IFX Brokers Review 2024 with Rankings By Dumb Little Man

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.6 1.5/5 | 97th  |  |

| Evaluation Criteria |

|---|

Dumb Little Man's team, consisting of financial experts, seasoned traders, and private investors, employs a specialized algorithm to evaluate brokerage services comprehensively. Their review focuses on key elements like:

|

IFX Brokers Review

Forex brokers play a pivotal role in the trading landscape, offering platforms for trading various financial instruments. They are key in facilitating access to global markets, including currencies, commodities, and indices. IFX Brokers stands out in this competitive field. Established in South Africa in 2018, IFX Brokers is a licensed entity under the FSCA (Financial Services Conduct Authority). It caters to traders globally, extending its services across 180 countries.

In our comprehensive review, we delve deep into the offerings of IFX Brokers. Our focus will be on unraveling the unique aspects that set IFX Brokers apart, alongside any potential limitations. We aim to offer a well-rounded analysis, covering crucial aspects like account types, deposit and withdrawal methods, commission structures, and more. Combining expert insights with real trader experiences, this review is designed to provide you with all the necessary information to make an informed decision about IFX Brokers as your preferred Forex broker.

What is IFX Brokers?

IFX Brokers is an online trading broker based in South Africa, renowned for its unique blend of traditional values and innovative technology. This broker has carved a niche in the financial trading industry by offering a comprehensive trading and investing experience. It serves both private and institutional clients, catering to a wide range of trading preferences and strategies.

IFX Brokers specializes in providing a broad spectrum of trading opportunities. Clients can engage in trading cryptocurrencies, metals, CFDs on indices, and commodities. This versatility is a cornerstone of IFX Brokers’ offering. The broker provides

diverse account options, each tailored to meet varying trader needs. With high leverage and seamless access to both mobile and desktop versions of the MetaTrader platform, IFX Brokers is positioned as a versatile choice for traders.

>> Also Read: 8 Ways To Read Forex Charts: In Depth Guide For Beginner

Safety and Security of IFX Brokers

In Forex trading, safety and security are paramount. IFX Brokers, a regulated entity headquartered in Jeffreys Bay, South Africa, places a strong emphasis on these aspects. It operates under the strict supervision of the local Financial Services Conduct Authority (FSCA), ensuring adherence to financial regulations and standards. This information has been thoroughly researched and verified by Dumb Little Man.

A key feature of IFX Brokers is its negative balance

protection on all accounts. This safeguard ensures that clients’ losses never exceed their account balance, a significant aspect for risk management in trading. Additionally, client funds are rigorously separated from the broker’s capital, a practice that enhances financial security and integrity.

Moreover, IFX Brokers engages a third-party auditor to monitor the segregation of its capital and client funds daily. This level of scrutiny guarantees transparency and accountability in the broker’s operations. Professional liability insurance is another layer of protection, covering traders against potential losses resulting from fraudulent or erroneous actions by IFX Brokers. However, it’s crucial to note that unlike some regulatory bodies, the FSCA does not offer a compensation fund to cover traders’ financial losses, which is an important consideration for potential clients.

Pros and Cons of IFX Brokers

Pros

- Access to MT4 and MT5 platforms

- Diverse educational content

- Variety of trading tools available

- Selection of four different account types

- Advanced ticket support system

- Over 200 trading instruments

- Competitive spreads in trading

Cons

- Maximum leverage capped at 1:500

- Excludes clients from the USA

- Absence of FIX API trading option

- Significant amount of negative client feedback

Sign-Up Bonus of IFX Brokers

IFX Brokers offers an attractive Sign-Up Bonus to its new clients. This bonus is a great incentive for traders who decide to open a Standard Account with IFX Brokers. It provides a boost for both first-time and recurring deposits, making it an appealing option for those starting their trading journey.

The structure of this bonus is straightforward and generous. New traders receive a 50% Deposit Bonus on their initial deposit. Additionally, this 50% bonus applies to subsequent deposits as well, although it’s subject to the cumulative maximum bonus allowance set by IFX Brokers. This ongoing bonus structure is designed to benefit traders as they continue their trading activities with IFX Brokers.

Minimum Deposit of IFX Brokers

The minimum deposit requirement at IFX Brokers varies based on the type of account a trader chooses. This flexibility in deposit options makes it accessible for a wide range of traders, from beginners to more experienced ones. The broker has structured its account types to cater to different trading preferences and investment capacities.

