Dead Cat Bounce – Explained by an Expert 2024

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

A dead cat bounce is among the terms investors need to understand as part of their analytical process. And this is also very helpful when it comes to managing positions in the financial markets.

As always, investors and traders should invest in information – as this gives them an upper hand whenever it comes to working around the risks that face their investments.

In this post, we’ll dive into the specific details of the term – Dead Cat Bounce. Our focus is to help you with factual yet practical information.

Therefore, to help us grasp the practical aspects of a dead cat bounce, we’ve contacted an expert – Ezekiel Chew, from the Asia Forex Mentor.

As an expert trainer and trader, Ezekiel brings in more than twenty years of trading. In the course of his aspirations to give back to society, he’s trained successful traders belonging to reputable banks, trading institutions staff, and retail traders.

Through the next sections of this post, He will guide us with practical insights regarding what a dead cat bounce indicates in a stock chart.

He’ll be specific on how long the occurrence lasts. There’ll be a practical example in images as well as one put in the form of a practical explanation.

Also, readers will find an exclusive section detailing the limitations that a dead cat bounce brings into the trading and investment scenarios.

And as always, after the conclusion, is an FAQs section – with answers to burning questions we may anticipate after reading through the entire post.

What is a Dead Cat Bounce?

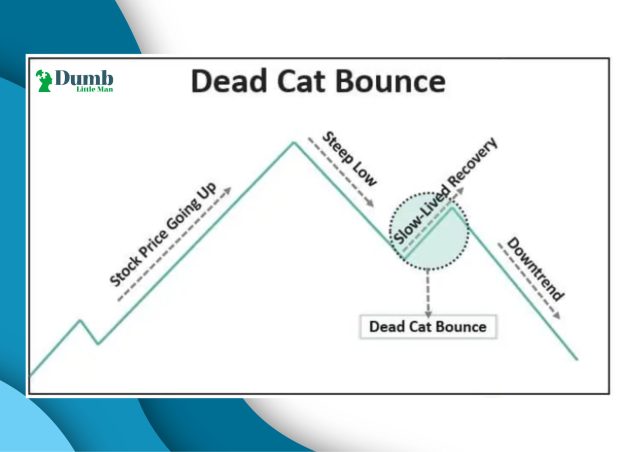

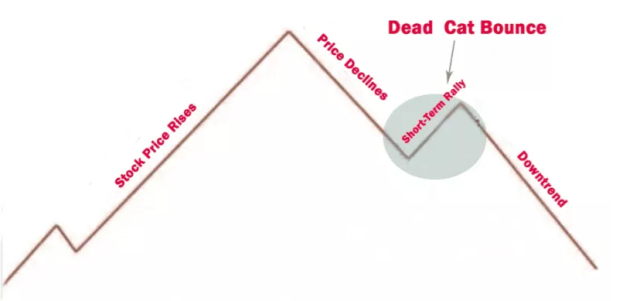

A dead cat bounce in stock refers to a scenario where prices make a brief recovery from a downtrend.

And it draws from a plain reference – prices recovering from an unexpected downfall – as a cat would survive a drop from several flats. Of course, it’s also related to the fact that cats are really strong – hence the proverbial reason why societies refer to a cat as having 9 lives.

In reference to a downfall in prices, traders may often mistake a dead cat bounce for a bullish trend reversal. Yet, after it’s done, prices resume the falling trend.

It’s, therefore, an awful situation if a trader has already jumped into the reversal trend – while in reality, it’s a brief recovery – a dead cat bounce, to be precise.

Many traders with substantial exposure must have experience with a dead cat bounce at one time or another. And it’s simple as a very clear downtrend incurring a momentary reversal of the prices.

From a technical analysis point of view, a dead cat bounce is only spotted once it has completely occurred. It’s an unpredictable pattern, and hence, this accounts for the biggest disadvantage.

Therefore, out of nowhere, prices will bounce into an uptrend – briefly, then resume the normal trend of falling. So, this is what really makes it hard for traders to figure out the legitimacy of the recovery in prices.

What Does a Dead Cat Bounce Indicate about Stock Prices?

Dead cat bounces are captured as part of technical analysis. Since it’s hard to rule out their chances of occurrence, traders can best approach markets with a solid grasp of the fundamental analysis.

Therefore, the best guarantee of reasonable returns is to use the two-fold approach – clear technical analysis with the backup of carefully sifted fundamental analysis.

Approaching with clear technical analysis will help recognize sustainable price rises. And mostly, the rise will have clearer connections with the current performance of the stock in question.

Ideally, the above point helps separate key issues with stock prices that are already deep into support zones for relatively long timeframes – with key pointers to sustainable bullish reversals.

As you can see from the above note, the first point with separating a dead cat bounce from a realistic trend reversal helps create clearer distinctions.

And therefore, it points toward the anticipation that dead cat bounces happen as prices break support zones, with a higher probability.

So, deeper towards and into prolonged decline regions, fewer chances of dead cat bounces occur – with higher chances favoring a full trend market reversal instead.

So, a dead cat bounce indicates risky scenarios where price will only resume into the main trend – despite the brief recovery out of fundamental triggers.

Lastly, there are two ways to approach the dead cat bounce as a trader with live short positions.

One is closing the short position – of course, this is more painful – assuming you have to part with a portion of capital.

The second is waiting a while to see if prices resume back to the initial course of the downtrend.

So, it’s a risky pattern to navigate- either way. And it is a resounding reminder of why traders should adhere to sound risk and money management practices for live positions at all moments.

All matters are presumably out on the table, and the chances of winning cool trades have higher probabilities of being hit by rare occurrences of dead cat bounces. And it’s an assurance of a portfolio scoring positive average returns to add up into consistent growth over lengthy timeframes.

