The Funded Trader Review with Rankings 2024 By Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The expert team at Dumb Little Man, consisting of financial experts and seasoned traders, is well-known for their thorough reviews of prop trading firms. They employ a detailed algorithm and rigorous evaluation methods to review brokers on crucial factors, ensuring all-encompassing reviews. These factors include:

|

A “Prop trading firm”, also referred to as a proprietary trading firm, provides traders with a unique opportunity. Investors can trade their hard capital for a cut of the profits at these companies. Prop firm traders do not stake their own money, in contrast to regular traders.

One unique participant in the prop trading market is The Funded Trader. It's an online resource for evaluating simulated trading demos. The Funded Trader provides users with a risk-free environment in which to demonstrate their simulated trading skills by requiring an upfront commitment for evaluation. With this method, traders can trade without suffering real financial loss.

This Funded Trading review looks at the goods that this prop trading firm offers. It mixes real consumer reviews with insights from Dumb Little Man's trade expertise. The goal of this review of The Funded Trader is to offer a thorough assessment of the company's offerings, highlighting both the positives and negatives as perceived by real customers and seasoned traders.

What is The Funded Trader?

To assist individual traders, The Funded Trader, a proprietary trading firm, was founded. It was established in response to a need that the members of VVS Academy and the Forex League saw in the trading community.

They offered retail traders the opportunity to acquire virtual currency because they wished to create an atmosphere in which they could expand their businesses in accordance with their dedication and performance.

What sets The Funded Trader apart is its dedication to giving traders a chance to demonstrate their expertise and risk-taking prowess. Through the risk-free evaluation procedures of several programs, traders can become sponsored traders.

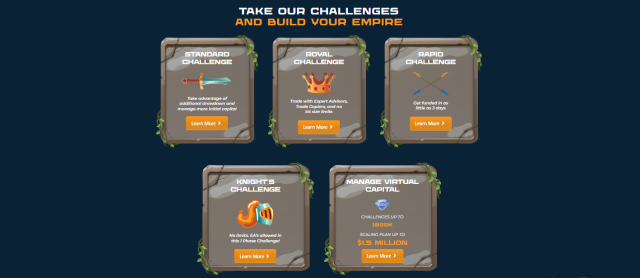

The Funded Trader, a Texas-based firm, was established in 2021. It is renowned for having more lenient trade regulations than its rivals and refundable entrance fees. To accommodate various trade profiles, the organization offers four unique programs: Standard Challenge, Knight Challenge, Royal Challenge, and Rapid Challenge.

Up to $600,000 in money may be handled by traders; with the scaling program, this amount can rise to $1.5 million.

By working with its primary broker, Eightcap, The Funded Trader provides access to a range of markets, including Forex, cryptocurrencies, commodities, and indexes. Traders must, however, pass two trading examinations in order to access the trading money.

Once they have, they might use an alluring profit-sharing plan to target high earnings.

In line with industry KYC/AML regulations, the company also frequently runs promotions that offer traders enticing terms and discounts.

Pros and Cons of The Funded Trader

Pros

- Variety of account options

- Opportunity to retake challenges

- Multiple trading platforms

- Diverse trading instruments

- No strategy restrictions

- Favorable profit split

- Intuitive dashboard design

Cons

- Limited instrument availability

- Restricted cryptocurrency trading

- Language and support limitations

Safety and Security of The Funded Trader

Unlike brokers, a prop trading firm like The Funded Trader is not regulated by authorized bodies because they do not conduct users' trades in the market. However, The Funded Trader is officially registered in the USA and operates legally in multiple countries.

An important factor in ensuring safety and security in such firms is the regulation of their partnering brokers. The Funded Trader partners with Eightcap, a fully regulated broker, adding a layer of trust and security for traders. This information has been gathered after thorough research by Dumb Little Man, highlighting the significance of proper regulatory compliance in the world of prop trading.

