Stagflation: Definition And How It Works (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex brokers for traders are Avatrade and FXCC

The #1 Forex Trading Course is Asia Forex Mentor

Since customers are capable and prepared to pay for rising prices and commodities, high whip inflation frequently coexists with economic policy. So what transpires when there are especially chronically high inflation mix and unemployment rates amid periods of economic sluggishness?

We have got Ezekiel Chew to share his take on stagflation. He is constantly contacted and looking for insight into the currency market.

He has influenced the lives of countless active traders in addition to training bank dealers, forex traders operating in trading organizations, and investment businesses. A few of his students transitioned from being total beginners to entire forex traders. Some of them then went to work as fund managers as well!

Stagflation seems to be the solution, and that's never a positive thing. So what precisely is stagflation, or what does it signify in economics? Here, we'll go over these inquiries.

What is Stagflation

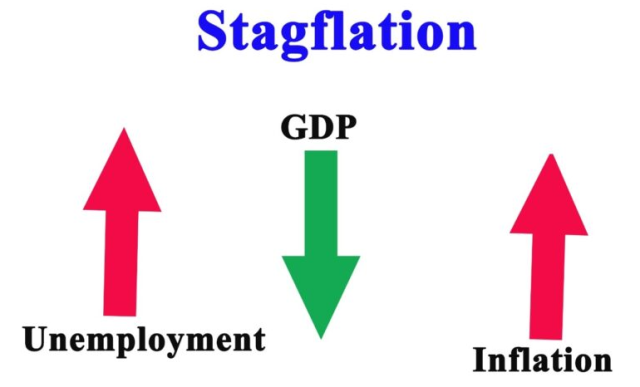

The definition of stagflation incorporates the principles of stagnation with high inflation, as the name indicates. An economic phenomenon occurs when poverty and high inflation expectations closer are significant, financial growth stop (or stagnate), or both.

Per the laws of supply & demand, sluggish economic development typically avoids whip inflation and unemployment rate. Energy prices decrease as customer demand declines. As a result of disruptive government actions interfering with a weak job market functioning, stagflation is a relatively rare economic research phenomenon.

Since most policies intended to lower inflation, it would also boost poverty, it could also be a significant challenge for authorities to find a solution.

The Economic Definition of Stagflation

Studying how the phrase was initially used will help us better comprehend what stagflation means in economic principles. For example, British lawmaker Iain Macleod originally alluded to stagflation occurring throughout the 1960s as he called the industry a “stagnation problem.”

Stagflation, meanwhile, is most commonly linked to the downturn of the late 1960s, when the United States saw five quarters with declining GDP growth following the oil price jump shock. Raging inflation throughout this period quadrupled in 1973 until reaching double digits in 1974 and a 9 percent jobless rate by 1975.

This was opposed to popular economic theories at the time, especially macroeconomic models based on Keynesians. These claimed that government initiatives intended to lower inflation exacerbated inflation and high unemployment economy rebounded, and vice versa. However, most economists learned that these beliefs weren't always true with stagflation.

What Distinguishes Stagflation from a Recession?

Absolutely, for several causes. Low or slow growth in commercial production is one symptom of stagflation, while economic output drops during a downturn. The GDP was neither flourishing nor bursting – it was shuffling along, not even in a devastating pandemic recession.

Another distinction: While stagflation is exposed to raising inflation, a downturn often results in low inflation or decreased costs for products and operations.

But to entirely reduce spending and put high inflation in check, central bankers might have to cause the market to enter a downturn to eradicate stagflation.

Controlling the Money Supply

A reserve bank's main instrument to implement monetary policy is interest payments. Financial institutions can often get short-term borrowing from the banking system to address short-term funding shortfalls. Its short-term rate of interest is what the world bank collects in exchange for borrowing.

The federal reserve bank can choose to raise the prices of short-term borrowing by aggressively raising interest rates of interest to decrease the money supply. Since financial institutions will boost the loan fees they bill their customers, the rate rise will impact individuals and companies in the market.

Slow Economic Growth

A triple whammy of economic problems, including slow economic growth, significantly high unemployment, plus high prices, is called stagflation. Economic shocks, monetary policy and fiscal policy are the main primary drivers of stagflation, according to experts.

Anything which makes the global economy less able to produce products and commodities at specific energy prices is considered a supplier shock. For instance, there were supply shocks during the epidemic in:

- Fewer individuals working in the labor force

- Shortages of certain products, including semiconductors, that before the epidemic

- Services were delayed due to people waiting for elective surgery and other medical treatments

Did you know that Economic Stagnation can cause a new Stagflation?

