Swap in Forex: How Does It Work and How To Avoid It

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Forex or currency trading involves working with broker platforms. Have you ever thought of how brokers actually make their money? One way is charging commissions to traders who have active trades by way of charging a few pips against the traders’ profits/loss.

However, forex brokers charge traders an interest fee for every foreign exchange transaction. The interest rate differential, whether in the form of an income or an expense, is known as the foreign exchange swap.

In this post, under the expertise of Ezekiel Chew, an Expert Mentor cum Lead Trainer with Asia Forex Mentor, we’ll set to expound more on foreign exchange swap in the forex market. The depth we’ll cover involves the following questions and beyond:

- What in exact terms is a foreign exchange swap?

- How does the interest rate differential arise on a currency pair?

- Does a forex swap affect your trading of any currency pair?

- Does a currency swap reduce forex market profits?

Ezekiel Chew’s Asia Forex Mentor is a comprehensive site with resources for all foreign currency traders – individuals and corporations.

Swap in Forex: What is Swap in Forex

A foreign exchange swap is a roll-over fee. Brokers expect traders to open and close trades within a day. The roll-over fee arises when a trader holds a running trade overnight. The longer the time it takes to close a trade, the higher the fee for the swap gets.

To arrive at the charge, brokers get the net fee between the interest rates of the two currencies in your pair. For fairness, brokers derive the actual interest rate as per the guides of central banks for each currency. Small variations occur, and one of them arises with respect to whether your transaction is a short/sell or a long/buy.

There are special circumstances where the net difference of interest rates is a positive figure. Under such situations, your trading account gains as the broker have to credit your account with the positive net difference. It’s only a fact that most occasions end with the negatives, in which case brokers debit your account.

How to Avoid Swap Forex?

There are a few ways a trader can escape payment of a foreign exchange swap in currency trade. That way, they can avoid any extra costs apart from the few pips settled to brokers by way of spreads.

To avoid paying swap fees, a trader must always close transactions on a daily basis. Bearing in mind that swap charges apply for transactions that go overnight without being closed. More so, the time cap for closing the trades to totally relieve them from swap interest is on and not later than 5 PM daily.

As many traders work with many brokers around the globe, it’s best to reach out to the broker and request clarification regarding their 5 PM timelines. That’s because of the different time frames across the forex markets and given that traders trade their local daytimes.

Overall, the requirement to close all trades on or before 5 PM daily can disadvantage a traders’ ability to hold trades and exit with profits. Some trade setups could only require a night or two to close positively.

What is Swap Free in Forex

In recent times there are brokers who offer swap-free accounts to their traders. It means with such an account, a trader can freely trade without the worry of the swap fees in forex. Holding trades for many days or even months can accrue significant amounts of swap interests – which is a cut on the profits a trader makes.

The category of accounts that are swap-free is also known as Islamic accounts in foreign exchange. According to Islamic Laws, Muslim traders are not allowed to take on very long-term strategies with very high amounts of foreign exchange swaps. A deeper analysis shows that the concept of Islamic accounts in trading has a conceptual connection to Islamic banking – where the compliance rules out charging interest fees to parties who get money in the form of loans from the investors.

Therefore, one way to go on trading and get a waiver of the swap fees on forex is to trade on platforms that allow you to open an Islamic account. It’s good to note that as much as this concept right from inception was meant for Muslim traders, brokers can offer them to traders who are not Muslims.

What is Swap on MT4

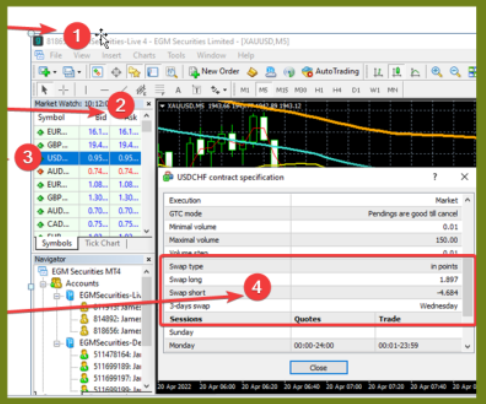

A swap is the interest charge for holding a trade overnight with a broker. On MT4 trading platforms, you can view the swap rates applicable and have time to see if they can affect your trading results.

Many traders may ignore the swaps, and here’s a straightforward process to check the prevailing rates for any currency pair you are targeting to trade:

Open your MT4 platform on a PC.

From the View Menu, Open the Market Watch Tab. You may also follow the shortcut by pressing on Control + M key.

The market watch tab shows a list of the currency pairs you can access and trade via your broker. Your point of focus is to get the specification options for each.

