Buy Limit: Overview, What It Is, And How It Works

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

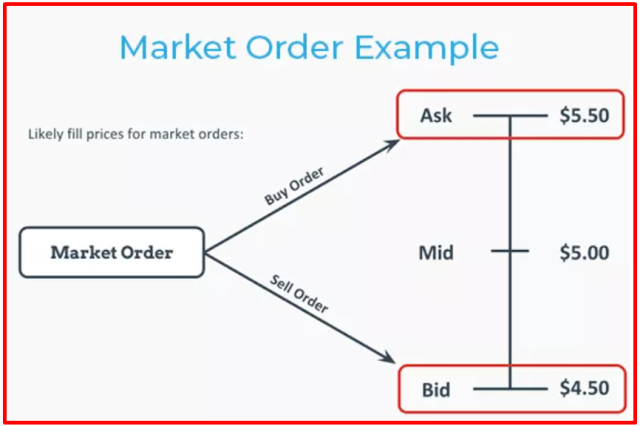

For investors, buy limit orders offer a way to control how much they pay for a security. By placing a limit order below the current market price or at a specified price, an investor indicates that they are only willing to buy the security at that price or better. In contrast, if an order is placed without a limit, it is considered a market order and will be executed at the current market price.

A buy limit order is usually used when an investor believes that the security is overvalued and wants to buy it only at a lower price. We have got Ezekiel Chew to share his take on the buy limit with us. He is the founder and CEO of Asia Forex Mentor, a Singapore-based company that provides Forex trading education. Let’s hear what he has to say.

What is a Buy Limit?

When asked about buy limit orders, Ezekiel says:

Buy limit is the order that enables the traders to control how much they pay for their assets. This is the order in which the traders can pay less or the specific rate for the assets. Investors usually use a buy limit order when they want to open a long position at a certain price in the stock. Whenever buying an investment, the investors can pay less or a certain amount using a limit order. The buy limit order is more suitable for traders looking for a decline in the asset price.

Even though the stock price is specific, the order value is versatile. The execution of buy limits from the stock market completely depends on whether the buying price is equal to or below the buy limit price. While using a limit order, the investor is ensured that they wouldn’t be paying any extra, if not less but the exact price but not more.

While the investors get the price guarantee, it is not guaranteed whether the order is even filed or not. If the asset does not reach the specific price, the order will not be filled, resulting in the investor missing out on the trading opportunity. Therefore, even though investors get a chance to purchase assets at the same or lower price, there is no assurance of order in the stock market.

Benefits of Buy Limit

There are various benefits of the buy limit. Firstly, it ensures that the investor doesn’t have to pay any extra than the certain price of the assets. It provides precision to the investors and traders while entering a certain position in the market. For example, if the stock market is trading an investment at $2.45, the buy limit of that asset would be $2.40. The order in the stock market will not proceed until the price drops to $2.40.

With the buy limit, the possibility of price improvement also increases between the stock gaps from the previous day to the next. Once the trader sets the buy limit of $2.40, the order will not be filed until the demand is in the position to benefit more from the stock gap. So, when the investors pay lower prices, they consider building assets at lower prices worth it.

The buy limit order is displayed on the stock trading book in which the stock order will be below the current market price of the particular asset. Whenever the price of assets is decreased below the buying limit, the charge is accepted, saving the trader from paying extra costs. This is also helpful in having immediate everyday profits. Therefore, the buy limit order is quite beneficial in the volatile stock market.

Disadvantages of Buy Order

Along with the numerous benefits come certain disadvantages as well. One of the biggest disadvantages of buy limit order is that it doesn’t provide any order assurance to the investors. The stock market will only execute the order if the assets trade below the limit value or the demand will be sold within the buy limit order. Therefore, the asset trading value with its order is not enough.

Even if the trader buys numerous assets at a specific price, many assets will still be ahead of them. For the buy limit to work, the buy limit will require a clearing from the assets’ worth. The transactions are completely dependent on the time of order placement. Another major disadvantage of buy limit order is that it makes the traders miss trading opportunities.

In case the assets’ price is not lower, or at the same price, there won’t be any transaction. Once the asset price rises, it doesn’t return to the buying limit without reaching the peak. Some brokers also tend to charge higher for the buy order than the market order, which is slightly more convenient. But this is not usually the case as the brokers do not charge considering the order type.

