LegacyFX Review 2024 with Rankings By Dumb Little Man

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.6 1.5/5 | 94th  |  |

| Evaluation Criteria |

|---|

Dumb Little Man's team, consisting of financial experts, seasoned traders, and private investors, employs a specialized algorithm to evaluate brokerage services comprehensively. Their review focuses on key elements like:

|

LegacyFX Review

Forex brokers play a crucial role in the global financial markets, acting as intermediaries between individual traders and the foreign exchange market. These brokers provide platforms for trading a diverse range of assets, including currencies, metals, indices, and more. For individuals looking to enter the Forex market, selecting the right broker is a key decision that can significantly impact their trading experience and success.

LegacyFX is a notable player in this field, having established itself as an international broker since 2017. Catering to a wide range of traders, from beginners to professionals, LegacyFX offers an expansive array of assets for trading. This inclusivity and versatility make it an attractive option for those looking to diversify their trading portfolio.

This review aims to provide a comprehensive assessment of LegacyFX, focusing on both its strengths and areas for improvement. It's designed to offer valuable insights into the broker's offerings, including account options, deposit and withdrawal processes, commission structures, and other essential aspects. By combining expert analysis with real-world trader experiences, this review strives to equip potential users with the necessary information for making an informed decision about choosing LegacyFX as their broker.

>> Also Read: 8 Ways To Read Forex Charts: In Depth Guide For Beginner

What is LegacyFX?

LegacyFX stands out as an international broker that has been actively involved in the financial services sector since 2017. Known for its wide reach and comprehensive services, LegacyFX serves a diverse clientele, ranging from those new to trading to seasoned professionals. The broker's platform allows clients to trade a variety of assets, including currencies, metals, and indices, among others, catering to the varied interests of its users.

Apart from facilitating independent trading, LegacyFX also offers unique investment opportunities. This includes access to trading signals and automated trading programs, tools that are especially beneficial for individuals seeking to streamline their trading experience. These features make LegacyFX a versatile choice for both hands-on traders and those who prefer a more automated approach to investing.

Safety and Security of LegacyFX

The safety and security of clients' funds and information is a paramount concern for any financial service provider. LegacyFX, in its commitment to maintaining high security standards, operates under stringent regulatory oversight. This broker is monitored by two key regulatory bodies: the VFSC (Vanuatu Financial Services Commission) with registration number 14579, and the CySEC (Cyprus Securities and Exchange Commission) under license number 344/17. These affiliations highlight LegacyFX's adherence to international financial regulations and standards.

To further safeguard its clients, LegacyFX has implemented proactive measures against potential scams. The broker maintains a blacklist of fraudulent entities, including organizations, individuals, and websites, to warn its clients and prevent them from falling prey to scams. However, it's important to note that LegacyFX clarifies its non-liability in cases where clients voluntarily provide third-party access to their accounts. This transparency in policy underscores the importance of personal responsibility in account management.

LegacyFX also assures the safety of client funds by keeping them in segregated accounts. This separation of company and client funds is a crucial aspect of financial security in the brokerage industry. Additionally, the broker provides a comprehensive list of cybercriminals and fraudulent organizations. This resource is designed to help clients stay informed and vigilant, further protecting them from cyber threats and hacking attempts. These measures, as gathered from thorough research by Dumb Little Man, reflect LegacyFX’s dedication to creating a secure trading environment for its users.

Pros and Cons of LegacyFX

Pros

- Protection against negative balance.

- Broker covers replenishment and withdrawal fees.

- Access to a variety of investment programs and tools.

- Comprehensive educational resources.

- Multiple customer support contact methods.

- Easy financial transactions.

- Segregated accounts for client funds.

Cons

- Limited stock trading for Standard and Bronze accounts.

- High initial deposit requirement.

- Customer support not available during nights and weekends.

Sign-Up Bonus of LegacyFX

LegacyFX currently does not offer a sign-up bonus or any other promotional incentives. As of the time of this writing, new clients joining LegacyFX should be aware that no additional bonuses will be provided upon account registration. This approach aligns with the broker's straightforward and transparent service philosophy, focusing primarily on the quality of its trading services and educational resources rather than on promotional offers.

