CMC Markets Review: Is it the Best for CFD Markets in 2024?

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

CMC Markets was created in 1989 in the United Kingdom and is one of the world’s oldest brokers. CMC Markets is deemed safe because it has a long track record, is listed on a stock exchange, and top-tier regulators regulate it.

The broker is well recognized for providing traders worldwide with a diverse choice of trading assets and services through their online platform, including CFDs, spread betting, FX, commodities, and even cryptocurrencies.

Our team of experts has examined the broker’s platform to provide you with a comprehensive CMC Markets review that considers essential factors like account types, trading platforms, CFDs, fees, and more.

CMC Markets might be a good fit for newcomers to its web platform. Login using two steps (safer) with Customizability is good (for charts, workspace). Overall, this platform may be the best option for newcomers.

CMC Markets Review: What Is CMC Markets?

CMC Markets (CMC) is a very well traded publicly and quite well regarded UK forex trader that was established in 1989 and has subsequently adapted to the ever-changing online trading environment. The company’s company name on the London Stock Exchange is CMCX (LSE). Like many other forex brokers, CMC does not allow traders from the United States.

CMC’s core platform is “Next Generation,” a feature-rich, web-based service. CMC’s whole internet offering to the user comprises this and the ubiquitous MT4 (downloadable) platform and a complete mobile application.

CMC gives you traders a wide range of products across several asset classes, including CFDs and swing trades. Alongside the standard forex, commodity markets, benchmarks, and individual investor services, the current offering also presents a comprehensive government bond market. Moreover, the 14 cryptocurrency offers (12 cryptos + 2 indices), giving investors of all sorts an overabundance of trading options.

Furthermore, the broker provides dynamic competitive spreads, meaning they broaden or contract in response to trade sizes. The clients’ accounts will safeguard from slipping into a negative balance.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

How does CMC Markets work?

You may simply and effectively access the direct share market with a CMC Markets Invest account. It comes with a competitive online brokerage, order processing in under a second, and unlimited free conditional orders for all clients.

Having a trustworthy and qualified investor is critical to your online trading success. Be sure your broker is not fraudulent or untrustworthy to avoid losing your money. To have a strong functioning lucrative partnership, make sure your needs match the profile of your broker.

This is why we’ve taken the time to examine only the top brokerage firms, their procedures, fee structures, and other critical factors. We urge you to study and analyze your options before entrusting your hard-earned money to only the safest and most reputable brokers.

CMC Markets is one of the industry’s most seasoned online financial brokers. You can anticipate exceptional service from one of the world’s top-ranked CFD brokers in terms of customer care. Additionally, before financing a genuine account, you may establish a demo account to test the appropriateness of its platforms and services.

CMC Accounts

You must first establish an account with CMC before designing a day trading strategy. CMC Trading offers two types of accounts: spread betting and CFD trading.

These accounts are available from CMC to both individual and business clients. The arrangements are very similar.

You can select from the following options:

- 11,000 instruments

- 60 worldwide indexes

- 300 currency pairings

- 90 goods

- 30 treasuries and bonds

- Over 9,000 stocks and exchange-traded funds (ETFs), including hallmark stock baskets

Account netting, telephone trading, position hedging, and a price depth ladder are all included with both account types. Overall, all CMC trading accounts provide roughly identical functionality and features.

| Broker | Best For | More Details |

|---|---|---|

| CFD Markets

| securely through CMC Markets website |

What are the Features of the CMC Markets platform?

Let’s discuss the features in detail!

Trading ideas

CMC Markets offers a variety of trading strategies. You can call as ‘Insights,’ and it involves CMC gathering market-related data. Evidently, it includes the expected production of a Tesla plant in the United States, and comparing it to market speculation. It’s more of an information service than anything else.

‘Chart Forums’ is a different service. When you open it, you’ll see a series of brief technical analyses and speculations from CMC specialists and users. People may exchange their chart analysis, similar to social trading.

Research Amenities

CMC Markets excels in this category, with in-house analysts doing thorough research and analysis and third-party resources such as Morningstar quantitative equities research reports (live accounts only).

You could entice a professional trader to register a live account with CMC Markets only because of this feature.

