Inverted Cup And Handle: In-Depth Explanation From An Expert

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Momentum indicators are crucial t in analyzing markets. While it is impossible to predict an asset’s price accurately, you can still use historical data and previous trends to identify buying opportunities in the market. Many momentum indicators are mostly used as part of broader technical analysis. But the inverted cup and handle pattern is one of the most popular.

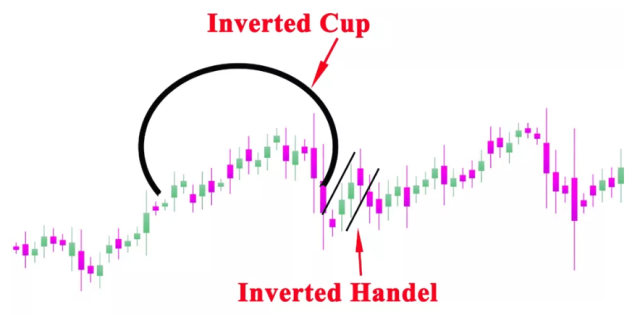

The inverted cup and handle is a bullish reversal pattern found in the price charts of financial assets and is used to indicate the end of a bull market. The pattern gets its name from its overall shape, similar to a cup with a handle. They can be used with other tools to find an ideal price target and price breaks for shorting assets. This will allow investors to hit a profit target from downward price movements.

An inverted cup and handle pattern is considered a reliable bullish signal and can be used by traders to enter long positions. We have got Ezekiel Chew to share more details about the handle chart pattern, how handle patterns work and more. Ezekiel is one of the best forex mentors in the industry and is highly sought-after for his knowledge in the field.

What is an Inverted Cup and Handle?

In the technical analysis of trading the assets, chart patterns represent the price movements of the particular assets. This is how investors find success while analyzing the chart patterns. Numerous methods can be used for this analysis. It enables the investors to capitalize on their initial investment.

With the chart patterns, the traders get a visual way of analyzing the trades and investing accordingly. The required information about price targets and prior trends, along with other necessary data, is derived by analyzing the charts. One of these chart patterns is the inverted cup and handle. This chart pattern indicates the bullish trend and is used to locate purchasing opportunities.

Just as in the case of the conventional stock market, the inverted cup and handle pattern is a vital chart pattern that crypto traders use to recognize bullish price movements and benefit from them. However, this pattern also signifies a bearish continuation and reversal and sends the traders a sell signal. As this chart pattern represents a crescent with an upward direction change, it is named inverted cup and handle. The time frame of development of this trend is around seven weeks, months to almost a half year.

Inverted Cup Chart Pattern

The inverted cup and handle pattern is only successful if the brokers use it after an uptrend. There are two components of this chart pattern. These segments or features include the unsuccessful rally in the inverted handle and rolling over price over price action in the cup segment. The inverted handle can also be a follow-up to an inverted cup. This means that the inverted handle can retrace the initial move but cannot reach the original trend level.

Once the stock loses the buyers at high prices, this is when the sellers come into the picture bringing the stock down by bidding. This is when the formation of an inverted cup top is created. Once this chart pattern is fully formed as an upside-down cup, it indicates a downtrend in the stock market. Short-term investors prefer investing when the stock falls out of the bottom of the inverted cup forms.

Moreover, the top of this pattern is formed when the potential investors declined to buy the highs of the resistance levels at the top of the chart pattern. Also, when you see an inverted handle formation of the original inverted cup pattern, you can consider selling the trend and setting a stop loss. This can certainly be a potential trade idea.

Limitations of the Handle Pattern

With the advantages, there also come certain limitations to the chart pattern. As mentioned above, one of the significant limitations is that the pattern is independent of the given timeframe. The formation can take a few days or even months. This is one of the most distinct limitations of this identifying trend. Moreover, false signals are also a drawback in these chart patterns and require excellent proficiency and attention while identifying the trends.

Another limitation is locating the cup and handle depth and length. Apart from that, the inverted cup and handle chart patterns have illiquidity, which is one of the most significant limitations of this handle pattern. Therefore, like all the other technical indicators, this one must be used in concert with other indicators and signals before making any trading decision.