For those opting for Standard, Islamic, or Cent accounts, the minimum deposit is remarkably low, set at only $10. This low entry barrier is particularly appealing for new traders or those testing the Forex market. On the other hand, more advanced traders looking for enhanced features can opt for the Premium account with a $250 minimum deposit. For the most exclusive services, the VIP account requires a $1000 deposit, catering to high-volume traders. This tiered structure ensures that IFX Brokers offers options suitable for a diverse range of traders and their respective financial capabilities.

IFX Brokers Account Types

After thorough research and testing by our team of experts at Dumb Little Man, the following account types at IFX Brokers have been identified:

Cent Account

- Minimum Deposit: $10

- Spreads: Floating, starting from 1.6 pips

- Fees: None

Standard Account

- Minimum Deposit: $10

- Spreads: Starting from 1.3 pips

- Fees: No fee per lot

Premium Account

- Minimum Deposit: $250

- Spreads: Starting from 1 pip

- Fees: None

VIP Account

- Designed for: Experienced traders

- Minimum Deposit: $1,000

- Spreads: Starting from 0.5 pips

- Fees: $6 per lot

Islamic Account

- Features: Similar to the Standard account but with no swaps

These account options are designed to cater to a range of trading styles and experience levels, from beginners to seasoned traders. Each type offers its unique balance of minimum deposit requirements, spread ranges, and fee structures.

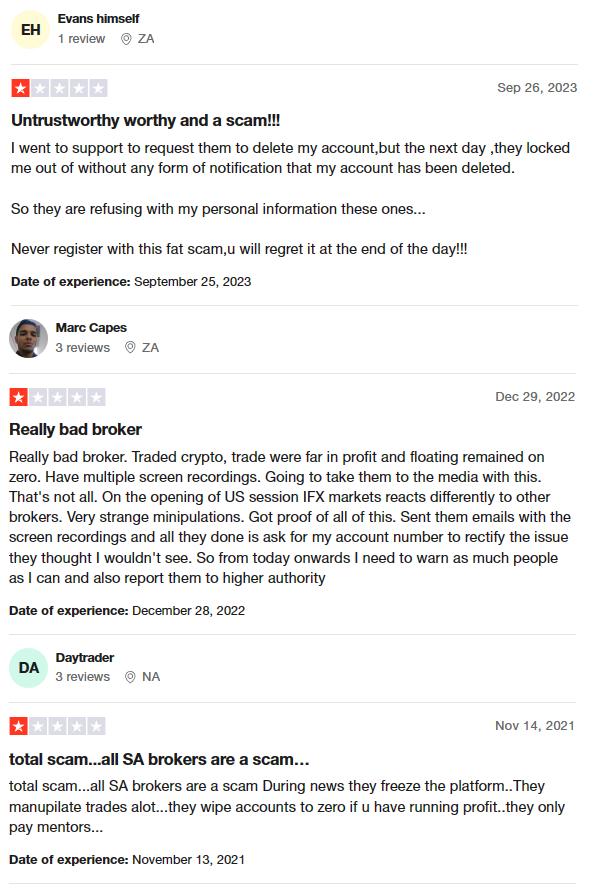

IFX Brokers Customer Reviews

IFX Brokers‘ customer reviews reveal a pattern of dissatisfaction among some users. Complaints primarily focus on customer support issues and alleged trading irregularities. One customer expressed frustration about account deletion without proper notification, raising concerns about personal data handling. Another trader reported problems with cryptocurrency trades, where profits did not reflect correctly, and suspected manipulative market behaviors during the US session opening. They claimed to have evidence of these issues and planned to escalate them.

A third review labeled the broker a scam, alleging that the platform freezes during news events and manipulates trades, particularly mentioning accounts being wiped out during profitable runs. These reviews collectively suggest a need for potential customers to approach with caution and conduct thorough research before engaging with IFX Brokers.

IFX Brokers Fees, Spreads, and Commissions

IFX Brokers has a clear structure for its fees, spreads, and commissions, which are key considerations for any trader. The broker primarily earns through spread markups on all account types, and an additional fee per lot is charged for VIP accounts. The spreads vary based on the type of instrument being traded and the account type a trader holds. These spreads are also subject to change throughout the trading day.

For the different account types, the minimum spreads are as follows:

- Standard and Islamic accounts: 1.3 pips

- Premium account: 1 pip

- VIP account: 0.5 pips

- Cent account: 1.6 pips

Regarding transaction costs, IFX Brokers’ clients benefit from no deposit and withdrawal fees when using electronic payment systems and crypto wallets, which is a significant advantage. However, it’s important to note that there is a bank transfer fee involved, which is 2.5% of the transaction amount. This fee structure is an essential aspect for traders to consider when evaluating the overall cost of trading with IFX Brokers.