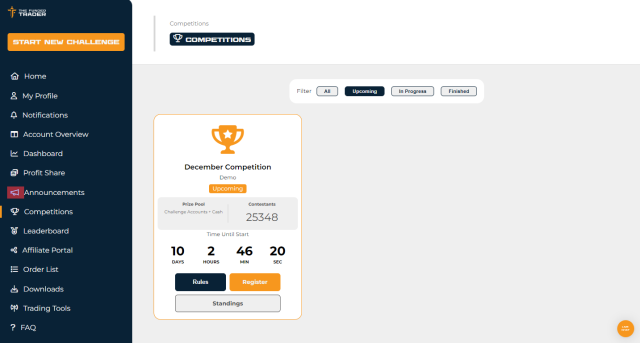

The Funded Trader Bonuses and Contests

The Funded Trader offers monthly contests and challenges that begin from the first day of the month up to the last day.

The prices include:

- First Place: $300k Royal Challenge + $5,000 Cash

- Second Place: $300k Royal Challenge + $3,000 Cash

- Third Place: $200k Royal Challenge + $2000 Cash

- Fourth to 100th Place: between $200k Royal Challenge to $25k Royal Challenge

Here are the rules for their December Challenge:

- 5% Max Daily Drawdown

- 10% Max Total Drawdown

- 5 Minimum Trading Days

- EA's are not allowed

- No taking advantage of unrealistic fills in the demo environment

- Daily Drawdown will now be calculated based on Balance or Equity whichever is higher at the end of the day

- Only 1 account per person is permitted

- The competition starts on the first of the month and ends on the last day of the month.

- The following lot size rules apply:

-

- 5 Lot Max for Forex Pairs

- 3 Lot Max for Indices

- 3 lot for Crypto, Commodities

- 5 positions max open at any given time

The Funded Trader Customer Reviews

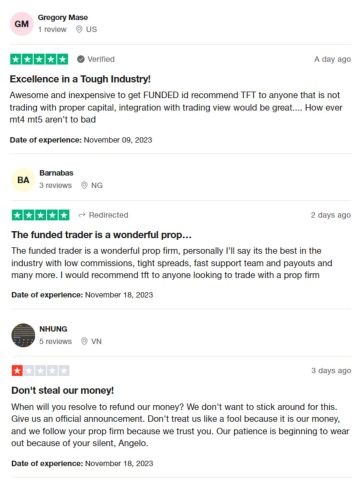

Despite boasting a 4.4-star rating on Trustpilot, which is surprisingly low, customer reviews of The Funded Trader reflect a mix of experiences. Some users, like Barbanas and Gregory, praise the firm for its low commissions, tight spreads, and fast support team. They recommend The Funded Trader to anyone lacking proper capital for trading, although they suggest integration with TradingView could enhance the experience.

However, not all feedback is positive. A customer named Nhung expresses frustration over issues with refunds, feeling ignored and mistreated. This highlights concerns about the firm's customer service and responsiveness.

The Funded Trader Commissions and Fees

Prop Trading Firms like The Funded Trader operate on a model where commissions and fees are structured around the success of its traders. Unlike traditional prop trading firms, it does not charge trading fees directly. These fees are determined by their partner broker, Eightcap. Instead, the platform earns through a share in the trader's profits.

An initial fee is charged, which varies depending on the account type and balance. For instance, a Standard or Swing account with a $100,000 balance has an initial fee of $315, while a Royal account with a $200,000 balance requires a $939 fee.

This fee is refundable upon successful completion of the challenge. Initially, the profit split is set at 80/20 in favor of the trader, but it can be increased to 90/10 after the challenge.

The Funded Trader, like its peers Topstep and FTMO, is part of a competitive trend where prop firms offer high-profit splits, up to 80%-90%, benefiting the traders significantly. Traders start with an 80% profit split, which can be increased to 90% after passing the evaluation phase.

This increase can be achieved by averaging a 6% return over the first three months, or a 2% return each month in the same period. Additionally, promotional offers often include a 10% bump to a 90% profit split.

The program sets specific profit targets, ranging from $5,000 to $50,000, which vary depending on the account type. Traders must meet these targets within a specified timeframe, adhering to a maximum daily loss limit that ranges from $1,000 to $2,500.

