How To Use Bitcoin Fear And Greed Index

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best cryptocurrency brokers for traders are Coinbase and Gemini

The #1 Crypto and Forex Trading Course is Asia Forex Mentor

If there ever was a term that could perfectly describe the cryptocurrency market, it's bipolar. It doesn't matter if you looked at short-term or long-term timeframes, all cryptocurrencies including bitcoin are influenced by factors that in turn cause large swings.

Many of these large swings are caused by greed and fear among crypto traders. Often the volatility in the crypto market displays investor sentiment.

According to legendary trader Warren Buffet, to be successful, you want to become greedy when other traders are fearful and you want to be fearful when other traders are greedy.

As a crypto trader, you can use the crypto fear and greed index to find out the general sentiment and emotions of traders. It does this by combining historical data from a variety of sources and compiling it into a single figure.

To help you learn more about the topic, we’ve got Ezekiel Chew a world-renowned crypto and forex trader who has mentored everyone from retail traders and large financial institutions and banks, to share with his take on the crypto fear and Greed Index.

In this review, we take a look at the Bitcoin fear and greed index, what it's all about and how you can use it to make smart trading decisions.

What is Bitcoin Fear and Greed Index

So what makes the bitcoin fear and greed index important in trading? The only comparable market crash to the one that happened on May 19 was back in 2017.

There are many elements that caused the crash on May 19. However, two of the major ones included the crackdown on crypto mining in china as well as Elon Musk's Tweet.

This left traders feeling vulnerable. Traders had a fear that they would end up losing money which caused them to sell off their investments. The crypto fear and greed index can gauge this issue.

The Fear and Greed index was designed by CNN as a way to judge the crypto fear and greed levels of crypto traders. According to CNN, the goal of the index is to assist traders in making well-informed choices, especially during those times when the market is erratic and highly volatile.

What typically happens is that people tend to become a bit greedy whenever bitcoin takes a bullish trend. This is due to FOMO or fear of missing out. This is considered by many the greedy section of the market.

On the other hand, once investors begin to see that prices are plummeting, they are taken over by the fear of loss and will start to pull back. The fear and greed index has a range of 0-100. 0 represents extreme fear and 100 represents extreme greed.

When the charts are showing that the investors are exhibiting extreme fear, then this can be used to show that the risk/reward ratio is fair. This can then prompt investors to search out a buying opportunity.

On the other end of the spectrum, if there is extreme greed on the index, it can be used to signify that there is little reward for keeping the investments at such high levels. This can be used to prompt investors to search out a sell signal.

Data Sources of the Bitcoin Fear and Greed Index

The bitcoin fear and greed index is often used to provide a comparison of several factors each of which carries its own weight on bitcoin. Below is a segment of data that has a qualitative impact on the bitcoin market sentiments.

#1. Volatility

This shows the current volatility as well as any drawdowns in the market. It compiles the average date from the last 30 to 90 days. When the volatility rises, then this is often a sign of fear.

#2. Market Momentum

This one works in a similar fashion to the volatility metric that we saw above. It is a measure of the volume and momentum in the bitcoin market over the last 30-90 days. High volume will show in the chart as a bullish trend which then shows that greed is high.

#3. Social Media

The information that is gathered from social media accounts such as Twitter and the number of different hashtags on bitcoin helps calculate the overall sentiment.

An example was the comment by Elon Musk that stopped his car company from taking payments in bitcoin as a result of environmental issues due to the high energy demands of computers used to mine bitcoin.

Granted Elon did ask bitcoin investors to refrain from taking his comments with seriousness but this didn't stop the plummeting of bitcoin following pullback by investors.

#4. Dominance

It is not a secret that bitcoin has lost a lot of market share. However, more bitcoins are continuing to be incepted which causes bitcoin to gain value. Subsequently, the bitcoin value remains high in the crypto market.

One of the reasons why bitcoin remains popular is because of the general sentiment that bitcoin is a great choice for investing in the crypto market. One thing to point out, however, is that this notion isn't as significant as one thinks.

When the dominance of bitcoin goes down, investors will then shift to buying other cryptocurrencies like altcoins. When a different cryptocurrency other than bitcoin becomes dominant, this can clearly show the extremely greedy nature of the crypto market.

5. Surveys

One of the largest public poll firms, straw poll often conducts surveys every week. It does this by going up to people and asking them their individual and subjective take on the crypto market behavior.

Very often, opinions from 200-3000 people will generally paint a good picture of the market sentiment. Many people often don't take the results that seriously but they often do give a good signal on trend direction.

#6. Trends

Several bitcoin-related searches are used to make up the Google Trends Data which in turn can be evaluated to understand the current momentum. If an investor checked out today's bitcoin news, it would be hard to have an overall and comprehensive image of the market.

That said, typing in “bitcoin price manipulation” can show a rise in the search query by %1500. This clearly shows fear in the market.

Bitcoin Fear and Greed Index Today

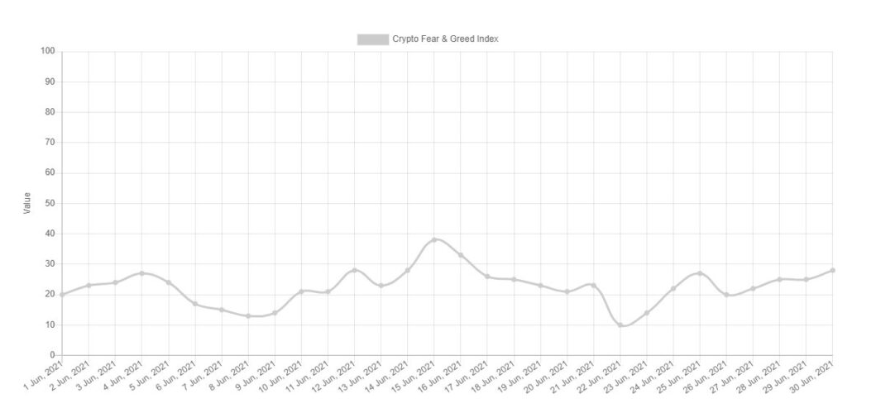

At the end of June 2021, the bitcoin fear and greed index stood at 21. This showed that investors and traders were dominated by the sentiment of fear.

