Cross Currency Swap: In-Depth Beginners Guide (2024)

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

When we talk about any financial market, the common feature among all is money. Be it buying stocks in the stock market or trading in currencies in the forex market, all transactions are based on cash. In this regard, swapping currencies for fair trade transactions is inevitable when the trade involves foreign exchange.

Financial experts consider cross-currency swaps as an integral part of any kind of financial trade. In this league, we’ve got Ezekiel Chew, a reputed and world-renown forex expert, and advisor who also emphasizes the importance of cross-currency swaps in finance. According to him currency swaps simply mean the fair exchange of two currencies, other than the U.S. Dollar, between two parties. However, the initial exchange rate is first converted into U.S Dollars to ensure fairness of trade.

In this regard, the main purpose of this review is to highlight the importance of cross-currency swaps in trading. Moreover, this review also provides information regarding the benefits, risks, and types of cross-currency exchange for a better understanding of the readers.

What is Cross Currency Swap

A currency swap also known as a cross-currency swap is all about exchanging one currency for another to trade. This exchange of currencies is a requirement of all financial personnel, investors, traders, and, even banks. Investors and traders do currency swaps whenever their trade entails international transactions.

Moreover, currency swaps are also performed for personal finance where individuals want to yield to exchange controls by escaping government limitations. Additionally, Banks also need cross-currency basis swaps to provide international loans.

These currency swaps are usually done on a contract basis. This contract is an agreement between two parties to make transactions of two different currencies in equal amounts. Similarly, the principal or the initial exchange rate is agreed upon at the beginning of this contract, nonetheless, fluctuating interest rates are also reviewed at regular intervals.

These contracts for currency swaps are sometimes fixed and sometimes flexible in nature. In a fixed contract the exchange and interest rates are rigid and any volatility may not intervene. In contrast, there are also over-the-counter (OTC) derivatives which are flexible contracts. These contracts are completely customizable and may include both a fixed interest rate and a floating rate.

What is the Purpose of Cross Currency Swap

In former times cross-currency swaps were mainly done to steer clear of governmental restrictions on foreign currency sales or purchases. Traders, businessmen, and investors were looking for a way to escape the exchange control and invest in the most desired currency. However, in modern times there are many other purposes have emerged for currency swaps.

The most common reason for currency swaps of financial institutions or investors is to hedge long-term investments. This means that investors and corporations are always looking for ways to avoid as much risk as possible from their investments. For this reason, investing in assets that are more prone to market volatility and currency fluctuations can be a disadvantage and so investment through currency swaps is mostly preferred by market participants.

Another main reason for currency swaps is to lower the cost or interest rates for business loans. Companies and businesses which deal in a foreign country need to borrow loans from banks in their own currency to get compatible interest rates. However, to invest in another country cross-currency swaps are inevitable.

Additionally, sometimes currency swaps are also made to manipulate or influence the currency flow. The aim of manipulating interest rates is basically to impact exchange rates as well as speculate the currency direction. For this reason, currency swaps are also made to exert influence over interest rates, and changing the exchange rate eventually affects the currency values.

All in all, whether it is the central banks, traders, multinational corporations, or investors of corporate firms, everyone benefits from currency swaps. For this reason, it is an integral part of the overall financial system.

How Cross Currency Swap works

In cross-currency swaps, agreements are made between two stakeholders who consent to exchange the principal amounts of two currencies during the initial exchange or at the maturity date of the agreement. This amount is also liable to a certain exchange rate. For instance, if two parties involved agree to swap £5 million with €7 million, this would be a EUR/GBP exchange rate of 1.16.

In this scenario, the two principal amounts will be exchanged at the maturity date of the contract. However, the parties may decide to swap at the original exchange rate or an agreed rate. Nonetheless, there is a strong possibility of risk involved here as the exchange rate may have changed from the initial to the maturity date of the contract.

This was one basic procedure of currency swap, however, cross-currency swaps can be done through many methods. The two parties may agree to pay the full principal amount at the beginning of the exchange contract. In contrast, agreements are also made by using notional principal amounts to calculate the interest rates which are payable at intervals however, the amount is not exchanged till the maturity date.

The maturity dates of cross-currency swaps are usually very flexible and can retain up to 10 years. Moreover, there is also an option to adjust the interest rate according to the floating rate or the collaborators may also go for the fixed interest rate.