Deposit and Withdrawal

IFX Brokers offers efficient and user-friendly deposit and withdrawal processes. This information has been validated after being tested by a trading professional at Dumb Little Man. Deposits with IFX Brokers are not only instant but also free of cost, making it a hassle-free experience for traders. The process is designed to be straightforward: traders simply log in to their secure client area and choose their preferred payment method to make a deposit. This ease of depositing funds is a significant advantage for traders.

Withdrawals at IFX Brokers are processed during weekdays. For clients in South Africa, transaction confirmations occur within 2-4 hours, showcasing the broker’s commitment to fast withdrawal processing. For international traders, while withdrawal requests are processed instantly, the actual fund transfer to a bank account may take up to 5 business days. In cases where the withdrawal amount exceeds 100,000 ZAR (approximately USD 5,200), the funds are received within the same 5 business day window.

It’s important to note that IFX Brokers ensures security by allowing withdrawals only to the bank account of the client who made the request. Additionally, the default withdrawal currency is ZAR, and any currency conversion fees are borne by the traders. This clarity in the withdrawal process and associated costs is crucial for traders to understand before engaging in trading activities with IFX Brokers.

How to Open an IFX Brokers Account

- Visit the IFX Brokers website and click the “Start Trading” button.

- Fill in personal details, phone number, email address, country of residence, create a password, and choose a wallet currency.

- Check your email and follow the link sent by IFX Brokers to confirm your registration.

- Submit necessary documents to open either a demo or a trading account.

- Deposit funds into your newly created wallet.

- Select the type of account you wish to open, such as Standard, VIP, or Islamic.

- Configure your trading preferences and settings in the user account.

- Download and install the trading platform, either MetaTrader 4 or MetaTrader 5.

- Begin trading or practicing on the platform with your IFX Brokers account.

IFX Brokers Affiliate Program

IFX Brokers has an Introducing Broker (IB) program that offers a rewarding opportunity for individuals who introduce new clients to IFX Brokers’ services and products. This program operates on a simple yet effective principle: when a referred client trades, the IB earns a reward. Specifically, for every standard lot closed by a referral, the IB can earn up to $12.

The program is structured to encourage growth and expansion. As an IB increases their client base, IFX Brokers enhances the reward, creating an incentive for ongoing client acquisition. Additionally, the program offers an attractive prospect where IBs can further increase their earnings by connecting with sub-IBs. These are referrals who also register new traders, creating a multi-tiered system of rewards and incentives. This aspect of the program allows for the potential of significantly increased earnings for active and successful IBs.

IFX Brokers Customer Support

IFX Brokers customer support, as experienced and reported by Dumb Little Man, offers 24/5 technical support, a crucial aspect for traders who operate in various time zones. This support is accessible in an impressive range of 30 languages, catering to a diverse global client base and enhancing communication effectiveness.

Clients looking to contact IFX Brokers have multiple channels at their disposal. They can reach out via phone, using the number provided in the Contact section of IFX Brokers’ website. Alternatively, email communication and ticket submissions through the user account are also available for more detailed inquiries or specific issues. This multi-channel approach ensures that clients can choose the most convenient way to get the support they need.

The registration address of IFX Brokers Holdings (Pty) Ltd, located at 79 Da Gama Road, Jeffreys Bay, South Africa, adds an additional layer of credibility and accessibility for clients seeking to connect with the broker. This comprehensive customer support system underlines IFX Brokers’ commitment to providing responsive and effective assistance to its clients.

Advantages and Disadvantages of IFX Brokers Customer Support

| Advantages | Disadvantages |

|---|---|

|

IFX Brokers vs Other Brokers

#1. IFX Brokers vs AvaTrade

IFX Brokers, established in South Africa in 2018, is known for its variety of account types, low minimum deposit, and a focus on the MetaTrader platform. AvaTrade, founded in 2006 and headquartered in Dublin, Ireland, has a broader global presence with more financial instruments and is heavily regulated in multiple jurisdictions. While IFX Brokers is attractive for its accessibility and tailored accounts, AvaTrade stands out for its robust regulatory framework and wider range of trading options.

Verdict: AvaTrade may be better for traders seeking a more globally established broker with a diverse range of instruments and stronger regulatory oversight.

#2. IFX Brokers vs RoboForex

IFX Brokers and RoboForex both offer MetaTrader platforms, but RoboForex, operating since 2009, boasts a more extensive selection, including cTrader and RTrader. RoboForex also offers a wider range of assets and trading options, appealing to various trading styles and volumes. IFX Brokers, however, is more accessible with lower minimum deposits, making it appealing to newer traders.

