FXORO Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 102nd  |  |

| Advantages | Disadvantages |

|---|---|

FXORO Review

Forex brokers play a crucial role in the global trading environment, offering platforms where traders and investors can buy and sell foreign currencies and other financial instruments. FXORO stands out in this competitive market, providing a gateway to a diverse range of trading options. It offers access to hundreds of contracts for difference (CFDs) on various asset groups including currency pairs, cryptocurrencies, stocks, indices, commodities, and exchange-traded funds (ETFs). Furthermore, FXORO extends the opportunity to invest in physical shares of American companies, broadening its appeal to a wide spectrum of investors.

Our comprehensive review of FXORO aims to deliver an in-depth analysis, highlighting both the advantages and limitations of the broker. This review is designed to provide readers with critical information about FXORO, covering account options, deposit and withdrawal processes, and commission structures. We merge expert analysis with real user experiences to offer a well-rounded perspective. This approach ensures that readers are well-equipped with the knowledge needed to evaluate FXORO as a potential choice for their brokerage services.

What is FXORO?

FXORO is a Forex and CFD trading brokerage firm, recognized for its extensive range of trading instruments. This broker facilitates trading in a wide array of asset classes, including Forex, CFDs, Shares, Commodities, Stocks, Indices, Cryptos, and ETFs. Its diverse offering caters to traders with various investment preferences and strategies, making it a versatile choice in the online trading community.

The Forex broker is strategically headquartered in Cyprus and prides itself on being regulated and authorized by CySEC (Cyprus Securities and Exchange Commission), a highly respected European regulatory body. This ensures a level of trust and compliance with European financial standards. Additionally, FXORO has extended its reach to Seychelles, obtaining authorization from the Financial Services Authority (FSA). This dual regulation highlights FXORO's commitment to maintaining a secure and reliable trading environment for its clients worldwide.

Safety and Security of FXORO

In assessing the safety and security of FXORO, it is important to recognize it as a legitimate and regulated broker. This status is crucial for traders who prioritize security in Forex trading. FXORO's adherence to necessary regulations and industry standards is validated by its regulation under a well-regarded European authority, ensuring a secure trading environment.

The broker, FXORO, operates under MCA Intelifunds Ltd, which is registered in Cyprus and abides by the regulations set by the Cyprus Securities and Exchange Commission (CySEC), and also by the FSA (Seychelles). This dual regulation underlines FXORO's commitment to operating within the legal frameworks of multiple jurisdictions, enhancing its credibility and trustworthiness.

However, it's important to note that FXORO holds an offshore license as well. Traders should be aware of the implications of trading in different jurisdictions. This information, gathered from thorough research by Dumb Little Man, highlights the necessity for traders to understand the differences in regulatory environments when engaging with brokers operating in multiple regions. Making informed decisions is crucial when navigating the complexities of international Forex trading with FXORO.

Pros and Cons of FXORO

Pros

- Regulated by European authority

- Attractive trading conditions

- Wide range of trading instruments

- Availability of MT4 platform

- Advanced analysis tools

- Customizable MT4 options

- Three complimentary withdrawals each month

Cons

- Restricted to CFD trading only

- Customer support is not available 24/7

Sign-Up Bonus of FXORO

The Sign-Up Bonus offered by FXORO is a notable incentive for new traders. Currently, they present an opportunity to boost trading power by 30%. This welcome promotion is exclusively available to new registrants who have completed their first deposit. By fulfilling these conditions, traders become eligible for a significant 30% increase in their trading capacity.

This offer underscores FXORO's commitment to attracting and supporting new clients. The promotion is designed to provide a substantial enhancement to a trader's initial investment, allowing for a stronger start in the trading world. It's an appealing prospect for those looking to maximize their initial trading potential with FXORO.

Minimum Deposit of FXORO

The Minimum Deposit requirement at FXORO is an accessible feature for traders. The broker has set a minimum deposit amount of $100. This amount is designed to be manageable for a wide range of traders, from beginners to those with more experience.