Many materials are available directly on the website, and news sources may sort by area and asset type. A regular economic calendar is also available on the site. One critique would have to be the lack of a specialized search feature or a well-organized archive, which makes finding many topics difficult.

Mobile Trading Platforms

CMC Markets allows customers to trade on their own native CFD mobile trading app. The software is available for download on the broker’s website, Apple App Store, and Google Play Store.

The following are some of the advantages and features of the CMC Markets mobile trading app:

- Mobile-friendly charting

- There are more than 40 technical indicators and drawing tools to choose from.

- A dashboard that you can customize

- Market calendar in real-time

- In-app assistance

Trade Experience

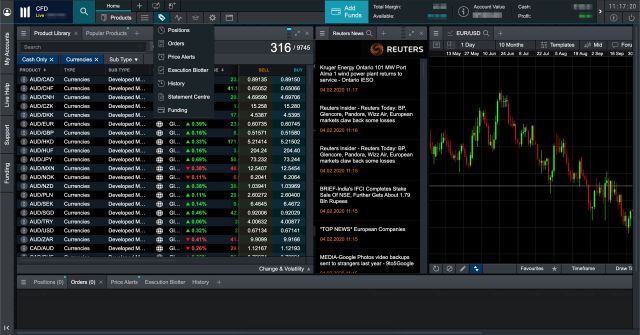

Technically inclined clients looking to upgrade from MetaTrader 4, which is also available, would appreciate the unique Next Generation trading platform for web, tablet, and mobile.

However, navigating is not as straightforward as it is on some other platforms, which might be due to the many functions crammed into this interface.

Although cryptocurrency CFD trading and spread betting are simple to use and do not require a particular interface or exchange, the comparatively large average spreads may deter clients.

Advanced charting with 115 indicators/overlays, 12 chart styles, and 35 drawing tools is available, as well as fully customizable watchlists, client sentiment, and a live Reuters feed. To create and optimize complicated desktop arrangements, you may pop charts out.

Clients interested in studying long-term patterns will discover price history for main instruments dating back 20 years. It includes price prediction and pattern identification capabilities and a built-in link to a client-based trader’s community.

Safety and Security

The organization has been working to strengthen user security constantly. As a result, to comply with regulatory requirements, client and corporate assets are kept separate. In reality, even if the broker goes bankrupt, the customer’s funds will be safe. As a result, creditors have no access.

So you can rest easy and chill knowing that when you receive your trading platform login information, it will keep all of your personal information and transaction data safe and private thanks to advanced encryption technology.

CMC Regulation and License

Broker regulation is vital to look out for in today’s world of internet trading. This guarantees that businesses must follow particular guidelines and safeguard their assets in various situations.

CMC currently has more than 80,000 active clients worldwide, 13 worldwide locations, and is regulated in the United Kingdom, Germany, Canada, and Australia. In New Zealand, CMC holds a derivatives issuer license.

As a result, the business keeps customer deposits separate in top-tier banks. The Financial Services Compensation Scheme also protects money. In the case of insolvency, consumers might get up to £85,000 in compensation.

Benefits

CMC reviews are eager to bring out a slew of noteworthy advantages:

- With over 11,000 CFD instruments to choose from, you may speculate on everything from currencies to stocks and gold.

- CMC offers genuinely worldwide trading, drawing clients from Dubai to Germany.

- CMC is regulated in several major financial centers and is publicly traded in the United Kingdom.

- Its company has received a lot of honors for its platform, instructional resources, and customer service.

- There is no demand for a minimum deposit.

- They have low pricing, narrow spreads, and leverage, as well as low margin requirements as low as 3.34 percent.

- Their desktop and mobile platforms include a lot of customization options.

- They claim to provide a variety of advanced trading tools, such as customer sentiment, pattern identification, analytic insights, chart forums, price alerts, and more.

- They provide a comprehensive learning school with webinar lessons, videos, courses, and textual resources.

- There is a free, fully functional demo account accessible.

- They offer a chat forum where users may exchange ideas and assist one another.

- Signature stock baskets monitor a group of equities with a similar price trend.

Additional Features

There are a lot of extra beneficial elements that make the CMC trading transaction more appealing. The Market Calendar window displays a countdown to the publication of each economic news item.

