ZFX Broker Review 2024 with Rankings By Dumb Little Man

By Wilbert S

February 4, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 107th  |  |

| Advantages | Disadvantages |

|---|---|

ZFX Broker Review

ZFX Broker, an NDD (No Dealing Desk), STP (Straight Through Processing), and ECN (Electronic Communication Network) broker, is a notable player in the online FX and CFD trading sector. Established in 2016 and headquartered in London, ZFX has quickly made a mark in the financial trading world. It operates under the stringent regulations of the British FCA (Financial Conduct Authority) and the Seychelles supervisory authority FSA, ensuring a high standard of operational integrity and client security.

This ZFX review aims to provide a comprehensive analysis of ZFX Broker. By delving into its unique selling points and potential limitations, our goal is to furnish readers with crucial insights. These include an overview of the various account types, the specifics of deposit and withdrawal processes, and the details of commission structures. Combining expert analysis with real-world trader experiences, this review is designed to help you make an informed decision about whether ZFX Broker aligns with your trading needs and preferences.

What is ZFX Broker?

ZFX Broker stands as a dynamic NDD (No Dealing Desk), STP (Straight Through Processing), and ECN (Electronic Communication Network) broker, with its base of operations in London. Since its inception in 2016, ZFX has been steadily providing online FX and CFD trading services to a global clientele. Regulated by both the British FCA (Financial Conduct Authority) and the Seychelles supervisory authority FSA, ZFX upholds stringent standards of financial integrity and consumer protection. They also offer a diverse range of trading instruments from Forex currency pairs to commodities,

Extending its reach beyond its London headquarters, ZFX caters to traders in Europe, Asia, and Africa. Its trading platform offers a wide range of financial instruments, including currency pairs, indices, stocks, and commodities. ZFX is a crucial part of the Zeal Group, a collective of fintech companies known for their expertise in providing liquidity solutions in regulated markets across major global regions. This association enhances ZFX’s capacity to offer diverse and efficient trading options to its users.

Safety and Security of ZFX Broker

ZFX Broker, officially known as Zeal Capital Market (UK) Limited, is a regulated broker that operates under the regulation of the Financial Conduct Authority (FCA). Based in England and Wales, it forms a part of the Zeal Group, a holding company that also includes Zeal Capital Market (Seychelles) Ltd, regulated by the Financial Services Authority of Seychelles (FSA). This dual regulatory framework is a significant factor in establishing ZFX’s credibility in the global trading market.

In terms of client fund security, ZFX maintains a strict policy of segregating client funds from its corporate funds. These client funds are kept in separate accounts at major banks, ensuring a high level of safety and transparency. Additionally, professional traders using ZFX are eligible for compensation under the FSCS (Financial Services Compensation Scheme), adding an extra layer of financial protection. The broker is committed to rigorously fulfilling all the obligations outlined in its legal contracts, thereby upholding legal compliance and operational integrity in its services.

Pros and Cons of ZFX Broker

Pros

- Competitive spreads in ECN accounts

- High leverage options

- FCA and FSA regulated

- Over 100 trading assets available

- No dealing center involvement in trade execution

- Mini account with low minimum deposit

- Wide range of account types

Cons

- Limit on open positions in certain accounts

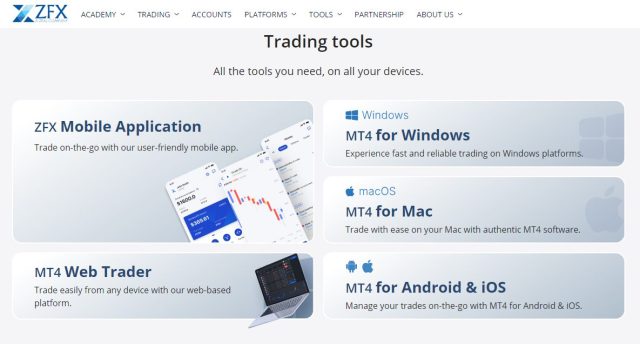

- No web-based trading platform

- High deposit requirement for ECN accounts

Sign-Up Bonus of ZFX Broker

ZFX Broker currently does not offer a sign-up bonus for new clients. This lack of a promotional bonus might be a consideration for those who are accustomed to such incentives when opening a new trading account. However, the decision to not provide a sign-up bonus allows ZFX Broker to focus on other aspects of their service, such as competitive spreads, diverse asset offerings, and regulatory compliance, which can be crucial for long-term trading success.