This also means that traders were generally cautious.

By taking a closer look at the bitcoin fear and greed index trading view chart, a savvy investor could anticipate a rise in prices.

Benefits of Fear and Greed Index

The brain responds in a certain fashion due to fear or greed according to psychological studies. Greed for example will cause people to set aside rational thinking and causes an irrational reaction. According to a study by ForexLive up to 76.1% of traders will lose their money as a result of fear.

Granted, there aren't many studies that clearly show a link between the thinking of humans and fear or greed. However, there is no denying that these two are powerful motivators and cause major price fluctuations.

Simply put, investors are often guided by their emotions, and decisions are often pushed by them. Many psychologists are able to show that fear and greed are highly impactful on investor choices. This is why it is important to monitor the fear and greed index.

Back in September of 2008 for instance, the fear and greed index went down to 12. This was around the time the S&P 500 plummeted as a result of The Aftermath Brothers going bankrupt as well as the collapse of AIG insurance.

Many investors are of the opinion that the bitcoin fear and greed index is an important indicator. However, they also agree that one should not use this tool exclusively for their trading choices. Investors also need to consider other pieces of information before making a trading decision.

Fear and Greed Index – Downsides

While different investors will have their own subjective opinion on the matter, many will agree that the best way to get a long-term return on their investments is to buy and hold.

Some traders will view the bitcoin greed and fear index as a tool to help them make certain choices such as when to enter the market but not necessarily the best tool to make decisions on trading.

By looking at past performance it becomes clear that the index doesn't always provide reliable results.

Is there a way to Overcome Fear and Greed

One thing about market participants is that they will react differently. This is not to say however that their choices are not motivated by fear or greed. The most proven way that crypto investors can overcome this fear and greed is through a trading plan.

By sticking to the trading plan, the investor is able to keep their actions consistent and take out the emotional element.

Examples of actions that could cause the reader to not follow the trading plan are taking out the stop during a losing trade, doubling down on negative positions, or overleveraging.

A trader can also minimize emotional impulses by taking down the position sizes.

Best Crypto and Forex Trading Course

Turn around the fortunes of your trading career with the One Core Program, a trading course from Asia Forex mentor. One Core Program is built on the two-decade trading expertise of Ezekiel Chew – the Lead Mentor and trainer.

While Ezekiel is key in Corporate Forex training, the One Core Program is a package to help anyone willing to transform their trading careers for life. Through the package, He has trained institutional investors like the DTP bank, which is State-owned by the Philippine Government.

As a go-to Forex expert, Ezekiel speaks in notable Forex events, and his career trading forex is living proof that anyone with the correct approach has a huge opportunity at earning through Forex as a life career.

One Core program is a rare course within the Forex fraternity. From the initial tutorials, Ezekiel builds on trading confidence by making it clear that trading profitably is far more different than what new and losing traders take it to be. The One Core program lays emphasis on the low risk of capital. However, the course vaults you into increasing odds by taking on a Risk- free approach.

In this post, our focus is on the ATR indicator. But there are many ways to bag pips, and the only way you can grasp that is by taking the One Core Program. Let a mentor shape into your trading mind what will take you decades fumbling out for. Change your trading psychology and approach forever, and get to stick to the rules professional traders ride on to thrive where you fail.

Lastly, it is worth pointing out that the One Core Program will help you build trading skills and discipline for life. It’s a course that builds your confidence, it skillfully shows you why you should not fear, and why you should not be greedy. And why you should not stop jobs, hobbies, and education, yet be a professional trader.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Crypto Brokers

| Broker | Best For | More Details |

|---|---|---|

| Earning Rewards Read Review | securely through Coinbase website |

| Altcoin Trading Read Review | securely through Binance website |

| Sign Up Bonuses | securely through Crypto.com website |

| New Investors Read Review | securely through Gemini website |

Conclusion: Bitcoin Fear and Greed Index

The bitcoin fear and greed index is not a scientific method of evaluating the crypto market, but many investors will agree that it does pretty well in showing the sentiment in the bitcoin market.

Whenever the current sentiment is dominated by a fearful market, this often triggers huge selloffs that cause prices to plummet. Savvy investors see this as an opportunity to get into the bitcoin market as they view the drop in prices as only temporary.

The bitcoin fear and greed index is viewed by many as a useful tool, especially when used with other tools to show the current market sentiment. While the index can be used to show when the market is overbought or oversold, to make the best investment decisions it is best to find out about the crypto market behavior by digging deeper into own research and analysis.

Online resources are one way to get further information. However, the Asia Forex Mentor tailored sessions can help you get a comprehensive understanding of the crypto market.

Bitcoin Fear and Greed Index FAQs

Is Bitcoin fear and greed index profitable?

The bitcoin fear and greed index can be used profitably as a trading signal. It worked perfectly in the first half of the bear market.

However, in the rise of the second quarter of 2019, the index suddenly failed to work. Once the bitcoin price consolidated around $10,000, the bitcoin fear and greed index suddenly began to work like a charm.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.