Traders can also sign up to receive notifications about certain occurrences. When the moment for the news release approaches, you will be immediately alerted. This is excellent for assisting you in preparing for important occasions.

The research services provided by CMC are equally extensive. You will have access to:

- Experts from around the world

- Breaking News

- Blog of CMC Markets

- CMC Television

- Social media platforms

Demo Account

A CMC trading platform demo account is also available. The majority of platform evaluations for the practice account are good. All of the above will be beneficial to you:

- Intuitive charting and trading tools

- Apps for mobile and tablet devices are available.

- Virtual currency worth up to £10,000

- You may use it indefinitely.

- Setup is simple and quick, and approval is immediate.

- No information about a credit or debit card is necessary.

Education resources at CMC Markets

To trade efficiently with CMC Marketplaces, you must first have a thorough grasp of their trading materials and industries. Make sure to fully use all educational resources available to you. This covers both internal and external education resources provided by CMC Markets.

CMC Markets has a wide range of teaching materials. Take your time and become familiar with how the financial markets operate.

Take the time to become familiar with your trading platform. Make buy and sell transactions, learn how to take benefit of worldwide trading hours, and most significantly, understand how to minimize and manage risk in your investments.

Using an analytical approach to trading with CMC Markets may be a smart idea. Take a peek around the CMC Markets platforms and practice thinking about markets more methodically and rationally. For many, it’s a new skill set, but it’s what the market demands.

Customer Support at CMC Markets

In this CMC Markets review, we look at customer service choices, response times, and CMC Markets’ trading platform problem resolution efficiency.

The CMC Markets support English, German, French, Polish, Spanish, Swedish, Italian, and Norwegian

Because CMC Markets provides live chat and email help in various languages, they earn a double AA support rating.

Money Protection

It’s critical to understand how they will safeguard your funds and what rights you have in the event of bankruptcy or insolvency while looking for a broker.

To begin with, CMC has set up separate accounts to safeguard customers’ funds, not for their personal use or everyday needs. In this manner, in the event of bankruptcy or insolvency, it will impact your money.

“Retail customer money is maintained separately from CMC Markets’ funds so that client money is safeguarded by the property, trust, and bankruptcy law and hence unavailable to general creditors of the business if the firm fails,” according to their website.

Another advantage is that you can never lose more money than you deposit, ensuring that you never have a negative balance. “Negative balance protection” is the term for this.

CMC Markets Pricing and Plan?

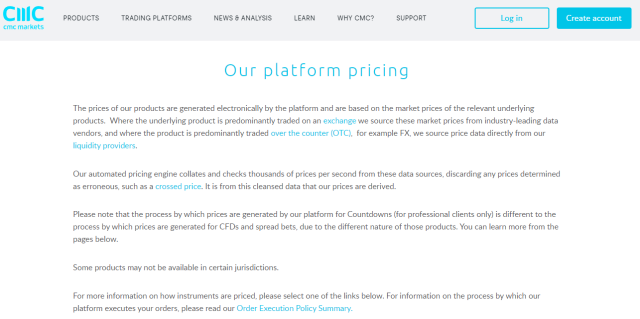

Here we go with the pricing details!

CMC Markets Minimum Deposit

Let’s discuss the minimum deposit. Generally, CMC markets need a minimum deposit $200 while you opt to open a trading account. It’s the minimum deposit and amount of money you require by CMC markets to open a new brokerage account. Different trading costs offer a minimum deposit to open a trading account. Some brokers charge high minimum deposits but CMC markets makers offer effective trading fees.

CMC Markets Withdrawal Fees

Besides this, the withdrawal fees vary differently depending on the withdrawal method. Different CMC markets account has specific withdrawal rules enabling you to withdraw funds from the trading accounts.

This market maker offers different withdrawal options and techniques with a payment provider that offers trading strategies and processing fees. There is a potential conversion fee that depends on the base currency and receiving currency. You can withdraw funds through bank transfer, payooner, and even Debit or credit cards.

CMC Markets Inactivity Fees

There is a charge on inactive accounts. YES! You heard that right. It will cost fees to any CMC markets regulated account. It has specific trading activity requirements with terms and conditions of different accounts.