Minimum Deposit of ZFX Broker

ZFX Broker has set its minimum deposit requirements at $50 for retail clients. This relatively low entry barrier makes it accessible for individual traders to start trading. On the other hand, for professional clients, the threshold is significantly higher, with a minimum deposit of $10,000. This distinction in deposit requirements reflects ZFX Broker’s effort to cater to both casual traders and those with more substantial financial resources or professional trading experience.

ZFX Broker Account Types

Based on comprehensive research by our team at Dumb Little Man, here’s an organized overview of ZFX Broker’s account types:

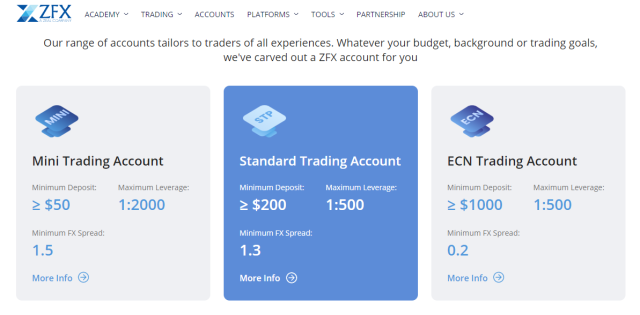

Mini Trading Account

- Designed for novice traders

- Minimum deposit: $50

- Leverage: Up to 1:2,000

- Spreads: Starting from 1.5 points

- Stop-out level: 20%

Standard STP Trading Account

- Ideal for more experienced clients

- Minimum deposit: $200

- Leverage: Up to 1:500

- Spreads: Starting from 1.3 pips

- Stop-out level: 30%

ECN Trading Account

- Offers direct market access via an electronic communication network

- Minimum deposit: $1,000

- Spreads: Starting from 0.2 pips (additional commissions may apply)

- Stop-out level: 50%

Professional Account

- An ECN account tailored for professional trading

- Minimum deposit: $10,000

- Spreads: Floating, starting from 0.2 pip

- Leverage: Up to 1:100 for currency pairs

These account options from ZFX Broker are designed to cater to a range of traders, from beginners to seasoned professionals, offering varied leverage, spreads, and deposit requirements to suit different trading styles and experience levels.

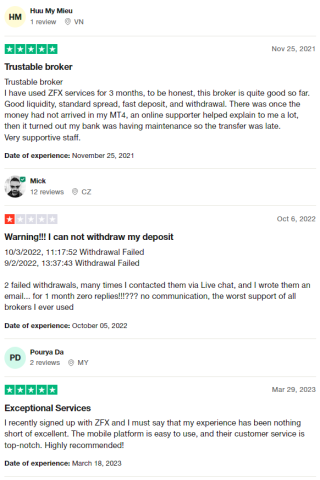

ZFX Broker Customer Reviews

Customer reviews for ZFX Broker present a varied picture of the broker’s services and customer support. Some clients commend ZFX for its good liquidity, standard spreads, and fast deposit and withdrawal processes, highlighting instances where the support staff was notably helpful and responsive. This positive feedback often includes praises for the user-friendly mobile platform and excellent customer service.

On the contrary, there are also reports of challenges, notably with failed withdrawals and a lack of response from customer support, leading to frustration for some users. This mix of experiences suggests that while many clients have a satisfactory or even exceptional experience with ZFX Broker, potential users should be aware of the reported issues in customer support and service inconsistencies.

ZFX Broker Fees, Spreads, and Commissions

ZFX Broker operates without a fixed brokerage commission, with spreads varying based on the account type and currency pair traded. The tightest spreads, starting as low as 0.2 pips, are available on ECN and Professional accounts. For those holding a Standard STP trading account, spreads begin at 1.3 pips, and for Mini Trading Accounts, the starting point is 1.5 pips.