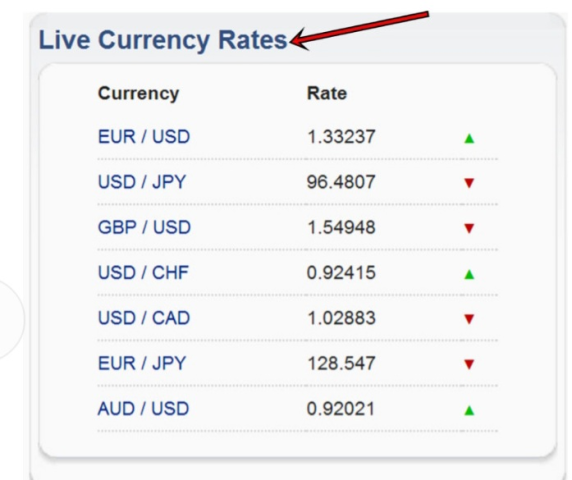

Currency Swaps and Exchange Rates

Most financial investment corporations prefer cross-currency swaps due to their predictability and safe transaction agreements. Since the cross-currency swap agreement is always pre-planned, the stakeholders can anticipate the risks and rewards of their currency exchange transactions. For instance, if there seem to be more chances of a currency value increasing, they would swap in that currency to minimize their borrowing costs.

In the above-mentioned scenario, we can take an example of a cross-currency swap between two currencies that is the pound and the euro (EUR/GBP) with an exchange rate of 1.16. If two corporations or investors swap currencies at this rate, even if there is fluctuation in the currencies during the contract period, the repayment will always be on the initial exchange rate of 1.16. As a result, it is clear that cross-currency swap agreements are a win-win situation for both parties no matter how much the currency deviates over time.

Hence, when the rate of exchange interest payments is always an obstacle for investors and other financial institutions, cross-currency swaps provide the ultimate solution. The fixed-rate agreement between two parties can determine an agreed spot rate. Consequently, the swap deal ensures the same exchange rate, even if there is a constant flux in the currencies.

Along with this, the swap agreements are also highly customizable. There can also be derivative contracts where the exchange rate can be the floating rate of the currency. Moreover, there is also the flexibility to renew the contracts whenever the agreed parties want to refresh the agreement.

How Cross Currency Swap Differs from FX swap

Cross-currency swaps and forex swaps are practically the same with some slight differences. Both kinds of swaps involve, borrowing and lending two different currencies from each other. In both cases, the principal amounts are set during the initial trade date. However, cross-currency swap agreements also include exchange interest payments whereas the interest rate is not always included in forex swaps. Thus, usually, forex swaps are made exclusive of interest rates.

Another difference between the cross-currency swaps and forex swaps is the contract maturity date. While the former is usually a long-term agreement of currency exchange lasting from one to thirty years, the latter is more liquid. Forex swap contracts are made generally for a short term ranging from a few months to a year. However, this time limit is not fixed and can be seen to be increasing in the coming years.

The process of forex swaps involves two legs; namely the near leg and the far leg. The near leg is all about exchanging one currency with another with an agreed exchange rate. The far leg includes the maturity date of the contract where the exchange is reversed using the forward rate. However, both these procedures start with lending and borrowing of currency which is reversed at the end of the agreement.

Benefits of Cross Currency Swap

Like any financial transaction, cross-currency swaps have their own benefits and risks. With a help of cross-currency swaps individuals as well as corporations can find a lender so that they can borrow currencies at a lower rate. However, looking for a partner who also wants the same currency one is willing to exchange can be a challenge. Nonetheless, in today’s outstretched financial markets it is comparatively easier to find access to cross-currency swaps.

One advantage for loan borrowers is that cross-currency swaps allow them to borrow loans at low-interest rates. Asa result, when corporations or investors internationally want to get loans at a low-interest rate, they always go for cross-currency swaps.

Another advantage of cross-currency swaps is that serve as a risk management tool for investors and financial institutions. Since investments in foreign currency are always prone to risks, cross-currency agreements protect like a shield against currency fluctuations. Consequently, it becomes a lot easier for the investors to obtain loans in their local currencies to reduce the funding costs.

Finally, another comparative advantage of currency swap agreements is that both parties are not expected to pay the interest payments at regular intervals. The stakeholders are only liable to pay the notional amounts at the fixed exchange rate towards the end of the contract. Nonetheless, there are also over-the-counter derivatives, where the parties agree to change the exchange rate towards the maturity of the agreement and start again with a new exchange rate.

Risks of Cross Currency Swap

Cross-currency swaps are based on agreements where both parties are required to repay the notional amounts at the maturity date of the contract. However, there is always a risk of default of repayment and credit risks. If any one or both parties are unable to pay the amount back at the payment dates the other party may have to face the consequences. As there are no guarantees or forms of collateral, both parties have to trust each other blindly and expect that the other will pay back.