Next, Right Click on the currency pair of your choice and click on the Option marked Specification.

The specification sub-window shows you the prevailing swaps applicable.

How to Avoid Swap Fees in Forex?

Apart from avoiding swap fees by being a strict day trader and or trading via Islamic accounts, you still have leeway. The leeway is to be exceptionally picky at the currency pairs you trade. And specifically, here you go for pairs that give you positive net differences for swaps rates for trades held overnight.

Suppose you adopt the model of selecting pairs that give you positive nets for the swap fees; you are making a carry trade. It’s one of the ways traders can keep increasing the amounts they hold in trading accounts by calculating the minute positives over a very long time.

Putting it in other words, a carry trade involves traders selling currencies with very low-interest rates and using their incomes to buy currencies with higher rates of interest. The ultimate goal is to pocket the net but positive difference in interest rates of the currencies.

Here is a list of currency pairs that mostly end up with positive net differences in interest rates between them:

- USD/CHF

- USD/JPY

- AUD/JPY

- AUD/CHF

- GBP/JPY

- GBP/CHF

- NZD/CHF

- NZD/JPY

- CAD/JPY

- CAD/CHF

Traders should note that holding the following currencies comes with very high and lowest interest:

High-Interest Rate Currency: AUD, GBP, CAD, NZD, and USD

Low-Interest rate Currency: JPY, CHF, EUR, USD, AUD and NZD

Taking a practical scenario, assume your target pair is the USD/JPY.

USD carries at the rate of 2% while the Yen carries at -0.1. Therefore, opening a position that runs overnight will get you an interest difference of positive 1.9%.

Caution: Sometimes, carry trading is not worth it. You may hold the transaction, only to end up with a massive move against you – you end up losing capital while chasing the peanuts. Any carry trade requires a long time picture while a trade must remain open.

Here are some more helpful tips for carry trading;

- Targeting only currency pairs with the largest differences in the interest rate for foreign exchange transactions

- Pairs should not be so volatile, plus they should not have a bias of upward trends for the currency with a higher interest rate

- Have prior knowledge of your risk tolerance limits before making any commitments

- Take on prior research and understand the backdrop of economic factors of the origins of the currency pairs.

Negative Swap Forex

A negative swap arises when a trader ends with a negative figure resulting from the sum of interests of the buy and the selling currency. Ideally, if the interest of the selling currency exceeds that of the buyer, you end up with a negative swap.

Let’s consider a practical example:

Assume you want to buy EUR/USD (Buying Euros, selling Dollars), and your position remains open overnight. Next morning, your interest from buying the EUR will net off by paying interest for selling the USD. Therefore, if the USD’s interest is higher than EUR’s interest rate, the result is a negative swap. That means, holding that transaction overnight, you end up losing some money equal to the difference in the interest rate or the swap.

Exact timelines when brokers effect the charges vary with every other broker around. For most, it happens every time the server time reads either 23:00 or 00:00 when a day starts. To get the exact timelines, you can ask the broker or screen your contracts to see the specifications. Next, you can then proceed to close trades in a timely manner, right before the swap fee updates in the foreign exchange systems.

What about Forex Swap Near Leg and Far Leg?

Ever come across the terms either “near leg” or “far leg” while trading forex? The terms applicable for transactions are known as cross currency swaps, and they involve two parties binding each other contractually to exchange forex currency pairs. Worth noting here is that the applicable rates are agreed upon mutually by the transacting parties.

The context of the leg here arises from the fact that swap charges are divided into two parts or steps.

Therefore, for the near leg, the swapping of the currency for another is done at a pre-agreed rate, which is often known as the spot rate. Note that the rate here is predetermined as the contract is drawn (a cross currency swap).

For a far-leg date, the swapping rate happens backward where the contract you draw states the exchange rate applicable. That too happens at the point of formulating the contract. The parties therein practice what is known as hedging or cross currency swaps to protect the value of a currency against the volatile nature of forex rates.

Usually, both the near leg and the far leg contracts apply for huge firms with heavy capital accounts in forex. In that context, a cross currency swap may involve central banks across the world, handling huge transactions across the markets.

Best Forex Trading Course

The best trading course is the One Core Program offered by the lead trainer cum mentor from Asia Forex Mentor – Ezekiel Chew. With a decade of experience trading forex, commodities, indices, and crypto-assets, He arises as a towering example of how you can move from zero to six figures!

Ezekiel Chew and through the One Core Program will forever transform the way you trade. If you want to bank six figures and move away from trading where you glare at screens all day long, explore this course. Do you want to trade the lifestyle way? Living your life and taking your hobbies more seriously, all that while trading like a pro? One Core Program is for you.