Therefore, clients need to fulfill as retail investor accounts lose money while trading CFDs. You have to reduce the chance of losing money rapidly with this CMC markets account ranked as a top-option in London Stock Exchange.

CMC Markets Commission Fees

Lastly, let’s discuss the commission fees. CMC markets website charges a commission on trading CFDs. That’s the service charge needed to facilitate while selling or buying through these complex instruments. It charges registered traders a fee on CMC markets clients to trade CFDs by market makers.

What’s more? The CMC markets fees differ within the CMC market account types along with the trading level of the account. Whenever these financial instruments or CMC markets accounts fulfill an order or cancel orders, it will charge you commission fees. But wait! If the market order remains not filled, It won’t charge you a commission.

| Broker | Best For | More Details |

|---|---|---|

| CFD Markets

| securely through CMC Markets website |

Who is CMC Markets best for?

Whom this CMC’s web trading platform best for! The research CMC markets are for every type of trader from retail traders to experienced ones. The online trading and CFDs, how spread bets work, and investment trends will determine benefits to s, and, and exposure to different products.

The firm offers competitive fees within the industry and has high ranks on many of our lists. The company won Investopedia’s award for Best Overall Forex Broker for 2020 and Best Forex Broker for Range of Offerings.

CMC Markets provides its clients with one of the biggest product catalogs that are available in the online forex brokers community. Based on the advertisement on its website the clients can conveniently trade around 10,000 financial instruments which offer many new opportunities to the long-term portfolio managers.

CMC Markets trading tools are best for traders with an effective opening process and trade ticket window. It is authorized by the Dubai Financial Services Authority making it reliable for most traders with the right generation platform for market volatility. Moreover, the CMC Markets mobile app is a benefit to people looking for an innovative option.

CMC Markets strongly emphasizes customer service that includes 24/5 phone support with an easy access to live brokers and chat service. In addition to this their educational offering coupled with customer services had buoyed them in the rankings.

CMC Markets Pros and Cons

Let’s discuss the pros and cons!

Pros

- Prioritizes education and customer service

- Research facilities are industry-leading

- Works as a shield for client accounts

- A vast range of offerings.

Cons

- Prohibits U.S clients

- Offers difference between Next Generation and MT4

CMC Markets User Experience

Due to its instinctual and enlightened nature, the CMC Markets platform offers the same services to professional and new traders. The Next Generation trading platform can be easily used by novices while the MetaTrader platform can be conveniently used by traders who have experience and knowledge about that platform.

Entering trades can be immediately done on both platforms but if you need automated trading then you might prefer the MetaTrader platform that offers its own programming language, a huge community of users, and a range of off-the-shelf trading robots. If you think the Next Generation trading platform is hard to operate then you can watch a tutorial video on its numerous features provided at CMT TV which is the broker’s YouTube channel.

CMC Markets top priority is to facilitate its clients with the best research, which is a commendable quality. It can be compared to the best offers that the online forex trading arena has to offer.

CMC Markets offer the negative balance protection feature which has now become one of the significant features that online brokers offer these days. The catalyst was introduced at the SNB event on January 15, 2015, and roiled the markets, especially the mighty FX market. In addition, the CMC market also offers the guarantee to stop losses.

CMC Markets vs. Competitors

#1. CMC Markets vs. Avatrade

CMC’s whole internet offering to the user comprises this and the ubiquitous MT4 (downloadable) platform and a complete mobile application. Avatrade is one of the safest online brokers and is regulated by the top tier-one jurisdiction. This is the reason which makes it a trustful CFD and Forex broker. The range of marketing is great, and it should also be good for traders. Avatrade is offering its clients worthy selections for trading platforms.

CMC gives you traders a wide range of products across several asset classes, including CFDs and swing trades. Avatrade features on attracting traders with different skills and levels to offer them an adaptable trade site. There are more than 200000 registered clients with a trading volume of 2 million per month.

With highly competitive prices and nearly 10,000 financial instruments to choose from across every market and asset class the CMC Markets is considered an excellent choice for CFD traders. Clients who execute traditional fundamental or technical trading strategies can opt for the industry- newer MetaTrader 5 or even the MetaTrader 4.

