Dollar-Cost Averaging: Overview And Benefits

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Dollar-Cost Averaging or DCA is one of the investment strategies that investors may rely upon to approach the riskiness and volatility in the markets. In straightforward descriptions, an investor commits a small and constant amount of capital over a long period.

Typically, the schedule a trader commits to make the deposits is either on a weekly or quarterly basis. Experts say it mitigates risks in the financial markets. There’s more to the DCA, and in his post, We’ll invite the insights of Ezekiel Chew, who is a trader and mentor with two decades of expertise in trading from Asia Forex Mentor.

And as with every investment strategy, there must be some benefits and drawbacks. First, capital is always scarce, and investors want a scenario where there are certainties in the inflow of incomes. However, in reality, the markets present scenarios opposite to the expectations. But investors thrive within the riskiness to protect capital while earning at the same time.

Dollar-Cost Averaging arises as one of the strategies that investors can ride on. In finer details, we’ll see a graphical exemplification. Part of the process will also involve coverage of the formulae that DCA is built on.

Dollar-Cost Averaging Example and Definition

We’ll start on the Dollar- Cost Averaging with the basics. And we’ll keep the concept simple. With the DCA strategy, an investor puts in a set amount of capital over a prolonged period. It’s almost a perpetual approach to capital inflows.

The plain simplicity of saving or investing the small portions spread over time is taken as a leeway to avoid making a once-off commitment that could go wrong. Let’s take, for instance, an investor targeting Apple stocks, yet they are fearful that anything could go wrong at any moment.

Essentially with dollar-cost averaging, you avoid going at it all at once with all your money. Therefore, you approach the investment by putting in the small amounts at regular intervals or consistent basis for, say, every end month or so.

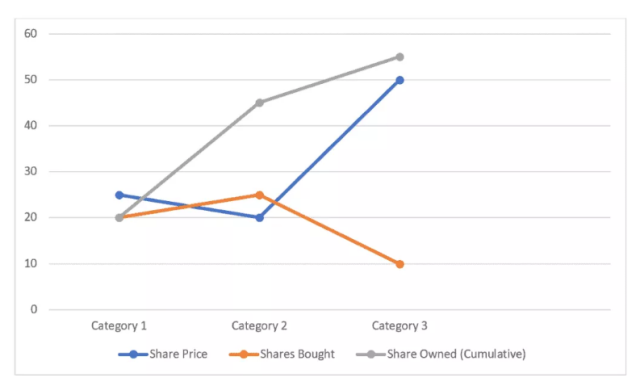

Let’s take, for instance, an investor willing to set aside some $500 on a monthly basis for a specific investment. And if the stock is selling at $25, the investor buys only 20 shares.

In the subsequent month, let’s say the price drops, and the share is selling at $20, the investor picks 25 shares that month. By the end of the 2 months, the investor will be holding a total of 45 shares. If a third month comes with a price increase, and each share goes selling at $ 50, the investor will purchase fewer shares at a lower price – taking only 10 in the third month.

Dollar-Cost Averaging is basically almost like a 401k plan. And your little but constant investments into the portfolio add up very fast. Seemingly, the amount may not look much, but over a long period, it amounts to an appealing investment. It can surprise you how much you could be held by the time you hit your retirement. And it goes without saying, DCA requires you to make and fulfill the long-term market commitments.

Dollar-Cost Average is seemingly a safe strategy for investors not for the promises of huge profits but rather for its low risky nature of slowly learning the ropes as an investor builds up volumes that are worth over time. By the time retirement comes knocking, and after investing regularly, investors usually end up with a lump sum at their disposal, courtesy of slowly building upon a slow but assured model.

To help with analyzing some of the metrics with dollar-cost averaging, one key thing investors would want to know is how much they would be worth. And you can easily know your worth by using a dollar-cost averaging calculator. Searching online, you can access many of them to help you figure out your worth in a lump sum over the next three or four decades.

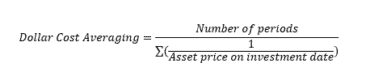

Earlier on, we made mentioned the concept of the Dollar-Cost Averaging formula to start investing.

And here is the formula:

It’s an important milestone with Dollar-Cost Averaging investors to bear in mind that it takes discipline and commitment over a long time. DCA is a long-term model that helps investors secure their retirement futures. Ideally, DCA is a model with low returns into the near future and it’s more oriented towards maintaining a good saving habit that builds so well into the financial future of an investor.