Example of Buy Limit

For better understanding, here is a comprehensive example. When the investors add it to their portfolio, Apple stock might be offering $125.26 and a bid of $125.25. In this trade, the investors and traders can practice different types of orders. If the market order is pursued, they will be purchasing the stock at $125.26, and if they are considering a buy limit order, they will opt for any price of $125.25 or lower.

If the trader is optimistic enough, they will set their buy limit considering that the price might fall considerably in the future. In this case, the trader has set a buy limit of $121 and contemplates if the stock price drops to $121, they will buy the stock. This implies that the investor will make the price offered by the Apple stock, which is $125.26 OR $125.25.

But there is no assurance that the price will fall this much and a possibility that it might increase further. If the stock price continues to grow in the coming time, the investor will keep on waiting for the buy limit and might miss the chance of trading at the current time for the particular assets.

Best Forex Trading Course

Ezekiel Chew is the founder and CEO of Asia Forex Mentor, a Singapore-based company that provides Forex trading education. He is not just a typical forex trainer but a highly credible one with the ability to make 6 figures per trade. His methods are backed by mathematical probability, and he is the trainer behind banks and trading institutions.

The Asia Forex Mentor program is a complete program that covers from beginner to advanced. It includes everything that a trader needs to know to be successful. The program is designed to give traders the edge over the competition.

Ezekiel is a highly experienced and successful forex trader. He has been trading for over 10 years and is a highly sought-after trainer. You may not know this, but he is frequently invited to speak at major trading and forex events. He cares about his community, so if you want to learn from the best, you should definitely check out Asia Forex Mentor.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Buy Limit

Buy limit order is quite famous among the traders and has its benefits and disadvantages. Some investors tend to play it safe by purchasing the assets in the market order, but some are persistent in taking the risk to buy assets at a lower price or the exact price offered. Even though there is no assurance of order filing in case of the buy limit order, there is still a chance for the traders to control the payment of their assets.

The prices in the stock market keep changing, and in the buy limit order, there is a great chance of price improvement, making traders stick to it. But the fact that the investors might miss the opportunity of trading on desirable assets in the case of a buy limit order is also undeniable.

In the end, it is the traders’ choice of how they want to trade and how much they are willing to risk. Every order has advantages and disadvantages, and it depends on the traders which order they choose for the outcome they seek.

Buy Limit FAQs

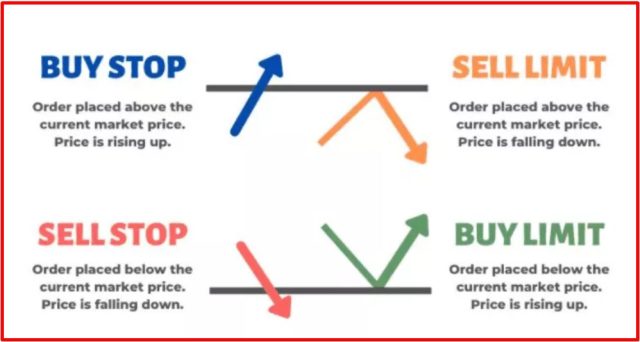

What is a Buy Stop Limit?

A Buy Stop Limit is an order to buy a security at a specified limit price or higher. It is used to purchase a stock when it reaches a specific point, and traders control the purchase of a security at a set price or higher. Besides, a limit and stop price is set when traders specify the highest price they’re willing to pay.

As a trader, you ought to select two price points to place a buy-stop order. The stop is the first price point, marking the beginning of the stock trade for that target price. The limit price would be the second point, which marks the outside limit of the trade price. Moreover, set a timeframe to execute the trade. The stop-limit order is converted into a limit order when the stop price is achieved.

How Do I Place a Buy Limit price?

First of all, you need to determine the limit price of the asset that you like to purchase before placing a buy limit order. The stock order will only execute if the trade is above or at your buy limit price. Furthermore, you should include an expiration date on your buy limit price.

You may complete your order as GTC (good ‘til canceled) to finish it whenever you want, and it will stay open until you want to close it. Generally, the broker will set a time limit on your GTC buy limit, usually 90 days.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.