FXORO Account Types

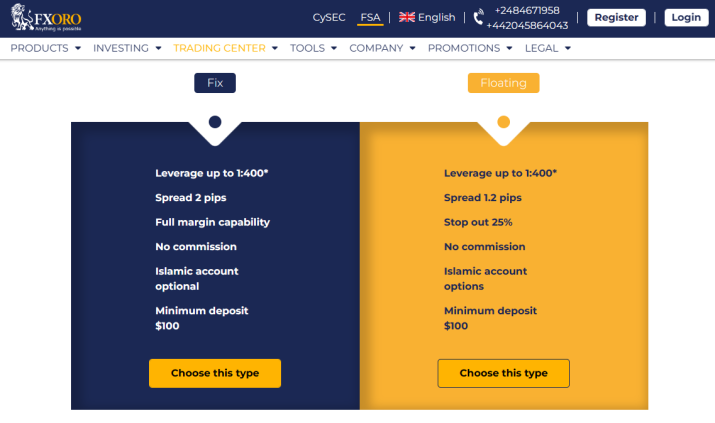

FXORO provides a choice of two distinct Trading Account Types, each tailored to different trading preferences. Our team of experts at Dumb Little Man conducted thorough research and testing to understand these account types better. Here's a clear and organized summary:

Fix Account

- Leverage up to 1:400*

- Spread at 2 pips

- Full margin capability

- No commission charges

- Option for an Islamic account

- Minimum deposit of $100

Floating Account

- Leverage up to 1:400*

- Lower spread at 1.2 pips

- Stop out level at 25%

- Commission-free

- Islamic account option available

- Minimum deposit remains at $100

The primary distinction between these accounts lies in the spread applicable to transactions. The Fix Account offers a fixed spread, while the Floating Account features a lower, variable spread. Both accounts present leverage up to 1:400, offering significant trading flexibility. The fix and floating spread accounts also offer Islamic accounts. These account options reflect FXORO's commitment to catering to a wide range of trading strategies and preferences.

FXORO Customer Reviews

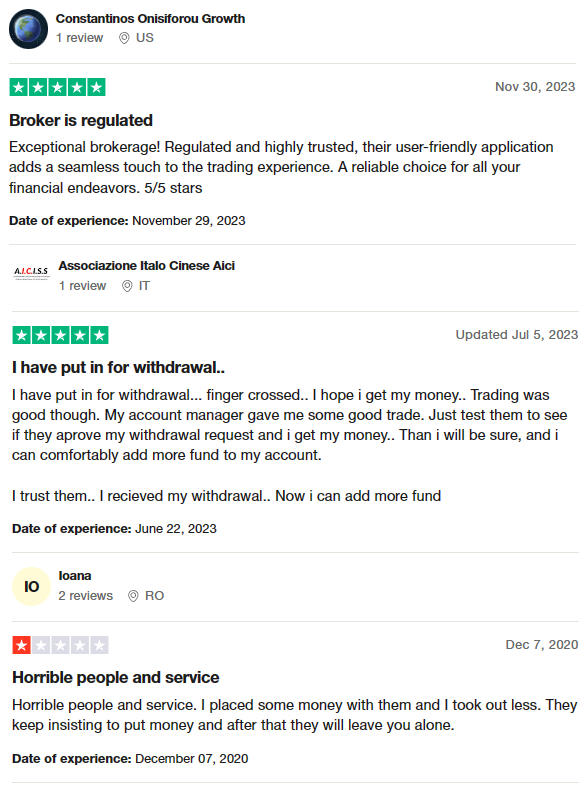

FXORO Customer Reviews reveal mixed experiences among users. Many regard FXORO as an exceptional brokerage, praising its regulated nature and user-friendly application, which enhances their trading experience. This has led to a high level of trust and satisfaction, reflected in ratings such as 5/5 stars.

On the other hand, some customers have experienced apprehension regarding withdrawals. While trading services and account management are generally viewed positively, the initial uncertainty about withdrawal processes causes concern for some traders. However, this concern tends to dissipate once the withdrawals are completed, reinforcing trust in the platform.