For investors drawing to weigh things around, it’s worth noting a few pillar points before jumping in.

Here are some key things investors need to know:

First and foremost, an investor has to be very clear regarding the amount they plan to put into the investment every other month. The good thing is that you can be flexible with the amounts you deposit according to your schedules. Also, you can go at it in an incremental nature if your incomes improve in the future. The prudential focus is settling down on an amount that you can easily maintain in terms of consistency regarding your intervals.

After settling on the figure to invest and the intervals, the next portion is picking on the investments to target. You may start with one; however, for diversification purposes, it’s best to go with a whitelist of several stock prices of existing investments.

When diversification comes into the picture, it helps spread risks – typically lowering risks with outlier investments that underperform by helping nil down their adverse effects with the portfolio items that over-perform. At the tail end, you stand the best chances with diversified portfolios as opposed to those with individual stocks.

Dollar-Cost Averaging Benefits

One of the biggest advantages of the Dollar-Cost average strategy is the fact that it removes the emotional downfalls which rip down investors many times. Emotions account for a huge portion of the confusion in the markets when volatility comes into the picture.

The plain simplicity of investing a small and constant amount is all that it takes for the long term. As elaborated earlier, the constant amount invested earns you varying amounts of shares since the prices keep shifting every month when your deposits fall due. Also, once you make your choice of the asset, you do not keep shifting it but only focus on the commitments to invest onwards.

Dollar-Cost Averaging works Only if Investors Remain Committed

There’s no worry about price dips or surges at any other moment. This is why DCA is almost a mechanical process of a systematic investment plan. Of course, there’s the temptation to jump ship during adverse periods. However, the price dips also present an opportunity to hold a little more shares for a lesser – if you look at the broader-term picture.

If you look at DCA from another perspective, diving into commitments all at once could be a recipe to blow all your capital away in an investment that’s losing. And, of course, the channeling of small amounts on a regular basis tends to allow you the time to absorb the shocks with huge magnitudes of adverse price movements.

It eventually saves you some capital when you iron out the outlier conditions that are seasonal yet detrimental to investors. While DCA offers no guarantee regarding future happenings, markets are known to take turns over time. And going longer-term could be the only trick you need with DCA.

On a very positive note, we made mention of a portfolio, and that’s the surest way to optimize your odds into the future. Quite true, some assets may bottom, while others top, and the nexus is an optimal portfolio that grows in value by bits over the long term.

Disadvantages of Dollar-Cost Averaging

One huge pitfall with Dollar-Cost Averaging as an investment strategy is – it’s not the best strategy to help your investments grow. On a fair scale, it’s termed a very passive strategy and especially for investors looking to save up for their retirement targets.

However, when it comes to a category of investors who want to make more returns in lesser time, Dollar-Cost Averaging won’t apply. Therefore, the Dollar-Cost strategy can therefore be an option among the substitute strategies for viable investments.

On a plain scale, DCA is a passive strategy to make earnings, it will only work if you select the good entries for stocks or assets in your portfolio. You could count on the Dollar Cost Averaging Stocks, and they are essentially 401K or mutual fund arrangements. And there’s no limitation regarding what assets you count valuable for your asset portfolio.

From an expert point of view, volatile assets like Bitcoin are some of you may count out of the list for candidates in your portfolio aiming to invest via the Dollar-Cost Averaging.

One other element that is disadvantageous regarding the passive elements with DCA comes with a hidden cost. Investing and forgetting about the capital is a rather too conservative approach. Investors under the DCA model sit by the side and make no responses to what the market prices say.

However, if you happen to watch the news and trail the prices in the markets, you may want to consider another investment approach to substitute how dollar cost averaging works. Lookup for a top-notch investment strategy that involves approaching advisory or brokerage services. There, you’ll find financial advisors with a better strategy for wealth management through exchange-traded funds and the stock market.

Let’s take, for instance; you lay hands on some insider information in the stock market -e.g., Apple is at the Blink of successfully acquiring Google. Therefore, while investing in an individual stock, you may be enticed to consider buying as many Apple stocks as possible as the prices are likely to soar in the future. So bad for Dollar-Cost averaging, it has no options to jump ship along the way.

