What is Leverage in Forex: All You Need To Know

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

One of the most misunderstood concepts by traders is leverage in forex. If it happens that you do not understand it comprehensively, here we have Ezekiel Chew, the trading expert and mentor at Asia Forex mentor, expound on everything you need to know.

Ezekiel has a decade of expertise trading profitably with leverage across forex, cryptocurrencies, commodities, and indices markets. As a mark of his distinctions, he is the mastermind behind the One Core Program training course on foreign currency trades.

Many upcoming traders confuse their greed and leverage or gearing. The equation gets complex when a trader adds fear while holding any trading positions to make matters worse. The living truth is if you manage your leverage smartly with key risk management tools, you’ll trade any underlying asset in the foreign exchange markets for as long as you wish and increase your potential profits.

On the flip side, mismanaging or ignoring correct leveraging is a cardinal sin in forex.

High leveraging is like driving a race car at thrilling speeds while closing your eyes. The truth is, your brilliant trading career can terminate in a matter of seconds, if not minutes.

What Does Leverage Mean in Forex?

Leverage is a ratio of the sum of the times your broker allows you to magnify the value of your trading positions. Out of that arrangement, traders, therefore, control huge amounts per position, and it’s usually far many times higher than the equity a trader has in the account.

One aspect that makes trading forex very lucrative is gearing. A trader working out right is able to make more money and multiply profits so many times. Worth noting too is that gearing leverage also multiplies your losses with equal measure – when a market runs against you.

Leveraging is very common in forex but is not a component in many other markets like stocks. Your successful survival as a trader builds so much on how you can balance your risk tolerance, capital available, and turning tides of gearing to your favor.

What is a 1:500 Leverage?

We’ve already seen that leverage offers vary with brokers. In this section, we’ll break down gearing with a practical scenario to better exemplify how it works. Once you get the concept, use it within a strategy to enable you to reduce market exposure and upscale potential profits.

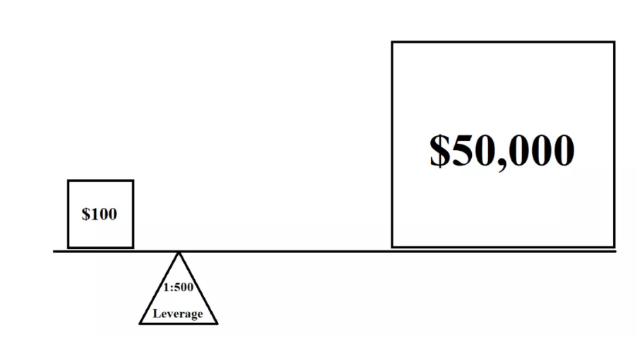

Looking at the image above, our theoretical broker is offering us the leverage of 1:500

It means, for a trader with equity of just$100, a trader can control upwards positions amounting to 50,000. In other words, it’s the capital multiplied by the gearing offered, i.e., $100X500 = 50,000.00

So high are the mouthwatering figures. And this builds towards the main point why with a few winning trades, you can bag in large profits. And again, worth mentioning, as little as one bad position would also blow your account almost within no time.

Forex Leverage Explained for Beginners

Having seen the awesome offers brokers provide with leverage, key questions arise – especially for those new to technical analysis in the fx markets.

Where does the extra amount of capital come from to enable traders to support the high margin requirement for the full value of positions?

The amount comes from the brokers. With proper use of risk management tools in the financial markets, you trade more by committing to borrow more from a broker. And to fulfill the commitments, traders must confirm by opening a trade which in turn locks or freezes a portion of capital in the forex account – that’s the margin.

To quickly recap, the margin is the commitment a trader makes to open a trade and hold it. Once you open a trade, the margin corresponding to it remains a locked/committed figure, and you can only access it once you close the trades -either in profit or loss.

A further note – before you can benefit from leverage, your commitments are in the form of margin. The more margin you commit or open trades, the lesser your opportunities to open more trades. However, traders have a leeway to deposit the money needed – which they can commit to opening and, of course, holding more trades.

Pro-Tip: Best trade management practices do not include a race to deposit funds and open more trades. First and foremost remains to avoid the high risk by capital protection and profiting later.

Observably, many new traders onboard into trading via Demo accounts – which makes matters worse if brokers or trainers fail to explain the consequences of high leveraging. Successful trading on demo accounts does not equal the same via live accounts.

Seems traders miss the masterly of managing greed and fear best via live accounts as opposed to dummies or demos. Huge messes occur while half-baked traders are shoved into the markets to learn correct leveraging on the job or live trading.

It’s better to grasp the concepts of leveraging and gain exposure in a slow but sure manner.

What is the Best Leverage for $100?

One rare fact with trading is that no matter how little you start trading with, you can always scale it upwards to as far as you want with proper management of high-risk exposure.