Conversely, a minority of users describe their experience as unsatisfactory, citing issues with service and investment returns. These customers feel pressured to invest more and report dissatisfaction with the overall service. These varied reviews highlight the importance of understanding personal trading goals and risk tolerance when choosing a broker like FXORO.

FXORO Fees, Spreads, and Commissions

At FXORO, understanding the fees, spreads, and commissions is essential for traders. For both fixed and floating accounts, the broker charges no trading commissions. The spread in a fixed account is set at 2 points, whereas in a floating account, it starts from a lower value of 1.2 points. This structure allows traders to choose an account type based on their spread preference.

For those opting for an ECN account, FXORO offers a floating spread starting from 0 points. However, this account type comes with a commission – $6 per lot traded. This fee structure is typical for ECN accounts, which often provide tighter spreads in exchange for a commission on trades.

The broker is known for its competitive spreads, especially notable in the Forex market. For instance, the average spread for the EUR/USD pair in a floating spread account is around 1.2 pips, which is considered favorable for Forex traders.

Besides spreads and commissions, FXORO also implements overnight/swap costs, which are common in the industry. Traders should be aware that additional fees might be incurred during their trading activities. These fees are a part of FXORO's transparent cost structure, enabling traders to make informed financial decisions.

Deposit and Withdrawal

The Deposit and Withdrawal processes at FXORO are straightforward, as confirmed by a trading professional at Dumb Little Man. Initially, traders using a demo account engage with virtual funds, meaning they cannot withdraw real profits. This type of account is ideal for practice and learning without financial risk.

Upon upgrading to a real account and making a deposit, traders gain the ability to withdraw their earnings, provided they have a successful trading record and a positive account balance. Withdrawals are conducted through the user account on FXORO's official website, offering a convenient and secure process.

FXORO offers multiple channels for withdrawing funds, including Visa and MasterCard, Skrill, Neteller, Wire2pay, and bank transfers. Traders have the flexibility to choose the method that best suits their needs. The first three withdrawal requests each month are free of commission fees. However, from the fourth withdrawal within the same month, a fee of $10, or its equivalent in another currency, is applied.

It's important to note that third-party fees may be incurred during the withdrawal process. These fees are charged by banks or e-wallet services and are independent of FXORO's charges. For any queries or issues related to fund withdrawals, FXORO offers prompt technical support to assist its clients, ensuring a smooth and efficient withdrawal experience.

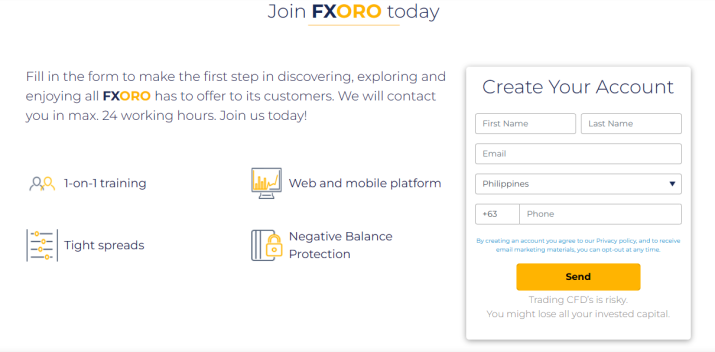

How to Open an FXORO Account

- Go to FXORO‘s official website to start opening an account.

- Choose a preferred language on the website.

- Press the “Register” button to begin registration.

- Provide your name, country, email, and phone number.

- Pick an account type from the options presented.

- Accept FXORO's terms by checking the boxes.

- Finish captcha verification and click “Join”.

- Log in with your email and receive a system-generated password.

- Verify your email for login details and MT4 access.

FXORO Affiliate Program

The FXORO Affiliate Program offers an opportunity to promote a professional and complete trading experience. This program is designed for individuals or entities interested in partnering with a trusted and regulated broker.

