XMTrading Review 2024 with Rankings by Dumb Little Man

By John V

May 14, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 141st  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies XMTrading as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

XMTrading Review

Firms known as forex brokers give traders access to a marketplace where they may buy and sell foreign exchange. The foreign exchange market, or forex market, is the biggest and most liquid financial market globally, with all transactions taking place between two distinct currencies.

Employing a group of experts whose knowledge covers all the important aspects of forex trading allows XMTrading to stand out in the global forex market. For anyone wishing to trade currencies, XMTrading is a highly recommended option due to its skill pool. XMTrading has a broad clientele that includes both novice and seasoned traders, offering services in more than eight languages.

What is XMTrading?

XMTrading is a big, established, and experienced forex broker, widely recognized for its extensive pool of trading expertise and support for multiple languages. This makes it a preferred broker for traders at all levels, offering robust resources to help achieve investment goals. The firm’s commitment to providing exceptional services in over eight languages enhances its appeal to a global audience.

The company prides itself on its fair and trustworthy trading conditions, which are uniformly applied to all clients, regardless of their investment size or trading account type. XMTrading’s operational efficiency is evidenced by the execution of 99.35% of all trading orders in less than one second, without any re-quotes or rejections.

In addition to its 15 full-feature trading platforms, XMTrading provides 24/5 personal customer service, emphasizing its dedication to client support. The broker ensures client funds are a top priority, and implements Negative Balance Protection to safeguard clients from losing more than their XM account balances. This approach has contributed to XMTrading achieving the highest levels of client retention in the industry.

XMTrading is also celebrated for its human approach to customer service, which values real human interactions. Their approach to workforce development is inclusive, embracing a wide spectrum of cultures and fostering openness to diversity. This philosophy enhances their ability to adapt to evolving market trends and client needs.

The operational philosophy at XMTrading focuses on client satisfaction, which in turn bolsters their loyalty and supports the broker’s strong reputation for credibility and reliability. XMTrading remains committed to offering tight spreads and the best execution, never compromising on factors that could impact client performance.

Safety and Security of XMTrading

Prioritizing the security and safety of its clients’ money, XMTrading complies with strict legal requirements to provide a safe trading environment. By following regulatory guidelines and having oversight, the inherent risks of trading on margin products are effectively handled.

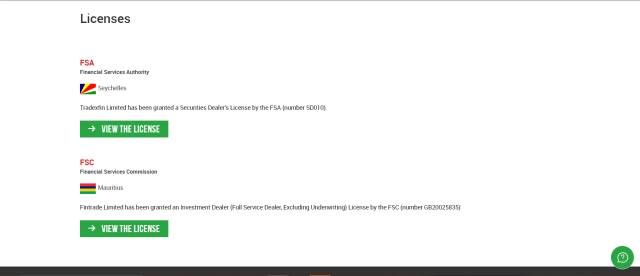

The organization is dedicated to legal compliance and customer security, as evidenced by the licenses it has obtained from respectable financial authorities. With license number SD010, Tradexfin Limited, a division of XMTrading, has been authorized to deal in securities by the Financial Services Authority (FSA) in the Seychelles.

Furthermore, the Financial Services Commission (FSC) in Mauritius oversees Fintrade Limited, another organization under XMTrading. With the exception of underwriting, it is able to provide full trading services because it is in possession of an Investment Dealer License (number GB20025835).

Pros and Cons of XMTrading

Pros

- $5 minimum deposit

- $50 no deposit bonuses (excludes European clients)

- Maximum leverage 1:1000 (excludes European clients)