Pretty sure that with an account with total capital or equity amounting to $100, you have adequate capital. The truth is, most brokers can allow you to trade with even far, much less. Traders are at liberty to switch down leverage to lower ratios, but you can always remain with the highest they offer and manage everything with a balance of the right strategy and reasonable risk tolerance.

Therefore in trading forex leverage of 1:500 is okay. If anything, it shoves you an opportunity to control a notional value of $50,000 (Equity of $100 X leverage offer of 500), but the power remains with the trader to navigate the high risk to first protect the $100 equity and increase it profitwise.

Before diving into live accounts, it’s good to open demo accounts. They are free, and you can use them for experimenting around with leveraged currency trading and seeing how it works. Bear in mind that losses via demos are risk-free as you are playing with virtual money.

Good brokers can allow you portal access to replenish your demo accounts after they run out of equity. However, having seen how leveraged trading works, it’s time to get into the serious stuff. Do not run away from the demos. Next, lower your leverage levels, and open trades after analysis.

The last hurdle can be challenging yourself to double the profits in a demo account with a detailed strategy. Achieving this feat is a great indicator that your trading strategy and skills have improved tremendously. Only past here can you fund an initial investment and position cautiously with margin trading.

Best Forex Leverage for Beginners Tutorial

There are many guides that can help you work around the concept of leverage. However, here are three pillars that you can build on right from the word go improve tremendously and earn more money and avoid losing money rapidly.

For every trade you place on the global currency markets:

#1. Maintain a low level of leverage and margin percentage

#2. Minimize the downsides by protecting your capital and deploying trailing stops to cover your positions

#3. Work with a capital of 1%, utmost, switch to 2%, and never more than that until you grasp reasonable mastery to handle larger exposure. The full value remains totally flexible, but at all costs, steer away from broker offers where you may risk more than 3% upwards. It’s something we encourage you to avoid at all costs.

In trading realms, the best leverage to work with varies in line with your levels of risk tolerance.

This fact remains cast in stone for as long as you trade; the higher you leverage, the higher the prospective profits get. And the opposite is equally true; the higher leverage will push you into equally huge losses with wrong currency movements.

How to Calculate Leverage in Forex

Having shared this earlier on, a broker will need some form of collateral for you to open trades and access the opportunity to access leverage. The commitment in the form of collateral is what’s referred to as margin, which is basically some percentage of the entire value of the position.

Let’s take a practical example:

You have a 1% margin and target to trade one mini-lot of the USDJPY pair, which amounts to $10,000.00. Therefore your margin will amount to 1,000.00. Based on the margin, the leverage of 1:100. We’ll calculate the margin-based leverage by getting it as a division between the total transaction values by the margin we require.

But, the margin-based leverage is not a realistic indicator of the floating profit & loss. Hence the requirement to calculate the real leverage. And real leverage will be equal to the total value of the transaction divided by the total amount of capital in the account for speculating.

In a better sense, if a capital account is worth $1,000 and our target is to transact a position aiming at $10,000 per mini lot, the applicable leverage is 1:10. It’s exactly ten times our capital in a trading account (10X$ 1000 = 10,000)

Advantages and Disadvantages of Leverage in Forex

Leverage amplifies or magnifies profits or losses. And it’s the main reason it’s too enticing for many forex traders. Leverage enables a trader to bank a decent profit from price movements in their favor with only a handful of pips. A pip is conventionally counted to the last decimals of any currency value. For example, in the USD or the dollar, one pip amounts to a hundredth of every cent ($0.0001).

Although a minuscule amount of trading without leveraging will require large sums of capital to bank any decent profits. Given that most traders have access to lower sums of capital, they take advantage of the leveraging opportunities provided by the brokers.

Let’s take another practical example:

Assuming your target is to trade the pair on GBP/USD, the price makes an upwards move by only 100 pips (From price1.9400 to 1.9500). Realistically, it’s only a single cent in terms of the price shift. But, the application of leverage transforms the minute move into a substantial amount in terms of profits that a trader makes from the change in price.

Further, let’s suppose leverage on the platform is 1:1000. Therefore, in the event of a change of price by a cent, a trader’s profits turn out as $10 (Bear in mind that it’s for only a single cent GBP). How much profit would you bank with 1,000 GBP? That turns out as $10,000 in profits.

The Catch? As much leverage multiplies your ability in profits, it still does so for your losses, at a multiple of applicably equal measure. It’s the main reason you’ll find traders refer to leverage as a double- edge sword.

Next is a more practical example for that – typically showing differences in leverage for the same currency pair.

We’ll consider two hypothetical traders, A and Trader B, and each of them has at their disposal USD 10,000 in capital on a trading platform.

The brokerage platform offers a 1% margin deposit, plus each decides to hit the market for the currency pair USD/JPY. Both speculators have the insights that the USDJPY currency pair will rise in price, hit resistance, and reverse within future timeframes. Both speculators go short on the USDJPY at the price of 120. But:

Trader A enters the trade with 50 times leverage by going short on $500,000 USD/JPY (That is Equity of $10,000 x 50 times leverage).