Minimum Deposit of LegacyFX

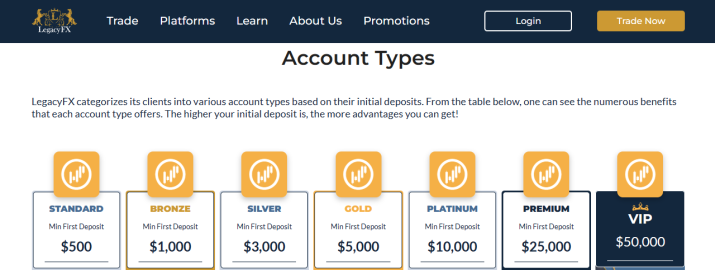

At LegacyFX, the minimum deposit required to begin trading varies based on the type of account a client chooses to open. This amount ranges from a modest $250 for a standard account, making it accessible to beginners or those looking to start with a smaller investment. For other account types, the minimum deposit can go as high as $25,000, catering to more experienced traders or those with a higher investment capacity. This tiered approach allows LegacyFX to accommodate a broad spectrum of financial commitments from its diverse client base.

LegacyFX Account Types

LegacyFX offers a range of account types, each designed to cater to different levels of trading experience and investment capabilities. Our team at Dumb Little Man conducted thorough research and testing to provide a clear overview of these account options:

Standard Account

- Minimum Deposit: $250

- Features: Free access to the trading terminal, commodity trading, signals, live support, training materials, tips, and updates.

Bronze Account

- Minimum Deposit: $1,000

- Additional Features: Includes all Standard account features, plus 3 protected trades and an automatic charting tool.

Silver Account

- Minimum Deposit: $3,000

- Additional Features: All Bronze account features, access to stock trading, materials on trading psychology, basic analytics, and mentoring.

Gold Account

- Minimum Deposit: $5,000

- Additional Features: Includes Silver account features, plus access to the Direct Dealing Desk, premium trading ideas, a personal plan for trading goals, and a European VIP MasterCard.

Platinum Account

- Minimum Deposit: $10,000

- Additional Features: Builds on Gold account features with access to the Dealing Room Direct Line and a personalized trading plan.

Premium Account

- Minimum Deposit: $25,000

- Additional Features: Offers all previous account functions, extended mentoring, and access to premium sessions and opportunities.

VIP Account

- Minimum Deposit: $50,000

- Special Feature: A highly individualized account combining all features of the aforementioned accounts, with trading conditions tailored to each client.

LegacyFX Customer Reviews

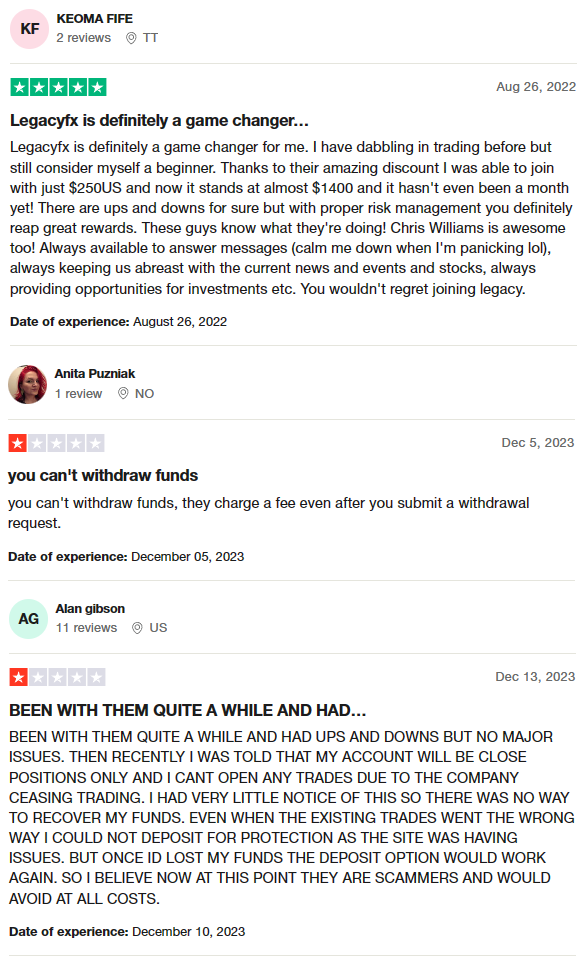

LegacyFX customer reviews present a mixed bag of experiences. Some traders, like Chris Williams, have found significant success, starting with a modest investment of $250 and seeing it grow to nearly $1,400 in less than a month. They attribute this success to effective risk management and the support provided by LegacyFX, including timely updates and investment opportunities.