- Policy of no requotes or slippages

- 11 currency options for account base

- Over 50 currency pairs available

- New Turbo Stocks feature

- New Copy Trading feature

- FX spreads begin at 0 pips

- Quick trade execution

- Support available in 30 languages

- Scalping permitted

- Options for MT4, MT5, or Webtrader

Cons

- Unavailable for USA traders

- Forex options not offered

- No fixed spreads

Sign-Up Bonus of XMTrading

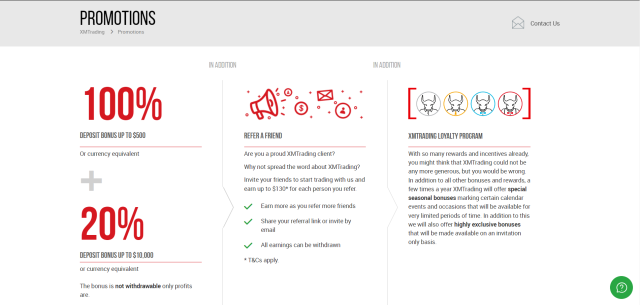

For both new and returning customers, XMTrading provides a variety of promotional programs that improve the trading environment. Because it offers substantial bonuses for deposits, the XMTrading Bonus Program stands out above the rest. In order to qualify for the two-tier incentive, traders must have both MT4 and MT5 accounts.

The first tier offers 100% up to $500, while the second tier offers 20% up to a maximum bonus of $10,500. The bonuses are non-withdrawable. Although KIWAMI and Zero Accounts are not included, this bonus structure significantly boosts trading capital.

Encouragement to invite friends to join XMTrading is also allowed via the Refer a Friend Program. The amount of money awarded for each friend who successfully gets recommended might vary from $130 to $140. Additionally, referees profit since they can earn $40 in trading credit by fulfilling specific requirements, including trading five standard lots.

Additionally, trader points (XMP) can be exchanged for credit benefits through XMTrading’s Loyalty Program. Through trading, clients can accelerate their point accumulation and move up to higher status levels, starting at the Executive level. This gives traders the opportunity to increase their trading capacity by exchanging these points for trading credit.

Minimum Deposit of XMTrading

A low $5 minimum deposit is available for all account types at XMTrading, making it accessible to a broad spectrum of traders, from novices to seasoned pros. With such a low entrance hurdle, prospective traders should feel encouraged to join the forex market without having to make a sizable initial commitment.

Because all four account types—Micro, Standard, KIWAMI, and Zero—have the same minimum deposit requirements, traders can select the account type that best fits their needs and trading style without having to worry about different deposit caps. For traders trying to successfully control their risk and investment levels, this uniformity in minimum deposits streamlines the decision-making process.

XMTrading Account Types

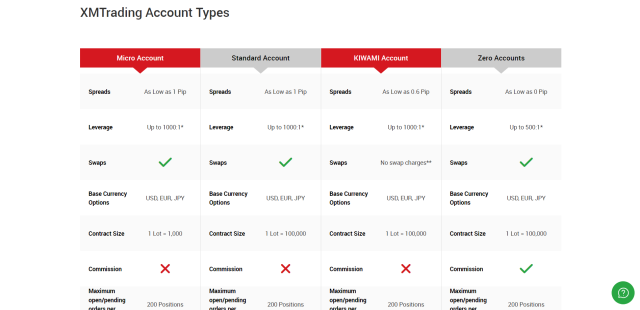

Several account types are provided by XMTrading, each intended to suit different trading styles and skill levels. Each account can accommodate up to 200 open/pending orders per client, has a $5 minimum deposit requirement, and allows for hedging.

Except for the XM Zero Account, which offers up to 500:1, most accounts have leverage that can go up to 1000:1. The Standard, KIWAMI, and Zero Accounts have a contract size of 1 Lot = 100,000, and the base currency options available for all accounts are USD, EUR, and JPY.

Micro Account

- Spreads: As low as 1 pip

- Contract Size: 1 Lot = 1,000

- Minimum trade volume: 0.01 Lots (MT4), 0.1 Lots (MT5)

- Lot restriction per ticket: 100 Lots

Standard Account

- Spreads: As low as 1 pip

- Minimum trade volume: 0.01 Lots

- Lot restriction per ticket: 50 Lots

KIWAMI Account

- Spreads: As low as 0.6 pip

- No swap charges

- Minimum trade volume: 0.01 Lots

- Lot restriction per ticket: 50 Lots

Zero Accounts

- Spreads: As low as 0 pip

- Minimum trade volume: 0.01 Lots

- Lot restriction per ticket: 50 Lots

XMTrading Customer Reviews

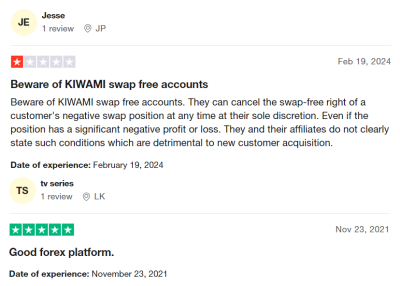

Several customers have raised concerns regarding KIWAMI swap-free accounts offered by the forex platform. Notably, the firm reserves the right to cancel the swap-free status of a customer’s position at any time, especially if that position is incurring significant losses. This important policy detail is reportedly not made clear in the platform’s terms and conditions, leading to potential surprises and dissatisfaction among traders who are not aware of these possible account changes.