One potential risk of cross-currency swaps is the unknown fluctuation of the currency value. This may result in the alteration of the exchange rate when a cross-currency agreement is held. This risk can be unanticipated by both parties and can also be uncountable. Hence, any change in the forward interest rates of either one or both currencies can result in negative values of the swaps currencies.

Furthermore, other risks are involved in the cross-currency swaps such as the manipulation of central banks in the derivatives markets. This mostly happens when a country’s currency declines due to adverse economic conditions. Similarly, when a country receives foreign aid or debts as support from other countries, then there is a risk of intervention from the central bank in exchange markets.

Types of Cross Currency Swaps

Cross Currency Swaps are most commonly divided into three types. Each type is classified through the leg or phase involved in the swap agreements. The first type of cross-currency swap is fixed vs fixed swap, the second is float vs float (also known as basis swap), and the third is the fixed vs float swap.

Fixed vs fixed swaps are those contracts where a fixed interest rate is applied that is approved by both the stakeholders. As a result, at the initial leg of the agreement, the currency is exchanged at a fixed interest rate and similarly, the interest rates remain the same at the maturity date of the contract. This is ideal for both parties involved in the contract as any fluctuations in the currency may not affect their swaps and there are minimum risks involved.

In contrast, fixed versus floating swaps are those contracts where one party agrees to swap the currency at a fixed interest rate whereas the other with floating interest cash flows. The reason behind this type of agreement is to minimize the interest rates as the floating rate may turn out to be lower than the current fixed rate.

The last type of cross-currency swap is also known as a basis swap where both the parties agree to pay a floating interest rate during each leg of the swap. The main purpose of this type of swap between two counterparties is to hedge against the interest rate risk that occurs due to the variable lending and borrowing interest rates.

Best Forex Trading Course

There is no doubt all these things may seem a bit technical to follow. In fact, the price makes so many wild swings each day that it can be very hard to measure buying pressure or selling signals. Also, learning all the technical analysis you need for forex takes more than just a day. Instead of relying on the odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It’s a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and these other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by someone who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Cross Currency Swap

Cross-currency swap is a financial term that simply means the exchange of one currency with another between two counterparties. The benefactors of these currency swaps are usually financial corporations, investors, traders, and even banks. Not only private corporate institutions but government and central banks also engage in cross-currency swaps with other foreign counterparts to make sure that there are adequate foreign currency reserves in the country.

Moreover, a cross-currency swap is not an informal exchange of currency but a legal contract made between the two parties. In his consensual contract, a fixed notional amount is exchanged at the first leg of the agreement. However, the interest payments can be fixed or floating depending on the terms and conditions of the contract. Moreover, these contracts may last for as long as 10 years or more, however, the maturity date is fixed at the beginning of the contract.

Furthermore, cross-currency Swaps not only have many advantages but also risks. One advantage is that investors can hedge interest rate risk, as a result, both parties have minimal exposure to the prevailing interest rates. Similarly, investors and multinational corporations can borrow loans in their local currency by swapping them with banks. As far as the risks are concerned there is always a possibility that one or both parties may not be able to fulfill the contract and return the loan. In such cases, cross-currency swaps possess much risk.

All in all, cross-currency swaps are most favorable for financial borrowers. Investors or corporations who are looking for taking a loan at the lowest cost would prefer cross-currency swaps. As getting a loan in the local currency would be more profitable than borrowing from foreign currencies. Therefore, a cross-currency swap works best when the investors find a counterpart who is willing to exchange or swap currencies at their domestic profitable rates.

Cross Currency Swap FAQs

What is meant by currency swap?

A currency swap is mainly an agreement between two counterparts who consent to exchange two different currencies with each other. This contract is legalized and comes with the approved terms and conditions of both parties. The agreed terms are comprised of many variables including the notional amount, the nature of the exchange rate, and the fluctuations of the foreign exchange markets.

If the cross-currency swap turns out successful then it can lead to a profitable exchange for both parties. However, there is also always a risk of one or both parties being unable to hold the contract and return the payment.

What is the difference between a currency swap and a cross-currency swap?

There is no distinctive difference between cross-currency swaps and currency swaps. Both of them involve exchanging two different currencies among counterparts under a contract. There is a minor difference in exchange interest payments on the loans while the contract is held, as currency swaps may not involve the interest rates. However, both these swaps have the principal amounts at the beginning and end.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.