In addition to the spread, ECN accounts may incur additional transaction commissions. While depositing and withdrawing funds are generally free of charge on ZFX Broker, traders should be aware that payment systems or the receiving bank may impose their own deposit or withdrawal fees. This fee structure reflects ZFX Broker’s commitment to transparency in its pricing while offering competitive conditions across different types of trading accounts.

Deposit and Withdrawal

ZFX Broker offers a streamlined process for deposit and withdrawal methods. To initiate a withdrawal, clients need to complete an application form in their MyZFX cabinet on the broker’s website. This flexibility allows for withdrawal requests even with open positions. However, it’s crucial to ensure that there are sufficient funds to cover the margin requirements, as failing to do so may lead to the closing of orders by Margin Call.

Prior to requesting a withdrawal, it’s essential to confirm that verification processes have been completed and approved. ZFX processes withdrawal requests within 24 hours of approval. Retail clients have the option to withdraw funds via bank transfer, bank card, or e-wallet, whereas professional traders can only use bank transfers. The minimum withdrawal amount is set at $15, and no commission is charged by the broker. Additionally, there is the option to convert funds to cryptocurrency during withdrawal, providing an extra layer of convenience for clients.

How to Open a ZFX Broker Account

- Navigate to the ZFX Broker official website and click on the “Open an account” button located at the top of any page.

- Fill out the registration form with your personal information, including email address, phone code, and mobile number, and create a strong password.

- Access your personal account by clicking on MyZFX and log in using your email address and the password you set.

- Complete the identity verification process by providing required documents.

- Choose your preferred account type from the options available.

- Set your trading platform preferences, selecting from the various platforms offered by ZFX.

- Decide and indicate your initial investment amount.

- Read and agree to the terms and conditions outlined by ZFX.

- Finally, fund your account to start trading.

ZFX Broker Affiliate Program

ZFX Broker offers a diverse affiliate program catering to different types of partners:

- Marketing Affiliates: This program is designed for those looking to leverage digital platforms. ZFX provides advertising banners that can be placed on websites and social networks, facilitating the attraction of clients through its dedicated affiliate portal.

- Introducing Broker (IB): Aimed at individuals and financial institutions, the IB program allows partners to operate under the ZFX brand. ZFX supports its introducing brokers with an experienced team of specialists, ensuring effective client assistance and smooth operations.

- Fund Managers: This role involves managing MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) accounts, tailored for professionals in fund management. This aspect of the affiliate program is especially geared towards those with expertise in overseeing substantial trading activities and client portfolios.

ZFX Broker Customer Support

ZFX Broker has a dedicated customer support team that offers varied channels of communication, tailored to different client statuses and selected units. Professional clients have the option to connect with broker representatives through phone and email. In contrast, retail traders can utilize online chat, email requests, or a pre-designed contact form in the ‘Contact us’ section of the broker’s website.

For unregistered users, ZFX provides an extensive support system. They can have their queries addressed via chat, phone, or email. Additionally, ZFX extends its customer support to social media platforms like Facebook, Instagram, Twitter, and LinkedIn, using their messenger services. This comprehensive approach ensures that all potential and existing clients have access to support, irrespective of their registration status with ZFX Broker.

Advantages and Disadvantages of ZFX Broker Customer Support

| Advantages | Disadvantages |

|---|---|

ZFX Broker vs Other Brokers

#1. ZFX Broker vs AvaTrade

ZFX Broker, a newer player in the market, offers high leverage and a diverse range of account types, catering to both novice and professional traders. On the other hand, AvaTrade boasts a longer history since 2006, a broader customer base, and a wider array of financial instruments. AvaTrade’s strong regulatory framework and global presence make it a more robust choice for traders seeking a well-established platform.

Verdict: AvaTrade may be more suitable for those looking for a broad range of instruments and stronger global regulation.

#2. ZFX Broker vs RoboForex

While ZFX Broker offers competitive spreads and high leverage, RoboForex stands out with its extensive range of over 12,000 trading options and variety of trading platforms. RoboForex’s ContestFX feature adds a unique element to its offerings.