On the other hand, there are customers who have faced challenges, particularly with the withdrawal process, citing fees and difficulties in fund withdrawal. Others have experienced restrictions on their trading activities, with sudden changes in account status leading to the inability to open new trades or protect existing ones. These experiences suggest that while some users are satisfied with the services and support offered by LegacyFX, others have encountered significant issues that raise concerns about the platform's reliability and transparency.

LegacyFX Fees, Spreads, and Commissions

LegacyFX adopts a straightforward approach to fees, spreads, and commissions, making it easier for traders to understand and manage their trading costs. Notably, the broker does not levy a separate fee for trade execution; instead, this cost is integrated into the spread. This method simplifies the cost structure for traders. Additionally, maintaining a trading account, using the trading platform, and accessing educational materials are all offered free of charge.

For funding activities, LegacyFX covers the commission on both deposit replenishments and withdrawals, which is a beneficial aspect for traders as it reduces their transactional expenses. The broker provides options between fixed or variable spreads, allowing traders to choose the model that best suits their trading strategy and preferences. For instance, the spread on EUR/USD starts at 1.6 pips with the Silver account and tightens to as low as 0.6 pips for Gold and Platinum accounts.

In terms of asset-specific commissions, all assets are traded commission-free, with the exception of stocks, which incur charges ranging from 0.15% to 0.45%, varying based on the account type. Another significant advantage for traders is the absence of rollover fees on long-term positions. This policy favors those who engage in long-term trading and investment strategies, as it eliminates the additional costs typically associated with holding positions over an extended period.

Deposit and Withdrawal

LegacyFX offers a range of deposit and withdrawal methods, as confirmed by the testing conducted by a trading professional at Dumb Little Man. Clients can use various payment options, including credit cards (VISA, MasterCard), debit cards (VISA Electron, Maestro), or wire transfer. However, it is important to note that transactions are currently limited to three major currencies: U.S. Dollars, Euros, and GBP.

The time taken for transactions varies depending on the chosen payment method. For instance, instant payments through the Blockchain system credit funds within a few hours, while bank transfers typically take 1-3 days. Conversely, transactions via Load might require 3-5 days to complete. This flexibility in processing times caters to different user preferences and urgencies.

Regarding withdrawals, the minimum transaction amount is set at $50 for the Blockchain system and $150 for bank transfers. A notable advantage for LegacyFX users is that the broker absorbs any transaction fees, ensuring that clients do not incur additional costs for their financial activities.

Before conducting any financial transactions, trader verification is a mandatory step. This requirement is part of LegacyFX’s commitment to maintaining security standards and ensuring the integrity of all transactions on its platform.

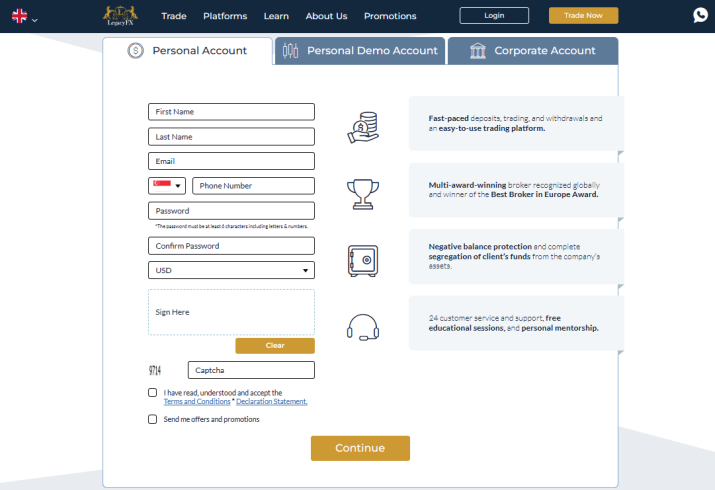

How to Open a LegacyFX Account

- Navigate to the LegacyFX official website.

- Press the menu button on the homepage.

- Opt for “Open Account” for a live account or “Open Demo Account” for practice.

- Decide between a personal or corporate account type.

- Enter your personal details including name, surname, email, and phone number.

- Set up your password, choose your account currency, and complete the security steps.

- Upload your identity documents in your personal account area.

- Provide your credit/debit card details to finalize account setup.

- Complete the account verification process to start trading.

