positive risk reversal and negative risk reversal. A positive risk reversal means the implied volatility of call options trading is higher than the implied volatility of put options. This instance signifies that the investors are estimating the increase in the currency.

Conversely, in negative risk reversals, the investors are mostly assuming that the currency will decline and so the implied volatility of put options is greater. Therefore, the value that is positive or negative risk reversal provides useful information to the investors to make informed trading decisions. As a result, the application of risk reversals in the forex market depends upon the expected positions of the volatility, and the price of the asset.

Maximum Gain vs Maximum Loss

When it comes to market price fluctuations in both the stock and forex market, there are no restraints. Prices of any underlying asset including stocks, commodities, and securities can drop as less as zero and can hike beyond any limit. In such a situation, there are also no restrictions for maximum gain and maximum loss in investments.

Even when the profit gains are limited in options trading as the strike price is already pre-determined, however investors with long call get the opportunity to consistently make money when the stock trades higher. Hence, there is no limit to capital gains till the maturity date of the call options.

Nevertheless, this uncertainty of profits and losses can be quite hazardous for investors. Investors may measure or predict the possible rise or fall of the stock price however, the exact numbers of profit or loss can never be anticipated.

Hence, with the help of risk reversals, the investors can shield themselves from possible pitfalls however, how deep the well is can not be gauged. So there is always a chance of losses even after applying the risk reversal strategy for hedging risks.

Risk of Early Assignment

Early assignment of options means that the investor of a call and put ends the contract before its maturity date. Consequently, there will be another seller who will switch positions and this usually does not turn out to be profitable for any of the counterparties. Therefore, early assignments especially in put options are considered to be very risky.

For any investor who has call options, it is easy to hedge risk by implementing the risk reversal strategy. Even if the price falls to zero the investor will not face terrible losses as they will be minimized by the call contract. However, if the investor owns a huge amount of stocks and makes an in-the-money call with an early assignment and the price falls incredibly below the strike price then it can turn into a massive hit for an investor.

Another risk of early assignment is that the cash the investor receives by selling options might be spent sooner or later. So it is a better option to save the money and invest it in another security such as a money market etc. to gain dividends rather than having an early call assignment.

Lastly, early assignments are also deemed to be risky when the dividend date is nearby the maturity date and the call option is deep-in-the-money. As a result, even if the investor closes the short call position with an early assignment, they will be liable to pay any dividend payments that are due. Thus, with many risks involved, early assignment in options trading is overall a bad choice for an investor.

How to Trade a Risk Reversal Strategy

For the risk reversal strategy to work effectively, it is important to sync the call and put options trading. This means that an investor needs to sell an asset and at the same time buy another asset of the same value within the identical maturity date of the options. Hence, an investor can sell an OTM put and with the premium received then buy an OTM call option.

In case of selling an option for a strike price that is higher than the market price, the investor will get the premium and that will be included in the net profit. However, considering the market trends, if the put option is sold below the market price then the investor will look forward to it as a hedge against potential risk. Thus, while taking a risk reversal approach the investor is turning around the possible skewing risk.

Generally, in a risk reversal strategy, a common pattern is that there are more buyers for put options as they are used to hedge against potential risks. For this reason, an investor first sells options with high implied volatility and later buys options with lower volatility.

Risk Management for Maximum Profit

The risk reversal strategy is mostly used by institutional investors and not retail traders. The reason behind this is that this is a tricky business that has great potential for profit-making if done right however, it can also lead to disastrous results if the investor's projections go wrong. Hence, this is not a strategy for inexperienced traders but can work wonders for veteran investors.

Investors can gain maximum profits and can limit risk only if this strategy is applied appropriately. The most precarious part of this approach is that one needs to have the skill of anticipating market fluctuations and reading the market trends accurately. Since all the decisions of buying and selling options depend on this skill, any wrong move can lead to undesired results.

However, those with substantial experience in risk management techniques, can use the risk reversal strategy and can not only gain maximum profits but can also minimize their losses to a great extent. It has profit potential if conducted appropriately, but it can bring losses if done wrong. Hence, with this approach, trading becomes subtle to changes due to the implied volatility as it is short one option and long another.

Best Forex Trading Course

No matter which background you belong to, an average inexperienced trader, or a member of a huge financial institution, everyone needs a competent forex training program. A training course which would guide them not only in the basics of forex trading but also help them to achieve substantial results.

