How To Effectively Use Trailing Stop Loss Technique

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

If you want to make the most money from trading while still taking advantage of market movement you should consider a trailing stop loss. Traders can benefit from using this technique, which helps them keep their losses small and improve earnings by keeping them in the trend for longer.

In this trailing stop loss guide, we invited Ezekiel Chew to share with us what a trailing stop-loss order is, how to establish one using the current market price, and how to make the most of your stops. You’ll learn how to incorporate the trailing stop loss into your trading system and use it as part of your exit plan.

Are you ready? Let’s dive straight in.

Trailing Stop Loss: What is Trailing Stop Loss?

The trailing stop follows the market price of the instrument you’re trading when it moves in your desired direction. In contrast, if the price moves against the trade, the trailing stop does not adjust.

Because of this, the trailing stop is so effective since it aids in determining when to leave the market. Amongst the most significant psychological issues that traders face is when should they exit a trade, resulting in them losing more money than necessary.

On one end of the spectrum, traders are quick to cash out and take gains early, only to discover that the stock price or market price rises further. This lowers earnings while enhancing losses.

Clearly, this is not the most ideal situation to be in when trading.

How to Set a Trailing Stop Loss

When setting up a trailing stop, there are two major things to consider. The trailing stop and the distance it trails are the most essential factors. As previously said, a trailing stop loss will be linked to an open position.

A stop loss order is intended to safeguard you from losing money if the market drops. This style of stop-loss functions in the same manner as a standard market order. The trailing stop loss, on the other hand, will be activated when the present market price has increased by a particular amount for you.

Placing Trailing Stop Loss

The trader may establish a trailing stop using the same method as shown above. In the M30 chart of GBPAUD, the trader opened his BUY position at 1.8100. A common way to set up a stop loss is by heading to the open position and double-clicking; this is what was done in the example above.

There are various methods to deal with this trade. Although the trade might just continue in an upwards direction, it may reverse its course before hitting a profit. with such a scenario, the position that was enjoying a profit might lose all of its gains and even result in a loss. A trailing stop loss will help avoid such a situation.

In MT4, the trailing stop loss is enabled by right-clicking on the trade by accessing the trading terminal. When you right-click, access the drop-down menu and pick the trailing stop, or opt for a custom option for selecting the desired value from the drop-down menu that appears when you add a custom trigger.

Assume the trader in the scenario above picks a 25-pip trailing stop loss with a trade entry point of 1.8100. Let’s say the stop loss is placed at 1.8050. Let’s also assume the take profit of 1.8200. If the price gains 25 pips, the trailing stop activates the trigger price and the stop loss is changed.

Through a trailing stop loss, you can raise the stop loss trigger price if the price momentum changes in the direction of the trade. Assume that the trade advanced even further and went from 1.8125 to 1.8127, at which time the stop loss is adjusted to 1.8002 to maintain a difference of 25 pips from the highest price.

As an alternative to manually adjusting the stop-loss, traders can utilize trailing stops. This is used in cases when a trader desires to lock profits in case of a sell-off. A trailing stop loss alters increases earnings so long as the price continues to move favorably for the trader.

Pros and Cons of Trailing Stop Loss

Pros

- A sell trailing stop order will automatically close out the position when prices drop against the trade

- Helps traders take the maximum amount of profits from the trade

- Helps take the emotions out of a trade

- It is a flexible market order and a trader can put their preferred parameters

Cons

- Doesn’t work well when the markets are volatile

- It takes out the ability to make analytical decisions on trade management

- Only works best in a trending market

Trailing Stop Limit vs Trailing Stop Loss

In addition to the stop-loss order, a trailing stop limit order will function as a way to track the prices. A trailing stop loss activates the stop loss and fills it at whatever price is available. However, limit orders are almost always filled at or slightly above the specified price.

Assume that a stop order is placed at 1.1825 for one standard lot. It can be filled at a similar stop price or a trigger price that is lower than 1.1825, yet the market order is completed for the entire lot.

If there is a restriction on the maximum price for one standard lot, for example, 1.1825 in this scenario, the order will be fulfilled only at the same price. During volatile markets, however, the broker might decide to fill just a part of the order because he or she may find it hard to access a counterpart for the whole lot.

Trailing Stop vs Stop Loss

The trailing stop-loss is simply a stop-loss order, but it has the ability to modify the values of existing stop-loss orders when the prices action moves in the direction of the trade.

A stop-loss price is not dynamic and must be changed by the trader. It is up to the trader to pick the sort of insurance required for his or her trading strategy.

For instance, if the trading instrument’s current price is 1.8100 and the stop price is set by the trader at 1.8050 regardless of whether the stop price rises or falls beyond the price by which the trader entered the market, the stop loss will still stay at 1.8050. In a situation involving the trailing stop, whenever the price makes a new high,

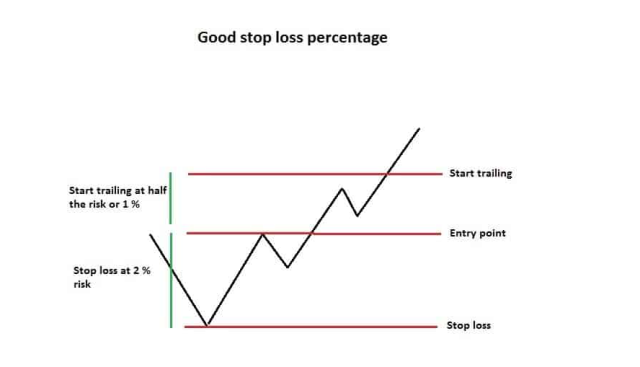

What is a Good Trailing Stop Loss Percentage

Stops are defined in many different ways by various technical trading tactics. The stop price of a scalper is different from that of a swing trader; stops are viewed differently by day traders than they are by swing traders. A trader using 5-minute or 15-minute charts has a distinct view of the best level for a stop loss levels than one working with 4- hour timeframe.