Exceeding this limit results in disqualification from the program. The default profit sharing starts at 80% for the trader and 20% for the prop firm, but with the scaling plan, this can increase to a 90% share for the trader.

The Funded Trader Account Types

The Funded Trader offers 4 account types divided into two phases:

Phase 1

Knight Challenge

- Trade up to $200,000 Challenge in Virtual Funds

- 0 Minimum Trading Days

- 3% Daily Drawdown and 6% Max Drawdown

- Phase 1 (10%)

- Relative Drawdown

- No Lot Limits, EA's & Trade Copiers Allowed

- First Withdrawal in 7 Days

- News Trading Not Allowed

Phase 2

Standard Challenge

- Trade up to $400,000 Challenge

- Unlimited Maximum Trading Days

- 3 Minimum Trading Days

- 5% Daily Drawdown and 10% Max Drawdown

- Phase 1 (10%) Phase 2 (5%) Profit Target

- Balance or Equity-Based Daily Drawdown

- EA's & Trade Copiers Allowed (Add-On)

- No Lot Limits

- First Withdrawal in 21 Days

- News Trading is Restricted ONLY on Regular Funded Accounts

Royal Challenge

- Trade up to $400,000 Challenge

- Unlimited Maximum Trading Days

- 5 Minimum Trading Days

- 5% Daily Drawdown and 10% Max Drawdown

- Phase 1 (8%) Phase 2 (5%) Profit Target

- Balance or Equity-Based Daily Drawdown

- No Lot Limits. EA's & Trade Copiers Allowed

- First Withdrawal 30 Days (14 Day Add-On Available)

- News Trading Allowed

Rapid Challenge

- Trade up to $200,000 Challenge

- 0 Minimum Trading Days

- 5% Daily Drawdown and 8% Max Drawdown

- Phase 1 (8%) Phase 2 (5%) Profit Target

- Balanced-Based Daily Drawdown

- Scale Every Single Month By 10%

- No Lot Limits

- First Withdrawal in 14 Days

- News Trading is Restricted ONLY on Regular Funded Accounts

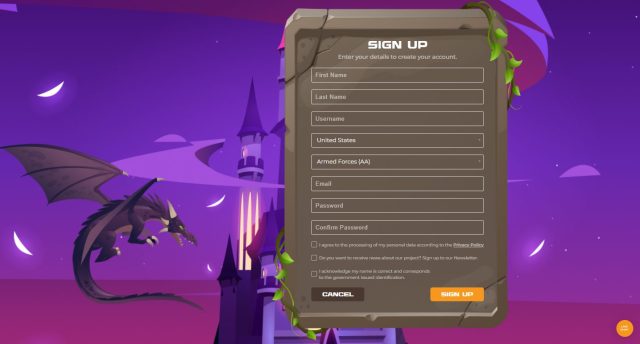

Opening a The Funded Trader Account

Opening an account with The Funded Trader is a straightforward process, designed to be user-friendly and accessible for traders of all levels. Here's a step-by-step guide to help you navigate the account opening process:

- Go to The Funded Trader's website.

- After completing the required information, watch for an email verification.

- Go to the “Challenge” area and choose the program and account size that you want.

- Before making a purchase, go through the Knowledge Center's unique guidelines and goals.

- To continue to the checkout page, click the “Buy” button under the program of your choice.

- Input your payment and billing information; if you're using cryptocurrency, stick to ERC20 network addresses.

- Soon after your purchase, you will receive an email with your account information.

- To see your dashboard and profile details, go to the Trade Hub.

The Funded Trader Customer Support

Unlike other prop trading firms, The Funded Trader's customer support system is made to be constantly accessible, working around the clock to help traders with any questions or technical problems they may encounter. Traders should be aware of the support schedule, though, as it is subject to change on occasion.

Through its newsletter and social media channels, the business proactively notifies customers of any changes to its availability or scheduled days off. Based on Dumb Little Man's experience using their customer service, this information demonstrates the company's dedication to keeping channels of communication open with its clients.