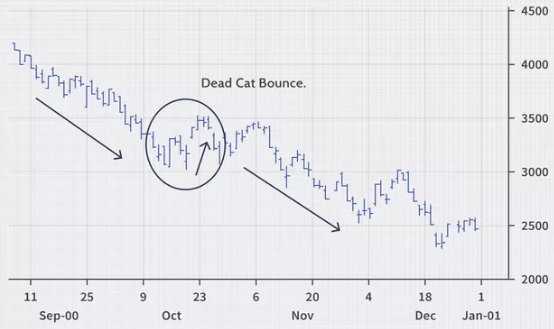

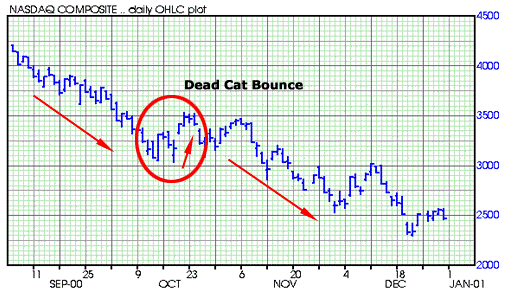

Dead Cat Bounces Length

The determination of the length of time a dead cat bounce lasts is not pre-determinable – just as its occurrence. Therefore, it could take a few days or spill all the way to several months.

Market prices of stocks happen in a complex fashion. And it results from the supply versus demand variables that interact with the relative equilibrium that shifts with time as fundamental or news media aspects reach the markets.

Of course, the other unquantifiable aspect arises with complications of unpredictable events that have a huge impact on prices. Specifically, there fall within the common PESTEL (Political, Economic, Social, Technological, Environmental, and Legal) framework.

Dead Cat Bounces Example

Here is a hypothetical presentation of a stock price of a company – ABS Computer, experiencing a falling trend with a dead cat bounce pattern.

First, the stock price for ABS Computers skyrockets into resistance zones, hitting a figure of $94 per share.

Secondly, the stock price falls all the way to a very low figure – hitting support at $12 come December.

Thirdly, the stock price of ABC Computers hits a dead cat bounce in the following fashion:

- Prices recover to $30 by the close of February of the coming year

- Come the close of April, the stock prices fell again to $11 in April

- Lastly, towards the end of the year, the stock prices record a price of $25 – notice that the closing price here is approximately a quarter-highest high ($96)

Dead Cat Bounces Limitations

As we stated earlier, the biggest problem with a dead cat bounce is that you can only confirm its occurrence once it has finished the course of price alterations.

Therefore, this presents a surprising problem for traders. It’s far more hidden, unlike price action anticipations, that traders have a high probability of picking before manifestation with indicators.

In line with the unforeseen happenings, dead cat bounces pose huge risks for traders with open positions. And, of course, the trap is whether to close positions and lose some capital.

Or hold on to the position with the uncertainty of an ultimate reversal – or certainty that prices will loop back into the normal course of the dominant trend.

So, the trap situation is a real threat – especially if traders are operating with small accounts with little margin to hold the temporary shift in prices.

For records, there’s no tool yet to predict dead cat bounces.

Therefore, it’s upon traders to make very wise choices regarding the stocks to hold, and in light of correct risks, management to help lower the drawbacks whenever a stock is hit by a surprise happening.

From a risk mitigation point of view, an optimized portfolio can best help lower the risks whenever a dead cat bounce hits one stock within it.

Best Forex Trading Course

One Core Program is the best Forex trading course. Out of the course, trainee traders acquire lifelong trading career skills from beginners to advanced traders. The focus is to help traders to aim for and close 6-figure profits per trade.

The One Core Program is built on a process that’s backed by mathematical probabilities to positively grow your ROI with low risk and high chances of wins.

The course is a cumulative effort by Ezekiel Chew, the Co-Founder, and Lead trainer, bringing in more than 20 years of trading in the financial markets. It’s a course that has benefited lead trading staff from many globally reputed banks, trading firms, and individual retail traders as well.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Dead Cat Bounce

A Dead Cat Bounce is a term in stock and forex trading circles, and it implies a brief reversal in prices from a declining stock price movement. For a bullish trend, the inverted dead cat bounce patterns also apply.

And after the brief reversal, the price fails, and the market continues in the direction of the long-term trend of a stock market.

It’s a risky scenario in trading circles. And one major challenge is that there are no reliable tools to predict a dead cat bounce. It hits the same way a black swan or an unforeseen occurrence stirs prices so violently in the charts.

When caught up by one, investors have two options. One is to hope that prices will stray temporarily and later resume the main trend. Secondly, traders have to exit the positions with partial profit or loss.

From a portfolio point of view, investors can expect the partial losses from a dead cat bounce from a single stock or asset to be spread out and covered up by other outperforming assets. It’s the main reason diversification remains an ultimate focus of any optimal portfolio.

Dead Cat Bounce Price Pattern FAQs

Why do dead cats bounce?

In real life, even a dead cat bounces back to life, arising from the proverbial belief that cats are very hardy animals. However, the same applies to trending on stock price charts – price action makes a temporary recovery from a free fall as very rare expectations.

Whenever it happens, traders on a downward trend find themselves locked up with two options – exit with the part profit or exit with some loss.

How long does a dead cat bounce last?

In the markets, it’s hard to foretell the real timeframe a dead cat bounce will last. And that lack of foretelling of its time limes of occurrence also links back to predicting the actual moment it will hit the price trends.

However, it’s a scenario that may show up from as short as two days to as long as a few months.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.