Cup and Handle Pattern: In Depth Analysis From an Expert

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Cup and handle a complete guide: Video Quick Setup Tutorial.

One continuation chart patterns in forex are the cup and handle pattern. The technical analysis pattern derives the name from the shape – which roughly appears to be a drawing resembling a cup on the left side, with a handle to its extreme left. It’s classified as a bullish signal for currencies and any stock.

In unique circumstances, traders may encounter the cup and handle pattern in the form of a V shape and the cup, while the handle takes the form of a downward channel which may also appear in triangular formations.

The key point to capture here is that the cup and handle is a continuation pattern and prices resume the longer-term trend subsequently. Also, traders should understand that the pattern presents two possible entries, and we’ll cover one for the purpose of this post.

To take us through the concepts of trading around the cup and handle pattern, we’ll tap from over two decades of expertise in trading by Ezekiel Chew from Asia Forex Mentor. As a distinguished expert, Ezekiel gets invited to speak at major forex panels and events.

As part of his achievements, He is a six figures trader who has trained traders at both retail and corporate levels – especially banking staff who trade among other like-minded groups of traders.

Cup and Handle Pattern: Different Types of Cups and Handles

Having shared the general shapes of the cup and handles chart patterns, it may appear in several variations. There are two key variants; the U shape and the V shape which mean different things are happening in the markets they appear in.

First, for the U formation, the markets show choppy trading or better referred to as consolidating markets. And secondly, for the V shape, the markets indicate a very sharp reversal of the trend.

Notably, the U shapes or cup forms take longer time frames to form than it takes for the V shape. The handles of the cups in the pattern also have significant meanings attached to the way they form. First, triangular shapes and handles indicate consolidation, plus they happen to have lower rates of occurrence.

Traders have to look at the gradients of the triangular formations for the handles to guide their insights into trading the chart pattern. However, one applicable rule is the depth of the handle which should not be more than one thirds that of the cup.

One more note- a smooth cup formation indicates a more bullish breakout of the prices. Sharper gradients of the curve indicate a less bullish breakaway.

How to use Cups and Handles Pattern

Trading the cups and handle pattern gives traders two entry opportunities:

First is where prices break off from the channel along with the cup formation.

The second level of entry is where prices break past the handle’s resistance level above the formation of the cup.

Once the trade is placed, the levels to take profit and stop loss are generally determined. For stop loss positions, the height is usually taken as half that of the cup.

As regards the take profit position, it can work as a given number of pips from the resistance zones and equal to the depth of the cap taken from the line of resistance. Therefore, the exact number of pips is taken by measuring the depth of the cup and targeting a similar number of pips, but in the opposite direction or upside-down cup.

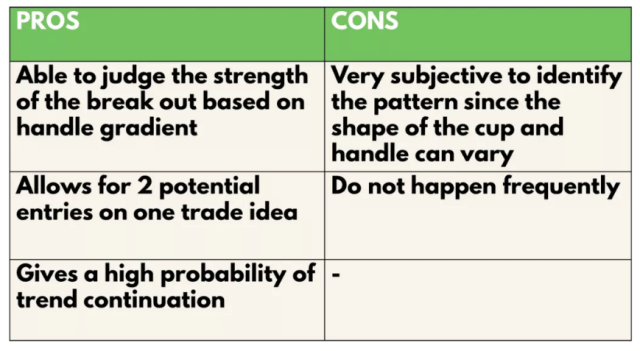

Pros and Cons

The cup and handle pattern has a higher win rate because it allows traders to trade with the trend of stock with continuation in mind. Besides, it’s a pattern that gives traders two opportunities to trade and rides in the direction of a trend. It provides a form of backup, and an over-aggressive trader can trade the opportunities presented by both entries.

The smoothness of the gradient of a cup holds huge insights regarding the pending breakout. And traders should take advantage of that and plan ahead accordingly. One key downside with the cups and handles pattern is that its occurrence is very rare, especially in high timeframes – like monthly charts, which probably increases a trader’s worth of banking more profits.

The other downside with the cups and handles pattern is the subjective nature of pattern identification for many traders. Earlier on, we highlighted that the same pattern could show up in a V shape for the cup and a descending channel for the handle. Therefore, the slight variations in the original expectations are a certainty that many traders will miss both the trading insights and the opportunity with the cup pattern.

Cup and handle patterns give clear entry and exit signals and can be used not only in the forex but also in the stock market. The potential take profit target is within a trading range of the distance or pips equal to an inverted cup. It’s a pattern that often requires the support of another indicator to firm decisions on entry and rules out a reversal pattern formation.