Despite these specific grievances, the platform is overall regarded as a good forex platform by its user base. The concerns about the KIWAMI swap-free accounts do not overshadow the general satisfaction reported by many other users, who appreciate the platform’s capabilities and offerings. This feedback indicates that, while there are areas for improvement in terms of transparency and communication, the platform successfully meets the trading needs of its diverse clientele.

XMTrading Fees, Spreads, and Commissions

With an emphasis on fees, spreads, and commissions that are affordable for a variety of traders, XMTrading provides competitive trading conditions. Variable spreads, which are usually less expensive than fixed spreads, are used by the broker. This pricing technique offers dealers an affordable option by imitating the dynamics of the interbank foreign exchange market.

XMTrading offers spreads as low as 0 pips on major currency pairings across all account types, including the Zero Account, which is special in that it does impose a commission, for traders who are interested in even lower spreads. This account is intended especially for traders looking to trade high quantities at the lowest possible spreads.

XMTrading also provides fractional pip pricing and has a Best Execution Policy in place. This adds a fifth digit to the pricing, allowing traders to profit from the tiniest price fluctuations. With the tightest spreads and most precise quotes accessible, traders may work with this degree of pricing precision, improving trading without incurring additional costs.

Regarding costs, XMTrading advocates for a zero-fee system for international wire transfers exceeding 200 EUR as well as deposits and withdrawals made using credit cards and electronic wallets. They guarantee rapid bonus crediting and account financing, with no additional fees, making trading’s financial aspects clear-cut and transparent.

Deposit and Withdrawal

Regardless of account type, XMTrading keeps the minimum amount for both deposits and withdrawals at $5 to streamline the process for its customers. This data is based on extensive testing conducted by a Dumb Little Man trading specialist. The minimum transaction amount, however, may change depending on the preferred payment method.

An AI-powered back office system at XMTrading, which runs on algorithmic parameters, expedites the processing of withdrawal requests. While bank wire transfers and credit card transactions usually take two to five business days, the majority of withdrawals are executed instantaneously, enabling traders to get funds that same day.

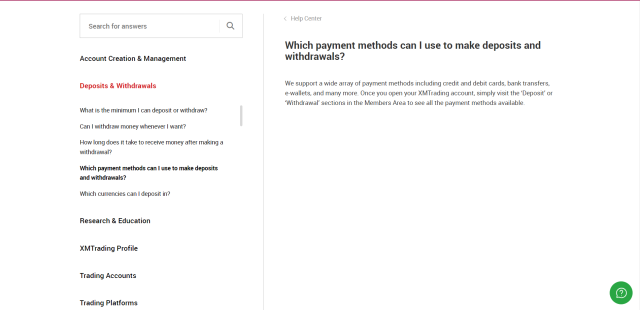

More than only credit and debit cards and bank transfers are among the many payment options that XMTrading offers. Following their login to the Members Area, clients can access these choices under the “Deposit” or “Withdrawal” sections. Although this policy is subject to change, XMTrading even covers all bank-imposed fees for international bank wires of $200 or more.

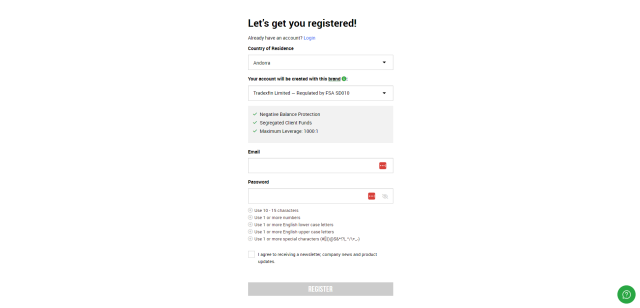

How to Open an XMTrading Account

- Visit the XMTrading website to start the account opening process.