Verdict: For traders looking for technological diversity and a wide range of trading options, RoboForex is the preferable choice.

#3. ZFX Broker vs FXChoice

ZFX Broker and FXChoice both cater to experienced traders, but FXChoice’s focus on automated trading and tight market spreads on professional ECN accounts sets it apart. FXChoice’s commitment to business integrity and its loyalty program designed for high-volume traders give it an edge.

Verdict: FXChoice is more suited for traders who prioritize automated trading solutions and integrity in brokerage services.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about building a successful forex trading career and attaining significant financial success, Asia Forex Mentor is the ideal platform for top-tier forex, stock, and crypto trading courses. Led by Ezekiel Chew, a renowned figure in the trading world known for his impressive seven-figure trades, Asia Forex Mentor stands out in the field of financial education. Below are the key reasons why we recommend it:

Comprehensive Curriculum: The program at Asia Forex Mentor thoroughly covers various aspects of stock, crypto, and forex trading, providing learners with a broad and detailed knowledge base essential for excelling in these markets.

Proven Track Record: Asia Forex Mentor has a history of nurturing traders who consistently achieve profitability, validating the effectiveness of their teaching methods and mentorship.

Expert Mentor: Ezekiel Chew’s expert mentorship at Asia Forex Mentor offers invaluable insights and guidance in stock, crypto, and forex trading, helping students confidently understand and navigate these markets.

Supportive Community: Being a part of Asia Forex Mentor means joining a community of dedicated traders, enhancing the learning process through collaboration, idea exchange, and mutual support.

Emphasis on Discipline and Psychology: The program emphasizes the psychological aspects of trading, teaching traders to maintain a strong mindset and discipline, which are crucial for successful trading.

Constant Updates and Resources: With the ever-evolving nature of financial markets, Asia Forex Mentor provides ongoing updates and resources, keeping students informed and ahead in their trading strategies.

Success Stories: The numerous success stories of students achieving financial independence through their education at Asia Forex Mentor demonstrate the comprehensive and effective nature of their forex, stock, and crypto trading courses.

Ultimately, Asia Forex Mentor is the leading choice for those seeking a comprehensive, practical, and well-supported path to success in forex, stock, and crypto trading. With its wide-ranging curriculum, expert mentorship, and dynamic learning environment, it equips aspiring traders with the skills and knowledge to become proficient professionals in the diverse world of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: ZFX Broker Review

In conclusion, the ZFX Broker Review by the Dumb Little Man team of trading experts presents a clear picture of this broker’s strengths and areas for improvement. ZFX Broker stands out for its high leverage, diverse account types, and competitive spreads, especially in its ECN and Professional accounts. These features make it an attractive option for both novice and experienced traders.

However, it’s important to note the limitations. The absence of a web-based trading platform and a high deposit requirement for ECN accounts might deter some potential users. Additionally, the limit on the number of open positions in certain accounts can be a constraint for more active traders. Prospective clients should weigh these factors carefully against their individual trading needs and preferences.

>> Also Read: FXORO Review with Rankings 2024 By Dumb Little Man

ZFX Broker Review FAQs

What is the minimum deposit required to start trading with ZFX Broker?

The minimum deposit varies depending on the account type. For retail clients, it starts from $50, making it accessible for beginners. However, for professional clients, the minimum deposit is $10,000, targeting more experienced traders with higher capital.

Are there any fees for depositing or withdrawing funds from ZFX Broker?

ZFX Broker prides itself on not charging any fees for depositing or withdrawing funds. However, it’s important to note that while ZFX doesn’t charge fees, payment systems or banks might impose their own charges, especially for international transactions.

Is ZFX Broker regulated, and how does it ensure the safety of my funds?

Yes, ZFX Broker is regulated by the British FCA and the Seychelles supervisory authority FSA. To ensure the safety of client funds, ZFX practices fund segregation, meaning client funds are kept separate from the company’s funds in major banks. This is a crucial aspect of their commitment to financial integrity and client security.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.