Stagflation is the confluence of price and real stagnation simultaneously. In this scenario, there is little real economic growth, substantial employment, rising costs for goods, and high-interest rates when Federal Reserve (Fed) adopts a highly aggressive monetary policy in stagflation, which causes massive inflation and hinders or stagnates any industry.

Employees face the possibility of losing their employment at this time, while businesses suffer due to increased input costs and declining sales. Instead of years, it often lasts a couple of extra months to quarters.

Hence, Stagflation seems to result from high inflationary pressures combined with periods of economic stagnation. Stagflation is a part of financial stagnation. However, economic stagnation by itself does not indicate the presence of stagflation. Stagnation is terrible, but stagflation is much worse.

Why Does Stagflation Occur?

Slow economic development and higher unemployment, sometimes known as economic stagnation, are the hallmarks of stagflation, which is also characterized by price increases (i.e., inflation). Stagflation often happens when economic output is restricted, whereas the supply of money is growing.

The Causes of Stagflation

Stagflation seems contradictory since it must not translate into higher prices, although slow economic outlook development would most rise dramatically high unemployment. This behavior is undesirable because it causes customer buying power to decline as unemployment rates rise.

When uncontrolled inflation is added, what little money customers have lost value over time since there is so little of it to buy, and the worth of their money is decreasing.

#1. Increase in oil prices

A change in supply frequently results in stagflation. For instance, rising resource prices, like the price stability of the oil, may increase company expenses (making transportation more costly) and produce a leftward shift in short-term quantity supplied. Reduced GDP and increased inflation are the results of this.

#2. Strong labor unions

The Labour movements could be capable of negotiating for more excellent salaries even during slower economic development when they have significant negotiating strength. Higher earnings significantly fuel inflation.

#3. Declining output

When productivity falls, employees become less effective, expenses increase, and output decreases.

#4. Structural unemployment is on the rise

We could see more wage stagnation and low-cost manufacturing if conventional industries collapse. Thus, even when inflation is rising, we may have more unemployment.

#5. Shocks in supply

Costs will begin to increase if supply networks are disrupted. Unemployment will decline as a result of the supply shock. For instance, supply disruptions in the UK during 2021 led to mild stagflation.

What Would be Stagflation's Recovery?

Stagflation cannot be cured entirely. According to experts, productivity needs to be raised to a level that would result in more growth without inflation. This will then enable the money supply to be tightened to contain the inflationary element of stagflation.

One answer to fighting stagflation would be to be exceedingly proactive in averting it since that is harder said than accomplished.

Can Stagflation be Prevented?

Since financial authorities must strike a balance between the opposing goals of inflationary pressures, preventing stagflation is challenging. Higher rates of interest for combating inflation rose often result in higher borrowing costs.

This lowers customer demand and raises the cost of doing business. As a result, employers frequently react by reducing their workforces, which increases the unemployment rate. On the other hand, the central bank may aim to reduce unemployment by lowering interest rates, motivating firms to produce significant investments, hire more employees, and take price risks.

But salaries increase when businesses recruit. Additionally, consumer prices surging as incomes do (i.e., inflation). Authorities are, therefore, mainly in a bind when it relates to stagflation. To combat inflation, this is generally accepted that one should raise interest costs at the expense of slower economic development and more unemployment.

The argument is that consistently higher consumer prices shot impact the industry's capacity to restore less than unemployment would. Recessions have been the only natural cure for stagflation.

Best Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn't. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It's a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Stagflation

Something must have gone wrong when stagflation persists for ages in wealthy economies. So reducing inflation and letting the market organically drive away unemployment are the primary ways to combat stagflation. And since recessions usually end in less than one year, the objective is to transform a stagflationary economy into a downturn market.

Which will result in challenging times for buyers and phases where tens of millions of employees are likely to lose their employment in developed countries like the US, the eurozone, and even Japan.

However, salaries will be more significant after the crisis, equity investments will settle, and businesses will start hiring again. Real wages that follow inflation often remain after prices are excellent.

Stagflation FAQs

What is a stagflation economy?

The phrase stagnation with inflation has been combined to form the name “stagflation.” It characterizes a failing economy wherein prices continue to rise and economic expansion, the pace of development in aggregate supply and output, slows down. Higher unemployment may result from a shortage of productivity expansion throughout time.

Is Stagflation a depression?

No. Stagflation causes a variety of things, including depression and unemployment low. Stagflation seems to be the simultaneous presence of reduced cost and market increases.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.