- Select your preferred account type, either a Demo or a Real account.

- Fill out the registration form with your personal details.

- Provide the necessary documentation to verify your identity and residence.

- Wait for approval from XMTrading once your documents are reviewed.

- Set up your trading preferences and any risk management measures.

- Fund your account using one of the available deposit methods.

- Download the trading platform of your choice, such as MT4 or MT5.

- Begin trading on your new XMTrading account once everything is set.

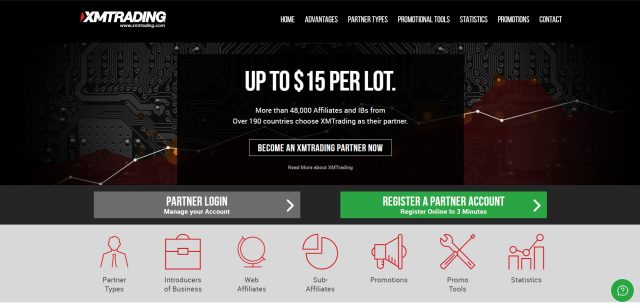

XMTrading Affiliate Program

Through its extensive Affiliate Loyalty Program, XMTrading enables users to accrue points that may be exchanged for cash payouts of up to $150,000. This program is intended for people who want to get the most out of affiliate marketing in the FX trading sector.

Individuals who would like additional information about the program are urged to get in touch with XMTrading directly at [email protected] through email. Affiliates are guaranteed to receive customized support and instruction regarding the program thanks to this direct channel of communication.

It’s simple to sign up for special affiliate promotions. After logging into their Affiliate Platform, affiliates can click the ‘Notifications’ icon located in the upper right corner of the menu bar to access the Notification Center. All of the latest specials and important information are available at this hub.

Affiliates are updated about the clients they have referred by XMTrading. Every time customers establish retail investor accounts through an affiliate’s referral link, an email notification is sent out. Affiliates can access the ‘Traders List‘ on the Affiliate Platform to monitor any clients who have registered under their code.

XMTrading Customer Support

XMTrading takes great satisfaction in offering outstanding customer service, making sure that every user may get assistance anytime they need it. Drawing from the experiences that Dumb Little Man has documented, XMTrading’s support system is designed to provide quick fixes for any problems or queries that traders could have.

Designed to be the most effective way to address frequent issues, the broker’s Help Center is the first place users go when they need answers. In case the Help Center page’s contents fail to address a user’s problem or if tailored support is needed, users can conveniently contact support by email or live chat.

XMTrading’s customer care can be reached via the main support desk at [email protected] and is open 24 hours a day, 5 days a week (24/5 GMT). The Affiliate Department can be reached at [email protected] from 07:00 to 16:00 GMT if an affiliate needs a specific service.

Advantages and Disadvantages of XMTrading Customer Support

| Advantages | Disadvantages |

|---|---|

XMTrading vs Other Brokers

#1 XMTrading vs AvaTrade

XMTrading and AvaTrade are both prominent players in the online forex and CFD trading landscape. AvaTrade, established in 2006 and headquartered in Dublin, offers a wide range of tradable financial instruments across various platforms and is known for its educational resources and AvaProtect, an insurance option for trades.

However, it is not regulated by the FCA and does not cater to U.S. traders. On the other hand, XMTrading offers flexible trading conditions, a low minimum deposit, and a strong regulatory framework.

Verdict: XMTrading may be more appealing for traders looking for lower entry requirements and comprehensive regulatory oversight, whereas AvaTrade offers robust educational resources and innovative trade protection tools.

#2 XMTrading vs RoboForex

RoboForex has been serving a global client base since 2009, recognized for its wide array of trading platforms including MT4, MT5, cTrader, and R Stock Trader, catering to various trading styles and sizes. XMTrading with its diverse retail CFD accounts and strong regulatory practices, offers a similarly broad service spectrum but with added benefits like high leverage options and a low minimum deposit.

Verdict: XMTrading generally provides a more accessible entry point for new traders and greater leverage options, making it potentially more suitable for those looking to start trading with less capital and who desire extensive leverage possibilities.