LegacyFX Affiliate Program

LegacyFX‘s Affiliate Program offers various opportunities for individuals to earn by promoting its services. Participants can benefit from high CPA payouts, with potential earnings of up to $1,000 per client acquisition. This program is one of the most lucrative in the industry, making it an attractive option for affiliates.

The program provides access to LegacyFX's advanced marketing tools through CellXpert. These tools are designed to optimize affiliate marketing efforts, and participants can create a customized plan to maximize their earnings. This tailored approach ensures that affiliates can work in a way that best suits their individual strategies and audiences.

For those interested in becoming an Introducing Broker (IB), LegacyFX offers revenue share plans. Under these plans, IBs receive a commission for all closed trades made by their referrals at the end of each trading day. To support their efforts, each Introducing Broker is assigned a dedicated IB manager, providing personalized service and assistance.

Additionally, the Refer a Friend program allows current clients to earn by inviting friends to trade with LegacyFX. This process is straightforward: clients share their personal referral link, and commissions are earned based on the trading volume of the referred friends. This aspect of the program is designed to be simple and user-friendly, making it easy for clients to benefit from their referrals.

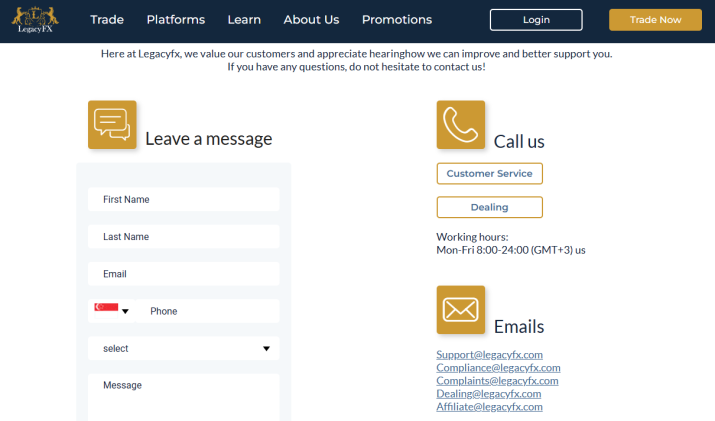

LegacyFX Customer Support

Based on the experience of Dumb Little Man with LegacyFX Customer Support, the broker offers a variety of communication channels to cater to its clients' needs. Clients have the option to send a message via the online chat feature on the LegacyFX website, providing a quick and convenient way to get in touch with support staff.

For those preferring a more traditional approach, there is the option to fill out a feedback form on the website, or call a specified number for direct verbal communication. These methods ensure that clients have multiple avenues to seek assistance or provide feedback.

Email support is also available, with LegacyFX offering different email addresses for various departments. This specialization ensures that clients' inquiries are directed to the appropriate team for efficient resolution. Additionally, for clients who prefer in-person interactions, visiting the broker's physical office is an option.

LegacyFX extends its presence to social networks like Twitter, Facebook, LinkedIn, YouTube, and Instagram. This broad social media footprint not only provides additional channels for support but also keeps clients informed and engaged with the latest updates and offerings from LegacyFX.

Advantages and Disadvantages of LegacyFX Customer Support

| Advantages | Disadvantages |

|---|---|

|

LegacyFX vs Other Brokers

#1. LegacyFX vs AvaTrade

LegacyFX focuses on a diverse range of traders, offering flexible account types and a comprehensive set of trading tools and educational materials. It is regulated by VFSC and CySEC. On the other hand, AvaTrade has been a prominent online Forex and CFD broker since 2006, serving a global clientele with an extensive array of over 1,250 financial instruments. AvaTrade is known for its strong regulatory framework, with multiple global jurisdictions, and offers its services in various locations, excluding the US.

Verdict: AvaTrade is better for traders seeking a more globally diversified investment portfolio with strong regulatory backing. LegacyFX, while robust in its offerings, may not match the scale and regulatory breadth that AvaTrade provides.

#2. LegacyFX vs RoboForex

LegacyFX caters to both beginners and professionals, offering a range of account types and a focus on educational resources. RoboForex, operating since 2009, prides itself on offering superior trading conditions through advanced technology. It offers a vast selection of over 12,000 trading options across eight asset classes and is known for its wide range of trading platforms and innovative contest project, ContestFX.

Verdict: RoboForex is likely the better choice for traders who prioritize a wide variety of trading options and innovative platforms. Its extensive range of instruments and technological advancements provide a more diverse trading environment compared to LegacyFX.