Note, since the price of USD/JPY is 122, every pip for a standard lot amounts to $8.30, or in total, $41.50 for all the five standard lots. Next, the price of USD/JPY shifts upwards to 123.

Our Trader A stands to lose 100 pips, amounting to a whopping $4,150.

In summary, a very slight change in the opposite direction of the fx market cost our Trader A 40% of their total equity or trading capital.

But the, Trader B also jumped in with a more conservative approach. Instead of hitting the 50 times leverage like trader A, their target was 5 times. So, the short transaction is worth only $50,000 for the USD/JPY or (Equity $10,000 x 5 time’s leverage).

The $50,000 at half a standard lot. With the move on USD/JPY upwards to 123, our Trader B will also stand to lose 100 pips; however, the move will only cost $415. Notice that the loss only represents 4.15% of the account balance – which is a seemingly more acceptable value for a loss.

Forex Leverage Calculator

For your information, there’s no forex leverage calculator online. And that should be no reason for you to fear – calculating forex leverage is easy mathematics. However, it is best if you target to obtain the real leverage since it best reflects best on the profit/loss applicable for your account equity.

The simplest way to calculate the leverage ratio in forex trading is by dividing the value of a position by the value of equity/capital in a trading account.

Also, there’s another way to go about it, and this goes to expressing leverage by the number of pips you want to take. Following this way, you’ll only need to express the number of pips into the amount of capital you stand to lose. Ideally, it should not be more than 3% of your total account.

Your task is to avoid losing huge amounts like, say, 30% of your account capital at once. You’ll notice that tuning down to less than 3% is a loss you can take comfortably; plus, you preserve a reasonable amount of equity to trade another timeframe in the future.

The last point here is that the 3% is never cast in stone, and it’s up to the trader to make wise decisions knowing that speculating on leverage is a highly risky engagement. The correct way is to make a bet with small amounts that you can lose comfortably and protect capital first before going for profits on any trading platform.

Best Forex Trading Course

Have you ever thought of how professional traders earn consistent profits with all the risks and leverage out there? The living truth is that while you lose one trade after another, there’re speculators out there smiling in profits. And the difference between you and them is only a course away.

The best course to take and trade forex is the One Core Program from Asia Forex Mentor. Ezekiel confesses that he’s been in similar frustrations – making losses and blowing accounts. What comprises the building blocks of the Once Core Program is the system he built with over a decade of trading in the same markets.

No doubt, no formal school out there will teach you practical trading like the training cum mentorship via Ezekiel Chew courtesy of the One Core Program. This is a course that turns the tables for traders from losing to banking profits with up to six-figure trades.

One Core Program is a holistic set that targets any individuals and corporate staff willing to learn the ropes and scale the heights of their speculating journeys. Ezekiel approaches the course by tackling many factors that contribute to being a risk-free and profitable trader.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Leverage in Forex

Leverage is the most wonderful aspect of forex trading; it gives the traders via brokers the ability to control huge amounts for a given position. It’s the main reason profits bulge so amazingly for trades that g into the target direction.

Without leverage, forex trading would not be worth it. A trader would need to bank so many pips to make enough profits. As a trader, learning to work around leverage has a huge bearing on the risk appetite to adopt while speculating.

Through leverage, a broker allows a trader to control a huge amount of capital in a forex market. Your control is in multiple amounts as defined by the leverage the forex broker allows you to select or adopt. There are some national jurisdictions that offer policy guidance on the upper limits a broker can allow for retail investor accounts. Others leave it at the broker’s discretion.

Leveraged Trading FAQs

What is Good Leverage in Forex?

A good leverage level in forex markets conforms to two things. One is the amount of capital a trader can access, and the second is the risk tolerance limits they possess.

A good leverage ratio is a must for every trader who wants to take trading CFDs or foreign exchange (like Canadian dollar)as a lifelong career.

speculators have to approach good leveraging by taking it as an opportunity within the confines of the risky nature it comes with.

The truth is, while brokers hand over the powers to profit excessively, the same brokers also unleash the lethal opposite of it, where speculators slip into a margin call and lose money rapidly.

What is Leverage in Forex for Beginners?

Leverage in forex trading for beginners is a scenario where brokers allow speculators to magnify or amplify the amount of profits they can make for a single trade that takes profits.

speculators should also know that the amplification of losses is also applicable for every trade that hits a stop loss or loops deeper into the losing regions of a market.

Beginner forex traders should follow guidance from either mentors or trainers and ask every question on leverage before opening trades on live accounts.

It’s however, allowable to mess around with leverage on dummy accounts and see how the figures work there where you do not lose actual money. However, some professionals believe that trading on dummy accounts does not bring the best from a trader.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.