#3 XMTrading vs FXChoice

FXChoice focuses on offering forex and CFD trading with a unique portfolio that includes less common forex pairs like the Russian Ruble and commodities like crude oil and precious metals, appealing to those interested in emerging markets and commodity trading.

XMTrading, with its robust platform offerings, extensive language support, and lower financial barriers to entry, caters to a broader audience.

Verdict: For traders looking to explore niche markets like the Russian Ruble or commodity CFDs, FXChoice offers specialized opportunities. However, for a more general trading experience with lower startup costs and comprehensive support, XMTrading is the better option.

Choose Asia Forex Mentor for Your Forex Trading Success

If you’re eager to embark on a successful career in forex trading and are aiming for significant financial success, Asia Forex Mentor is the top pick for comprehensive forex, stock, and crypto trading courses. Ezekiel Chew, a prominent figure in the trading world known for his involvement with trading institutions and banks, leads Asia Forex Mentor. Personally, Ezekiel regularly secures trades in the seven-figure range, marking a notable distinction from other educators in this sector. Below are the key reasons we endorse this choice:

- Comprehensive Curriculum: Asia Forex Mentor provides a thorough educational program that spans forex, stock, and crypto trading. This structured curriculum is designed to equip emerging traders with the necessary skills and knowledge to thrive in various markets.

- Proven Track Record: The reliability of Asia Forex Mentor is well-documented through its consistent history of developing profitable traders across different markets, showcasing the success of their educational strategies and mentorship.

- Expert Mentor: Asia Forex Mentor offers the expertise of an accomplished mentor, Ezekiel Chew, who has an impressive track record in forex, stock, and crypto trading. His personalized guidance helps students confidently understand and navigate market complexities.

- Supportive Community: Enrollment in Asia Forex Mentor includes joining a community of ambitious traders focused on succeeding in the forex, stock, and crypto markets. This community encourages sharing ideas and collaborative learning, greatly enriching the educational experience.

- Emphasis on Discipline and Psychology: Achieving trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to assist traders in managing their emotions and stress, fostering decision-making that is both thoughtful and well-informed.

- Constant Updates and Resources: Recognizing the dynamic nature of financial markets, Asia Forex Mentor ensures that students stay current with the latest trends and strategies through ongoing access to essential resources.

- Success Stories: Many students at Asia Forex Mentor have dramatically transformed their trading careers, achieving financial independence with the help of the program’s comprehensive education in forex, stock, and crypto trading.

- Asia Forex Mentor stands out as the foremost choice for those seeking an extensive course in forex, stock, and crypto trading, aimed at forging a lucrative career and securing financial growth. With its detailed curriculum, experienced mentors, practical approach, and collaborative community, Asia Forex Mentor equips budding traders with the tools and guidance needed to become successful professionals in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: XMTrading Review

Dumb Little Man’s team of trading professionals holds XMTrading in high respect due to its reliability and strong regulatory structure, which guarantees a safe environment for forex traders. In order to appeal to both new and seasoned traders, the platform offers a range of account types and a low minimum deposit.

However, potential users should consider the drawbacks, particularly the risk associated with high leverage, which can magnify both gains and losses, making it a double-edged sword especially for newcomers to trading. Overall, XMTrading offers a solid trading experience but requires careful consideration of leverage risks and market access limitations before engagement.

>> Also Read: What Is An ECN Forex Broker – An Expert’s Complete Guide 2024

XMTrading Review FAQs

Is XMTrading Platform legit?

Like Trading Point Holdings, XM Trading is a legitimate forex broker. It operates under strict regulatory oversight and adheres to international financial standards including Australian securities and Cyprus securities, ensuring a secure and trustworthy trading environment for its clients.

Is XMTrading good for scalping?

As mentioned in this XM group review, XM forex broker is suitable for scalping as it allows this trading strategy across its platform. The broker offers tight spreads and fast execution speeds, which are important for scalpers looking to take advantage of small price movements.

How long does XMTrading withdrawal take?

Depending on the withdrawal method, it can take between 2 to 5 business days for XM group funds to reach your account. Transactions via e-wallets are usually faster, while those done through bank wires or credit/debit cards might take the full length of time specified.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.