Most traders risk 2 percent of their account on every trade, on average. When the losses go above 2% of their funds, the order is triggered and closed by placing a stop loss. You will need to use a trailing stop price to help balance risk while also allowing for sizeable market fluctuations.

Traders typically set a trailing stop loss of 1% to 1.5%, which they track closely. If for instance the trailing stop loss is set at 1%, the stops are adjusted to break even once the market price rises in the direction of the trade. This is similar to moving stops to break even after a move against them has occurred. The trailing stop

The stop loss percentage, on the other hand, must be calculated keeping in mind the demands of the employed trading strategy.

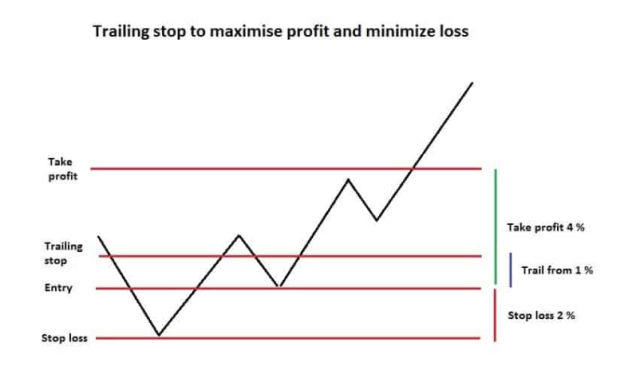

How to Best Use Trailing Stops for Good Profit and Minimize Loss

A trailing stop can be used in various ways, but the most common is utilized as a risk percentage. Because the risk proportion of a stop price was already determined and taken into account in the trading plan, traders often view this as the best approach.

Let’s suppose that one trader develops a trading system that risks 2% of her account and seeks a 4% return. According to the trade plan, the trader will set her to stop at 2%, as is usual practice, and include a 4% take profit. The outcome would be determined by the price action and market condition.

However, assuming this trader has a trailing stop set at 1% if price action moves in the direction of 1% but then reverses back, the outcome is a break-even; if the market price changes 2 % and reverses, the trader will make money. If the price moves up 3 % and reverses the trade, it will result

Trailing Stop Loss for Long Term Investment

Fear and greed act as a drag on the market, causing many traders to prematurely close their positions in order to keep losses at bay. Many traders will close out their trades shortly after they see profits, preserving the losses for as long as possible.

On the downside, new traders are frequently reckless with the stop loss, which leads to frequent hitting of the stop loss. As a result, the trader loses his capital and confidence in the financial markets.

Stop losses are a strategy that helps traders overcome their fear and as well as their greed and cultivate discipline. A trailing stop protects traders from their own feelings. A frequently asked query by many traders is when to exit.

A trader must follow the market price changes for long-term trading decisions. Long-term traders often won’t stay in front of their trading screens and make frequent stop loss adjustments, but they should place reasonable trailing stops.

Best Forex Training Course

If you want to be a successful forex trader, and for the best investment advice, the Asia Forex Mentor is a must-read. Ezekiel Chew, an extremely renowned forex trader, created this course. He has trained traders from across Asia and the world.

They stem from different backgrounds from retail traders to banks and other financial institutions. Ezekiel is known for making 6 figures in every trade using a method that is based on probability.

The Asia Forex Mentor course is divided into five parts and includes access to Ezekiel’s live trading room. It is ideal for any level trader from beginner to advanced.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Trailing Stop Loss

A trailing Stop-Loss order could assist a trader by taking emotions out of the equation, allowing them to profit and optimize a position. It also aids in minimizing losses.

The stop loss is automatically triggered and adjusted by the trailing stop loss.

It also serves to prevent winning trades from turning into losers. There may be a time when the market price rapidly begins in the trader’s direction, only to reverse later on. Even if this occurs, this type of stop loss order can ensure that the trader comes out ahead.

The trailing stop loss isn’t ideal in a volatile market scenario, and it may not execute at the trader’s intended price.

Trailing Stop Loss FAQs

Is a trailing stop loss a good idea?

Yes, trailing stops are a good idea. They allow the trader to retain a position and realize the greatest possible profit as the current market price moves in his or her favor. Trailing stop limit order also aids traders in managing their emotions and dealing with volatile equities and currencies.

How does a trailing stop loss work?

The trailing stop is a kind of stop loss that activates when the price moves against you. When the stock price or currency price rises, the trailing stop price goes up; and when the previous trade’s closing stock price reverses, the stop loss price remains in place. This enables traders to capture gains while protecting them from a currency or stock decline.

What does Broker do

Let’s assume you used a trailing stop limit order, for example, at 10%. If the stock falls or prices drop too far below 10%, your broker will issue a sell order. However, if the stock price does not rise above 10%, no order will be executed and the trailing price will stay in the same initial position.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.