Learn How To Trade Iceberg Order – An Expert’s Take 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

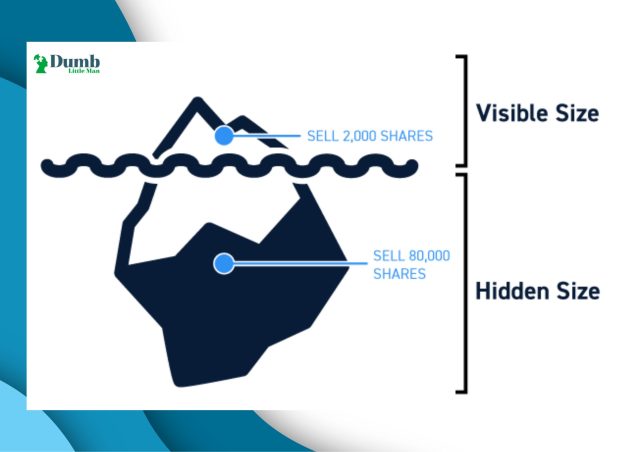

Just like the popular saying, ” the tip of the iceberg” means that the portion of the iceberg visible in the sea is little compared to the larger invisible portion beneath the sea. In the financial market, institutional investors and traders are part of those controlling the market. Still, whenever they decide to place a large order in the market to avoid disrupting trade markets, they adopt a trading strategy called iceberg order, otherwise known as reserve orders.

An Iceberg order is one of the popular trading strategies used by an institutional investor that consists of a single large order divided into several smaller orders through an automated program to hide the actual large order placed. The “iceberg” term implies that only a small portion of the market maker iceberg order will be visible, while the remote part consists of large or hidden orders.

For this article, we have Ezekiel Chew, a world-renowned and seasoned forex mentor and expert, to further elaborate on the concept of the iceberg order to us. Scroll down the paragraphs below for a better understanding of the iceberg order, how to identify it, and apply it to your day trading as a day trader.

What is Iceberg Order

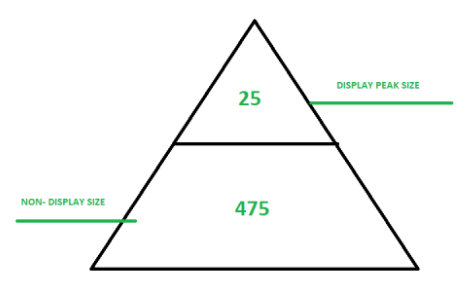

Iceberg orders are large orders broken down into several limit orders by institutional investors to avoid disrupting trading markets. Instead of an institutional investor approaching the market as a large sell order, the market makers help them to divide it into smaller orders until the entire order is executed. However, these iceberg orders are initiated by an automated program to reveal the entire order quantity placed by the institutional investor.

“The tip of the iceberg” in the iceberg order trading strategy refers to the large orders that have been reduced to several small orders visible to the day traders while the total order quantity remains unrevealed. Iceberg orders are also referred to as reserve orders, one of the trading techniques used to place limit orders on buying and selling financial securities in large quantities.

An example of an iceberg order is when institutional investors place a large trade to purchase shares worth 50,000. The iceberg order breaks the large buy order into several smaller orders. 50,000 shares can be shared into 5 divisions by market makers like 15,000,10,000, 5000, 10,000, & 10,000. The traders can benefit from the iceberg orders by buying shares higher than the initial price level because, by now, it has affected price movements.

Basics of Iceberg Order Explained

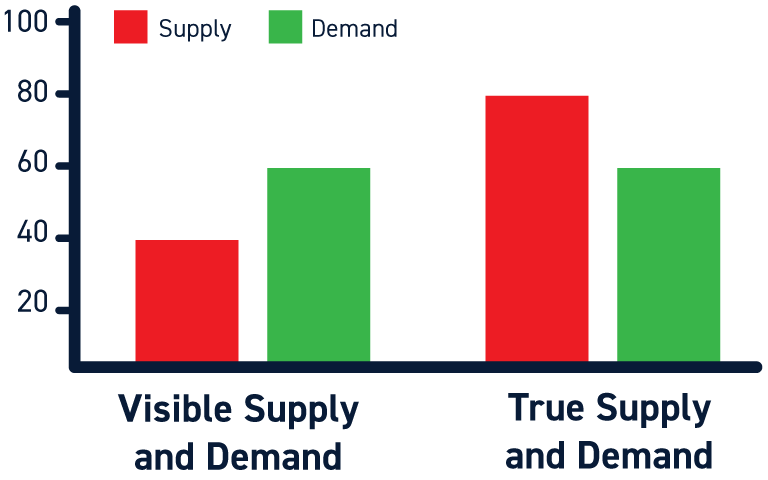

Generally, iceberg orders are placed by institutional investors to buy and sell large amounts of financial securities to avoid disrupting trading markets. Hence, only a small portion of the entire order is revealed and visible on Level 2 order books at any time. Through that, the iceberg order reduces the price movements caused by significant changes in stock supply and demand by dividing large orders into smaller orders to cover up the entire trade.