Advantages and Disadvantages of The Funded Trader Customer Support

| Advantages | Disadvantages |

|---|---|

|

The Funded Trader Withdrawal Options

The withdrawal options at The Funded Trader have garnered positive feedback for their efficiency and variety. Traders generally express satisfaction with the timeliness of payments and the processing time, which is usually within 24 hours of a request. This information has been confirmed through testing by a trading professional at Dumb Little Man.

The time frame for receiving initial and subsequent payments depends on the chosen program. The Knight Challenge offers the quickest withdrawal option, allowing traders to withdraw profits within just 7 days. The Rapid Challenge follows, with a 14-day withdrawal period.

The Royal and Standard Challenges have a longer period, permitting withdrawals after 30 days, though the Standard Challenge allows for fortnightly payments after the first month.

As for payment methods, traders have a choice between major cryptocurrencies and Deel, an intermediary offering several options like bank transfer, PayPal, Coinbase, Payoneer, Revolut, and Wise.

The payout process itself is straightforward: once traders meet their profit targets, they become eligible for their share of the profits, which are paid out monthly and can be withdrawn at any time.

The Funded Trader Challenges and Difficulties

Limited Instrument Availability

At The Funded Trader, while the partner broker Eightcap offers a wide range of instruments, only a selected few are available to traders using the platform. This limitation might restrict trading styles and strategies for some users.

Cryptocurrency Trading Restrictions

Cryptocurrency trading with The Funded Trader is confined to the duration of the challenge. Outside of these challenges, traders don't have access to cryptocurrency markets, which may be a drawback for crypto-focused traders.

Regulatory Concerns

Traders have expressed concerns regarding the regulatory status of The Funded Trader, especially given its similarities to My Forex Funds, a firm that faced action from the CFTC. Being US-based adds to these worries, as traders fear potential regulatory scrutiny.

Demo Mode Operation

All trading activities on The Funded Trader occur in demo mode. While traders can earn real profits, the actual trades are not conducted in live markets, mirroring the approach used by My Forex Funds.

Adjusted Drawdown Limits

The platform recently adjusted its drawdown limits, reducing the maximum daily drawdown to 5% and the overall max drawdown to 10% for their standard account. This change affects the risk management strategies and trading styles of traders.

Customer Service Strain

The rapid growth of The Funded Trader has occasionally led to its customer service being overwhelmed. This has resulted in delays and challenges in promptly addressing trader issues.

How to Pass The Funded Trader Evaluation Process

Passing The Funded Trader Funding's Evaluation Process often presents a significant challenge due to its rigorous demands and criteria. To increase the likelihood of success, it's crucial to be thoroughly prepared and well-informed.

Engaging in a comprehensive training program is a strategic step towards this goal. Such a program provides the essential knowledge, strategies, and trading styles needed to navigate and successfully complete the evaluation process of The Funded Trader.

This preparation is key to understanding the nuances of the program and meeting its expectations effectively.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is highly regarded as a trading platform that significantly enhances your chances of passing The Funded Trader's Evaluation Process. This recommendation comes from the trading experts at Dumb Little Man, especially for those serious about succeeding in The Funded Trader's challenge.

Thousands of traders have benefited from Asia Forex Mentor's proven track record of helping them pass their prop firm's evaluation programs.

Ezekiel Chew, a well-known forex trading expert with over 20 years of expertise and a steady six-figure profit each trade, developed the platform. In addition, he is the one who started the Golden Eye Group and the exclusive One Core Program.

The primary goal of this training is to teach forex traders how to close deals at a profit.

Before founding Asia Forex Mentor, Ezekiel began his career as a trader by instructing close acquaintances. His classes were expanded to be offered online due to the increasing demand for his knowledge and experience.

His accomplishments attest to his abilities and background, which makes Asia Forex Mentor a priceless tool for anyone hoping to ace The Funded Trader exam.

How Could Asia Forex Mentor Help You Pass The Funded Trader Challenge?

