How To Use The Fractal Indicator: Explained By An Expert

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Traders in forex have spent money and time trying to develop the right strategies. Some have even dived into mathematical books and algo trading just to get an edge in trading signals. The sad reality however is that most of these folks are doing it all wrong. There are many trading strategies, each designed for specific conditions in the market.

But there is no single strategy that can get you the results you need. It’s important to learn how to apply different trading tools for specific market trends. The focus of this review will be on fractal indicator trading. This is a form of technical analysis that has been used by some of the most experienced traders in the market. Our perspective will be based on Ezekiel Chew, an experienced and seasoned trader. He is also the author of the Asia Forex Mentor, one of the leading forex trading courses.

Whether it’s the up fractal, the down fractal indicator, the bullish fractal, or the bearish fractal indicator, you will need deep knowledge to leverage these tools. We are going to give you some of these tips below and also offer you additional info on how you can use the fractals indicator in combination with other technical indicators in the forex market. You are also going to get ideas on how to expand your knowledge in forex trading and some FAQs that will make it easier for you to understand this topic better.

Key Priniciples of Fractal Indicator in Technical Analysis

The Fractal Indicator was created by someone called Bill Williams. In fact, this approach is often referred to as the Bill Williams fractal indicator in honor of the man himself. The purpose of the fractal indicator, as with many techniques in trading, is to be able to identify repeating patterns in the forex market.

You see, the forex market moves up and down all the time. Bill Williams saw this chaos and tried to make sense of it. In fact, in his original conceptualization of fractal indicators, Bill Williams admitted that the process is based on chaos theory. Despite this, the fundamental principles behind the idea were fractal patterns.

Bill William believed that with the right approach, it was actually possible to find recurring patterns in the market and use your trading platform and trading tools to benefit from this. Now, you can argue that every trading strategy follows the same approach. But when you learn the principles of fractal signals and other fractal forms, you see how unique this approach is. We will cover the sell fractal principle below in additional detail.

Interpreting the Fractal Pattern

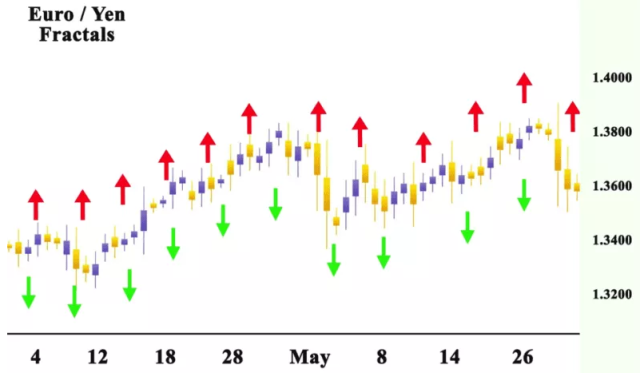

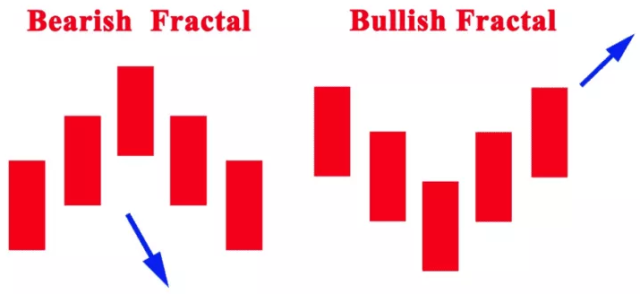

There are two main ways to interpret the fractal indicator or pattern. Fractal arrows can either be U shaped or V-shaped. These shapes will also form in the upper and lower parts of the market. So, the main goal is to determine price support or resistance levels and then decide what to do.

In a V pattern, you may identify a bottom where the price pattern has managed to find support. If the asset holds the support for some time, it could suggest that a trend reversal in the market is going to happen.

Please note, however, that the previous fractal is not enough. Even a downward fractal indicator is not enough. You will need to combine this trading indicator with other tools. There are also false signals in all this. Not all buy and sell signals will lead to a profit. However, a better understanding of support and resistance levels will be a good start.

Also, note that when it comes to forex trading, all technical tools have limitations. There is no tool that can give you a decisive indicator or prediction of where the market will go. You must therefore manage your risk even as you employ a wide range of technical indicators in your strategy. As long as you protect your capital, there will always be so many opportunities to make money in the market.