This can only be achieved with trainers who are not only expert trainers themselves but have traded on the ground and have proven themselves as successful traders.

If you are looking for such a course then look no more because the Asia forex mentor forum is offering the best forex course with the most experienced traders and financial experts.

The director of this program Ezekiel Chew is a well-known and proven forex trader who has himself made 6 figures per trade in the forex market for two decades and he and his team has trained traders and investors from day-to-day retail traders to banks, investment firms, multinational corporations. These traders have not only learned how to trade from this course but have learned to make the most profit from each trade possible.

This skill of applying mathematical probability is the recipe for ingenious trading results in massive profits. All of this is possible due to the expert traders and trainers of the one core program who have designed strategies and know how to adhere to the market every time from basic to advanced level.

Moreover, the One Core Program is not just a set of strategies to learn from but a complete trading solution with expert advice and tweaks and customized expert solutions for every individual client whether a beginner or an experienced trader. Hence, the AFM Proprietary One Core Program is the ultimate solution to all your trading needs.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Risk Reversal

Risk management is the most significant factor for any kind of investment. Therefore, investors are ways looking for ways to minimize their potential risks. Moreover, all financial experts and advisors also favor risk management strategies to make any investor's portfolio strong. These hedging strategies may not completely subside the risks however, it certainly helps in limiting the losses.

Risk reversal is one such strategy that is used to manage risk in investments. Mainly this strategy is used for options trading where an investor buys one option while selling another within the same maturity date. By using this approach investors can hedge the possible risks due to downward trends in market prices for both long and short positions.

Risk reversal strategies are mostly used for forex trading and also for commodities. However, investors from the stock market also at times follow this strategy to hedge risks. Nevertheless, more than the type of asset, the type of investor is more important to attaining effective results of this approach. Investors who are competent enough to deal with the implied volatility of the market trends and can do accurate market analysis would only be able to benefit from this strategy.

Like any other investment strategy, risk reversals also have their advantages and flaws. The advantage is that investors can benefit from this strategy by shrinking their losses b selling their assets and can also earn returns from simultaneously buying the same value assets. However, higher implied volatility is the key factor that allows this strategy to work successfully. Hence, for any options trading transaction using risk reversals, an accomplished volatility-detecting investor or financial expert is a must.

Risk Reversal FAQs

Why is it called a risk reversal?

A risk reversal strategy is basically a kind of risk management where investors safeguard their long or short positions through put-and-call options trading. Due to this strategy, the investors can dodge the price fluctuations and can sail safely to the shore. Hence, any kind of risk is avoided through an options contract, where sometimes the profit is confined and at times can lead to major turns.

However, this strategy is called risk reversal because the potential risks associated with the price fluctuations in the market are reversed through this strategy. As a result, trading certain assets a minimized due to this strategy. Hence, the reason why a risk reversal is so called is that the losses or risks overturn through this strategy.

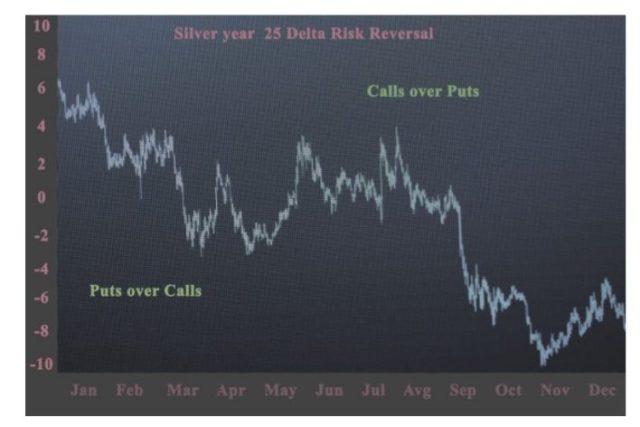

What is a 25-delta risk reversal?

In the Out-of-the-Money options, the trading transactions are measured in the form of the delta. Being in delta, an option has to be expired in-the-money. Hence, to obtain a 25 delta risk reversal the investor needs to buy a 25 option delta and sell the same 25 deltas. As a result, the 25-delta put is the put whose strike price has been chosen such that the delta is -25%.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.