Analysis

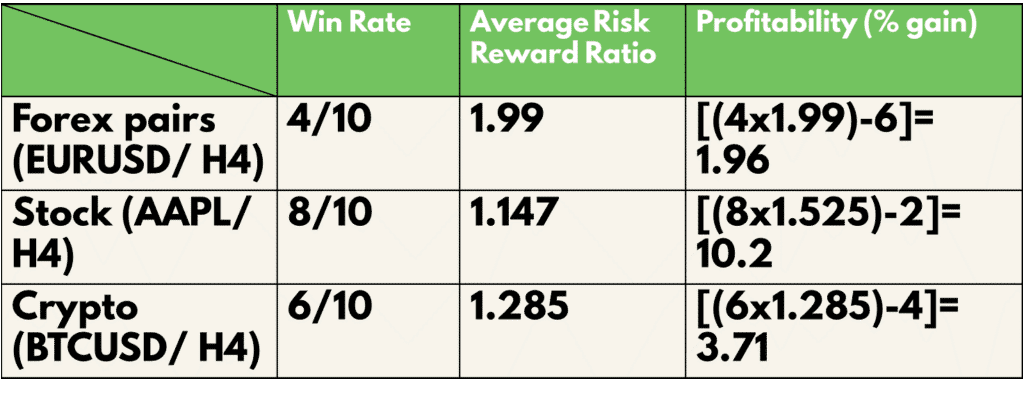

Next, we’ll delve deeper into practical with an aim to find the profitability of the cups and handles pattern trading strategy. Therefore, we’ll carry out a backtest involving five trades and working with the 4 hours candles or timeframes.

The backtest will run concurrently on three other markets. We picked EURUSD from Forex and BTCUSD for crypto-assets, and for stock, we’ll use AAPL.

Regarding the risk measures, we’ll adhere to 1% of the amount in the accounts.

Key Definitions:

#1. Average risk to reward ratio = (Total risk-reward ratio of successful trades/ total number. of wins)

#2. Profitability Percentage (% gain) = (number. of wins X reward)- (number of lossesX1) [ Risk which is 1%]

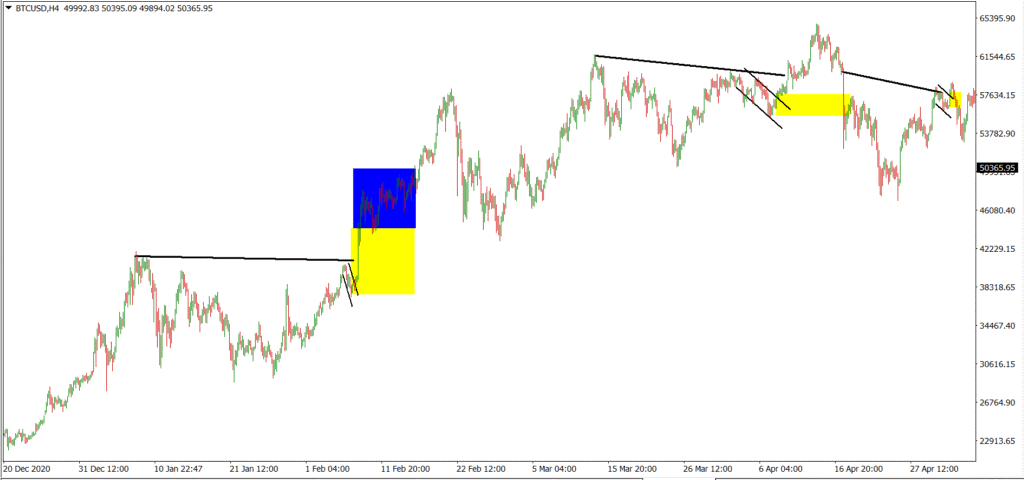

Below is an image mimicking the application of our strategy:

After the backtest, the results of trades, the regions are blue and yellow indicate the overall wins – the blue zone is the reward while the yellow zone is the risk taken.

Here are the percentages of the results per investment vehicle:

#1. For EURUSD (Forex), the score is 40%

#2. For AAPL (Stocks), the score is 80%

#3. For BTCUSD (Crypto-asset), the score is 60%

And the following are the average risk-reward ratios of the strategy per market/investment vehicle.

#1. For EURUSD (Forex) average risk-reward ratio is 1.99,

#2. For AAPL (Stocks) average risk-reward ratio is 1.147

#3. For BTCUSD (Crypto-asset) average risk-reward ratio is 1.285.

Thirdly, are the profitability percentage of the strategy across the three markets/investment vehicles:

#1. For EURUSD (Forex), profitability is 1.96,

#2. For AAPL (Stocks), the profitability is 10.2

#3. For BTCUSD (Crypto-asset), the profitability is 3.71.

Best Forex Trading Course

One Core Program by Asia Forex Mentor is the best forex trading course, and it’s run by Ezekiel Chew, the Founder, and Lead Trainer at Asia Forex Mentor. Going through the One Core Program helps upskill your trading skills along a proven path that builds on winning six-figure trades while cutting you the risk of losing trades at the earliest opportunities.

Ezekiel Chews’ One Core program fits all categories of traders: retailers, fund managers, and lead traders with banks or other financial institutions. As a holistic course, the One Core program helps transform the mindset of a newbie and losing trader into a budding winner in a realm referred to as lifestyle trading.

With Lifestyle trading, traders approach markets with ease by looking to bank on very few trades that win big. On the flip side, novice traders experience burnout and fear as they chase the markets greedily – a path that is a rabbit hole to the end of many trading careers.