By exploring the One Core Program, you will appreciate the winning approach that Ezekiel refers to as the PPE approach. PPE stands for pre-planned trading, and it’s a model where you never chase markets. It’s almost like waiting for the markets to come to your favor.

One most unbeatable note with PPE is that you only need a few trades that fill into your ROI. And you achieve that, the professional way Ezekiel guides you. Plain simple, few killer trades that you hit with mathematically proven strategies, and all of that is away from trading emotionally and staring at screens all day long!

Last but not least. You may feel like there’s no time to get into a class or commit long hours to yet another course. One Core Program suits you perfectly. Ezekiel will only require your commitment of twenty minutes daily – to transform your income for life.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: Swap in Forex

A swap in forex is a cost the traders bear for holding transactions overnight. It arises as a calculation of the net difference between a buying currency and a selling currency. On most occasions, the figure is a negative difference, which brokers push to traders and cushion themselves from absorbing it.

The ways to avoid a swap fees are to close transactions daily. Another leeway in which you can escape swaps is opening Islamic trading accounts as a trader. Islamic trader accounts arise from the premise of Islamic laws that prohibit charges of interests and or commissions to money lent out to borrowers by lenders.

Also, there’s a way you can escape swaps by trading in currencies with a rare differential that is a net positive. Under such, brokers keep adding the amounts as long as you hold the trade. Cautious though, in trading, never chase those transactions without due regard to the shift of prices, which are the ultimate target.

Large banks and institutions with huge capital also engage in pinning rates to hedge against the volatility of the rates. Those comprise the hedging and derivatives involving forward and futures contracts.

All said and done, knowledge of swaps before trading and when they are charged can help you trade in a proactive way to manage the swap fees.

Swap in Forex FAQs

What is Swap cost in Forex?

A swap cost in forex is an accumulation of all the daily interest rate differences calculated for every pair or transaction that exceeds a day in the trading platforms. The amount varies, and brokers charge it on a day-to-day basis with respect to the interest rates guided by each currency’s respective Central bank.

In the final end, other than paying brokers a few of the pips you win in the markets, you have to take profits less the swap values. Therefore, swap is not a cost to the brokers as they pass it on to traders with every trade that goes on for more than a day.

Traders have ways they can go around escaping the swap costs. However, that is not the primary purpose of trading forex. Chasing the little incomes has a term in forex-carry trading. If done recklessly, a huge and adverse move in prices will draw out your capital as a trader remains under the pre-occupation of carry trading.

In most pairs, the net difference in interest rate ends up as a negative figure, and that’s what you pay for as swap cost. Only on a few instances across pairs would you find the net being positive. The positive figure is finally credited to your account as long as the trade carries on.

How do you avoid swaps in Forex?

Avoiding swaps in forex has benefits. Your account balance remains as it were without any charges. More so, the profits you close with aren’t deducted whatsoever. But traders should play caution and find a balance between evading paying swap and overall profitable opportunities.

The first shot at avoiding swap is ensuring you close your trades every day before 5 PM. It’s also a wise idea to talk to the brokers and get the precise timelines to help you close trades optimally.

The second way to go around and avoid swaps in forex is by trading on pairs that have positive net differences in interest rates. Under such, no negative net difference arises. If anything, the brokers credit your account with the positive net difference.

A third way is to open swap-free trading accounts. There are brokers out there who perpetuate the so-called Islamic trader accounts, which have nil charges for interest rate swaps. That arises under part of the religious compliance to charge no interest or commissions to loans.

What is a swap in MT4?

A swap in MT4 is a calculation of the net difference in interest rates for any forex pairs a trader holds overnight. A trader under the MT4 platforms can access the applicable swap rates by going through the market watch tab and pulling out the specifications panel per every currency pair provided by the broker.

Also, MT4s auto-calculate the swap and show it as a figure along the columns showing all the pairs/assets a trader is holding past a day. A trader will notice that the swap in MT4 is not a constant figure as it varies with the rates of the currencies as applicable on day to day basis.

Typically, a swap in MT4 reduces your profits by the amount shown on each transaction. Of course, the longer you hold a transaction, the higher the swap fee does get in MT4s. Therefore, to break even, a trader must-win profits to cover the swap and, in excess, pocket the difference as profits.

Lastly, the swap figure charge does not change with respect to whether your trade is running into losses or profits. Also, on MT4s, traders must notice that the charge is totally distinct from what the broker charges as a commission by taking a few pips for every profit or loss you make on any trades.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.