These are the limitations observed by the practitioners. The indefinite time frame can cause various problems and losses, leading to late decisions. The fact that it could take even years for the pattern formation makes it less considerable. The depth of cup formation can also be quite an issue. A shallower cup can produce a signal, while a deep cut can produce a false signal. The cup might also form without a characteristic handle.

How to Trade with an Inverted Cup and Handle?

The inverted cup and handle chart pattern is quite famous and is widely used in forex trading. You can rely on these indicators when you are looking to enter a profitable trade. If you are looking to trade in Forex, you must define a few parameters before opening any order. The parameters to measure and define include entry point, take-profit, and stop-loss.

In the entry point phase, you must enter once the chats show a candlestick. This candlestick breaks out on the very top of the cup in the chart. Take-profit is when the increase in price and height of the cup comes equal. The third one is stop-loss which is the rounding bottom of the handle.

When trading according to the inverted cup and handle chart pattern, there are things to consider. The cup has a pause or a stabilizing period. This point is at the bottom of the cup, where the price forms a rounded bottom or the price moves sideways. It indicates that the price is on a support level and won’t drop below. With this comes improvement in the odds of price going higher after the breakout.

The Risk in Chart Pattern

There are various risks in this pattern as well. First, you must remember there are two absolute stop-loss levels. Along with the bullish continuation, the potential reversal must also be considered. When the surface’s breakout rate is used to stop loss, the distance between the breakout rate entries concerning the cup’s height influences the ratio of risk to reward.

When utilizing the handle’s high to stop loss, the risk versus reward ratio increases significantly if the handle’s height is shorter than the cup’s height. Therefore, your trade’s stop-loss rate must be above the levels to make the trader analyze their position and prepare, keeping the rates in mind.

The major risk is that the inverted cup and handle trade will fail when the market turns bullish. The first indication of this trend in the market shift is when the breakdown price rises over several days. This is when it crosses above the pivot point of the price line. This causes a breakout to the topside. These risks are considered while trading, and the brokers must be aware of them.

Chart Pattern Inverted Cup

Any chart patterns are a map of any business’s business activities every day. This is what helps them to understand the price formation and behavior of a stock. You must never forget that patterns break down or dissolve at some point. Through technical analysis, any trader or investor can identify the chart patterns and determine the time for successful trades.

With the inverted cup and handle pattern, you will be warned about potential problems in the stock market and can also work as a signal for profit. This enables you to determine what you must do at a certain time or moment to benefit from the trade. For example, the inverted cup pattern signals when a stock begins to rise or when it breaks its uptrend.

Whenever you are looking to open a short position, you will have to look at the chart for interpretation of the cup part and the cup bottom. Whether you are trading stocks or foreign currency, the bull market’s weekly charts provide insight into the risk capital and the trading range. Money managers also use other types of patterns other than handle patterns, which have proven quite helpful.

Best Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn’t. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It’s a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Inverted Cup and Handle

Like many other technical analysis patterns, the inverted cup and handle pattern is helpful but comes with certain limitations and risks. For the new buyers and investors, there must be a pattern to identify various buying opportunities for successful trading in the future. Also, it would help if you kept in mind that the past results of any traders do not define their future participation and trading.

The inverted cup and handle patterns are a bearish trend. Through the handle patterns, traders can create different buying opportunities. Even though it might seem like a great benefit, it is; it requires proficiency too. Traders must be careful as the price might break, and any chart indicator might give a false signal.

But when the reversal pattern is used correctly, it can give profitable results to the traders. It can also provide adequate information to the traders about the trading volume and selling pressure. Thus it is evident that the inverted cup and handle are beneficial if observed attentively and proficiently while keeping the risks away. Also, the limitations must not come in the way of successful trading.

Inverted Cup and Handle FAQs

Is Cup and Handle Bullish?

The cup and handle is a bullish continuation pattern, indicating that the stock will continue its upward trend. Many experienced traders use it to find possibilities in the long run. They use signals to set a stop buy order above the handle pattern’s bullish candlestick.

How do you trade an Inverted cup and handle pattern?

If you see a drop in the trading volume over days, you can start a short position when the stock breaks out of the handle to the downward handle. You can also buy when the stock breaks out of the handle to the upside.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.