For individuals looking to pass The Funded Trader's Evaluation Process, Asia Forex Mentor stands out as a very reliable and successful platform. Its popularity in the field of financial education is evidence of its capacity to help traders achieve success.

Best Comprehensive Course Offering: Investopedia, a reputable source of financial content, named Forex Mentor is the course with the greatest depth. The One Core Program is the best option for in-depth forex education because of its wide coverage, which has been praised.

Best Forex Trading Course for Beginners: The Asia Forex Mentor One Core Program has been ranked as the best Forex trading course for beginners by Benzinga, a reliable source of financial and business information. This recognition demonstrates that the program is appropriate for traders of all skill levels.

Best Forex Mentor: BestOnlineForexBroker named the site the best Forex mentor for the year 2021. This acknowledgment is predicated on the platform's ability to significantly increase traders' profits in the foreign exchange market.

Best Forex Trading Course: Asia Forex Mentor was rated highest for its trading tactics and superior trading system in a review conducted by leading forex traders and platforms. Its standing as a pioneer in forex trading education is further cemented by this.

These honors demonstrate how Asia Forex Mentor continuously goes above and beyond expectations for both novice and seasoned traders with its One Core Program. It is an invaluable resource for anyone trying to overcome The Funded Trader's challenge because of its tried-and-proven tactics and extensive training courses.

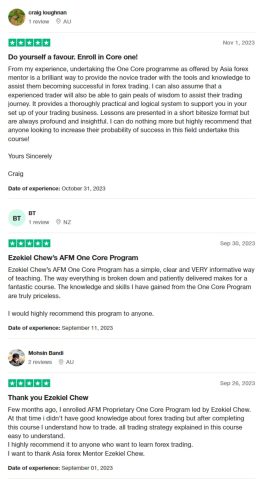

Asia Forex Mentor Members' Testimonials

Positive comments about Ezekiel Chew's One Core Program have been given by members of Asia Forex Mentor, particularly about how well it prepared them for prop firm evaluations. Craig, for example, highlights that the course is very helpful for both new and seasoned traders, offering useful, rational techniques and enlightening, bite-sized teachings.

Moshin, who had little prior experience with forex trading, commends the program for being understandable and clear and admits that it greatly enhanced his trading abilities.

Similarly, BT emphasizes the program's easy-to-understand, informative teaching method while highlighting the priceless knowledge and abilities acquired. When taken as a whole, these endorsements highlight how beneficial the One Core Program is for increasing traders' success rates in forex and prop firm assessments.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: The Funded Trader Review

To conclude this Funded Trader review, Dumb Little Man's team of trading specialists gives a fair and balanced assessment. This prop trading is well known for providing traders with a wide range of account options, lucrative profit splits, and the chance to retake challenges. The website includes a number of significant features, including a variety of trading tools and its partnership with Eightcap.

For many traders, The Funded Trader is an alluring alternative because of these advantages.

It is important, therefore, that prospective traders understand the drawbacks. Some factors to take into account are restricted tool access, bans on cryptocurrency trading outside of challenges, and inconsistent customer service. Furthermore, some traders may have serious reservations about the business's regulatory status and demo mode.

To increase your chances of profiting from The Funded Trader, you should enroll in a reliable program such as Asia Forex Mentor. The information, readiness, and guidance this course offers may be the secret to a successful experience with The Funded Trader.

>> Also Read: Fusion Markets Review 2024 with Rankings by Dumb Little Man

The Funded Trader Review FAQs

What are the key strengths of The Funded Trader?

The Funded Trader has many benefits, including a large selection of account types, an easy-to-use dashboard, a high profit-share ratio, and the ability for traders to retry difficulties.

Are there any drawbacks to using The Funded Trader?

Actually, there are certain drawbacks, like a limited range of trading instruments, the inability to trade cryptocurrencies outside of emergency situations, and occasionally sluggish customer support.

How does The Funded Trader handle profit splits and withdrawals?

The Funded Trader offers an initial 80/20 profit split in favor of the trader, which can increase to 90/10. Withdrawals depend on the chosen program, with options ranging from 7 to 30 days for the first withdrawal.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.