Also, with Lifestyle trading, Ezekiel Chew builds your confidence to trade less while winning big. Believe it – Lifestyle traders have no business staring at screens all day long. One Core program will help you create an amazing balance, where you focus on your hobbies and occupations while trading like a pro.

Lastly, the One Core Program will not require you to take leave to study trading. Never, it’s a ritual that will need you to dedicate 20 minutes daily to hit both – study through and graduate into the realm of a Lifestyle trader.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Cups and Handles Pattern

As the name suggests, the cup and handle patterns resemble the scribbled shape of prices tracing through the depth of a cup and its handle at the extreme right. Of most importance is to grasp the two opportunities it presents to enter the markets at the breakout point.

The other keynote for traders is the comprehension of the fact that the cups and handles formation is a bullish continuation signal. Meaning that it makes some pause along with the longer-term bullish or prior trend, in which prices grapple with and eventually move back to the main trend or upper trend line.

The formations of a smooth cup within the formation indicate build-up towards a very strong bullish breakout at subsequent time frames (Bullish continuation pattern in the direction of a prior advance). However, the formation may also confuse novice traders if it appears in a variant of a sharp V formation. Also, the handle may appear in triangular formations, causing further confusion.

The cup and handle pattern is common in short timeframes and, therefore, may not be beneficial to long-term traders targeting the weekly and monthly charts and who aim at banking larger profits. It may also require that traders work alongside it with another indicator to help firm positions before committing any trades.

The last note here is pattern identification, whether a cup and handle or else does not guarantee profitability. Nevertheless, spotting one is the work of a diligently analytical trader, which increases the odds of profitable trading by entry at the breakout point. In fact, as a bullish continuation pattern, cups and handles have a very good win rate for traders who trade with the longer-term trend in the broader picture.

Cup and Handle Pattern FAQs

Is Cup and Handle a bullish pattern?

The short answer is YES. The cup and handle pattern shows up within bullish trends, which break away but eventually resume in the longer time frames. While a trend remains, it’s never a guarantee to stay course or reverse. However, keen traders have taken enough stock to analyze the behaviors of the formation and also trade it.

Due to the complex effects of factors triggering market moves in forex, bullish trends remain so for as long as the prices keep rising. No one knows the extent, and one probable shake-up of prices pushing back to the normal course is the cup and handle formation.

Traders working along the bullish trends look for opportunities with maximum value for entry. While the formation may show up clearly and quite early, it’s never a guarantee that the prices will hit and break past the resistance. Of most importance will be the insights it brings into the analysis of price action to traders.

Since all traders ride on price prediction, it’s no harm for a reversal trader to stay calm and wait for eventual bullish runs to end and counter them once their indicator signals to sell. Also, part of the insight is the depth of the cup itself measured from the resistance line. The cup’s depth gives an insight into the extremes, and the eventual bullish break may eventually hit the profit target if the cup and handle pattern follow the predictive plans.

How reliable is the cup and handle pattern?

The cup and handle patterns are reasonably reliable to trade. The best way will be to approach it in view of the fact that it forms in markets with a bullish sequence of prices in the broader or longer time frames. Therefore, the key is to identify buying opportunities in the market. However, it’s best to hold and look for two opportunities the formation presents as opportunities to traders at the breakout point.

When we refer to the reliability of a pattern like a cup and handle, many factors come into play other than price. And reliability here can be best described as the ability to spot the patterns formations and look for opportunities to trade them correctly. Arguably, it will not help for a trader to be overexcited by spotting the formation early enough and fail to wait for correct entry confirmations.

Towards improving the odds of reliability, it’s best to trade the cups and handle pattern with another price indicator or two in the picture. So the reliability of trading with the patterns will arise from a host of other several factors playing in well and in timely fashions.

From an extreme point of view, it does no harm for a reversal trader to wait until a price reversal pattern occurs as long as the cup and handle formation plays out, and they enter prime short positions when markets change trend eventually. Overall, the reliability of the formation is a product of effort in analysis and patience in the price moves or price breaks.

Do cup and handle patterns fail?

Cups and handles patterns do fail as there’s no master of the markets out there. Spotting the formation is not a fool-proof guarantee that prices will stay the predicted course. In forex and CFD markets, anything can happen at any given minute and jeopardize a trader’s targets.

The surest way to trade the cup and handle the pattern is by working with a reasonable risk to reward ratio and within the broader contexts of risk mitigation and capital protection in the markets. With a tight risk strategy, a trader should not worry so hard about losing 1% of an account due to a failure to materialize for a cup and handle pattern.

If a trader has well-placed stops, they can exit trades with partial profits – that applies if the price breaks fail to hit the target number of pips as indicated by the depth of the cup. With a live trade and after correct analysis, one failure should not limit your career progression if your risk appetite is small. An otherwise greedy trader will blow an account once prices deviate from the course due to a wrong entry point or price target in the financial markets.

Lastly, the forex market has numerous opportunities despite the risks involved. So one failing is not the end of everything. As long as you have lost a fraction of only one percent of your initial investment, it’s not so hard to recover it if you approach your next position with great technical analysis and the right timing of entry.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.