Verdict: RoboForex is likely a better choice for traders seeking diversity in trading platforms and a broader range of trading options.

#3. IFX Brokers vs FXChoice

FXChoice, established in 2010 and regulated by the International Financial Services Commission of Belize, caters more to experienced traders with its focus on professional ECN accounts and a limited range of account types. IFX Brokers offers more variety in account types and is more accessible to beginners. However, FXChoice’s emphasis on professional trading might appeal more to experienced traders looking for ECN accounts and high-volume trading benefits.

Verdict: FXChoice is more suited for experienced traders seeking professional trading conditions, while IFX Brokers is better for those looking for a range of account options and lower entry barriers.

Choose Asia Forex Mentor for Your Forex Trading Success

If you’re passionate about forging a successful career in forex trading and aim for significant financial returns, Asia Forex Mentor is the top pick for the best forex, stock, and crypto trading course. The brainchild of Ezekiel Chew, known for his influence on trading institutions and banks, powers Asia Forex Mentor. Ezekiel himself is a standout in the industry, regularly securing trades in the seven-figure range, distinguishing him from his peers in educational circles. Here’s why we recommend it:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough training program encompassing stock, crypto, and forex trading. The curriculum is designed to provide budding traders with essential skills and knowledge for success in these varied markets.

Proven Track Record: The effectiveness of Asia Forex Mentor is evident in its history of consistently creating profitable traders in different market areas. This record underscores the success of their educational techniques and mentoring.

Expert Mentor: Students at Asia Forex Mentor receive insight and guidance from an accomplished mentor in stock, crypto, and forex trading. Ezekiel offers tailored support, helping students adeptly navigate these complex markets.

Supportive Community: Being part of Asia Forex Mentor means joining a community of traders focused on success in stock, crypto, and forex markets. This network encourages sharing ideas and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: Trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to assist traders in managing emotions, coping with stress, and making informed decisions.

Constant Updates and Resources: With the ever-changing financial markets, Asia Forex Mentor keeps students updated with the latest trends, strategies, and insights. Ongoing access to resources ensures traders stay informed and competitive.

Success Stories: Asia Forex Mentor is proud of its many students who have significantly improved their trading careers and achieved financial independence through their robust education in forex, stock, and crypto trading.

Asia Forex Mentor stands as the leading choice for anyone seeking the best course in forex, stock, and crypto trading. Its detailed curriculum, experienced mentors, practical approach, and supportive community equip aspiring traders with the tools and guidance to excel as professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: IFX Brokers Review

In conclusion, based on the evaluation by the team of trading experts at Dumb Little Man, IFX Brokers emerges as a noteworthy player in the Forex trading landscape. The broker’s strengths lie in its diverse account types, low minimum deposits, and access to the popular MetaTrader platforms. These features make IFX Brokers an appealing choice for both novice and experienced traders alike, providing flexibility and a range of options to suit various trading needs and strategies.

However, it’s important for potential clients to be aware of certain drawbacks. The broker’s limited educational resources and customer support challenges, particularly the lack of a live chat option, might be significant considerations for some traders. Additionally, the absence of services to U.S. clients and reports of trading irregularities as noted in some customer reviews, should be taken into account.

>> Also Read: LegacyFX Review 2024 with Rankings By Dumb Little Man

IFX Brokers Review FAQs

What types of trading accounts does IFX Brokers offer?

IFX Brokers provides a range of account types to cater to different trader needs. These include Standard, Cent, Islamic, Premium, and VIP accounts. Each account type comes with its own set of features, such as varying minimum deposits and spread levels, providing flexibility for traders at different levels of experience and investment capacities.

Is IFX Brokers regulated and safe to trade with?

Yes, IFX Brokers is a regulated entity, overseen by the Financial Services Conduct Authority (FSCA) in South Africa. This regulation ensures that IFX Brokers adheres to certain financial standards and practices. However, potential clients should note that unlike some regulators, the FSCA does not offer a compensation fund to cover traders’ financial losses. Traders should also be aware of customer feedback regarding account management and trading conditions.

Are there any fees or charges I should be aware of with IFX Brokers?

IFX Brokers earns primarily through spread markups on various account types and charges a fee per lot on VIP accounts. While the broker offers free deposits and withdrawals using electronic systems and crypto wallets, a bank transfer fee of 2.5% is applied to transactions. Additionally, for withdrawals, currency conversion fees, if applicable, are borne by the traders. It’s advisable for traders to review the detailed fee structure on IFX Brokers’ website to understand all potential charges.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.