For further explanation, an institutional investor would not want to place a large sell order in the market to prevent market panic among traders. In that case, the investor would divide the large sell order into smaller limit orders that would not disrupt the selling price in the market.

On the other hand, an institutional investor who wants to place a large buy order would not want it to be noticeable to some day traders who might see and also want to place a bid for the same order because they also want to buy at the lowest possible price.

Iceberg – How does it work

In iceberg orders, when an institutional trader places a large order, and the entire order becomes visible to other market participants for a longer period, it can affect the traders' trading. Also, the large buy order placed to buy the shares of a stock will influence the demand for that shares by increasing the price to triple the initial amount just because an institutional trader is interested in it.

On the other hand, the large sell order placed to sell the same share of a stock will influence the demand for that share by bringing down the price. For this reason, an iceberg order remains the best. For example, suppose an institutional trader wants to place a single large trade. In that case, they divide it into smaller orders to ensure that their total order size will not affect the stock price.

Once the entire trade is known to the other market participants, it will also affect the institutional traders because the price of the stocks can go against their order, stopping them from buying or selling at their price. Also, market makers, aware of the entire trade placed, might decide to opt for a similar stock to buy the stock for themselves.

In this case, the market gradually begins to feel it, especially if it is from the same market markers, and this will lead to an inflation in the price of stocks forcing the institutional traders to pay higher than their initial price for that particular stock.

How to Identify an Iceberg Order

Traders and market participants can identify iceberg orders by searching for repeated series of limit orders from the same market maker. For example, suppose the institutional investor divides his order of 500 000 into several market orders. In that case, other market participants must be vigilant in monitoring the orders in Level 2 order books.

The other traders must pick up the order sequence, identify the iceberg orders, and check if they're being filled up quickly. Iceberg orders are a helpful trading strategy that guides traders to know when to enter the market and buy the shares of the stock above the initial price level, creating an avenue for scalping profits.

Another way to identify an iceberg order is by checking the trades column for repeated prints and the bid price for the order quantity of the same print. If a potential iceberg order is detected in the market, check again if it executes and reloads because only the visible portion of an iceberg order is executed first. After that, the hidden part of the order is executed once it becomes visible in the order book; with this, you can know that it's an iceberg order.

How to Place an Iceberg Order

Institutional investors and traders willing to place an iceberg order should check out a trading platform that offers Direct Market Access (DMA). After getting your trading platform, open up a dealing ticket and select the market order type, limit order or you can choose an iceberg order; this will automatically set to limit orders on the trading market.

At this point, you need to adjust it to the iceberg order type since iceberg orders allow large traders to divide their large trades into smaller orders. By doing this, you can profit from it when you place your order; also, you can benefit from the hidden liquidity of the entire trade because other market participants do not know the extent of the entire trade.

Best Forex Trading Course

To learn about forex trading to become a pro, look no further because Asia Forex Mentor by Ezekiel Chew is all you need. Over the years, this popular online Forex trading course has been helpful to thousands of retail traders and forex traders working in trading institutions to make millions of dollars through Forex across the world.

Ezekiel is a seasoned Forex trader and mentor who has taken the responsibility of training and teaching all others, and his impact has been felt worldwide. He has been trading Forex for more than a decade, and he knows how to be a profitable Forex trader as an expert. In his Forex trading course, he'll also teach you how to become an expert.

This forex trading course is a complete package loaded with everything you need, either as an amateur or an expert trader. The trading techniques and tactics shared by Ezekiel from his trading experiences will help you make accelerated progress in no time.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Iceberg Order

Iceberg orders are one of the automated trading strategies used by large traders to sustain the transaction price of the share of a stock and, at the same time, not disrupt the trading market. This is achieved by setting the limit price of your bid for the single large buy order you placed.

Institutional investors who are market traders use iceberg orders to break down large orders into several smaller orders to avoid disrupting the market price movements and exposing the hidden part of the order.

Other traders can identify iceberg orders by carefully checking out for a series of recurring limit orders from a single market maker and checking on Level 2 order books, the level at which the visible order is shown. I hope you enjoyed this article and find it helpful in identifying the iceberg orders in your trading markets. The more you understand this strategy, the more you can benefit from it.

Iceberg Order FAQs

Are Iceberg Orders Profitable?

Yes, it is.

Like iceberg orders, it is hard to know that an institutional investor is carrying out a vast order and even harder to assume how vast that order might be. So, traders who might attempt to increase the price of a stock, take on more stakes because they are unaware of how much more there is to be replenished.

What is an Iceberg Order Binance?

A dependent order trades a vast number of shares in nominal, predefined amounts to conceal the entire order size.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.