Key features of the program include a dynamic CPA (Cost Per Acquisition) of up to $1,000, although this is subject to specific terms and conditions. This dynamic structure allows for significant earning potential for affiliates. FXORO has been operating for over 5 years, establishing a solid reputation in the trading industry.

Affiliates benefit from the support of expert account managers, ensuring they have the necessary guidance and resources for successful promotions. The program also offers CPA on ECN Accounts, catering to a wider range of trading preferences.

FXORO's affiliate system is considered world-class, incorporating advanced features like cookie tracking, pixel tracking, and API integration. These tools are crucial for monitoring and enhancing affiliate marketing efforts, providing detailed insights into traffic and conversions. Joining FXORO's Affiliate Program opens doors to a rewarding partnership with a respected player in the Forex trading sector.

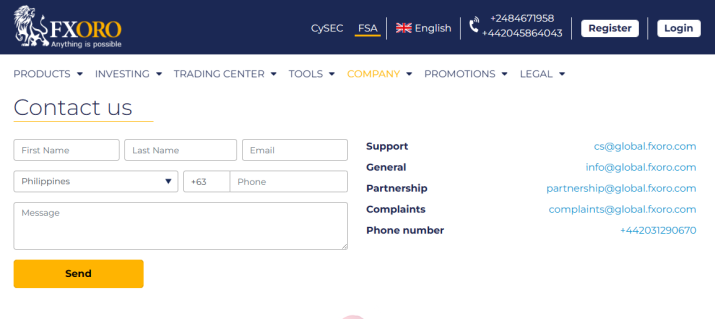

FXORO Customer Support

FXORO‘s Customer Support is renowned for its effectiveness and accessibility, operating consistently throughout the trading week (24/5). Based on the experience of Dumb Little Man, it is evident that the broker offers multiple channels for assistance. These include live chat, email, phone lines, and social media platforms. This variety ensures that traders can choose their preferred method of communication, whether it's for quick queries through chat or more detailed issues via email.

The support team at FXORO goes beyond just resolving basic queries. They are staffed with trading experts who offer in-depth insights and support. These professionals are well-equipped to provide technical assistance, analysis recommendations, and respond to general inquiries and operational issues. Such a level of expertise in customer service is invaluable, especially for traders seeking guidance in different areas of their trading activities. This comprehensive support structure enhances the overall trading experience with FXORO, making it a reliable partner in the trading journey.

Advantages and Disadvantages of FXORO Customer Support

| Advantages | Disadvantages |

|---|---|

FXORO vs Other Brokers

#1. FXORO vs AvaTrade

FXORO and AvaTrade are both prominent players in the Forex and CFD brokerage space, but they cater to different trader needs. AvaTrade, established in 2006, boasts a large global presence with a strong focus on regulatory compliance and diverse financial instruments. It's known for serving a broad international client base, except in the US, and provides a full online trading experience. In contrast, FXORO offers a range of trading instruments and is known for its customer-centric approach, with a focus on various trading platforms and instruments.

Verdict: AvaTrade may be better for traders seeking a more established broker with a global reach and a strong regulatory framework. FXORO, however, could be more suitable for traders prioritizing diverse trading options and personal customer service.

#2. FXORO vs RoboForex

RoboForex, established in 2009 and regulated by FSC, is known for its cutting-edge technologies and tailored trading conditions suitable for various trading styles and volumes. It offers an extensive range of over 12,000 trading options and excels in providing a variety of trading platforms. FXORO, while also offering a range of trading instruments, differentiates itself with its dual regulation and focus on providing a secure trading environment.

Verdict: RoboForex is likely a better option for traders who value a wide selection of trading options and platforms. FXORO, on the other hand, is more suited for traders who prioritize security and regulatory compliance.

#3. FXORO vs FXChoice

FXChoice, established in 2010 and licensed by FSC Belize, focuses on serving experienced traders with its array of trading instruments and services for automated trading. It offers both classic and professional ECN accounts but is less beginner-friendly, lacking offerings like cent accounts or optimal leverage for new traders. FXORO offers a more balanced approach, catering to both new and experienced traders with its range of account types and trading instruments.