Benefits of the Fractal Indicator

The Bill Williams fractals offer several pros in trading the financial markets. First of all, the indicator is actually very simple to understand. You don’t need to be a seasoned trader or expert to understand an upward fractal or downward fractal indicator.

Additionally, the last upward fractal indicator can be used to determine the trending market and how the price chart will go. This will not be an accurate prediction of course. But it can be combined with other indicators of price movement including the Fibonacci retracement level for the best results.

Finally, the first and last fractal indicators can help you determine the perfect entry point for a trade in the market. You see, these indicators provide support and resistance levels. In most cases, the price bars around these levels tend to be decent entry points for most financial instruments.

Nonetheless, you should consider using virtual funds and a demo trading account before you jump in. Some of these trading strategies are not always 100% perfect. They need to be fine-tuned a bit before you use them. Besides, the fractal pattern indicator is a very complicated tool as it is. You may need a demo account to trade while learning how it all works out.

Disadvantages of the Fractal Indicator

For all its benefits, the Williams fractal indicator approach may also have a few shortcomings. For starters, although it’s considered simple to understand, for someone who is new to this, you may struggle. Reading reversal points, the middle bar, third candlestick movements, and other indicators take time.

Also, the buy fractal indicator is backward looking. This essentially means it is a lagging indicator. This can actually be problematic for a trader. Remember the price moving on that asset will not stay there for long. You need an active analysis tool that will help you make real-time trading decisions. The fractals are not always ideal for this.

Finally, you cannot use the fractal indicator if the price action in the market is sideways. In fact, fractals are only effective if there is volatility. It will therefore be hard to potentially profit from the strategy if the market is calm. Also, the fractal patterns do not account for other price-changing factors. It’s all about looking at charts and patterns.

There are however other non-technical factors that can affect the market. This includes things like geo-political tensions, economic problems, and so on. It is therefore incumbent upon the trader to decide to what extent the market is being influenced by external shocks before they get into fractal pattern trading.

Bullish Fractals Indicator

As the name suggests, the bullish fractals indicator is designed to suggest a trend reversal on the upside. In other words, this indicator will tell you if the market is about to go up. This happens when the last three consecutive candlesticks head towards a lower low. The two candlesticks preceding them will also start to hit higher highs. While there are still risks involved, you can identify upward trends with this approach.

Bearish Fractals Indicator

The bearish fractal indicator often shows the market is about to reverse the trend on the downside. In other words, potential breakouts on the low point are possible. Now, just like the bullish fractal pattern, you need to watch five candlesticks in the daily chart patterns.

If the last three candlesticks are approaching higher highs while the next two are hitting low highs, it means the market is bearish. The high point could therefore be a good entry position but make sure you also use the alligator indicator as the price moves just to be sure you have considered everything.

Deference in Fractal Indicator and Chart Patterns

The biggest difference between fractal indicators and chart patterns is that fractals are original. In essence, they are five bars showing patterns on the original trend of the market. Chart patterns on the other hand can be drawn easily. You can also interpret them using a wide range of tools.

While the charts can help you identify trends in the market, they are not nearly as effective and original as the fractals indicator. Having said that, both these tools are important for traders who want to profit. Do not think of them as two-dimensionally different options. See them as tools that you can use in tandem as you develop your ultimate trading strategy.

Best Forex Training Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It’s a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Fractal Indicator

The forex market is a $6 trillion market. But making a killing here is not as simple as it often feels. The biggest mistake most people make is to approach trading as gambling. Well, in the midst of the chaos in the market, it is possible to identify decent patterns that you can eventually use to make some profits. That is why it helps to learn fractals.

Whether you want to buy breakout or enter a trade when the market is about to reverse, the fractal pattern is your best bet. It is however important to make it clear that the tool can’t be used in isolation. The best traders in the world understand that one strategy or indicator is not enough to make money in forex. You will need a combination of strategies and indicators to make good calls on your investments.

So, even as you start learning about the fractal pattern and how it works, you must be ready to accept its limitations. That way, it will be easier to take measures that will ultimately make it possible for you to take advantage of potential breakouts in the market.

Fractal Indicator FAQs

What is Williams Fractal Indicator?

The Williams fractal indicator is a technical analysis tool that helps to identify trend reversals in the market. It uses support and resistance and could offer a decent prediction of where the market will trend in the short term.

What is Fractal Chaos Indicator?

The fractal chaos indicator is one of the most innovative trading tools that allows you to find patterns in a market filled with chaos. While the tool has its own fair share of limitations, it can actually be a very effective option when it is combined with a host of other technical analysis tools.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.