#3. LegacyFX vs FXChoice

LegacyFX offers a balanced trading environment suitable for various trader levels. In contrast, FXChoice, established in 2010 and regulated by FSC Belize, is known for its focus on experienced traders, offering professional ECN accounts with tight market spreads and a commitment to quality services for both active and passive trading.

Verdict: FXChoice is preferable for experienced traders due to its specialized trading conditions, such as professional ECN accounts and a focus on high-volume trading. LegacyFX, with its broader appeal and support for various trader levels, may not be as tailored for the needs of seasoned traders as FXChoice.

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a lucrative career in forex trading and desiring significant financial rewards, Asia Forex Mentor is the leading choice for top-tier forex, stock, and crypto trading courses. The brainchild behind this institution is Ezekiel Chew, recognized for his pivotal role in training at trading institutions and banks. Ezekiel's personal trading achievements include consistently securing seven-figure trades, a feat that distinguishes him in the realm of trading education. The reasons we endorse Asia Forex Mentor are compelling:

Comprehensive Curriculum: Asia Forex Mentor's curriculum thoroughly covers stock, crypto, and forex trading, providing learners with the essential knowledge and skills for success in these varied markets.

Proven Track Record: The effectiveness of Asia Forex Mentor is underscored by its history of cultivating consistently profitable traders in diverse market areas, reflecting the strength of their educational and mentoring approaches.

Expert Mentor: Students at Asia Forex Mentor benefit from the wisdom and expertise of an accomplished mentor in stock, crypto, and forex trading. Ezekiel's personalized guidance empowers students to confidently tackle the complexities of each market.

Supportive Community: Membership in Asia Forex Mentor grants access to a community of fellow traders, promoting a collaborative environment for sharing ideas and learning from peers, thereby enriching the educational journey.

Emphasis on Discipline and Psychology: Recognizing the importance of mindset and discipline, Asia Forex Mentor focuses on psychological training, equipping traders to manage emotions, stress, and make informed decisions in trading scenarios.

Constant Updates and Resources: With the ever-evolving nature of financial markets, Asia Forex Mentor ensures its students stay informed about the latest trends, strategies, and insights, providing ongoing access to critical resources.

Success Stories: The numerous success stories from Asia Forex Mentor alumni, who have transformed their trading careers and achieved financial autonomy, are a testament to the quality of its forex, stock, and crypto trading education.

Asia Forex Mentor stands out as the superior choice for those aiming for the best forex, stock, and crypto trading course. With its in-depth curriculum, experienced mentors, practical methodologies, and a supportive community, Asia Forex Mentor equips aspiring traders with the tools and guidance necessary to become successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: LegacyFX Review

In conclusion, the team of trading experts at Dumb Little Man has conducted an extensive review of LegacyFX, uncovering both its strengths and areas of concern. LegacyFX stands out for its diverse range of account types, catering to both beginners and experienced traders. The broker's commitment to educational resources and various trading tools enhances the trading experience, making it a viable choice for those seeking a comprehensive trading platform.

However, it is crucial for potential clients to be aware of certain drawbacks. The high minimum deposit for some account types might be a barrier for new or low-volume traders. Additionally, the limitations in customer support availability, particularly during nights and weekends, may pose challenges for traders needing assistance during these times.

>> Also Read: WorldForex Review 2024 with Rankings By Dumb Little Man

LegacyFX Review FAQs

What types of trading instruments does LegacyFX offer?

LegacyFX provides a diverse array of trading instruments, catering to a wide range of traders. Clients can trade in currencies, metals, indices, and various other assets. This range makes LegacyFX suitable for traders who seek to diversify their portfolio across different market sectors.

Is LegacyFX regulated, and how does this impact traders?

Yes, LegacyFX is regulated by the Vanuatu Financial Services Commission (VFSC) and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight ensures that LegacyFX adheres to specific standards and practices, offering a level of security and trustworthiness to its clients. For traders, this means they are engaging with a broker that is held to high standards of financial integrity and transparency.

What should I know about LegacyFX's deposit and withdrawal processes?

LegacyFX's deposit and withdrawal processes are straightforward, with the broker covering commission costs for both. Clients can use credit/debit cards, wire transfers, and other methods for transactions. However, it's important to note that the minimum withdrawal amounts vary depending on the method used, and traders should be aware of the processing times which can differ based on the chosen payment system. Potential users should also consider the requirement of account verification before conducting financial transactions.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.