Verdict: FXChoice is preferable for experienced traders seeking specialized services in automated trading and ECN accounts. FXORO is more suitable for a broader range of traders, including those new to Forex trading, due to its diverse account options and user-friendly approach.

>> Also Read: AvaTrade Review 2025 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're passionate about building a successful forex trading career and aiming for significant financial returns, Asia Forex Mentor is the ideal selection for top-tier forex, stock, and crypto trading education. Ezekiel Chew, known for his influential role in shaping trading institutions and banks, is the driving force of Asia Forex Mentor. Notably, Ezekiel regularly secures seven-figure trades, distinguishing him significantly from other educators.

Here's why we recommend Asia Forex Mentor:

Comprehensive Curriculum: The program offered by Asia Forex Mentor is all-inclusive, addressing forex, stock, and crypto trading. This curriculum is meticulously designed to furnish learners with essential skills to thrive in these varied markets.

Proven Track Record: Asia Forex Mentor's success is evident in its history of developing consistently profitable traders. This success underlines the efficacy of their educational and mentoring approaches.

Expert Mentor: Students at Asia Forex Mentor receive mentorship from an expert with a proven track record in stock, crypto, and forex trading. Ezekiel's personalized mentorship empowers students to confidently tackle the complexities of each market.

Supportive Community: Being part of Asia Forex Mentor means joining a collaborative community of traders focused on success in forex, stock, and crypto trading. This environment encourages sharing ideas and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: The program stresses the importance of mental strength and discipline in trading. Asia Forex Mentor equips traders with psychological tools to manage emotions, stress, and decision-making.

Constant Updates and Resources: Recognizing the ever-evolving nature of financial markets, Asia Forex Mentor ensures that students stay informed of the latest trends and strategies, providing ongoing access to crucial resources.

Success Stories: The numerous success stories from Asia Forex Mentor are a testament to their effectiveness in transforming students' trading careers and aiding them in achieving financial independence.

Asia Forex Mentor stands out as the top choice for those seeking a comprehensive course in forex, stock, and crypto trading. With its well-rounded curriculum, experienced mentoring, practical learning approach, and community-driven environment, Asia Forex Mentor lays the groundwork for turning ambitious traders into skilled professionals in the diverse world of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FXORO Review

In conclusion, the team of trading experts at Dumb Little Man provides a balanced perspective on FXORO. This broker stands out for its diverse range of trading instruments and accessibility to traders at different levels. The no commission structure on certain accounts and the competitive spreads particularly appeal to those looking to maximize their trading potential.

However, it's important to approach FXORO with an awareness of its limitations. The lack of 24/7 customer support could be a drawback for traders who require assistance outside of standard business hours. Additionally, the restriction to CFD trading limits the options for those interested in other types of financial instruments.

>> Also Read: NS Broker Review with Rankings 2025 By Dumb Little Man

FXORO Review FAQs

Is FXORO suitable for beginner traders?

FXORO caters well to both beginner and experienced traders. With its user-friendly platform and a range of educational resources, it offers a supportive environment for newcomers. Beginners can start with a manageable minimum deposit of $100 and choose from different account types to match their skill level. However, beginners should be aware of the trading risks and start with caution, especially when trading CFDs.

How secure are my investments with FXORO?

Security is a key concern for traders, and FXORO addresses this by being a regulated and authorized broker. It adheres to strict guidelines under the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) in Seychelles. These regulations help ensure that client investments are handled securely. However, as with any trading platform, there are inherent risks, and traders should always be aware of these.

What types of trading instruments are available on FXORO?

FXORO offers a comprehensive range of trading instruments, making it appealing for diverse trading interests. Traders have access to CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and ETFs. Additionally, there is the option to invest in physical shares of American companies. This diversity allows traders to explore various markets and develop a diversified trading portfolio.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.