Moreover, the CMC Markets Next Generation TRading platform is highly powerful and versatile with numerous configuration options and plenty of tools for trader to meet their needs. Avatrade has stopped the trading platforms like mirror trader and Robox.

CMC Market makers have low pricing, narrow spreads, and leverage, as well as low margin requirements as low as 3.34 percent. With their dedicated web trading platforms like meta-trader and Avatrade acting as an alternative, it offers a huge variety of platforms for catering to automated and manual traders.

| Broker | Best For | More Details |

|---|---|---|

| CFD Markets

| securely through CMC Markets website |

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

#2. CMC Markets vs. FXCC

CMC gives you traders a wide range of products across several asset classes, including CFDs and swing trades. FXCC offers forex traders to trade on forex and silver and gold, indices on trusted MetaTrader 4., available as web or download solution.

CMC Markets has a wide range of teaching materials. Take your time and become familiar with how the financial markets operate. We will log in to Traders Hub to explore minimum regulations, demo, deposits, and leverage accounts in this online broker review. This is your chance to learn further about FXCC.

Moreover, the CMC Markets Next Generation TRading platform is highly powerful and versatile with numerous configuration options and plenty of tools for trader to meet their needs. FC XX provides MT4 to every client that is accessible on various gadgets and major web browsers.

CMC Market makers have low pricing, narrow spreads, and leverage, as well as low margin requirements as low as 3.34 percent. FXCC platform has many advanced features for trading; this includes a built-in library with more than 50 indicators for indicating technical analysis. There is also access to plus embedded charts, stop and pending orders, the market for accurate analysis.

The highly competitive prices and 10,000 financial instruments across every market and asset class makes CMC Markets an excellent choice for CFD traders and global forex. As the best forex broker, FXCC also provides users to leverage. It can make multiple the initial accounts balance. But as a matter of fact, it should be used very wisely as it can increase the power of losses too.

| Broker | Best For | More Details |

|---|---|---|

| CFD Markets

| securely through CMC Markets website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Are CMC Markets the Best for CFD Markets?

The CMC Markets is an excellent fit for all kinds of traders with a vast product offering, a plethora of research facilities and accessible feature-rich platform. It includes the Next Generation Trading platform, an emphasis on customer service and useful educational resources.

Being FCA regulated offers credibility to the extent to which the CMC emphasizes account security. The Negative Balance Protection features provide customers with peace of mind.

It also offers a premium that guarantees to stop loss which is reasonable and the account-saving risk management that is offered in volatile market conditions. Additionally, they do not have any unwieldy costs and offer free withdrawal via wire transfer.

With highly competitive prices and nearly 10,000 financial instruments to choose from across every market and asset class the CMC Markets is considered an excellent choice for CFD traders and global forex. Moreover, the CMC Markets Next Generation TRading platform is highly powerful and versatile with numerous configuration options and plenty of tools for the trader to meet their needs.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

FAQs

Is CMC Markets Safe and Legit?

CMC Markets founded in 1989, is a worldwide forex and CFD traders platform. CMC Market can be considered safe due to its long track record, enlistment on a stock exchange and is usually overseen by top-tier regulators.

The CMC Markets is an excellent fit for all kinds of traders with a broad product offering, numerous research facilities and accessible feature-rich platform. CMC Markets emphasizes on customer service and useful educational resources.

Are CMC Markets suitable for beginners?

CMC Markets offers its clients with huge product catalogs that are available in the online forex brokers community. According to the advertisement on its website the clients can easily trade upto 10,000 financial instruments which provides many opportunities especially to the long-term portfolio managers.

Many management is a key feature if you want to achieve your goal of becoming a successful day trader. In fact money management is one of the most significant elements of victorious trading over anytime frame. If you want to trade for many upcoming years then you need to use successful money management strategies.

What does CFDs means?

CFD trading is a technical arrangement within the financial derivatives for trading within the open and close trade prices. You will get no delivery of physical goods or even securities within the CFDs. That’s how the CFDs work within the CMC markets UK PLC.

CFDs permits its investors to trade the direction of securities on a short-term and are quite famous in FX and commodities products. CFDs are cash-settled but they usually permit ample margin trading so the investor only have to put up a small amount of the contract’s payoff.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.