Best Forex Trading Course

If you want to earn at far much better rates than Dollar- Cost Averaging offers, consider learning to trade forex, CFDs, and crypto-assets. A sure way is to lay hands on the best forex trading course under the guidance and mentorship of Ezekiel Chew.

Ezekiel offers the One Core Program as the ultimate and holistic course you’ll find out there. Simply put, the objective of the One Core program is to put you in a fast lane where you grasp the psychology of trading. Bear in mind that no formal school teaches that, and it’s the main reason why he, as the lead trainer, offers mentorship modules.

Building on the psychology of trading, you’ll learn to trade fearlessly. And by removing fear from your trading equation, your target to making six-figure trades, you join ranks with retail and institutional traders who’ve gone ahead of you through the One Core program.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Dollar Cost Averaging – Formula to Success

Dollar-Cost Averaging or DCA is among the investment strategies an Investor can rely on and follow the facts to the letter. First, it’s plain simple to set apart a constant amount where you buy assets or shares into your portfolio without the bother of looking at charts. It takes a very long time, and it’s the main reason why DCA is more or less a mutual fund or 401K plan.

Another term for the Dollar-Cost Averaging is the constant dollar plan or the fixed dollar amount. And perhaps that borrows from the point that an investor sticks to the constant outlay of capital whether prices dip or surge. Overall, the strategy helps by removing the human emotions that trigger fear as market prices oscillate into adverse values.

Surprisingly, simple as it is, the silent accumulation of amounts into an admirable portfolio from almost nothing. The longtime compounding works like magic, which comes with a host of pros and cons, like any other investment strategy. But the decades of growth seemingly iron out the seasonal downsides with risky market conditions for DCA.

For investors looking for investing strategy with higher returns within shorter timeframes, DCA is not a strategy to go for. The reality is it’s a strategy for conservative investors. More aggressive investors go for riskier strategies where market timing earns with price action, whether the market declines or surges.

Last note, Dollar-Cost Averaging is not an assured guarantee of earnings after the lengthy times you commit to making investments. And that applies to other strategies as well. So, to help mitigate the risks with markets, investors pick on particular stocks to form an optimized portfolio. In an optimized portfolio, some assets may fail while others excel. And it all comes to the old adage of – not putting all your eggs into a single basket.

Dollar-Cost Averaging FAQs

Is dollar Cost averaging up a good idea?

The question as to whether Dollar-Cost Averaging is a good idea is a relative situation. By relative, we mean it suits some scenarios, and in some cases, it’s off the curve. First, most governments provide retirement packages, and the workplace retirement plan is part of financial planning to cover their old age and other benefits.

Basically, since Dollar-Cost Averaging is a mutual fund or 401K plan, it takes too long. While at the same time, there are many other investment plans with a fixed amount where investors can earn higher with the average price invested plus higher ROIs. Also, with high tech, an automatic trading plan is a possibility to build wealth. But you must get good investment advice before making any lump sum investment at regular intervals.

There are many risks that face investors. While the Dollar-Cost Averaging or Constant dollar plan has a reasonable idea poised against market volatility, there are more ways the investors can cut through the risky noise. The conservative approach to market riskiness and financial decisions is vaguely quantified in the DCA model.

When you allow yourself to think loudly as an investor – CDA is saving for retirement. Will you be alive by then? Could your capital get lost if your portfolio-asset items dip in prices or you end up owning fewer shares? Many questions may arise. The bottom line is that there are better ways to invest than DCA and explore them.

What is Wrong with Dollar-Cost Averaging?

First, with Dollar-Cost Averaging, your rates of return are tough to quantify since it almost takes all your productive working life ramping up the investments. Therefore, DCA is a strategy that is far too vague besides its plain simple facts with saving small portions constantly. Who has that resource to commit for all their working life?

Secondly, DCA faces huge challenges with some critical variables. Economists bring our senses alive to the fact that – “a bird at hand is worth ten in the bush.” While you have a constant (fixed amount) investment figure, its true value is eaten away by inflation over time. It’s a strategy that is too conservative with its approach to risk and the promise of returns too far into the future.

The proposers of the Dollar-Cost Averaging strategy are blind to one key fact – they are silent about the optimization of portfolios. While very simple to grasp the concept, it limits your decisions as mutual funds do. DCA does not come out very clearly that investors need to spread risks by carefully picking assets into a portfolio.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.